A 529 plan could be an efficient property planning instrument. However as a result of many households are unaware of its advantages, only a few think about using a 529 plan for property planning.

Nonetheless, households might have to think about together with 529 plans as a part of their property plans due to potential adjustments to loss of life taxes.

We clarify why in additional element beneath and break down all of the “how-tos” of utilizing a 529 plan for property planning. This is what it is advisable know.

Attainable Modifications To Loss of life Taxes

In 2024, the unified lifetime reward, property and generation-skipping switch tax exemption is $13.6 million ($27.2 million for married {couples}), up from $5.49 million in 2017.

Since 2010, the lifetime exemption has been moveable between spouses, permitting a surviving partner to get the unused portion of their partner’s lifetime exemption. This successfully offers a married couple with twice the lifetime exemption of a single individual. The deceased partner will need to have been a U.S. citizen on the time of loss of life. The surviving partner should elect portability after they file a well timed Federal Property Tax Return, IRS Kind 706, for the deceased partner. IRS Kind 706 should be filed inside 9 months plus extensions after the date of the decedent’s loss of life. IRS Kind 4768 could also be filed to assert an automated 6-month extension.

Nonetheless, the way forward for the exemption from loss of life taxes is unsure. The Tax Cuts and Jobs Act of 2017 doubled the lifetime exemption. However this improve will sundown for tax years after 2025 except Congress acts to increase it. The lifetime exemption will revert again to $5 million plus an inflation adjustment for taxpayers who die in 2026 and later years.

As well as, President Biden has proposed reducing the lifetime exemptions to $3.5 million for estates and $1 million for presents (returning to the exemptions that have been in impact in 2009). His proposal additionally requires growing the tax fee, which is at present 40%. He has additionally proposed eliminating the stepped-up foundation for inherited property and to tax the unrealized capital beneficial properties at bizarre earnings tax charges (versus long-term capital beneficial properties tax charges).

Though President Biden didn’t embrace the proposed decreases within the lifetime exemptions within the American Households Plan, these cuts could be included in future laws.

Opposition To Property Tax Modifications

These proposals have generated bipartisan opposition from lawmakers for a number of causes:

The proposed adjustments additionally generate comparatively little tax income. Fewer than 2,000 households pay federal property taxes every year, yielding lower than $20 billion in tax income.

States That Levy Property Taxes

State property and inheritance taxes, which differ by state, might have decrease exemptions than the federal ranges, inflicting smaller estates to be taxed. Households might want to use 529 plans to cut back state property and inheritance taxes in these states.

At present, 13 states have state property taxes: Connecticut, District of Columbia, Hawaii, Illinois, Maine, Maryland, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont and Washington. The state property tax exemption is $1 million in Massachusetts.

As of writing, 6 states have state inheritance taxes: Iowa, Kentucky, Maryland, Nebraska, New Jersey and Pennsylvania. Pennsylvania contains out-of-state 529 plans within the account proprietor’s property, however not in-state 529 plans.

Inheritance taxes might rely upon the connection of the inheritor to the decedent. In Pennsylvania, for instance, the inheritance tax fee is 0% for surviving spouses or mother and father of a minor baby, 4.5% for direct descendants, 12% for siblings, and 15% to different heirs (apart from charitable organizations, exempt establishments and authorities entities which can be exempt from tax).

Advantages Of Utilizing A 529 Plan For Property Planning

Some great benefits of utilizing 529 plans for property planning contain contributions, distributions, management and monetary help affect. They’re easier, simpler to make use of and cheaper to arrange than difficult trusts. Additionally they have beneficiant and versatile contribution limits. There aren’t any earnings, age or closing dates.

Account house owners retain management over the 529 plan account and may change the beneficiary. Earnings accumulate on a tax-deferred foundation and distributions are tax-free if used to pay for certified academic bills. Grandparents can even use 529 plans to go away a legacy for his or her descendants. And policymakers are unlikely to restrict these estate-planning advantages.

Contributions

Contributions are faraway from the contributor’s property for federal property tax functions. Contributions are thought of to be a accomplished reward.

Though there isn’t a annual contribution restrict for 529 plans, contributors may give as much as the annual reward tax exclusion, which is $18,000 per 12 months in 2024, with out incurring reward taxes or utilizing up a part of the lifetime reward tax exemption.

There aren’t any reward tax limits if the beneficiary is the account proprietor or the account proprietor’s partner. The partner should be a U.S. citizen. If the partner just isn’t a U.S. citizen, the presents are capped at $157,000 a 12 months, as of 2000.

If the beneficiary is a grandchild, contributions might end in generation-skipping switch taxes, however the annual and lifelong exemptions and tax charges are the identical as for reward and property taxes. Era-skipping switch taxes apply if the beneficiary is 2 or extra generations youthful than the contributor or if the beneficiary is at the least 37.5 years youthful than the contributor. There’s an exception if the grandchild’s mother and father are deceased on the time of the switch.

Superfunding

5-year gift-tax averaging, also called superfunding, permits a contributor to make a lump sum contribution of as much as 5 instances the annual reward tax exclusion and have it handled as by way of it happens over a five-year interval.

The contributor could also be unable to make further presents to the beneficiary through the five-year interval, except the prorated reward is lower than the annual reward tax exclusion quantity. If the contributor dies through the 5-year interval, a part of the contribution could also be included within the contributor’s property.

For instance, if the contributor dies in 12 months 3, the remaining 2 years of contributions might be included within the contributor’s property. The contributor might have to file IRS Kind 709 to report the contribution, even when there aren’t any reward taxes or discount within the lifetime exemption.

State Limits And Advantages

There are excessive mixture contribution limits, which differ by state, starting from $235,000 in Georgia and Mississippi to $542,000 in New Hampshire. As soon as the account steadiness reaches the mixture restrict, no extra contributions are permitted, however the earnings might proceed to build up.

Households might be able to bypass the state’s mixture contribution limits by opening 529 plans in a number of states. However contributors will nonetheless be topic to the annual reward tax exclusion limits.

Contributions are eligible for a state earnings tax deduction or tax credit score on state earnings tax returns in two-thirds of the states. The quantity of the state earnings tax break varies by state. There aren’t any earnings limits, age limits or closing dates on contributions. The beneficiary doesn’t have to be of faculty age and may have already got a school diploma.

Distributions

Earnings in a 529 plan accumulate on a tax-deferred foundation. And distributions are tax-free if used for certified academic bills. The cash can be utilized to pay for elementary and secondary college tuition, faculty prices, graduate or skilled college prices, and persevering with training.

Non-qualified distributions are topic to bizarre earnings taxes on the recipient’s tax fee and a ten% tax penalty. The penalty is simply levied on the earnings portion of the distribution, not the total quantity of the distribution.

Non-qualified distributions are usually not topic to capital beneficial properties taxes, reward taxes or property taxes. If the contributor beforehand claimed a state earnings tax deduction or tax credit score, the state earnings tax break could also be topic to recapture if the account proprietor makes a non-qualified distribution.

There aren’t any earnings limits, age limits or closing dates on distributions. Account house owners are usually not required to make distributions when the beneficiary reaches a specific age. They will select to go away the cash within the account, letting it proceed to build up earnings.

Management

The account proprietor retains management over the 529 plan account, not like direct presents to the beneficiary or difficult belief funds. The account doesn’t switch to the beneficiary when the beneficiary reaches a specific age. As an alternative, the account proprietor will get to determine whether or not and when to make distributions.

The account proprietor can change the beneficiary to a member of the beneficiary’s household, together with to the account proprietor. This successfully lets the account proprietor revoke the reward, in the event that they select, by altering the beneficiary to themselves.

Monetary Support Impression

Grandparent-owned 529 plans are usually not reported as an asset on the Free Utility for Federal Scholar Support (FAFSA).

The Consolidated Appropriations Act, 2021, simplified the FAFSA beginning with the 2023-24 FAFSA (subsequently delayed till the 2024-25 FAFSA by the U.S. Division of Training). Amongst different adjustments, the simplified FAFSA drops the money help query, so distributions will now not depend as untaxed earnings to the beneficiary on the beneficiary’s FAFSA.

This can remove any affect from a grandparent-owned 529 plan on federal pupil help eligibility beginning with distributions in 2022. This, after all, assumes that there aren’t any additional delays in implementation of the simplified FAFSA.

Leaving A Legacy

Grandparents can open a 529 plan for every grandchild. If the grandparents have three kids and 9 grandchildren, they may open a complete of twelve 529 plans, one for every baby and grandchild.

With 5-year gift-tax averaging, they may make lump-sum contributions totaling $1.8 million as a pair (e.g., $150,000 per beneficiary x 12 beneficiaries = $1.8 million). This yields a big discount within the grandparents’ taxable property. Grandparents can even use a 529 plan to trace that they’d like their grandchildren to go to varsity.

529 plans are a good way of leaving a legacy in your heirs. If there’s leftover cash within the 529 plan after paying for faculty, the unused funds can proceed to develop and be handed on to future generations.

Leftover cash can be used for different bills by making a non-qualified distribution. However the earnings portion of the non-qualified distribution might be topic to bizarre earnings taxes and a tax penalty versus property and inheritance taxes.

Main 529 Plan Coverage Modifications Are Unlikely

Policymakers are unlikely to restrict the usage of a 529 plan for property planning. When President Obama proposed taxing 529 plans in 2015, his proposal was met with fierce opposition from each Democrats and Republicans. In actual fact, the resistance was so hostile and swift that he was compelled to drop the proposal just some days later.

Lifetime Exemption For Federal Present Taxes

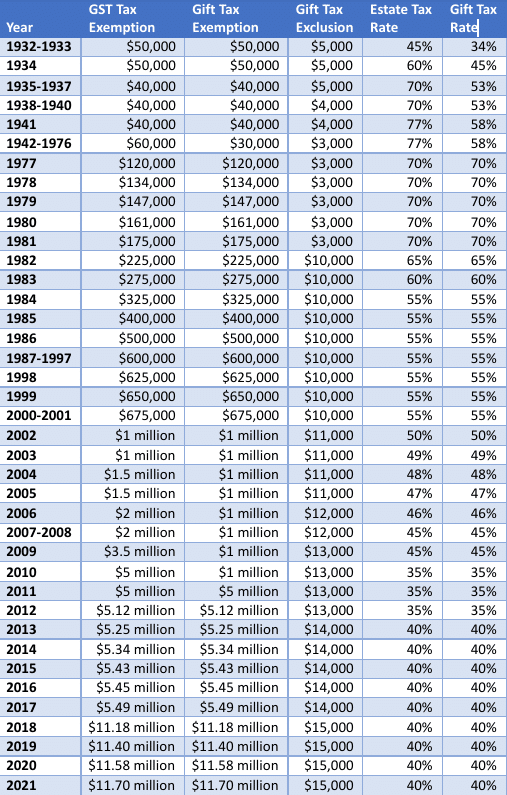

This desk beneath reveals the adjustments within the lifetime exemption for federal reward, property and generation-skipping switch taxes over the past 9 a long time. Key adjustments have been made by the next items of laws:

Who Ought to Think about 529 Plans For Property Planning?

If grandparents are near the lifetime exclusions or are frightened about future cuts within the lifetime exclusions, they need to think about using 529 plans for property planning.

529 plans are significantly helpful when the grandparents are rich however the mother and father are usually not. The favorable monetary help remedy of 529 plans lets grandparents who’re rich assist pay for elementary, secondary and postsecondary training bills with out affecting the grandchild’s eligibility for need-based monetary help.