If the success of Chandrayaan 3 is #1 information for Indians this week, #2 is the profitable launch of Marriott Bonvoy Credit score Playing cards in India. That’s proper, HDFC Financial institution at present (twenty fourth Aug 2023) launched the Marriott Bonvoy Co-brand Credit score Card in India on Diners Membership Platform.

I’ve been ready for this to occur for over 7 years and it’s actually an occasion within the Indian Credit score Card Business which can revolutionise the best way travellers have a look at journey bank cards in India, as that is the primary co-brand bank card with a resort chain.

Whereas we’ll have an in depth look into the product someday later, right here’s a fast look of what to anticipate from the newly launched Marriott Bonvoy Credit score Card in India.

Options & Advantages

- Becoming a member of/Annual Charge: 3000 INR+GST

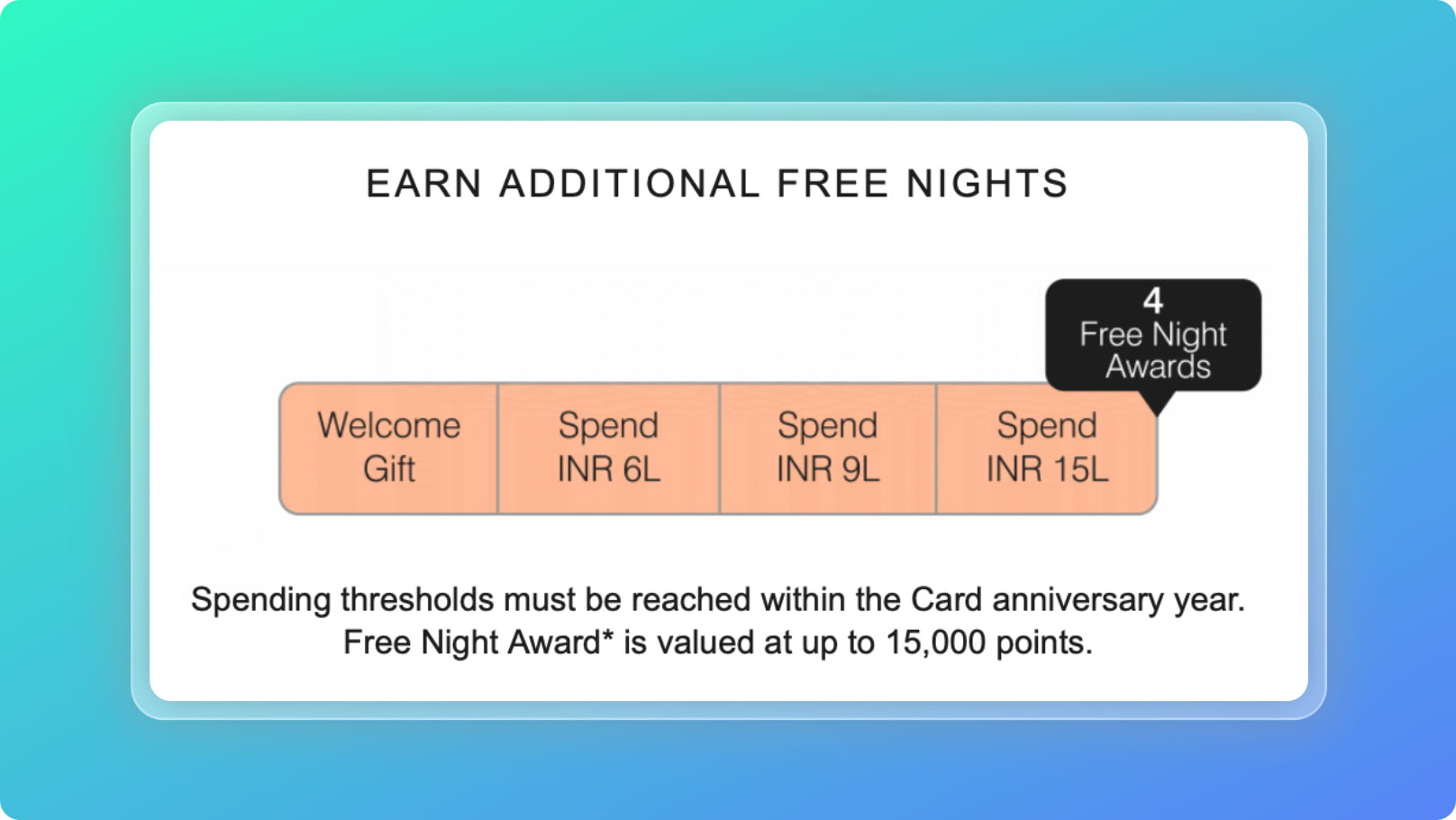

- Welcome/Annual Profit: 1 Free Evening Award (valued upto 15,000 Factors)

- Card Community: Diners Membership

- Lounge Entry (per 12 months): 12 Home entry + 12 worldwide entry

- Elite evening credit: 10 Nights to get nearer to Gold

- Elite standing: Silver Standing

- Milestone Advantages: 1 Free Evening Award for each 6L/9L/15L spend

- MB factors on Spends: 8/150 INR on MB Motels; 4/150 INR on journey/eating/leisure; 2/150 INR on common spends

- Golf: 2 Per quarter

My Ideas

That is going to be a super-hit card within the nation certainly, maybe among the best playing cards journey bank cards in India going ahead because it has the right set of advantages for freshmen moving into journey.

For the annual charge of 3K INR, one can truly get nicely over 40K INR simply with a single keep if one redeems the Free Evening Award on the lovely Westin, Himalayas which is by the way from the place I’m writing this text, with a view like this. (not at present although, because it’s wet and cloudy).

Provided that HDFC Financial institution has huge community within the nation, I truthfully want each eligible Indian will get this bank card and enjoys a trip within the Himalayas at one of many Marriott’s most interesting luxurious resort.

I can’t stress that sufficient as a result of the time is ticking and this excellent profit at Westin received’t final lengthy. But, there are additionally first rate sufficient properties throughout the nation and even past (like SE Asia) to simply get 2x-3x worth for the becoming a member of charge paid even in any other case.

Having stated that each one, I’m equally upset that they’ve not targeted on a brilliant premium variant for the time being. Whereas Marriott might be testing waters with this product, I see no level in not going straight for a Tremendous Premium Variant.

Bottomline

Whereas this can be a AMAZING bank card for freshmen, it’s not enticing sufficient for tremendous premium card holders (aside from the welcome profit & 10 elite nights) because the common earn charge is poor together with not so enticing milestone advantages, as in, it might have been lot higher if milestones are set at 3L/6L/9L as a substitute which may even match within the goal group extraordinarily nicely.

However nicely, at 3K charge, we will’t ask an excessive amount of, so it’s advantageous. I’ve shortly gone forward and utilized, consequence of which will probably be identified in few days.

I hope HDFC financial institution makes it simple going ahead to get a number of playing cards, similar to they did so with Tata Neu Co-brand playing cards with shared credit score limits. We’ll have to attend and watch on this because it’s the “most necessary” issue of this card’s success.

So similar to most us right here, I’d be eagerly ready for the day after they launch a brilliant premium variant, maybe at 50K charge or so and provides on the spot Marriott Bonvoy Platinum standing as that’s when the true worth kicks-in.

I want I don’t want to attend for one more 7 years for that to occur!

Till then, benefit from the free evening awards at a few of the most interesting accommodations within the nation with the HDFC Financial institution Marriott Bonvoy Credit score Card!