“Greenhushing” is greenwashing’s psychotic twin. “Greenwashing” is the apply of pretending to care in regards to the setting; in fund phrases, it happens when entrepreneurs jam an inconsequential, mealy-mouthed sentence right into a fund’s prospectus (“will contemplate ESG elements in all portfolio choices to the extent they mirror financially materials issues”) after which advertising them as an indication of Twenty first-century sensibilities, however the fund’s intensive coal holdings. DWS is within the highlight at present because it tries to resolve fees from each the US SEC and German investigators that arose from claims by their former sustainability chief that the investor “made false statements” about sustainability actions.

“Greenhushing” is the newer phenomenon of operating, as far and as quick as doable, from any accusations that your agency finds points surrounding environmental sustainability, workforce fairness, group engagement, or company boards that aren’t closed golf equipment in any respect related.

“Greenhushing” is the newer phenomenon of operating, as far and as quick as doable, from any accusations that your agency finds points surrounding environmental sustainability, workforce fairness, group engagement, or company boards that aren’t closed golf equipment in any respect related.

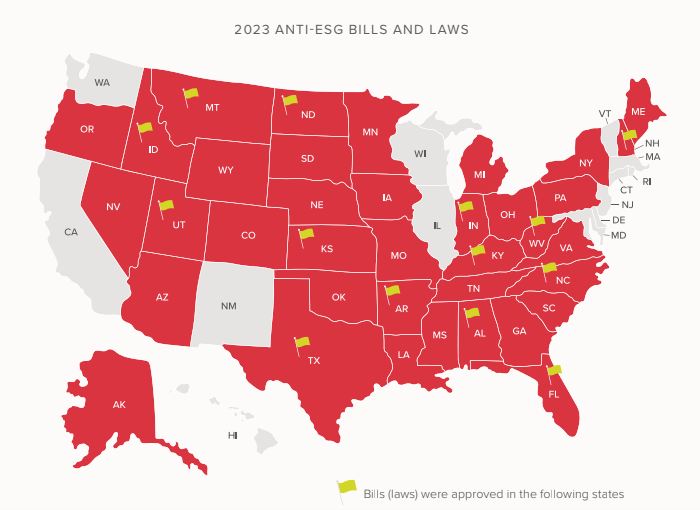

Greenhushing is pushed by two issues. First, they’re scared to dying of the demagogues who try to gasoline their political ascendance by demonizing the willingness of managers to contemplate some elements that they contemplate financially related. Thirty-seven states have seen anti-ESG payments launched within the final legislative session.

To be clear: pink on this map is not “Republican.” It’s “no less than one anti-ESG invoice launched.” The yellow flags sign the situations through which no less than one invoice grew to become regulation. (Supply: Pleiades 2023 Statehouse Report).

Second, their authentic ESG commitments have been typically an inch deep, to start with. A 2022 survey by Deloitte revealed that the majority corporations view ESG commitments by the lens of “model recognition and status.” A separate assessment by the EU (2021) discovered that one thing like half of all “inexperienced claims” have been “exaggerated, misleading, or false.” Upon additional assessment, MSCI downgraded 95 % of the AAA scores it had given European ESG ETFs.

And so, they flee. The newest occasion was the choice by Loomis Sayles to withdraw from the Local weather 100, a coalition of enormous traders that had dedicated to strain corporations to cut back their carbon output. Loomis’s clarification of their resolution is an epic phrase salad:

I can verify that in June 2023 Loomis Sayles selected to withdraw as a signatory of the Local weather Motion 100+ initiative because of our routine evaluations to make sure that all our trade commitments proceed to be aligned with the agency’s ESG philosophy,’ the spokesperson mentioned. ‘Our ESG philosophy stays unchanged: we consider dangers and alternatives related to materials ESG elements are inherent to funding decision-making and shoppers’ long-term monetary success. In service of our fiduciary responsibility, we consider one of the best ways to contemplate ESG is thru integration that goals to determine the monetary materiality of ESG elements. (“Loomis Sayles exits Local weather Motion 100, citing ‘fiduciary responsibility,” Citywire, July 31, 2023).

Different markers of anxious greenhushing:

S&P World has stopped handing out scores to company debtors on ESG standards (“S&P drops ESG scores from debt scores amid scrutiny,” Monetary Occasions, 8/7/2023)

“ESG is maybe essentially the most manifestly absent time period on this spherical of earnings transcripts.

-

-

- “The variety of S&P 500 corporations citing ‘ESG’ on earnings calls has declined (quarter over quarter) in 4 of the previous 5 quarters,” in accordance to a Truth Set research.

- “The time period was cited by solely 56 of the S&P 500 this quarter, down 24% (from 74 mentions) since final quarter and down roughly 64% (156 mentions) since its peak in This fall of 2021.” (“Company America is rebranding ESG,” Axios, 8/10/2023, good article!)

-

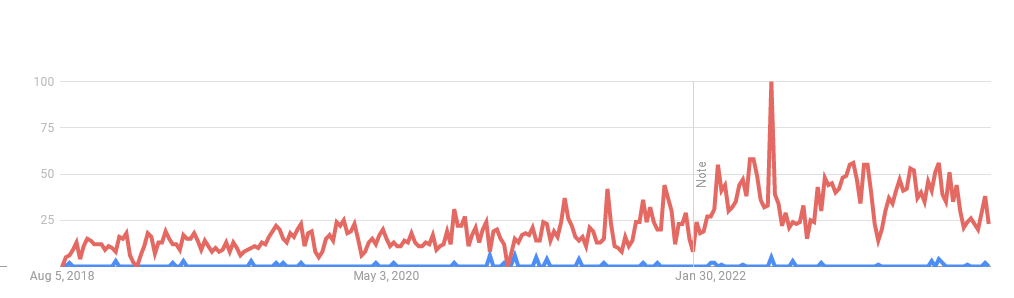

Maybe fittingly, greenhushing (the blue line) receives far much less consideration than greenwashing (the pink line):

All of this performs out, even whereas the general public, throughout age and beliefs, helps motion in any respect ranges to deal with world warming (“What the information says about People’ views of local weather change,” Pew Analysis Middle, 8/9/2023). And the general public continues to demand proof of company accountability in each social and environmental arenas (Alan Murray, “Shoppers are rejecting the anti-woke motion to demand CEOs communicate out on vital social points,” Fortune, 8/11/2023). Even a majority of Republican voters need their candidates to depart firms alone to make their very own choices. In a basic failure to speak, most People do not help Biden’s local weather initiatives (no less than while you label them “the Inflation Discount Act”), whereas concurrently calling for extra of the initiatives in … properly, sure, the Inflation Discount Act (“Most disapprove of Biden’s dealing with of local weather change, Publish-UMD ballot finds,” Washington Publish, 8/7/2023).

Backside Line

The planet is in, so to talk, a world of damage, from Canadian and Hawaiian wildfires to recording the warmest month and highest sea temperatures on report. We have to act with much more unity, velocity, and power than we’ve proven any willingness to do if we’re to avert an epic disaster.

The reporting on greenhushing paints a reasonably constant image: non-investment companies are extending their company sustainability initiatives as a matter of excellent enterprise apply, although they’re not speaking about them. Mid-sized funding companies are backtracking after one 12 months of weak efficiency, redemptions, and political warmth. Fund boutiques, which hardly ever get seen within the nationwide political furor, proceed to plug alongside.

Because the US enters the lunacy of a presidential election cycle, it’d profit all of us to challenge, by our phrases and actions, a easy two-word message to the peddlers of overheated conspiracies and fearful rhetoric: “Cool it.”