Life has change into very unpredictable. It’s OK to PAUSE or to postpone your funding selections quickly. However it may be very dangerous should you postpone shopping for an satisfactory Life / medical insurance cowl. Being under-insured or un-insured will be financially very dangerous to you and your loved ones.

“If Life is unpredictable, INSURANCE can’t be non-compulsory.“

The one and the easiest way to get ample life insurance coverage cowl at reasonably priced premiums is to purchase a Time period Life Insurance coverage Plan. When you have already taken a time period plan with satisfactory life cowl, you could have carried out an important favor to your loved ones.

In case, you could have been planning to purchase a Time period life insurance coverage plan and doing all your homework to determine the most effective time period plan, you might probability upon a seemingly engaging model of plain vanilla Time period plan referred to as as Return of Premium Time period Insurance coverage plan.

Who doesn’t wish to get a life cowl and on prime of it, additionally get again all of the premiums paid? We wish one thing tangible in return for our cash. In spite of everything, it’s our hard-earned cash proper!

It appears like a win-win state of affairs for each the insurers and the potential patrons. However does it actually make sense to purchase a Time period Life insurance coverage Plan with Refund of your premium possibility?

On this submit let’s perceive – What’s a pure Time period Life insurance coverage plan? What are Return of Premium Life Insurance coverage Plans? How do they work? Is it good to purchase a Time period Plan with return of Premium?

What’s a Time period Plan?

Time period insurance coverage is the best and most basic insurance coverage product. These insurance coverage are designed to make sure that within the occasion of the policyholder’s demise, the household will get the sum assured (the duvet quantity). Time period plan supplies threat protection for a sure time frame (coverage time period/period). If the insured dies in the course of the time interval specified within the coverage and the coverage is energetic – or in drive – then a demise profit might be paid. It’s the most cost-effective type of Life insurance coverage when it comes to premium.

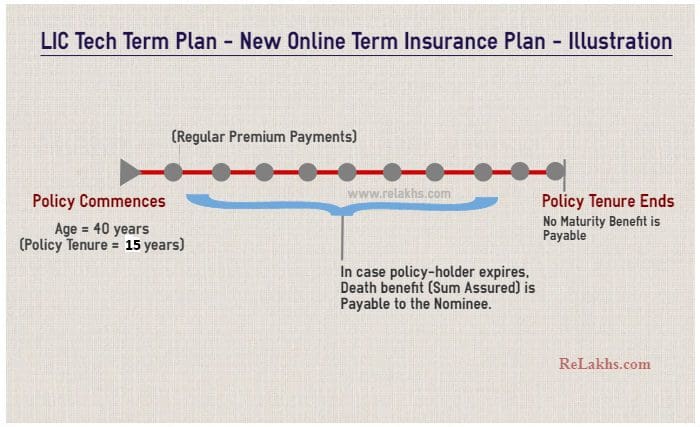

Common Time period Insurance coverage Plan – Instance

Let’s perceive how a time period plan works by taking a well-liked on-line Time period Life insurance coverage plan referred to as – LIC Tech Time period Plan. It is a plain vanilla time period life insurance coverage plan with NO return of premium possibility.

Let’s take into account an instance – A 40 12 months Saral buys LIC’s Tech Time period insurance coverage plan (on-line mode) for Rs 1 crore degree Sum Assured, with 15 12 months time period, premium payable @ Rs 14,863 p.a., opts for normal premium cost for 15 years and selects ‘lump sum’ demise profit possibility. (Whole Premium with GST is Rs 17538 (Rs 14,863 + GST Rs 2,675.)

In case, the coverage holder expires anytime in the course of the coverage tenure (15 years), his/her nominee will obtain the demise good thing about Rs 1 cr as a lump sum quantity and the coverage will get closed. In case, the coverage holder survives the time period then the insurance coverage cowl ceases, and nothing is payable to him/her.

What are Return of Premium Life Insurance coverage Plans

A return of premium Time period Plan supplies for a refund of the premiums paid on a time period life insurance coverage coverage if the policyholder doesn’t die in the course of the said time period.

So, it’s a sort of time period insurance coverage plan that provides a profit to your loved ones in case your demise occurs in the course of the time period, plus a survival profit to you, must you outlive the time period. The survival profit on this case, is a return of all of the premiums you pay by means of all the coverage period.

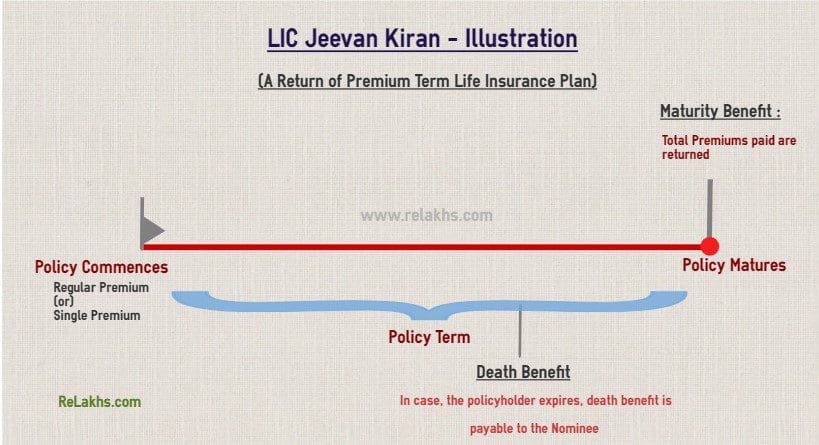

Return of Premium Life Insurance coverage Coverage – Instance

Let’s now perceive how a time period plan with refund of premium works by taking the newest LIC plan referred to as – Jeevan Kiran, a Time period Plan with assured return of premium. It is a time period life insurance coverage plan with return of premium possibility.

Let’s take into account an instance – A 40 12 months previous Anvesh planning to purchase LIC’s Jeevan Kiran Coverage for Rs 1 crore lakh Sum Assured, with 15 12 months coverage time period, premium payable @ Rs 90,301 p.a., opts for normal premium cost for 15 years and selects ‘lump sum’ maturity profit cost possibility. (Whole payable premium is Rs 94,365 (Rs 90,301 + GST Rs 4,064 for 1st 12 months and Rs 2,031 GST from 2nd 12 months onwards.)

In case, the coverage holder expires anytime in the course of the coverage tenure (15 years), his/her nominee will obtain the demise good thing about Rs 1 cr as a lump sum quantity and the coverage will get closed.

In case, the coverage holder survives the 15 12 months tenure then the insurance coverage cowl ceases, and he/she receives the maturity good thing about Rs 13,54,515 (15 years X Premium i.e., 15 X 90,301). This maturity profit is known as as assured ‘return of premium’ (whole premiums paid).

Do be aware that Whole Premiums Paid means whole of all of the premiums paid, excluding any additional premium, any rider premium and taxes.

Comparability of Premiums on Common Plain Time period Plan Vs Return of Premium Time period Plan

| Sort of Time period Life Insurance coverage Plan | Yearly Premium (unique of Taxes) | Particulars |

|---|---|---|

| Plain or Common Time period Plan (LIC Tech Time period Plan) |

Rs 14,863 | Saral has to pay Rs 14,863 yearly for 15 years for Rs 1 crore cowl. He doesn’t get again something on the finish of coverage tenure. |

| Return of Premium Time period Plan (LIC Jeevan Kiran) |

Rs 90,301 | Anvesh has to pay Rs 90,301 yearly for 15 years for Rs 1 crore cowl. He does get again all of the premiums paid i.e., Rs 13,54,515 (excluding taxes paid). |

Is it good to purchase a Return of Premium Time period Life Insurance coverage Plan?

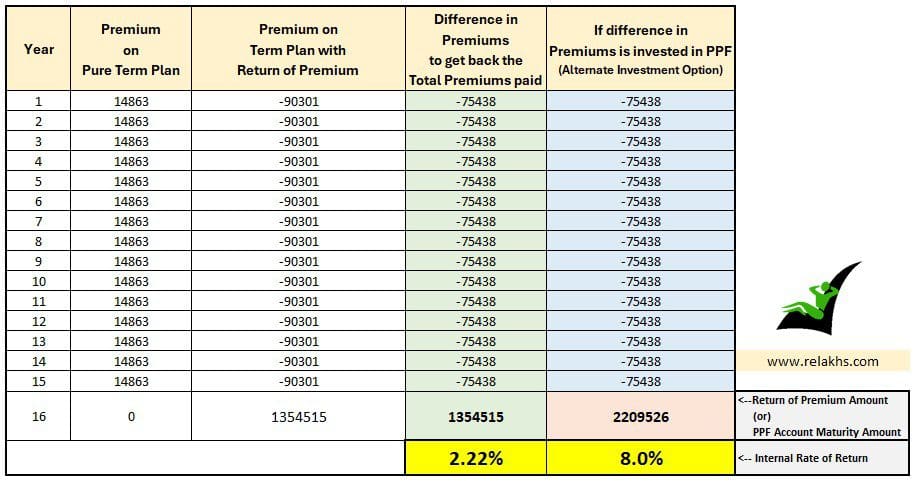

For those who discover the premiums on a Time period Plan with return of premium are costlier than a time period plan with no return of premium. In truth, the distinction between the 2 premium quotes is HUGE i.e., Rs 75,438.

Each of them Saral and Anvesh, are getting the identical life cowl which is Rs 1 crore however take a look at the premiums payable by each of them. In our view, it’s a silly factor to pay such excessive premiums simply to get again all of the premiums paid.

- As per the above illustration, Saral pays Rs 14,863 however will get again NIL on the finish of the coverage tenure.

- Anvesh will get again Rs 13,54,515 by paying additional Rs 75,438 (Rs 90,301 – Rs 14,863). Meaning, to get Rs 13.5 Lakh, Anvesh has to pay the additional premium of Rs 75,438 on a Rs 1 cr time period plan.

- By paying Rs 75,438 additional, Anvesh will get Rs 13,54,515 on the finish of the fifteenth 12 months (sixteenth 12 months starting). If we calculate Inner Fee of Return on this cost schedule, it’s a meagre 2.22%.

- Keep in mind, it’s a must to additionally bear the taxes (GST) on the premiums and that’s not refundable, so the precise IRR will be lower than 2.22%.

- If Anvesh realizes {that a} Time period plan with return of premium is a high-cost association that favors solely the Insurers then he can choose another like Public Provident Fund (PPF), which is a risk-free, protected and tax-free saving possibility.

- If Anvesh deposits the identical differential quantity of Rs 75,438 in a PPF account, he can withdraw a maturity quantity of round Rs 22 lakh after 15 years (assuming a 8% fee of curiosity).

- In case, he invests in a risk-oriented Fairness fund(s), he might make far more cash in long-term.

- Do be aware that longer the coverage tenure, the decrease could be the Fee of return on Time period plans with return of premium possibility.

Beneath are the important thing factors to ponder over earlier than shopping for a Time period Plan with return of premium;

- ‘Return of Premium’ comes with a Value : There’s nothing ‘free’ on this world. Every part has a value hooked up to it. As this plan affords you ‘the return of premium’, the quoted premiums are greater than the plain vanilla time period life insurance coverage (with out return of premium possibility).

- Comparability : For those who examine the premiums of Return of Premium time period plans with pure time period plans, the premiums are on the upper facet.

- Psychological Issue : The primary motive, for coverage holders selecting return of premium insurance policies, is the notion that they aren’t shedding any cash by getting their premiums again. Most of us solely are likely to see absolutely the quantity of web money movement paid to the insurance coverage firm with out taking into consideration the time worth of cash of these money flows.

- No Compounding Impact : The precise quantities of premiums you pay are returned by the insurance coverage firm on the maturity of the coverage and these quantities don’t earn any curiosity. Additional, this premium quantity is just not even adjusted for inflation and excludes the taxes you paid.

Our Take : In our opinion, even should you can afford to purchase a time period plan with return of premium, you should buy a pure time period plan and canopy the monetary threat of your life. Make investments the steadiness quantity (Pure time period premium minus return of premium coverage premium) in any different monetary instrument that will provide you with higher actual fee of return. After-all, it’s your hard-earned cash and we would like one thing tangible in return for our cash. Am I proper?

Proceed studying:

(Submit first printed on 01-Sep-2023)