Final yr most economists assumed the Fed elevating charges so aggressively meant a recession was inevitable:

Now they’re backing off these predictions:

So why hasn’t the financial system crashed from going 0% to five% in such brief order?

There are loads of causes.

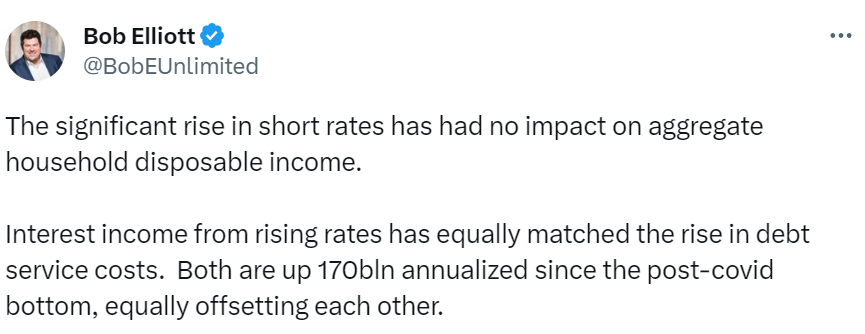

I like this one from Bob Elliott:

If you concentrate on what occurred it is smart greater yields and better borrowing prices have offset each other.

We went from a scenario the place it was low cost to borrow however savers couldn’t discover yield anyplace. Now savers have greater yields nevertheless it’s far more costly to borrow.

It’s a Lindsay Lohan-Jamie Lee Curtis switcharoo scenario.

The savers and debtors aren’t the identical households however take into account what’s transpired over these previous years to grasp why we haven’t seen a lot of an financial affect from greater charges simply but.

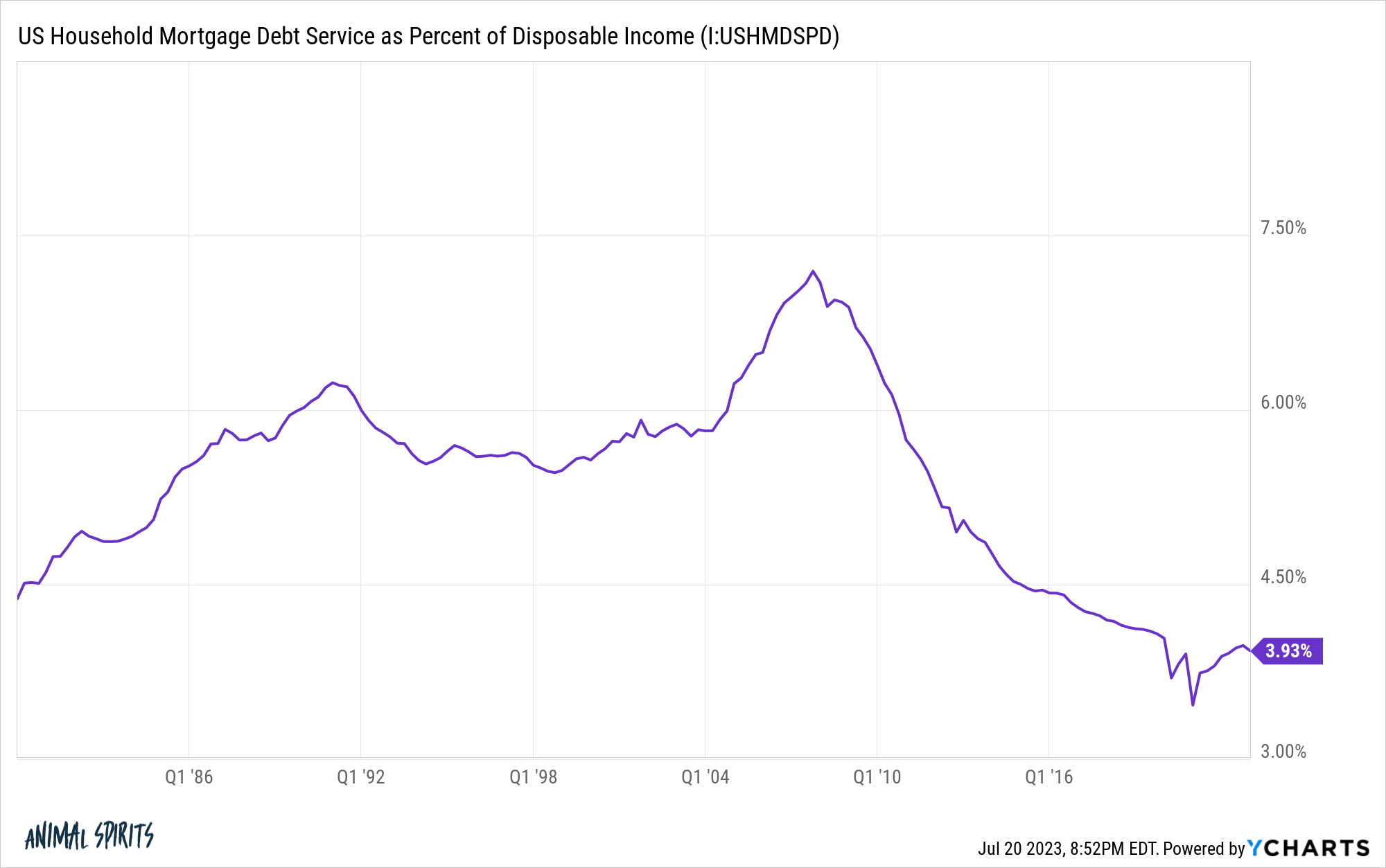

The homeownership charge heading into 2022 (earlier than the speed hikes) was roughly 66%. Lots of people already proprietor properties and borrowed to purchase them. These households have been capable of borrow or refinance at terribly low mortgage charges.

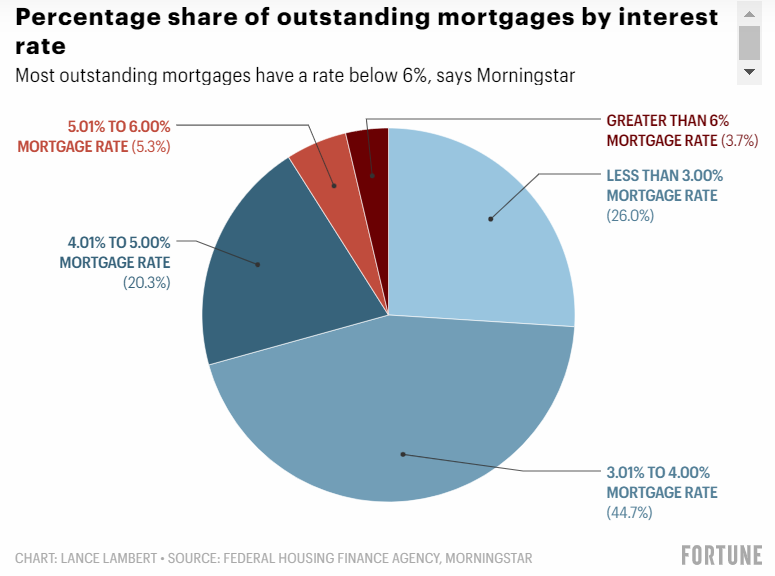

Because of this 91% of debtors have mortgage charges below 5% whereas greater than 70% have borrowing charges at 4% or much less (by way of Fortune):

And these numbers are just for the 62% of house owners who at present maintain a mortgage. In accordance with U.S. Census information, practically 38% of households have their mortgage paid off free and clear.

Greater borrowing prices aren’t impacting these households the place it hurts probably the most.

And guess who has the monetary property to benefit from the upper short-term yields on their financial savings proper now?

Individuals who have their mortgage paid off or a 3% mortgage charge!

Are you able to think about telling somebody in 2019 within the coming years they’d have the prospect to borrow at 3% to purchase a home after which see short-term charges of 5% to park their money all within the span of 3-4 years?

Nobody would have believed you.

Plus their inventory holdings have now recovered. And so they have $28 trillion collectively of fairness of their properties.

Clearly, if charges keep are present ranges for an prolonged time period, finally, that ought to have an effect on the funding of capital within the financial system.

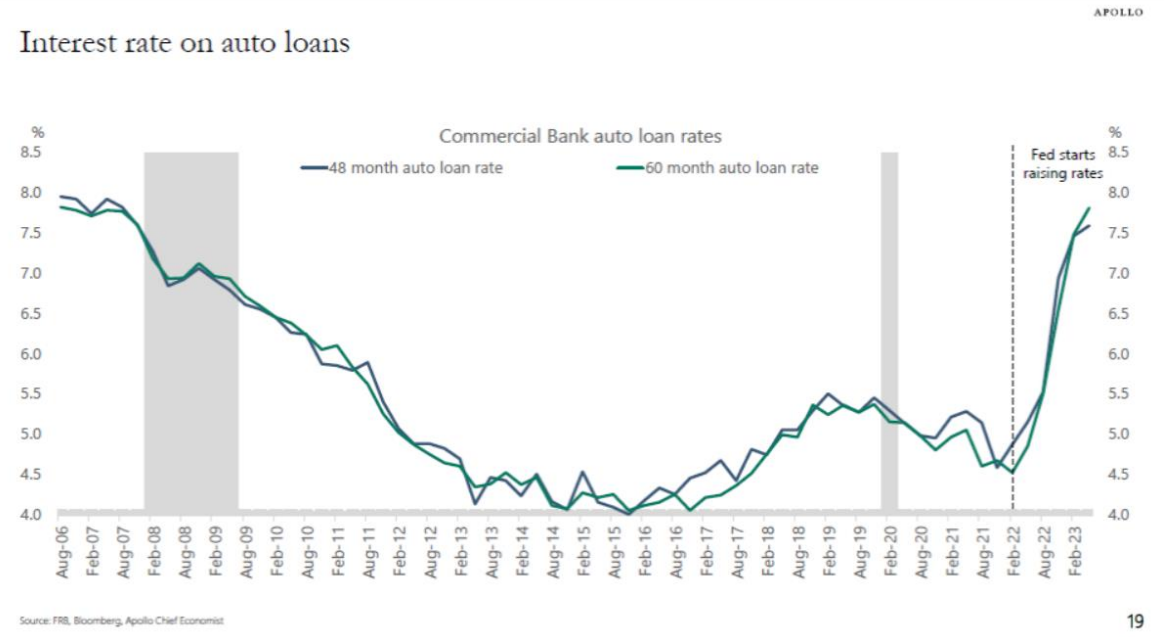

Simply have a look at auto mortgage charges:

Charges have gone from 4.5% at first of 2022 to eight% now.

Whereas this makes it extra value prohibitive I don’t suppose greater borrowing charges affect auto consumers as a lot because it does for homebuyers.

The common value for a brand new automobile is now one thing like $46,000.1

Assuming a ten% down fee your month-to-month fee for a 5-year mortgage at 4.5% could be roughly $770. At 8% that month-to-month fee shoots as much as round $840.

Now $70 extra per thirty days isn’t enjoyable so as to add to your finances however I’m unsure it’s going to discourage many individuals who really need and/or want a automobile.

These a lot greater charges will discourage some homebuyers however there may be far much less turnover within the housing market than the automobile market.

I’m not saying this can be a prudent monetary transfer however that is the fact for many households.

I feel all of us underestimated simply how ready the patron was for greater charges within the financial system.

If you’d like a great rationalization as to why we haven’t gone right into a recession it’s most likely some mixture of extra financial savings from the pandemic, pent-up demand from not spending in 2020, repaired shopper stability sheets and the truth that we love spending cash on this nation.

I can’t make any guarantees so far as how lengthy it will final.

The financial system is cyclical similar to all the things else.

However for now, it’s good to know we didn’t must undergo a recession and see thousands and thousands of individuals lose their job to carry inflation again to extra affordable ranges.

There’s nothing fallacious with celebrating excellent news within the financial system as a result of it gained’t final without end.

Michael and I talked about greater charges, recessions and far more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

When Will Curiosity Charges Actually Begin to Matter?

Now right here’s what I’ve been studying recently:

Books:

1Is it simply me or does $46k sound like A LOT for the common worth of a brand new automobile? That is partly because of the pandemic provide chain/inflation and partly on account of the truth that persons are shopping for dearer vans and SUVs than ever. Both approach, it’s excessive.