Yves right here. I need to confess to having undue curiosity on this matter by advantage of getting a tiny window into what was then and doubtless nonetheless is known as “the commerce,” as within the New York Metropolis diamond district on forty seventh Road. Again within the Eighties, huge and actual jewellery was A Factor amongst feminine Wall Road professionals, a standing marker displaying you belonged in the identical room because the heavyweights. As an illustration, a buddy purchased the right double stand of pearls Claire Sales space Luce was married in. She later traded them in for larger however barely flawed pearls, as a result of the Claire Sales space Luce pearls had been so good that they may simply be mistaken for fakes.

Throughout this time, I received to know the one goy who was accepted within the diamond commerce. The then class act within the {industry}, Ralph Esmerian, had taken my contact beneath his wing. He had a exceptional eye and dealt in property jewellery and associated collectables. He understood how undervalued Cartier thriller clocks had been then and simply traded a 3rd of all of them, however lacked the capital to purchase and maintain on to them for his or her eventual, massive appreciation.

I used to be intrigued by the dealings within the commerce, that sellers would lend extraordinarily worthwhile stock to one another to indicate to finish clients, on “memo” as in small items of paper describing the merchandise and the worth, and the get together that borrowed the collateral had both to return it in a month or pay the stipulated value.

Esmerian later went to jail for fraud and embezzlement. He had bought the tony high-quality jewellery retailer Fred Leighton (storefront on 66th and Madison) and have become overextended. He resorted amongst different issues to the fraud of double-pledging collateral for loans. He was convicted and despatched to jail.

To my data, my contact, the Esmerian protege, by no means engaged in humorous enterprise within the commerce, however his enterprise additionally went down in flames, partially as a consequence of huge flashy jewellery going out of style, but in addition to him extending his enterprise into different high-quality collectables and misrepresenting his wares (as an illustration, promoting trendy copies of Artwork Deco Normandie arm chairs as originals).

By John Helmer, the longest constantly serving overseas correspondent in Russia, and the one western journalist to direct his personal bureau unbiased of single nationwide or industrial ties. Helmer has additionally been a professor of political science, and an advisor to authorities heads in Greece, the USA, and Asia. He’s the primary and solely member of a US presidential administration (Jimmy Carter) to ascertain himself in Russia. Initially printed at Dances with Bears

Mazal u’ Bracha has been the Hebrew expression for sealing transactions within the worldwide diamond commerce for a whole lot of years – in Amsterdam till World Warfare II, and Antwerp since then. Actually, it means “luck and blessing”. Sociologically, it signifies that should you default, the group of Jewish diamantaires will impose the sanction of non secular legislation, redline your credit score, and you’ll be unable to take items on approval, purchase, borrow, commerce, or proceed within the enterprise.

Within the main Jewish diamond enterprise centres – Antwerp, Ramat Gan (Tel Aviv), New York – the efficiency of this blessing has been waning beneath stress of falling client demand, rising borrowing prices, firm bankruptcies, authorities sanctions, and sanctions-busting. And that was earlier than the Palestine struggle started.

On March 1, after heavy lobbying by Israeli and American diamantaires – and regardless of resistance from the Belgian companies – new restrictions had been imposed with the goal of driving Russian diamonds – tough and polished – out of the key jewelry markets of Europe and the US. The brand new scheme has a catch, nevertheless. It’s now the US Customs Service with whom diamond patrons and merchants should shake palms.

In a rule issued on March 1, the US Authorities requires importers to signal a press release declaring: “I certify that the non-industrial diamonds on this cargo weren’t mined, extracted, produced, or manufactured wholly or partially within the Russian Federation, however whether or not such diamonds have been considerably remodeled into different merchandise exterior of the Russian Federation.”

The US Customs Service doesn’t converse Hebrew and it lacks Talmudic authority. Even when it did, there may be growing doubt amongst commerce attorneys that there’s something equal to the standard Jewish group sanction to assist the blessing. Israel’s engagement in what the Worldwide Court docket of Justice (ICJ) has dominated to be “believable genocide” additionally exposes the Tel Aviv-New York commerce to the cost of aiding and abetting struggle crimes and crimes in opposition to humanity.

That is greater than a case of the pot calling the kettle black. It’s a case of the Israeli diamantaires financing the genocide of Gaza and the struggle in opposition to the Arabs similtaneously they try and drive competing diamond producers and rival diamond merchants out of the market. The so-called blood diamond sanction of the Kimberley Course of, which was first supposed to curtail central and west African diamond provide since 2003, is now being utilized to Russian diamonds by the Israelis, the Jewish communities engaged within the diamond commerce, and the US Authorities.

Martin Rapaport, a Tel Aviv-New York diamond dealer and writer of an {industry} bible known as Rapaport.com, has printed a warning that the brand new system shouldn’t be solely an unenforceable mazal-bracha system, however additionally it is a devious scheme to channel diamond certification by way of loopholes in Antwerp, on the expense of different, stricter channels in Tel Aviv and New York; and in addition to favour the Anglo-South African De Beers diamond group over the Russian rival miner Alrosa and different diamond miners in Africa.

“Beforehand, items ‘considerably remodeled’ (i.e., manufactured) in nations reminiscent of India had been technically authorized within the US,” Joshua Freedman of the Rapaport group reported on March 11. “The US and different member nations have launched info on how enforcement will work, however many questions stay. The {industry} continues to be not sure how the ban will work in each the quick and the long run. Sellers have begun sending items to the US with self-declaration statements, however there may be uncertainty about what’s going to occur if customs authorities ask for proof a couple of explicit cargo and whether or not the US will add extra complicated necessities later…[there are] allegations that Belgium is utilizing the sanctions to profit its personal diamond sector…These importing diamonds into the EU [European Union] between March 1 and August 31 could select between doing so by way of the Diamond Workplace [DO] in Antwerp, ‘resulting in the issuance of a G7 certificates,’ or by offering documentary proof with detailed details about the diamond and its origin. Single-origin Kimberley Course of (KP) certificates — or combined origin for De Beers DTC [Diamond Trading Company] items — qualify as acceptable proof of origin, in line with query 12 of the EU’s FAQs. Nevertheless, there is a crucial caveat: documentary proof is accepted solely ‘supplied that items of CN codes 7102 31 00 and 7102 10 00 with a weight equal to or above 1 carat are submitted at once’ to the Antwerp Diamond Workplace. These codes are for tough diamonds. In different phrases, all 1-carat or bigger tough diamonds coming into the EU should go to this Belgian entry level.”

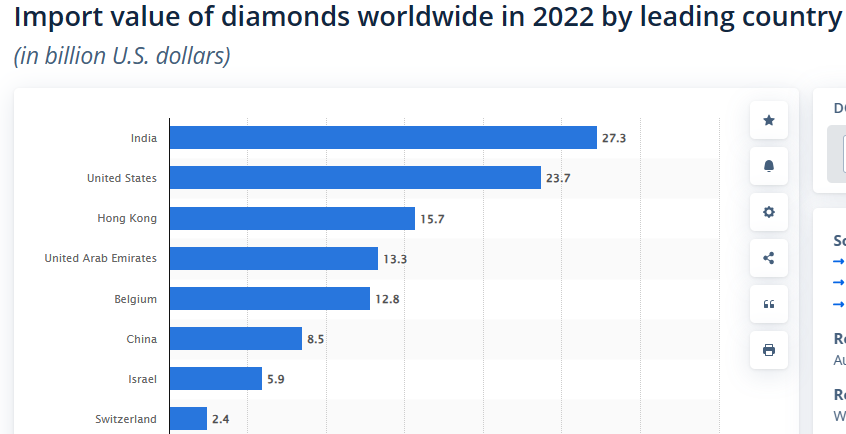

In a global market through which weak demand for diamonds is already squeezing the profitability of the commerce in key jewelry manufacturing centres in India and China (Hong Kong), the Russian technique is to bust the sanctions, defeat De Beers and the hostile Israeli-American operations, and create various companies buildings, After all, the small print are actually secret.

There are diamantaires out there who categorical confidence that Alrosa, Russia’s dominant diamond miner, might be as profitable because the Russian oil, gasoline, and coal exporters who’ve been beneath sanctions for longer. “The market might be in a state of shock for the primary few months,” feedback a Russian diamantaire now primarily based in Dubai. “Most probably, the price of stones could improve by 10% to twenty%, however after the primary shock, a correction will happen. Ultimately, workarounds might be discovered for the export of Russian diamonds. To determine parallel imports — from Russia to the skin — won’t be so troublesome.”

There are additionally sources who declare Alrosa will fail. Says a diamantaire in Europe, “even earlier than Putin’s invasion, the Russian share of tough manufacturing was beneath 30% in worth and quantity. Since then after all, all manufacturing and gross sales figures popping out of Alrosa have been pure make-believe and are up for the following Nobel prize for fiction. It may very well be stated there might be extra incentive to prospect for future tough in Africa or Canada, or for De Beers and others to elongate the lifetime of a few of their mines – as they’re already doing at Venetia [South Africa]. I don’t see any actual change within the buying and selling and sprucing centres, within the diamond jewellery-consuming nations, and within the construction of the pipeline typically. Simply much less authorized Russian tough.”

In final result, these two diamond {industry} sources could also be predicting the identical factor. The reason being what within the Russian diamond enterprise is known as submarining.

For the previous thirty years, as Russian language diamond publications have come and gone, this web site — and earlier than it the diamond media of London and Johannesburg — have reported on Russian diamond mining, manufacturing, exports, and submarining. Against this, diamond {industry} reporters within the US, Belgium, UK, and Israel typically comply with the Russian struggle line of their governments; in South Africa diamond reporters comply with the De Beers line. Click on to open the archive.

The newest chapter in Rapaport’s try and mobilize the US and EU sanctions businesses in opposition to Alrosa was printed final December. However at the moment the Russians made an alliance with the African miners in opposition to the Rapaport scheme for tightening US sanctions. The Indian diamantaires tried to play either side – “impartial, ready to see who would win”.

Within the December 6 report, the prediction for 2024 was unsure. “If the diamond market cracks in half, because the oil market has performed, the worth of market price-setters like Rapaport’s Rapnet might be erased. Nobody within the commerce is able to predict with confidence what the choice diamond commerce will appear like, and what affect it can have on diamond pricing.”

Click on to learn: https://johnhelmer.internet/

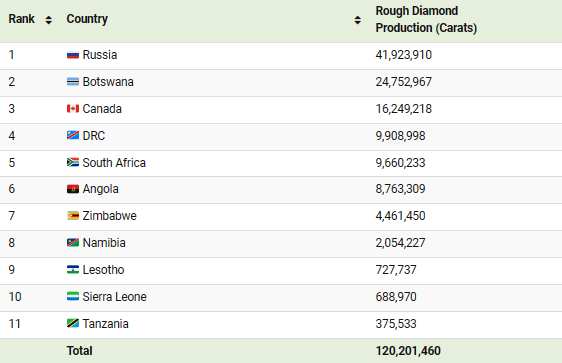

In charts of mine manufacturing of tough diamonds by weight in carats, and of worth in US {dollars}, that is what the worldwide diamond enterprise seemed like at the start of final yr:

OFFICIAL DIAMOND MINE PRODUCTION BY COUNTRY, 2022 – BY WEIGHT IN CARATS, BY VALUE IN USD

Supply: https://www.visualcapitalist.com/

On these official figures, the Alrosa share of world output by weight was 35%; 21.8% in worth. The corresponding De Beers totals – counting De Beers mines in Botswana, South Africa, and roughly half of the Canadian figures – are 35.3% and 46.2%. Alrosa’s 41% share in Angola’s diamond mining output has not been counted on this comparability; Alrosa’s stake within the Angolan mine at Catoca is in negotiation for a type of divestment.

As seen as diamonds are within the international commerce in luxurious items, and as dominant as Alrosa is on the mining and export finish of that commerce pipeline, the worth of diamonds in Russia’s commodity exports is tiny. Even when the US-Israeli sanctions had been to be as efficient as Rapaport hopes they are going to be, the discount in exports wouldn’t have a major affect on Russia’s stability of funds — in 2022, Russian commodity exports, in line with the Federal Customs Service, reached $591.5 billion; exports of diamonds against this fetched $4.7 billion, much less than 1%. As Forbes Russia reported lately, “after all, this may increasingly negatively have an effect on the monetary efficiency of Alrosa, which produces many of the Russian diamonds, as a result of a small a part of the stones is shipped to the home market. However everybody understands that the chapter of the state-owned firm shouldn’t be in peril. Even on the information of the suspension of diamond gross sales within the fall of 2023 as a result of demand state of affairs, the corporate’s shares sank by solely 2.5%.”

FIVE-YEAR SHARE PRICE TRAJECTORY OF ALROSA ON THE MOSCOW STOCK EXCHANGE

The federal authorities shareholding of Alrosa quantities to 33%; the Sakha area and native district shareholding is 33%; the free float, 34%. Nominal market capitalization on the present share value is Rb551.4 billion; the share value of Rb74.70 is 25% above the wartime low of Rb59.88 set in March 2023. Supply: https://markets.ft.com/

Russia can also be the one state within the diamond mining world able to doing for the state’s profit what De Beers has historically performed to guard and revenue its personal diamond-pricing cartel – purchase and promote mined tough with the state stockpile, recognized in Russia because the Gokhran. For the backfile on the politics of Gokhran’s diamond stockpiling, click on to learn.

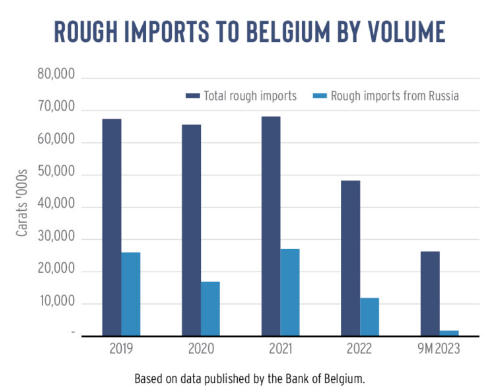

Beginning in 2022, the diamond trade in Dubai, United Arab Emirates (UAE), had overtaken Antwerp because the main import-export hub or trade between the mines, cutters and polishers, and the jewelry {industry} within the worldwide commerce. The rivalry between Dubai and Antwerp is, nevertheless, muted on either side, coated by the standard double-dealing of the enterprise; the blood-diamond sanctions and the anti-Russia sanctions; and now the political and navy vulnerability of the UAE within the struggle of Israel and the US in opposition to the Arabs.

For the official Dubai trade assertion on competitors with Antwerp, learn this.

Supply: https://rapaport.com/

There's rancour within the diamond enterprise to the tried profiteering from the March 1 sanctions by the Antwerp diamantaires; particularly hostile are the African miners and the Indian producers. Their opposition is mirrored on this industry-wide letter despatched to the G7 member states final month. “We stand united in opposition to forcing all contributors who want to promote their polished diamonds within the G7 markets, to ship their tough to Belgium first. As diamond consultants, we all know that this may add no worth to the aims of the G7 member states and would lead to a significant restriction for all non-Russian diamonds, with horrible impacts on the {industry}. It could additionally pressure, a functioning trans-global commerce into one centralised level that will create bottlenecks in provide and provides unwarranted energy and benefit to at least one participant on the detriment of all others… The method detailed by the EU, because it stands, undermines Sovereign African Governments to ship their diamonds on to the market of their selecting. It additionally undermines reputable native {industry} beneficiation and will encourage smuggling, which might be counterproductive.”

Supply: https://www.statista.com/

Final week the Dubai Diamond Change (DDE) introduced that in 2023 it had damaged its information for tough and polished diamond buying and selling, because it continues its year-on-year income progress averaging 11% over the previous 5 years. A complete of $21.3 billion-worth of tough diamonds had been traded by the DDE in 2023, the trade experiences; carat quantity was up, offsetting the 13% lower of tough value over the yr. The worth of polished items traded in Dubai surged by 32% year-on-year, reaching $16.9 billion in 2023. Complete worth of diamonds traded by way of the trade in 2023 got here to $38.3 billion. Laboratory grown diamonds (LGD) are additionally being traded by way of Dubai; the worth of LGDs traded in 2023 rose 10% year-on-year, reaching $1.6 billion.

In keeping with Ahmed Bin Sulayem, Government Chairman and CEO of the diamond trade’s father or mother firm Dubai Multi Commodities Centre (DMCC): “At $38.3 billion in tough and polished commerce final yr, these figures are additional proof of Dubai’s meteoric rise as a worldwide diamond commerce hub. Our attraction to diamond {industry} segments internationally is exemplified by our means to keep up sturdy commerce volumes in tough while quickly advancing polished and lab-grown diamonds. The polished section now represents virtually half of our diamond commerce, consolidating our standing because the world’s primary hub for tough and polished and, with main {industry} gamers persevering with to be drawn to Dubai away from the previous hubs of yesterday, DMCC will proceed to set the benchmark for the providers and worth that diamond merchants must develop and prosper.”

That’s placing it politely. The extra Alrosa tough which is submarined into Dubai after which traded out of DDE as polished, the extra successfully the Israel-American sanctions might be defeated, and the standard prosperity of the Belgians and the Jewish diamantaires of Antwerp will go down with them.

Russian sources affirm the development towards value discounting, as has already occurred in Russia’s oil and coal exports. In keeping with Alexei Kalachev, an analyst at Finam in Moscow, the geography of provides within the diamond pipeline will shift to much less worthwhile markets, the place the costs for stones are decrease and reductions are increased, reminiscent of in India. “A direct ban on the import of diamonds lower from Russian diamonds might be troublesome to implement, if in any respect potential.” He additionally acknowledges that Russian diamonds will stay on the US and European markets, however solely in a “laundered” type. He cites Germany for example, which refuses Russian oil, however doesn’t hand over Indian gas comprised of it. On the identical time, the markets of Asia, Africa and Latin America will stay open for Russian diamonds, Kalachev provides. The margin of revenue for diamond commerce intermediaries, significantly the Indians primarily based in Dubai, is leaping.

Roman Semenikhin, CEO of Ingosstrakh Investments Administration Firm, declines to reply questions from overseas reporters, however instructed Forbes Russia final October: “Within the occasion of a major and extended decline in demand in overseas markets, we’re prone to see vital purchases of diamonds from Alrosa by Gokhran as one of many measures to assist the corporate and the {industry} as an entire.” Different Moscow {industry} analysts following Alrosa agree that the reorientation of Russian diamond exports to the UAE, India, and China will restrict the affect of the brand new sanctions on Russia. They warn that within the quick time period, by lowering provide to the market there might be a rise in diamond costs, and that in flip will stimulate progress within the manufacturing and sale of synthetic stones – the LGDs.

Boris Krasnozhenov, head of the Securities Markets Analytics Division at Alfa Financial institution, says that in 2023 the worth of jewelry-quality diamonds on the world market was within the vary of $155-$160 per carat. He’s forecasting “a major improve in costs” this yr.

Deputy Finance Minister Alexei Moiseyev, who supervises the state stake in Alrosa and the diamond stockpile within the Gokhran, says that within the worldwide market it is going to be not possible to compensate for the substitute restriction of the provision of Russian diamonds from different sources. So there might be a mixture impact – sharp lower in provide, sharp rise within the value of pure diamonds, and sharp improve in “reasonably priced synthetics”.

Ahmed Bin Sulayem of the DDE and DMCC, assembly Deputy Finance Minister Alexei Moiseyev in Dubai on January 12, 2024. Sulayem will return the go to to satisfy Moiseyev in Moscow later this yr.

Moiseyev has held one of many fifteen seats on the Alrosa board which is rigorously balancing the income necessities for the Sakha republic and the regional districts which rely on preserving mine manufacturing, employment, tax and social funding ranges; inventory ranges at each Alrosa and Gokhran; and the pricing of exports. In impact, this implies reversing twenty years of the privatization scheming of Russian oligarchs, promoted on the Finance Ministry and on the Alrosa board by the ex-finance minister now in exile, Alexei Kudrin. Re-nationalization of Russian diamonds is one other of the outcomes of the Israeli-American sanctions.

Within the current circumstances no Russian supply will talk about these particulars.