In the event you had topped up your Supplementary Retirement Scheme (SRS) at any level earlier than to scale back your revenue taxes, it is best to observe that your funds solely earn measly 0.05% p.a. curiosity. With elevated inflation ranges in the present day, keep away from dropping the worth of your retirement funds by investing them as an alternative. Right here’s how.

It’s loopy to assume that whereas banks have raised their rates of interest over the past 2 years to maintain up with the Fed hikes and retain deposits, none of that applies to our SRS account, which nonetheless earns a depressing 0.05% p.a. Good for the banks, I suppose, however horrible for us.

And that’s why I don’t simply preserve my funds idle in my SRS account. However it was stunning to be taught that 1 in 5 Singaporeans try this, and whether or not this is because of ignorance or pure laziness is anyone’s guess.

As a taxpayer in Singapore, the SRS is an effective way to legitimately scale back one’s revenue taxes payable…capped at a restrict of $15,300 per yr. I’ve talked about it typically, and also you undoubtedly ought to use the SRS when you’re making an attempt to pay much less taxes!

Then, when you flip 63 (i.e. hit the prevailing statutory retirement age), you’ll be capable to make penalty-free withdrawals out of your SRS account to fund your retirement life-style and be taxed at solely 50% of the sum withdrawn.

Psst, the statutory retirement age is about to be revised to 65 by 2030. Opening your SRS account earlier than that occurs and funding it (even when simply with $1) will provide help to to “lock in” your withdrawal age at 63.

Vital observe: This is applicable for Singaporean residents. For Everlasting Residents and non-citizens residing in Singapore, completely different taxation legal guidelines apply, which you'll be able to view right here on IRAS.

However you already know what’s even higher than that?

When you will get away with paying ZERO taxes 😉

That’s proper, with cautious planning, you possibly can even keep away from paying revenue taxes solely in your funds withdrawn!

Right here’s the way it works in in the present day’s context:

- People with an annual revenue of $20,000 or much less usually are not obliged to pay any taxes in Singapore (the revenue tax fee for this group is 0%).

- So the trick is so that you can withdraw $40,000 annually out of your SRS account, you’ll solely be taxed on 50% of that i.e. $20,000.

- In different phrases, you received’t must pay any taxes 😉

Primarily based on present tax charges, the best sum to have in our SRS account on the level of withdrawal can be $400,000 as a way to pay zero taxes.

This determine could change if IRAS modifications their revenue tax charges.

Nonetheless, when you’re a excessive revenue earner or a talented investor can develop your SRS funds to a bigger quantity (e.g. $800k), your tax fee can nonetheless be low e.g. withdrawing $80k a yr out of your SRS solely incurs a $350 tax.

So let’s think about that we max out our yearly contributions of $15,300 between the age of 35 – 55 (20 years). This interprets into $306k in complete.

Even when we’re fortunate sufficient to proceed incomes a excessive wage between age 55 – 60 and might contribute for an additional 5 years, that works out to be $382,500 on the finish (or $384,996 to be correct, after accounting for 0.05% p.a. curiosity).

That’s hardly near the best quantity of $400k in any respect!

Thus, you possibly can see that as a way to meaningfully develop your SRS retirement funds, you might want to make investments it to earn higher returns.

What can my SRS funds be used to spend money on?

At the moment, there are a variety of investments you could select from on your SRS funds.

A false impression is you could solely make investments through the SRS supplier the place you may have your account with (e.g. DBS / OCBC / UOB). Actually, you should utilize virtually any dealer of your selection, so long as you hyperlink your SRS account because the supply of your funds.

Vital Word: You possibly can solely use native brokers to speculate your SRS funds, which implies standard low-cost brokerage companies comparable to Tiger Brokers, MooMoo, WeBull, Interactive Brokers, TD Ameritrade, Saxo Capital, uSMART, and many others won't be obtainable so that you can make investments your SRS funds in.

I’ll cowl just a few methods you could discover investing your SRS funds in, whereas sharing about which strategies I want to make use of:

Singapore Financial savings Bonds

For the tremendous risk-adverse who don’t need to take any danger in your capital, you possibly can spend money on Singapore Financial savings Bonds – the most recent tranche presently yield a median return of two.81% p.a. The excellent news is, you possibly can make investments as much as $200,000 (MAS has raised the restrict up from $100k beforehand).

Change-Traded Funds

Those that want to make investments and get market returns can think about exchange-traded funds, which generally monitor an underlying index as its benchmark. That is a simple method to diversify and get broad-based publicity with out having to do an excessive amount of analysis on particular person shares both.

In Singapore, standard ETFs utilized by many SRS buyers embody these monitoring the Straits Instances Index (STI), bond ETFs and REIT ETFs.

A RSS plan is a simple method to spend money on shares, bonds, ETFs or REITs listed on the SGX from as little as $100 a month. In the event you want to dollar-cost common into the market as an alternative of making an attempt to time the market, this might be choice for you.

You possibly can arrange an RSS plan with any of the under 4 native brokerages:

- FSMOne ETF Common Financial savings Plan

- POSB/DBS Make investments-Saver

- OCBC Blue Chip Funding Plan

- Phillip Share Builders Plan

Shares

You can too use your SRS funds to speculate immediately in shares listed on the SGX, comparable to in sturdy blue-chip corporations like DBS Financial institution, OCBC or Capitaland Trusts.

Nonetheless, I personally don’t practise this as a result of I want to have liquidity in my inventory account. There’s nothing fallacious with this methodology, however that is simply my private desire.

Robo-Advisors

Digital robo-advisory platforms comparable to MoneyOwl and EndowUs additionally mean you can use your SRS funds to speculate with them, comparable to of their money administration accounts or low-cost unit trusts (e.g. Dimensional Funds).

Insurance coverage

You can too use your SRS funds to spend money on single-premium insurance coverage merchandise, endowments or annuities. Because the 10-year withdrawal interval restrict for SRS accounts doesn’t apply to annuities, this makes SRS annuity merchandise much more engaging.

Nonetheless, the downsides are that returns on such insurance coverage merchandise are typically low (averaging 2 – 3%) and comes with bigger sums for funding, with prolonged lock-in durations.

This isn’t one thing I favour since I’m nonetheless younger and have a long term funding horizon, however I’m overlaying this because it continues to be a well-liked instrument utilized by many SRS buyers.

So…what does Funds Babe make investments her SRS funds in?

Personally, my desire can be for ETFs or unit trusts in terms of managing the funds in my SRS account.

That’s as a result of I would like one thing for the long-run, which I don’t must persistently monitor as typically, and might let it run extra passively in distinction to my lively inventory funding account.

Another excuse is that I’ve a decrease danger tolerance in terms of my SRS funds, as these are meant primarily for my retirement and I don’t need to tackle an excessive amount of capital danger. For the reason that volatility in particular person shares are greater, I want to not deploy my SRS funds right here.

Use your SRS as a instrument to spice up your retirement revenue

My husband and I are planning for our retirement in such a method that we hopefully won’t must depend on our children giving us allowance to outlive. You can too examine how I really feel about this “parental allowance” subject right here on CNA.

Because the title suggests, your SRS ought to complement your different retirement funds, so don’t make the error of relying in your SRS funds alone for retirement as that’s unlikely to be sufficient.

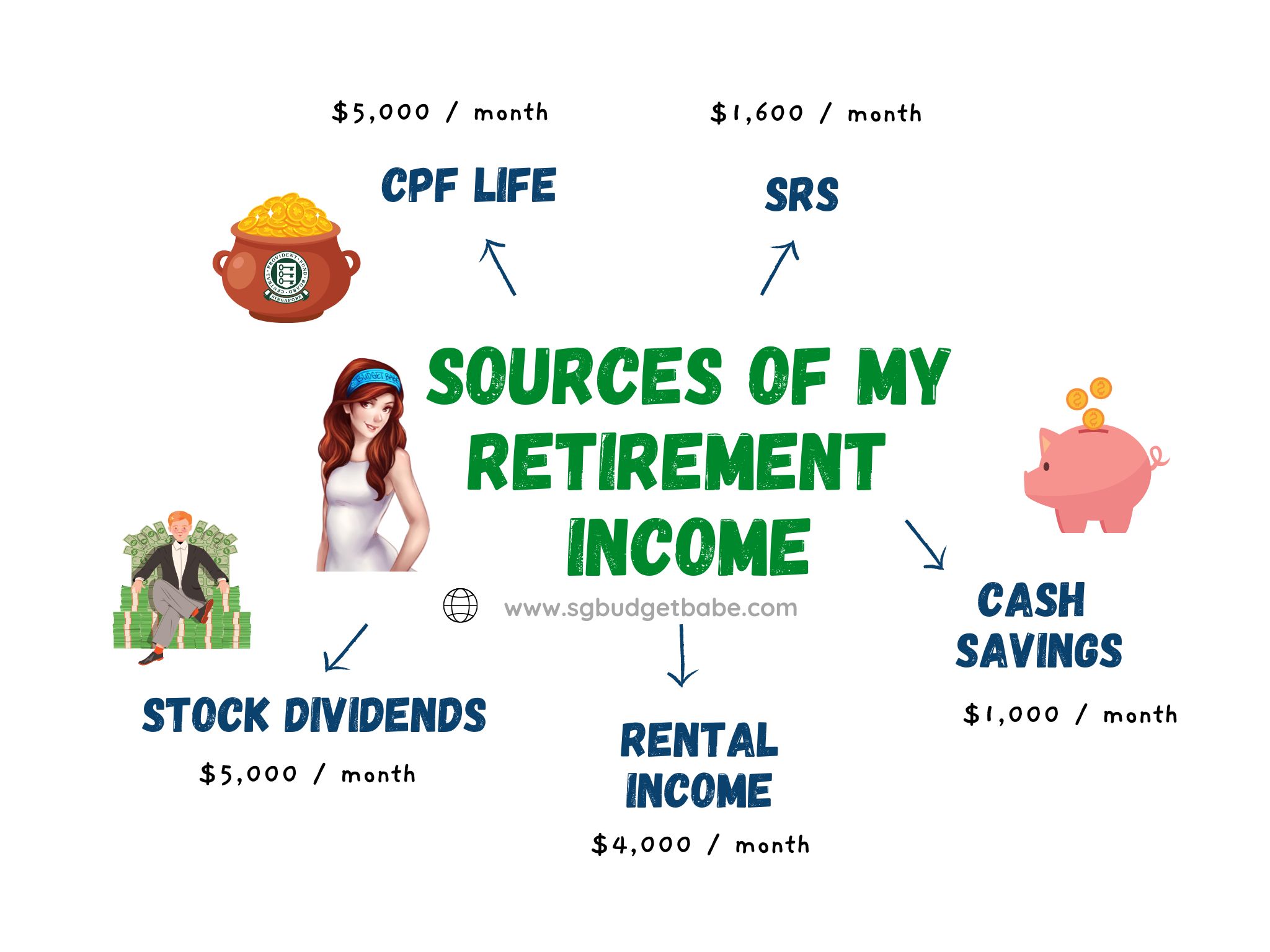

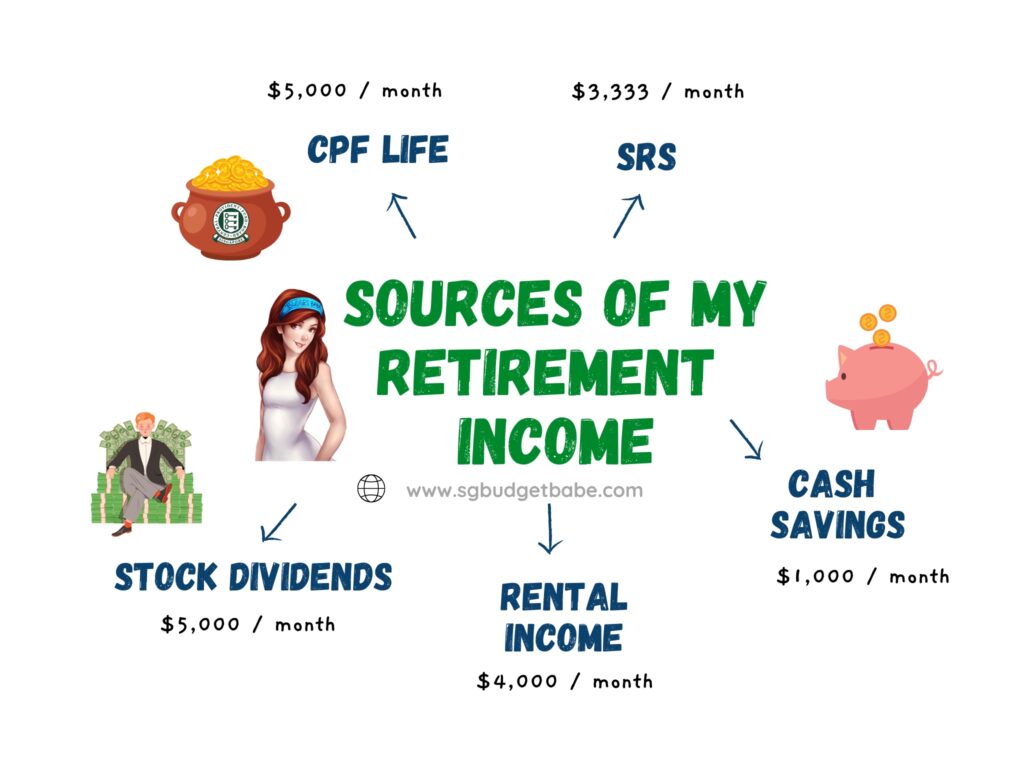

At $40k withdrawn a yr, that works out to be about $3,333 a month – however given inflation ranges and the rising value of dwelling, you’ll have to be sure to produce other revenue sources funding your retirement years as properly.

Right here’s mine:

I’ve already deliberate for my CPF Life payouts – click on right here to see how I’ll be attaining $5,000 a month. My SRS and inventory dividend portfolio are nonetheless very a lot a work-in-progress and I’ll be persevering with my efforts there to construct it up over time.

A few of our associates have already secured their funding property for his or her retirement plan, however in the intervening time, we’re nonetheless just a few years away from making ours change into a actuality (principally on account of MOP timelines). As soon as that’s settled, I’ll breathe one other sigh of aid.

Lastly, I hope to ultimately have sufficient money financial savings put aside in fastened deposits, treasury payments and short-term endowment plans for the aim of liquid cashflow within the occasion of any emergencies. 20% shall be at all times saved absolutely liquid to allow a month-to-month withdrawal of $1,000 every month.

If my plan works out, this can permit us to have a cushty retirement – one the place I cannot solely pay for our personal dwelling bills, but in addition journey overseas and even pay for meals and items for our youngsters with out worrying that we’ll run out of cash.

Essentially the most encouraging half is, even when you’re clueless and eradicate the portion from inventory dividends and rental revenue, you too, can safe a good retirement quantity for your self by constructing along with your CPF and SRS from the beginning. The important thing factor then, is to begin early.

How are YOU planning on your retirement?

With love,

Funds Babe