Earnings tax discover below part 143(1) is a message despatched after processing return. It Compares your filed return with division’s computations. When you’ve got acquired the earnings discover below 143(1)(a) because of variance in earnings as a mismatch with 26AS and the main points are appropriate then It’s a must to conform to the discover and file a revised return.

Discover below part 143(1)

Discover below part 143(1) is solely an intimation in response to the tax return filed by you, which can do one of many following:

- The return filed by you matches the evaluation of the AO and no additional motion is required

- You can be issued a refund, by the checking account said within the return, as the quantity of taxes paid is extra.

- A requirement discover, as you’ve paid lower than the required quantity of taxes and taxes are due by you, which can must be paid inside 30 days of receiving the demand.

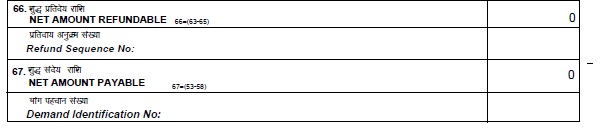

You must open the doc despatched within the e mail with the discover. Scroll all the way down to the underside and see what’s web tax payable as proven in

Discover below part 143(1A)

Discover u/s 143(1A) is distributed If there are any mismatches, corresponding to you haven’t included in your return all of the earnings as reported in your 26AS, then these computer-assisted notices might be despatched in search of essential clarification. You will have to reply to this discover inside 30 days by logging onto the earnings tax portal and importing the proof wanted to appropriate the mismatch. Discover Variance because of Earnings From Different sources

When you’ve got acquired a communication of proposed adjustment u/s 143(1)(a) discover, please learn the article right here. That is totally different from a 143(1) discover.

Earnings tax discover below Part 143(1)

When is the Earnings tax discover below Part 143(1) – Letter of Intimation served?

Three varieties of notices will be despatched below part 143 (1)

- Intimation the place the discover is to be merely thought-about as remaining evaluation of your returns for the reason that CPC or assessing officer has discovered the return filed by you to be matching together with his computation below part 143 (1).

- A refund discover ,the place Earnings tax refunds you for additional tax paid, then you possibly can look ahead to the cheque.

- Demand Discover the place the officer’s computation exhibits shortfall in your tax cost. The discover will ask you to pay up the tax due inside 30 days.

What’s the time restrict of sending the intimation?

The intimation is distributed earlier than the expiry of 1 yr from the top of the evaluation yr by which the earnings was assessable. In different phrases, earlier than the expiry of 1 yr from the top of the monetary yr by which the return was filed.

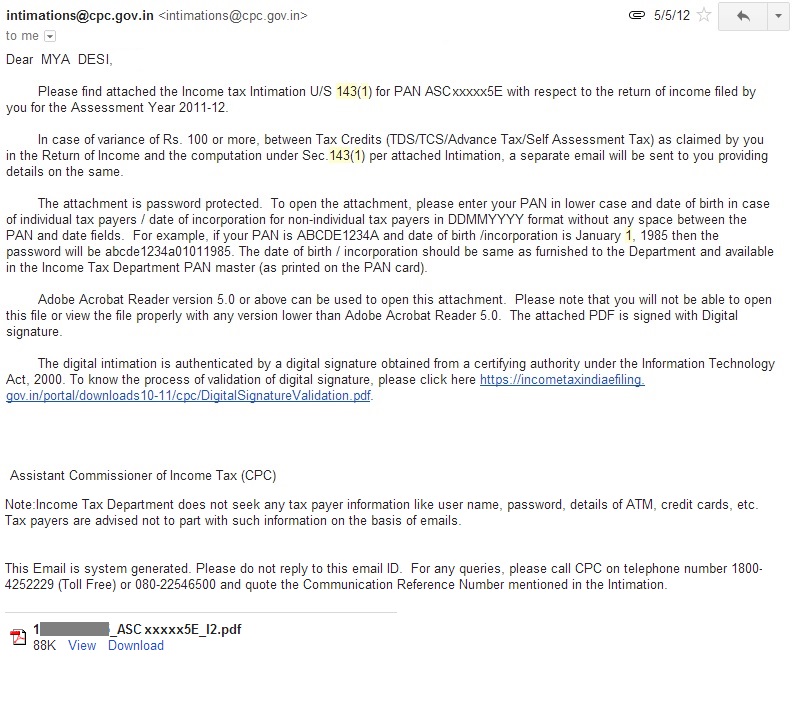

How is the intimation despatched?

These intimations are despatched by e mail to the E mail tackle supplied in submitting earnings tax returns on-line. As e-return are processed by Central Processing Centre (CPC) sender is intimations@cpc.gov.in. For e-return exhausting copy may also be despatched by submit on the tackle related to PAN quantity identical to the non digital filed ITRs. Our article Earnings Tax Discover :Sections,What to examine,How one can reply explains how one can discover tackle related to PAN quantity.

Pattern e-Mail despatched with an attachment is proven in picture beneath.Attachment is usually a pdf file or a zipper file.

As talked about in e mail, attachment is password shield. Password is your PAN quantity in decrease case, adopted by your date of start in DDMMYYYY format , for instance for Mr Sharma with PAN quantity AJSPD8693E and date of start as 20-Mar-1976 the password can be ajspd9693ed20031976

If it’s zip file extract the pdf and open the pdf.

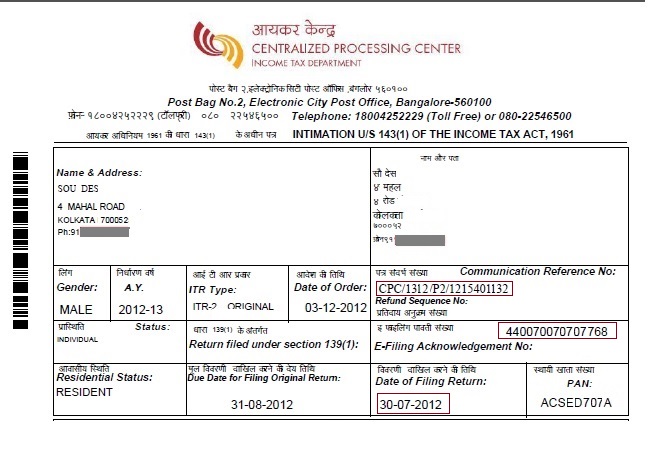

The Doc with Earnings Tax Discover 143(1)

First a part of the doc has info on Title & Handle, PAN quantity, ITR Sort,A ssessment Yr, E-Submitting Acknowledgement Quantity ,C ommunication Reference Quantity, Date of Order as proven within the picture beneath. Date of order is that Date on which order below part 143(1) was handed by the CPC Bengaluru . Please examine that the intimation is for you solely.

One can contact Earnings Tax Helpline/Toll Free Variety of CPC Bangalore Earnings Tax Division (Bengaluru) at 1800 -425 2229 or 080-22546500 for Earnings tax queries. Earlier than you contact you need to have Communication Reference No (marked in picture above) with you and bear in mind your PAN card particulars like PAN Card quantity, Date of Delivery

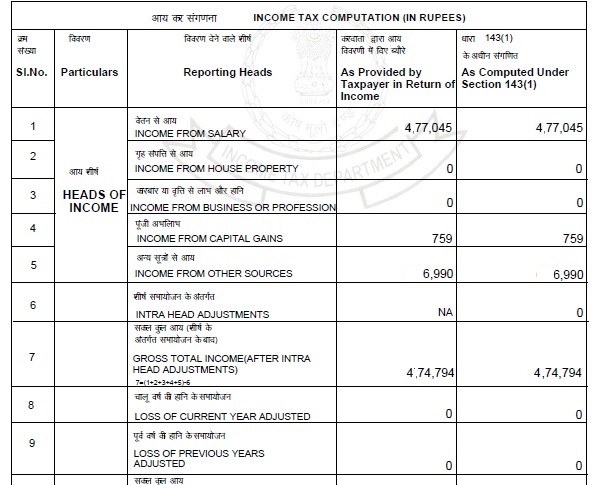

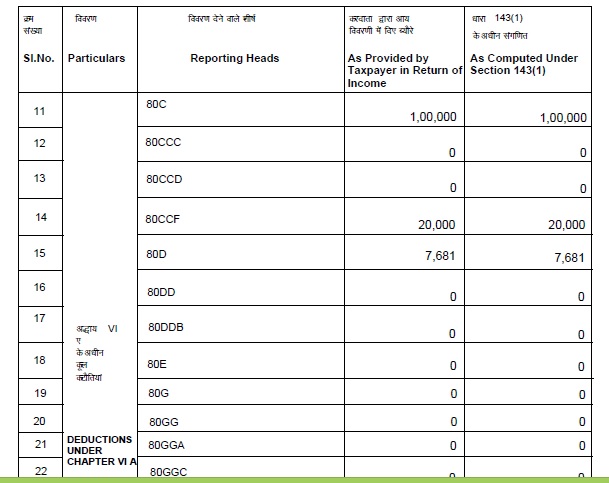

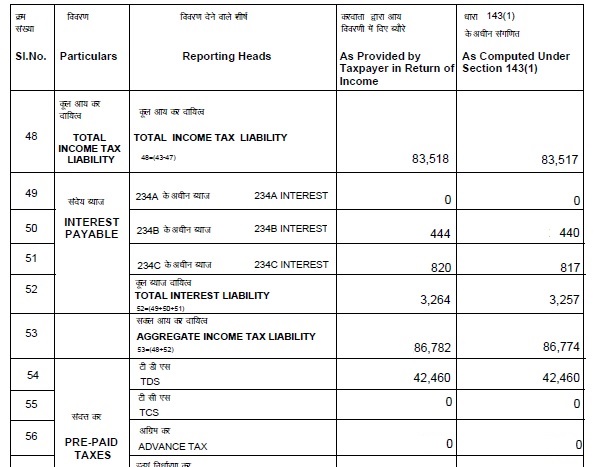

The second a part of the doc exhibits computation of earnings, with earnings reported below varied classes, deductions claimed, taxable earnings, tax due, tax paid ex advance tax, self evaluation tax, TDS, and so on in two columns as proven in picture beneath:

a) As supplied by taxpayer in his Earnings tax return is from the ITR filed by the tax-payer.

b) As computed below part 143(1) are computations by CPC .

A part of doc which exhibits Earnings kind (Earnings from Wage, Earnings from Home Property and so on) is proven in picture beneath. Observe: The heads of earnings could also be totally different relying on ITR filed by you. For instance ITR1 won’t have Earnings from Capital Beneficial properties. Please examine that Earnings is taken into account correctly below applicable head. Earnings below one head of earnings isn’t thought-about as from one other head or repeated below one other head of earnings

Computation in two columns in 143(1)A part of doc which exhibits Deductions claimed below varied heads corresponding to 80C, 80D and so on is proven beneath. Please examine that deductions you’ve claimed below 80C and different sections of chapter VI are thought-about.

A part of doc which exhibits the tax calculation is proven beneath.

Please examine that TDS claimed, Advance Tax and Self Evaluation Tax paid is mirrored within the computation by CPC. CPC picks up the figures out of your Type 26AS. Type 26AS is the tax division’s assertion exhibiting earnings tax deposited in your behalf and may considered on TRACES web site or by netbanking. One ought to confirm Type 26AS earlier than submitting returns. If there are mismatches in Type 26AS with respect to Type 16/Type 16A then it must be taken up with the accounts division of your organization/financial institution and errors must be rectified.

Small Distinction in Calculations: You might even see distinction between the calculations in two columns for instance whole earnings after deductions As Computed Beneath Part 143(1) is 5 rupees greater than the quantity in Return of Earnings. That is because of Rounding of earnings and Earnings tax payable The earnings tax act suggests rounding off of earnings below Part 288A and the earnings tax payable Part 288B. That is mentioned later in Rounding of Earnings and Tax

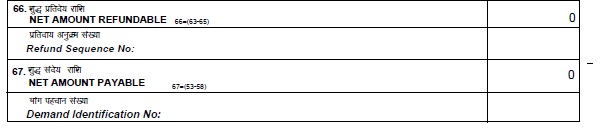

Scroll down and on the finish of all calculations you’d see two headings Internet Quantity Refundable and Internet Quantity Payable as proven in picture beneath.(Row numbers could also be totally different)

If web quantity refundable talked about in Intimation below part 143(1) greater than 100 rupees, it implies that tax refund is due from earnings tax division to tax payer. Refunds quantities lower than 100 rupees aren’t refunded. You may examine refund standing on-line. He’ll first obtain this intimation on mail then a handbook intimation together with the refund cheque will attain his tackle. On receiving the cheque, one can deposit the cheque .

If web quantity demand talked about in Intimation below part 143(1) is greater than 100 rupees, then tax payer must pay tax . This might be handled as demand discover for the cost of earnings tax due. This Intimation letter encloses challan type to pay earnings tax if the due is greater than Rs 100. In case of Demand, this intimation could also be handled as Discover of demand u/s 156 of the Earnings Tax Act, 1961. Accordingly, you might be requested to pay your entire Demand inside 30 days of receipt of this intimation“. If tax payer thinks that

- Tax Demand is legitimate : he must pay the tax.

- Tax Demand is mistaken : then he should show his case following applicable process. He could make an utility for rectification below part 154. He could seek the advice of a certified CA or good tax skilled for additional motion. Nevertheless,someday return processing by CPC turns into tough and the taxpayer could contact native earnings tax officer (ITO) and submit a written utility for rectifying your evaluation. Help it together with his TDS statements, Type 26AS, intimation below part 143 (1) and see of demand. In a plain paper he also can submit an utility for Keep of Restoration. Proceedings for requesting them to carry additional proceedings until rectification is made.

If web quantity refundable/web quantity demand is lower than Rs 100 or no distinction, you possibly can deal with Intimation below part 143(1) as completion of earnings tax returns evaluation below Earnings Tax Act.

Rounding off Earnings and Tax

Part 288A : As per part 288A of the Earnings Tax Act, the entire earnings computed as per varied sections of this act, shall be rounded off to the closest Rs 10. For the aim of rounding off, firstly any a part of rupee consisting of paisa must be ignored. Thereafter, if the final digit within the whole determine is 5 or larger than 5, the entire quantity must be elevated to the subsequent larger quantity which is a a number of of Rs. 10. If the final digit within the whole determine is lower than 5, the entire quantity must be diminished to the closest decrease quantity which is a a number of of Rs 10. This rounding off of earnings must be finished solely to the entire earnings and never on the time of computation of earnings below the varied heads. Eg: If whole earnings is Rs. 7,83,944.50 will get diminished to 7,83,940 whereas if earnings had been 7,83,945.50 it will get rounded off to 7,83,950.

Part 288B : Rounding off Earnings Tax As per Part 288B of the earnings tax act, the entire tax computed shall be rounded off to the closest Rs 10. The rounding off of tax can be finished on the entire tax payable or refundable and to not varied totally different sub-heads of taxes like earnings tax, schooling cess, surcharge and so on. Rounding off can be finished in the identical method as above i.e.. firstly paisa can be ignored and thereafter if the final digit within the whole determine is 5 or larger than 5, the entire quantity must be elevated to the subsequent larger quantity which is a a number of of Rs 10. Eg: If the entire tax payable of a taxpayer is Rs. 79,223.25 will get rounded to 79223 after which to 79,220, whereas Rs.79226.25, will get rounded off to Rs 79226 after which to Rs 79230

Associated Articles :