There’s a bull market in bull market indicators flashing purple proper now.

Barron’s had a bullish cowl:

The Economist too:

The Nasdaq 100 is up greater than 60% because the begin of 2023. Nvidia is up 500% in that point.

There are tens of billions of {dollars} flowing into the brand new bitcoin ETFs. Hypothesis in tech shares, crypto, NFTs, choices, day buying and selling, and so forth. makes it really feel like we picked up proper the place we left off within the mini-2020/2021 meme inventory bubble.

If you wish to discover areas of concern and complacency, you don’t should look very exhausting proper now.

The unusual factor is there are some offsets to this bullish habits.

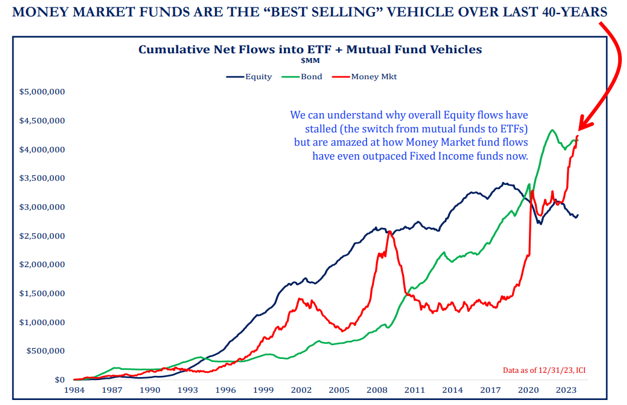

Strategas has this chart exhibiting the long-term internet flows for shares, bonds and cash market funds:

Take a look at the trillions of {dollars} which have poured into cash market funds these previous few years. Cash has really come out of inventory market mutual funds and ETFs on a internet foundation whereas cash market funds have raked in trillions of {dollars}.

Does that sound like speculative habits to you?

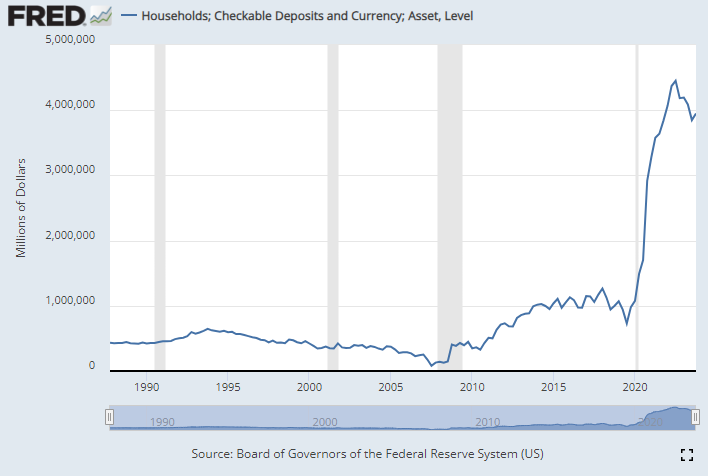

Now take a look at the sum of money in checking accounts:

The post-Covid transfer in money held at banks is not like something we’ve ever seen. And whereas it’s rolled over a bit, there’s nonetheless far more cash simply sitting in checking accounts doing nothing.

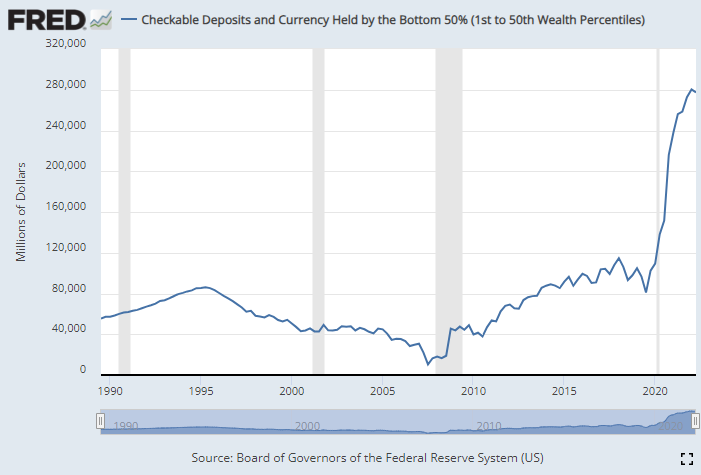

And this isn’t simply the rich both. Take a look at checkable deposits for the underside 50% by wealth:

This group is sitting on far more money too.

The inventory market has confirmed much more resilient than most individuals would have anticipated contemplating the inflationary setting we lived by. Everybody thought it was sure we might be in a recession by now.

There are lots of causes the inventory market is up and the economic system stays sturdy (I’ve chronicled them right here, right here, right here, and right here).

Possibly the best cause is that most individuals are wealthier than they’ve ever been.

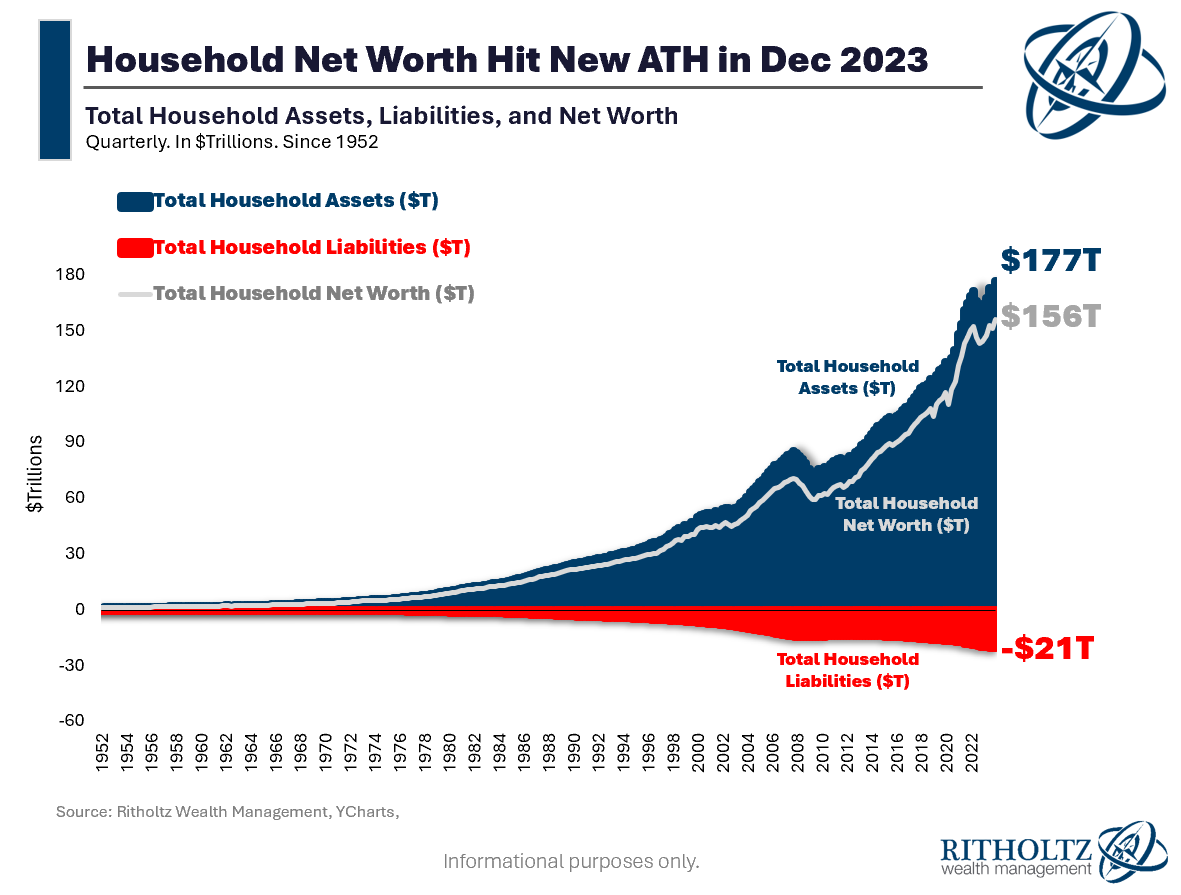

Simply take a look at the up to date Fed knowledge on family wealth by the tip of 2023:

The online price of People hit one other new all-time excessive by the tip of 2023. And certain, debt ranges have hit new all-time highs as effectively however belongings are rising at a a lot sooner tempo:

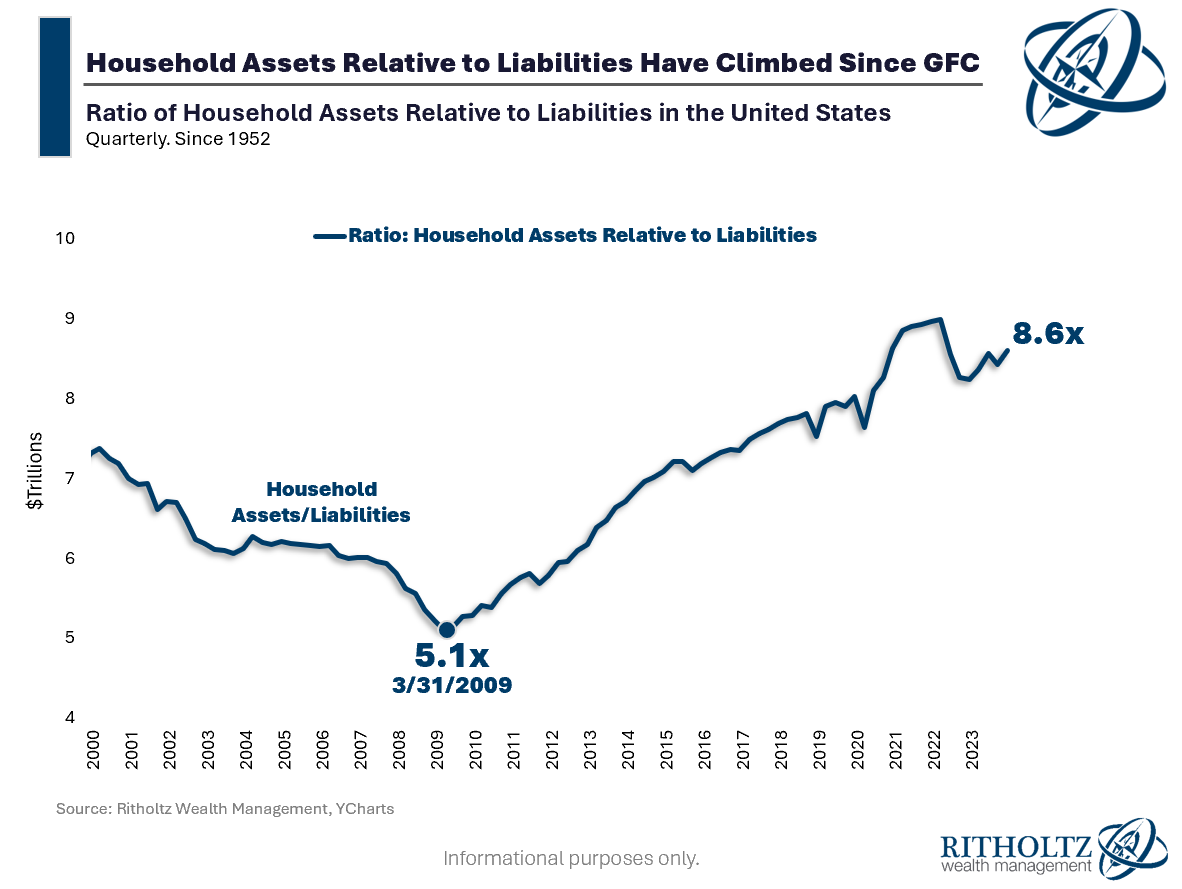

You may see that the ratio of belongings to liabilities was falling all the best way from the tip of the dot-com bubble in 2000 proper by the underside of the Nice Monetary Disaster in 2009.

That was not good. Ever since then households have reversed that development.

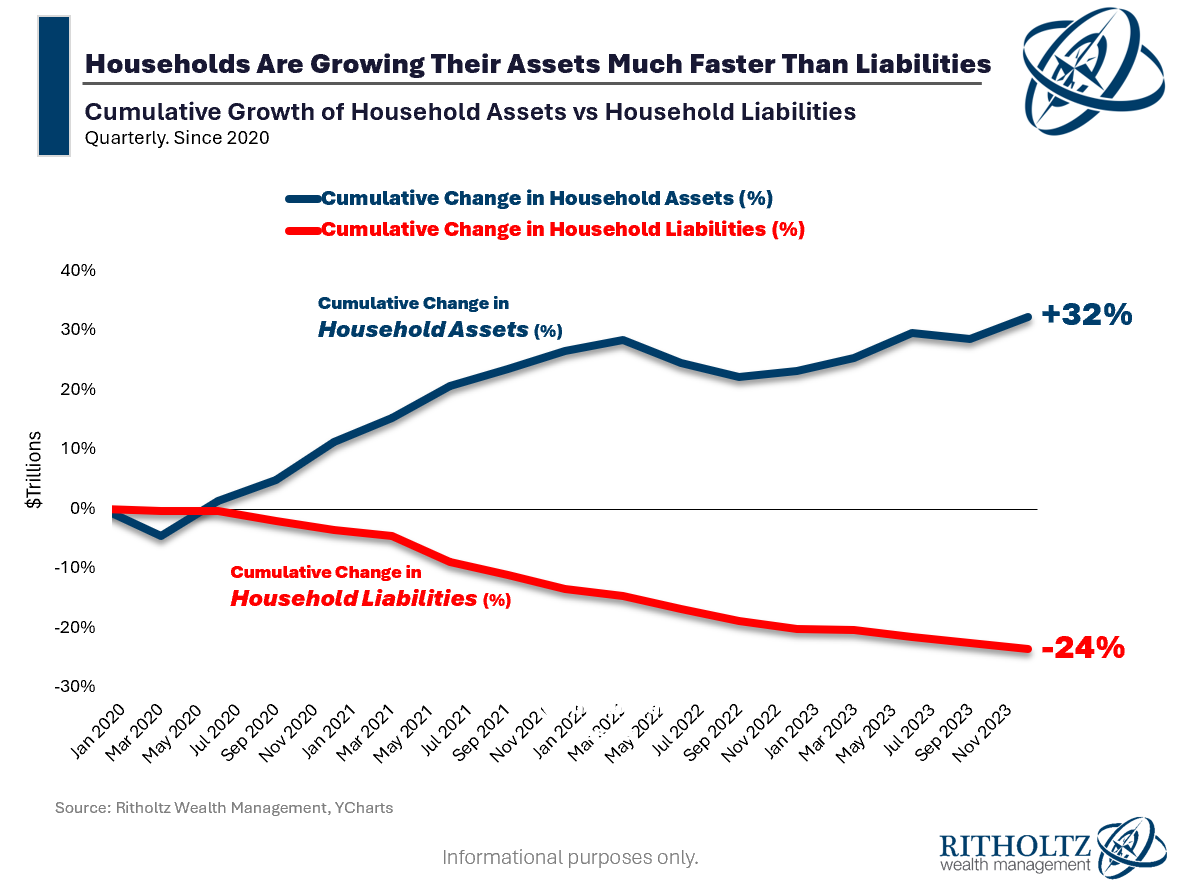

The pandemic has put the collective steadiness sheet of People in a fair higher place:

For the reason that begin of 2020, belongings have grown at a wholesome clip whereas debt totals have really fallen.

Shoppers had been in horrible form heading into the 2008 monetary disaster. They had been overleveraged and didn’t have the funds for saved to supply a margin of security.

That’s merely not the case this time round.

Money balances are excessive. Inventory costs are excessive. House fairness has by no means been increased. Yields are on the highest ranges they’ve been in effectively over a decade. Buyers, savers and customers alike are in good condition.

Clearly, this isn’t everybody. Wealth inequality remains to be an issue. Not everybody owns monetary belongings or a house.

However the individuals who do personal monetary belongings are as flush as they’ve ever been. And that is the group that spends essentially the most cash and buys shares, cash market funds and homes.

Costs on the whole lot are up as a result of individuals have some huge cash proper now.

After all, this case gained’t final endlessly.

There can be a recession in some unspecified time in the future. Asset costs will fall. The economic system will overheat or an sudden occasion will trigger a slowdown.

Recessions haven’t been outlawed.

However American family steadiness sheets are in an incredible place when we have now to climate the inevitable storm.

Additional Studying:

People Have By no means Been Wealthier & No One Is Glad