The Indian inventory markets hit all-time highs on Friday (July 14, 2023). The bellwether indices Nifty 50 and Sensex closed above 19,500 and 66,000, respectively.

In case your portfolio had a good fairness allocation, you’ll be a cheerful investor right this moment. Your portfolio should be displaying wholesome good points. Nevertheless, your funding journey shouldn’t be but full. An even bigger query bothers you: What to do now? Methods to make investments when the markets are at all-time highs?

- Do you have to promote all (or an element) of your portfolio and reinvest when the market falls? OR

- Do you have to cease SIPs and restart when the markets have corrected? OR

- Do you have to do nothing, promote nothing, and let the SIPs proceed?

There isn’t a black and white reply to this. We are going to know the CORRECT reply solely sooner or later. Say 3 to five years from now. Nevertheless, on this publish, I’ll attempt to share what in line with me is the RIGHT strategy in such conditions. Observe my definition of the RIGHT funding strategy could also be completely different from yours.

For me, the RIGHT strategy is the one that’s straightforward to execute and follow, is much less mentally exhausting, and gives passable returns. Adequate to assist me attain my monetary objectives. I don’t attempt to time the market (nor do I’ve the talents to try this). I don’t lose sleep attempting to get the perfect out of the markets. And I’m wonderful with my neighbour incomes higher returns than me.

Market hitting all-time highs shouldn’t be unusual

Occurs extra typically than you’ll think about.

Anticipated too, isn’t?

In any case, Nifty 50 has gone from ~1,500 because the flip of the century to 19,500. Ditto with Sensex that has moved from ~5,000 on the finish of 1999 to 66,000 right this moment. So, these indices have gone up 13X. That’s not doable with out markets hitting all-time highs repeatedly.

I wrote this publish in March 2021 when Sensex hit 50,000 for the primary time. We’re up 30% in 27 months since then. Not unhealthy in any respect.

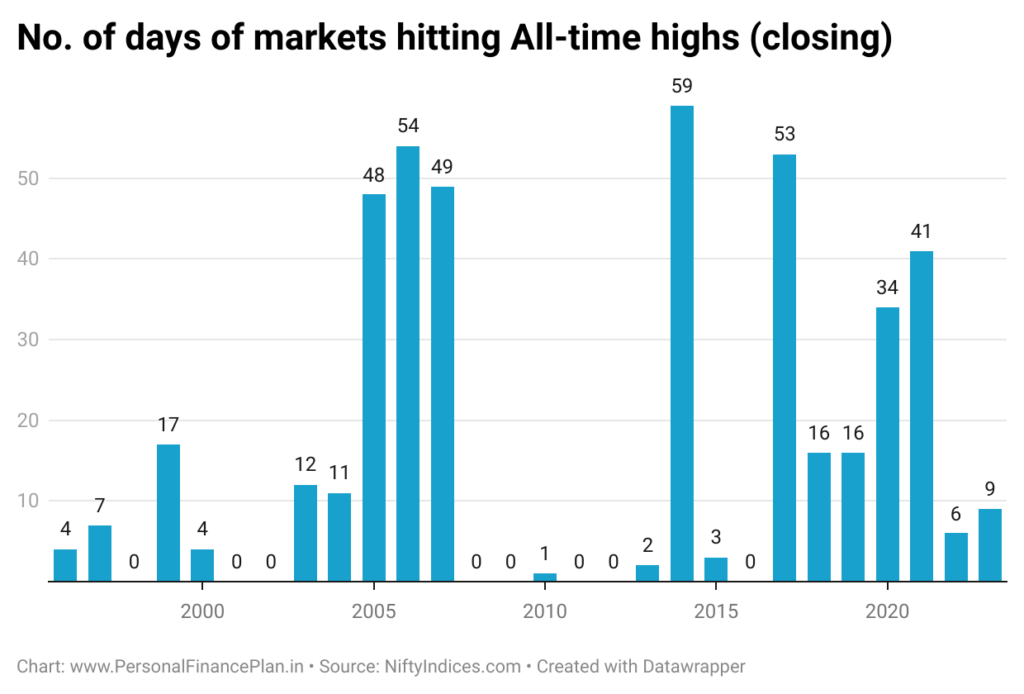

We’ve got hit an all-time excessive on Nifty 50 atleast as soon as in 17 out of the final 24 years. Fairly frequent, proper? The years after we didn’t hit an all-time excessive even as soon as are 2001, 2002, 2008, 2009, 2011, 2012, and 2016. And within the years when the markets have reached the all-time highs, they haven’t damaged the height simply as soon as.

What have been the returns like when investing at an all-time excessive?

I checked out 1-year, 3-year, 5-year, 7-year returns from the date markets hit all-time highs (closing).

*Previous efficiency, as you see within the historic information above, might not repeat.

You’ll be able to see that the returns are NOT that unhealthy. Common previous returns (from all-time highs) for medium to long run vary from 9% to 11% p.a.

Sure, this efficiency might NOT be thrilling for a few of you.

Nevertheless, my expertise is that promoting at all-time highs is simply not an issue. It’s fairly straightforward. You need to have made cash with all of your investments (let’s ignore taxes for now). The issue is easy methods to get again in. For those who promote at all-time highs planning to get again in when the markets fall, when do you make investments these quantities again?

- If the markets begin rising, you wouldn’t make investments. In any case, you offered at decrease ranges.

- If the markets take a pointy U-turn and begin falling, the market commentary will seemingly flip opposed. You might be scared to take a position and should need to wait till the whole lot “normalizes”. Then, the markets would all of the sudden reverse, and also you go to (1).

When you’ve got lived via these feelings, when do you make investments again this cash?

You might not behave on this method, however I feel many traders do. Timing the markets (frequent shopping for and promoting) shouldn’t be straightforward and isn’t for everybody. Actually not for me. Lacking the perfect day, the perfect week, or the perfect month of the 12 months can adversely have an effect on long run returns.

If you put money into inventory markets, you aren’t simply combating towards the inventory markets. In actual fact, you aren’t combating markets in any respect. The value of inventory or the inventory markets will take a trajectory of its personal. You’ll be able to’t management that. You battle a a lot fiercer battle towards your feelings and biases. That’s the place a lot of the funding battles are gained or misplaced. It’s straightforward to say, “I’m a long-term investor and don’t care about short-term volatility”. You hear this extra typically when the occasions are good. Nevertheless, when the tide turns and markets wrestle for an prolonged interval, your persistence will get examined. That’s if you return and query your funding decisions. And maybe make decisions that you’d remorse sooner or later.

The occasions taking place round you may have an effect on your conviction and strategy in the direction of investments, threat, and reward. This is the reason, regardless of all of the speak about worth investing, most traders come into the markets when the markets are rising. And the traders shun the markets when the markets are struggling (worth investing would counsel in any other case).

Let Asset Allocation be your information

If you work with an asset allocation strategy to investments, you’ll mechanically get solutions about when and the way a lot to promote. You wouldn’t have to depend on your guts.

When the markets hit all-time highs, the fairness allocation in your portfolio additionally rises. It’s doable that your fairness allocation has breached the rebalancing threshold. If that occurs, you rebalance the portfolio to focus on asset allocation. Till the rebalancing threshold is hit, you don’t do something.

Then again, when the markets fall, the fairness allocation falls. When the rebalanced threshold is hit, you rebalance to focus on allocation.

It’s that easy.

In investing, easy beats complicated.

By the way in which, don’t consider this as a conservative strategy. Common portfolio rebalancing can cut back portfolio volatility and enhance portfolio returns. Extra importantly, it reduces the psychological toll, helps you keep sanity, and follow funding self-discipline. And sure, there is no such thing as a such factor as the perfect asset allocation. You need to choose a goal asset allocation you may reside with.

For those who go away your funding choices to your guts, you’ll seemingly mess up. I reproduce this excerpt from one in every of my outdated posts.

///////////////////////////////////////////////////////////////////////////////////

You’ll both promote an excessive amount of too quickly. OR purchase an excessive amount of too late.

Whereas it’s unattainable to take away biases from our funding decision-making, we are able to actually cut back the impression by working with some guidelines. And asset allocation is one such rule.

For many of us, over the long run, rule-based investments (decision-making) will do a much better job than gut-based resolution making.

Promoting all of your fairness investments (simply since you really feel markets have gone up an excessive amount of) and ready for a correction is more likely to be counterproductive over the long run.

Equally, rising fairness publicity sharply (after a market correction) can backfire. Additional corrections might await. Or the market might keep rangebound for a couple of years. That is an excellent greater downside when you’re speaking about particular person shares (and never diversified indices). You might nicely find yourself averaging your inventory right down to zero. In fact, it may be an immensely rewarding expertise too, however it’s essential admire the dangers. And if you let your guts resolve, threat appreciation normally takes a backseat.

As an alternative, if you happen to simply tweak your asset allocation (or rebalance) to the goal ranges, you’re by no means utterly in or out of the markets. You don’t miss the upside. Thus, you’ll by no means really feel ignored (No FOMO or Worry Of Lacking Out). And corrections don’t crush your portfolio utterly both. You’ll not be too scared throughout a market fall. Thus, it’s also simpler to handle feelings. And this prevents you from making unhealthy funding decisions.

//////////////////////////////////////////////////////////////////////////////////////

There isn’t a excellent strategy

- You wouldn’t have to optimize on a regular basis. It’s okay to sit down again and loosen up and do nothing. Motion shouldn’t be all the time higher.

- To be pleased along with your funding efficiency, you wouldn’t have to promote the whole lot earlier than the markets fall. And go all in earlier than the markets rise.

- Managing feelings is tremendous vital. In case you are too involved that the autumn within the markets will wipe off your notional good points, it’s okay to promote a small portion (say 5%) of your fairness portfolio. Sure, this may create friction within the type of taxes and have an effect on long-term compounding. Nevertheless, if this helps you care for your restlessness and allows you to sleep peacefully at evening, so be it. In my view, you’ll make lesser funding errors with a peaceful thoughts.

- In case you are investing by means of SIPs, you’re anyhow not placing all of your cash at one time. You’re placing cash steadily. Even when the markets have been to right sharply, your future SIP installment would go at decrease market ranges. Therefore, persevering with with SIP (when the markets are at all-time highs) is a straightforward resolution, a minimum of for me.

How are you strategy the latest all-time market highs? Do let me know within the feedback part.

Supply and Extra Learn

Knowledge Supply: NiftyIndices.com

Investing at 52-week highs vs. Investing at 52-week lows

Disclaimer: Registration granted by SEBI, membership of BASL, and certification from NISM on no account assure efficiency of the middleman or present any assurance of returns to traders. Funding in securities market is topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing.

Observe: This publish is for training objective alone and is NOT funding recommendation. This isn’t a suggestion to take a position or NOT put money into any product. The securities, devices, or indices quoted are for illustration solely and aren’t recommendatory. My views could also be biased, and I could select to not give attention to facets that you just take into account essential. Your monetary objectives could also be completely different. You’ll have a distinct threat profile. You might be in a distinct life stage than I’m in. Therefore, you could NOT base your funding choices based mostly on my writings. There isn’t a one-size-fits-all resolution in investments. What could also be a superb funding for sure traders might NOT be good for others. And vice versa. Subsequently, learn and perceive the product phrases and situations and take into account your threat profile, necessities, and suitability earlier than investing in any funding product or following an funding strategy.