I spotted one thing essential for all of you who’ve computerized mortgage funds and in addition wish to robotically pay down additional principal every month. It’s remember to regulate your mortgage autopay quantity down when charges improve.

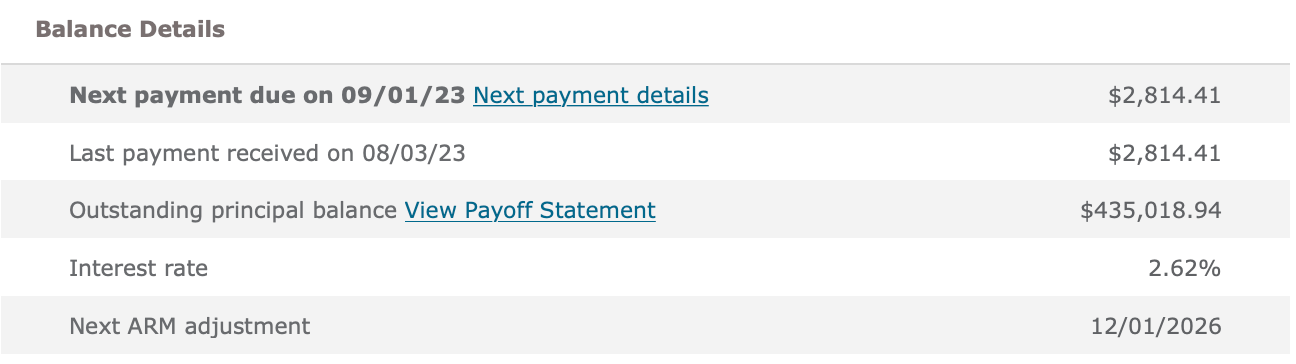

After I refinanced a major residence mortgage in 2019, I made a decision to get a 7/1 ARM at 2.625% with no charges. I had gotten a 5/1 ARM once I bought the home in 2014 for two.875% and I wished to refinance earlier than the speed reset.

Given I’ve an ARM, I at all times wish to pay additional principal with every mortgage cost. So as a substitute of constructing the common $2,814.14 mortgage cost, I made a decision to pay $4,500 robotically every month.

$4,500 is a pleasant even quantity which pays $1,685.59 additional towards principal. This quantity is on prime of the $1,847 (goes up each month) that’s already going to principal from the $2,814.14 mortgage cost. Not dangerous for the reason that mortgage fee is so low.

Not solely do I like taking out low-cost debt to dwell a greater way of life, I additionally like the sensation of paying down debt. Routinely paying down additional principal every month ensures I’m making monetary progress, even when I did not do anything.

Over time, the additional pressured financial savings from paying down extra principal provides up! And once you’re lastly carried out paying off your mortgage, you personal a pleasant asset that may be rented out for money circulation.

Why Adjusting Your Automated Mortgage Cost Is Essential

Reviewing my mortgage cost historical past since 2019, I’ve persistently paid $4,500 for the reason that starting.

Most individuals simply pay the mortgage quantity every month, however not me. And possibly not these of you who wish to speed up your debt reimbursement as nicely.

Nevertheless, since 2019, mortgage charges have surged greater because of the pandemic, authorities stimulus, provide chain points, and the sturdy economic system. Since 2021, I’ve additionally written posts equivalent to:

In different phrases, despite the fact that I used to be recommending to not pay down additional towards a mortgage in a excessive mortgage fee, excessive rate of interest, excessive inflation, and inverted yield curve surroundings, I used to be doing simply that!

As somebody who tries to behave congruently with my beliefs, I used to be shocked to study I had missed this monetary transfer. As quickly as I spotted my inconsistency, I known as the financial institution and had them decrease my cost from $4,500 right down to $2,814.14.

Paying down additional principal when the yield curve is inverted is suboptimal since you scale back liquidity within the face of a possible recession. If dangerous instances return, you need as a lot money circulation and liquidity as attainable to outlive.

Paying down additional principal can be suboptimal when Treasury bond yields and inflation are excessive. You might earn a higher return risk-free and inflation is already paying down debt for you.

Why I Missed Reducing My Mortgage Cost

With over 40 monetary accounts to handle, it is simple to overlook issues. I arrange computerized funds for all the pieces to get rid of lacking funds. However the draw back is that I generally fail to regulate my funds when situations change.

The extra difficult your internet value, the extra you’ll miss issues. There could be some massive winner inventory you have been holding for years that is now within the gutter. It is simple to lose observe.

For this reason monitoring your internet value diligently utilizing Empower or one other free wealth administration instrument is essential. Having not less than a quarterly, if not month-to-month monetary checkup, is essential.

Advantages Of Autopay And Paying Down Additional Debt

Paying an additional $1,685.59 towards principal for 48 months ($80,908.32) is not the top of the world. I now have $80,908.32 much less mortgage debt for this one property. I’ve accelerated the time to fully repay the mortgage by a number of years.

Nevertheless, from March 2022 till August 2023, I may have earned a assured 4% – 5.5% return in Treasuries. This return compares favorably to the two.625% return I made paying off the debt.

There may be additionally one other profit to paying off a detrimental actual property fee mortgage, and that’s saving cash from a possible bear market. The additional mortgage principal funds I made in 2022 saved me from a ~20% loss plus the two.625% in mortgage curiosity expense.

If I had by no means remembered to regulate my mortgage autopay, issues would nonetheless be positive. I might merely have a decrease principal stability in 2026, when my ARM resets.

I do know solely about 11% of mortgage holders have an ARM. Nevertheless, when you get an ARM to economize, you could be extra inclined to repay your mortgage faster. With a 30-year fastened mortgage, there isn’t any sense of urgency to pay additional towards principal. So that you have a tendency to not.

It is optimum to cease paying down additional principal robotically every month when charges are excessive and the yield curve is inverted. Due to this fact, the logical conclusion is to renew paying down additional principal when charges are low and the yield curve is upward sloping.

Particularly, I might resume paying down additional principal robotically when Treasury bond yields are equal to or lower than your mortgage fee. The decrease the 10-year Treasury bond yield is beneath your mortgage fee, the extra you need to pay down additional principal.

One other time to begin paying down additional principal robotically is when your money circulation and financial savings quantity is powerful, and you do not know the place to speculate the additional money.

When unsure, pay down debt.

We Will Earn, Save, And Make investments Extra If We Need To

One closing takeaway from this submit is that the majority of us will rationally take motion to enhance our funds if we have to. Due to this fact, I would not fear an excessive amount of about being completely caught financially.

I discovered this mortgage cost mismatch as a result of I used to be motivated to search out extra methods to enhance money circulation. We’re within the course of of shopping for one other home. As well as, there’s the potential for one more recession.

Consequently, I reviewed all our expenditures and realized this was the one expenditure that would unencumber a major amount of money circulation ($20,227/yr). I’ve additionally considered going again to work to spice up earnings and scale back healthcare bills.

If I did not really feel the necessity to increase our funds, I in all probability would not have related the dots about this computerized mortgage overpayment. However I might have if I discovered myself in a money crunch.

If we want more cash, we’ll discover a approach to save extra, slash prices, and/or earn extra. This logical habits is a win for us all.

Reader Questions And Ideas

Do you pay additional principal by way of your computerized mortgage funds? In that case, how far more do you resolve to pay? Have you ever remembered to decrease your additional principal funds as soon as risk-free charges surpassed your mortgage rate of interest? Are you making an attempt to enhance money circulation resulting from one other potential recession?

When you’re buying round for a mortgage, take a look at Credible, a mortgage market place the place yow will discover customized prequalified charges. Credible has a handful of lenders on its platform competing for what you are promoting.

Pay attention and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview consultants of their respective fields and focus on among the most attention-grabbing matters on this website. Please share, fee, and evaluation!

Be part of 60,000+ others and join the free Monetary Samurai e-newsletter and posts through e-mail. Monetary Samurai began in 2009 and is without doubt one of the largest independently-owned private finance websites at the moment.