Saving cash may help create a way of stability and management over your funds, particularly as you grow old. From with the ability to spend money on your future to recognizing the spending habits that eat away at your financial institution stability each month, there are various advantages to studying sensible and straightforward methods to avoid wasting your cash.

Hold studying for some money-saving ideas or soar to the part that’s most useful for you.

- Create a funds

- Observe your spending

- Make detailed budgeting plans

- Attempt envelope budgeting

- Use a budgeting app

- Carpool to work or college

- Audit your subscriptions

- Change to a less expensive telephone plan

- Decrease your utility payments

- Take into account canceling your gymnasium membership

- Plan your groceries

- Use coupons

- Reap the benefits of seasonal gross sales

- Designate no-spend days

- Use the 30-day rule

- Attempt the 24-hour rule

- Construct an emergency fund

- Create a financial savings account for retirement

- Use a high-yield financial savings account

- Automate financial savings transfers

- Take into account funding accounts

- Refinance your mortgage

1. Create a funds

When studying how to economize, assess how a lot you actually have and the place that cash goes. Consider using the 50/30/20 rule that can assist you create a funds.

The 50/30/20 rule is whenever you save …

- 50% of your earnings for necessities like lease and meals

- 30% of your earnings for extras like leisure

- 20% of your earnings for financial savings and debt, like accounts you owe or that assist with emergencies and retirement

2. Observe your spending

It’s possible you’ll be shocked to be taught the place your cash is definitely going each week. By maintaining a report of what you spend, you’ll be able to see how small bills take away out of your month-to-month financial savings.

An effective way to trace your spending and begin budgeting is with a budgeting app like Mint, which places all of your accounts in a single place that can assist you navigate your spending and saving habits with ease.

3. Make detailed budgeting plans

Breaking your long-term targets into smaller, more-manageable milestones may help you get monetary savings extra successfully.

For instance, in case your total purpose is to avoid wasting $1,200 a yr, begin with smaller targets of $100 each month and even $25 each week. An in depth plan may help you get on observe and make progress towards your larger purpose.

4. Attempt envelope budgeting

Picture: Envelope-budgeting

Picture: Envelope-budgetingEnvelope budgeting may help you get monetary savings by limiting your spending to divided money allowances. This technique makes you extra conscious of your spending and encourages you to not spend an excessive amount of of your cash in a single space.

5. Use a budgeting app

Utilizing a budgeting app may help you not solely with saving cash but additionally with staying on observe with spending targets, bills and budgets. It may be a simple technique to keep up to date on the way you’re doing and get extra conversant in your spending habits.

6. Carpool to work or college

A simple approach to economize on commuting prices is by sharing the trip. When you have youngsters, enlisting close by mother and father to assist lighten the burden of the varsity drop-off traces is a good way for everyone to get monetary savings on fuel each month.

7. Audit your subscriptions

A survey from Could 2022 discovered that 42% of individuals forgot about subscriptions they have been nonetheless paying for however not utilizing. Check out your month-to-month financial institution statements to audit your subscription companies and cancel those that you just not want.

8. Change to a less expensive telephone plan

In terms of your telephone plan, observe how a lot knowledge you’re truly utilizing and cease paying for companies you don’t want. This can let you save extra money each month in your telephone invoice.

9. Decrease your utility payments

Consider whether or not or not you’re being as environment friendly as potential together with your utilities. Is your air con at all times working within the background? What about an upright fan that you just use for each cooling and white noise? Unplugging your small home equipment whereas not in use is a good way to scale back your electrical energy invoice.

10. Take into account canceling your gymnasium membership

In case you get lots of worth out of your gymnasium membership, this may occasionally not apply. But when your membership is expensive, you may wish to reevaluate what you are able to do at residence or open air that’s simply as efficient.

Some money-saving strategies for individuals who wish to prioritize their well being on a funds embrace …

- Watching YouTube tutorials for concepts about residence exercises

- Going for a stroll or run in your neighborhood

- Swimming laps at your neighborhood pool

- Becoming a member of an area novice sports activities league

- Taking part in exercise video video games

- Including exercise plans to way of life apps

11. Plan your groceries

Making a listing of the meals you wish to eat for the week and the groceries you want may help you get monetary savings. Sticking to your listing may help you keep away from further purchases and even assist cut back your meals waste within the meantime.

Use Credit score Karma’s funds calculator when you need assistance figuring out an affordable funds on your journeys to the shop.

12. Use coupons

Coupons are extensively out there and generally is a handy and straightforward approach to economize when procuring. They’ll additionally enable you get extra bang on your buck. Usually, coupons can get you a free merchandise, an inexpensive bundle or perhaps a discounted subscription plan.

Nice locations to search out coupons embrace …

- Newspapers and magazines

- Grocery retailer adverts

- Firm web sites

- E-mail subscriptions

- Web site browsers and apps

13. Reap the benefits of seasonal gross sales

Demand for sure big-ticket objects can fluctuate by the season. Take into account timing your large purchases to rake within the financial savings. For instance, October to December generally is a nice time to purchase a automobile as a result of dealerships wish to meet end-of-year quotas. Their need to promote a automobile could be helpful to your buying energy.

14. Designate no-spend days

Problem your self and your loved ones to go sooner or later every week with out shopping for something, out of your morning espresso to a film ticket. It’s possible you’ll be taught to avoid wasting higher by lowering your spending and changing into extra conscious of how often you make small purchases that aren’t vital.

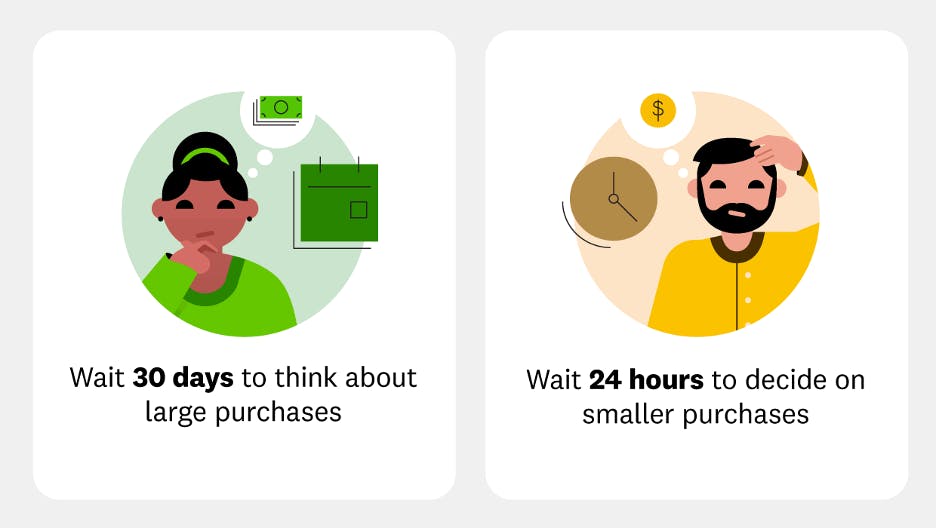

15. Use the 30-day rule

While you wish to make a big buy, give it some thought first. Take into account what it’s and the way a lot it prices, and when you really feel that it’s nonetheless necessary after say 30 days, perhaps you’ll really feel extra assured buying it.

It’s additionally necessary to do not forget that dipping into your financial savings for an enormous buy can deter your long-term targets. If it’s not an emergency, think about saving up extra funds for the acquisition first.

16. Attempt the 24-hour rule

Picture: 24-hour-rule-vs-30-day-rule

Picture: 24-hour-rule-vs-30-day-ruleFor less-expensive purchases, the 24-hour rule can provide the identical pause the 30-day rule does for big-ticket objects. Take into account ready a whole day earlier than shopping for a small, non-essential merchandise … you could discover it’s not price it in spite of everything.

17. Construct an emergency fund

Some specialists suggest setting apart about six months’ price of dwelling bills in case of emergencies. Save your cash to create a cushion that may enable you keep away from going into debt when you ever lose your job or need to pay unexpected medical bills.

If the concept of an emergency fund overwhelms you, begin with our financial savings calculator to get you began on the precise foot. The very last thing you need is to be unprepared.

18. Create a financial savings account for retirement

In terms of saving on your retirement, some specialists suggest placing away not less than 15% of your earnings every year. Decide how a lot you’ll want and break that down by paycheck to put aside a selected sum of money that’ll enable you hit your targets over time.

19. Use a high-yield financial savings account

Excessive-yield financial savings accounts — like Credit score Karma Cash™ Save — may help you develop your financial savings with out even desirous about it. All you want to do is deposit your earnings in an account and let curiosity do the be just right for you. The nationwide common charge as of February 2023 is .35%, however your returns will rely on the account you utilize.

20. Automate financial savings transfers

Automating deposits into your financial savings account may help you get monetary savings extra simply — and with out desirous about it. There are a number of methods you’ll be able to create computerized financial savings account deposits, and every financial institution provides a special answer. Listed here are just a few examples.

- Some money-saving apps permit customers to avoid wasting spare change from their purchases.

- Sure banks will spherical up purchases to the closest greenback and deposit that change right into a financial savings account.

- There are additionally packages that mechanically transfer cash out of your checking to your financial savings account for each debit card buy you make.

Automated financial savings packages enable you spend money on your self and your future.

21. Take into account funding accounts

Whereas belongings like shares, mutual funds and certificates of deposit shouldn’t be your solely type of financial savings, they’ve the potential to supply engaging returns in your funding over time.

Earlier than making any riskier funding strikes, you should definitely totally analysis your choices, or when you can, speak to knowledgeable monetary adviser.

22. Refinance your mortgage

It’s possible you’ll discover which you could get monetary savings in your month-to-month mortgage cost by making the most of a greater mortgage charge — one thing that would add as much as 1000’s of {dollars} over time.

Listed here are just a few steps on find out how to refinance your mortgage.

- Verify your present APR to see if it’s increased than the present market charges

- Double-check your credit score scores

- Store round for various mortgage lenders

- Use a mortgage calculator to crunch the numbers

- Full a refinancing software

- Select your lender, put together for closing and pay charges

Keep in mind to do the maths to make sure a refi makes monetary sense for you, and think about speaking to a monetary adviser when you’d like knowledgeable opinion.

Extra ideas that can assist you get monetary savings

Need extra perception on how to economize in particular conditions? Whether or not you want to spend much less cash basically, wish to get monetary savings with your loved ones, or want concepts on bundling leisure, the following pointers may help you in your saving journey.

Learn how to spend much less cash

- Keep away from consuming out. Consuming in could be a good way to economize each month. Plus, there are many methods to make it enjoyable and interesting.

- Go for water. In case you do eat out, you should still be capable to avoid wasting cash by ordering water relatively than a soda or alcoholic beverage.

- Purchase generic. An effective way to avoid wasting extra whereas procuring will not be permitting identify manufacturers to affect you. If the standard of the generic merchandise is similar, you don’t essentially want to purchase the identify model.

- Purchase used objects. In case you love money-saving offers, native thrift shops and on-line public sale websites and marketplaces can supply all the things from garments to electronics at stellar reductions. You will get barely used high-quality objects at a fraction of the price of their newer counterparts.

- Use public transportation. Attempt changing your drive to work sooner or later every week. You’ll be capable to get different issues finished on the bus or prepare whereas saving cash on fuel and avoiding some put on and tear in your automobile.

- Verify your insurance coverage charges. Automobile insurance coverage corporations often elevate their charges, so you could avoid wasting cash by procuring round for decrease costs once in a while. Store round for auto insurance coverage quotes to see if you will get a greater deal.

- Ask for reductions. Some services supply reductions for issues like being a senior, AAA member or scholar. You by no means know what it can save you when you don’t ask!

- Unsubscribe from advertising emails. Typically advertising emails can result in unplanned purchases. Unsubscribing may help stop you from being tempted.

- Save your tax refunds. Fairly than spending your tax refunds, set them apart in your financial savings account.

How to economize on leisure

- Get a library card. Libraries don’t solely supply books — you can even lease motion pictures, audiobooks, comics and video games, and attend free occasions like readings for youths regularly.

- Discover free occasions in your space. Browse social media to search out free occasions in and round your space. It’s possible you’ll discover a number of family-friendly occasions or concert events that received’t value you a penny.

- Lower the cable. Chopping ties with cable TV and choosing internet-only streaming companies can prevent a fairly penny.

- Watch matinees. Many theaters supply discounted matinee tickets for film showings within the daytime versus the night.

- Hire motion pictures. It can save you cash by ready for motion pictures to hit the rental market as a substitute of seeing them in theaters. Whereas film tickets value $9.57 on common as of 2021, a rental can value only a few {dollars} and streamed motion pictures may solely value you the month-to-month membership worth.

How to economize with your loved ones

- Have household recreation nights. Get monetary savings with an evening in — play a board recreation or online game with your loved ones on a chosen evening every week. You’ll get monetary savings on leisure prices and bond with one another too.

- Double your meal recipes. While you cook dinner, it may be sensible to purchase groceries in bulk and double your recipes. You possibly can spend much less time cooking all through the week and save extra money whilst you’re at it.

- Spend time outdoors. With the nice open air virtually at all times free to take pleasure in, there are tons of low-cost or cost-free actions. Attempt packing a basket and occurring a pleasant household picnic within the park.

- Take pleasure in a staycation. Fairly than spending cash on costly airplane tickets and resorts, see what common sights or experiences await you in your yard as a vacationer in your personal metropolis.

- Have a household yard sale. By promoting previous objects across the residence you not want, you could possibly elevate some trip or night-out funds — with out consuming into your money readily available.

- Create a present restrict. When you have a number of members in your loved ones, gift-giving throughout holidays or birthdays can develop into costly. Set a worth restrict for household presents to avoid wasting cash.

Home-owner money-saving ideas

- Shut blinds and curtains. Closing your blinds and curtains whenever you’re not residence is an efficient technique to hold your own home cool and decrease your air con utilization.

- Take heed to water utilization. Taking shorter showers can decrease utility prices. It’s also possible to flip off the tap whenever you brush your tooth and use low-water settings in your dishwasher and washing machines to assist decrease your water invoice.

- Decrease your water heater temp. By decreasing the temperature of your water heater to 120°F, it can save you on fuel and heating utility payments.

- Begin weatherproofing. Use caulk to fix holes and cracks in your partitions. Determine windowpanes and door frames which have drafts and fill them in. Place plastic wrap round home windows to maintain the warmth from escaping within the winter.

- DIY residence repairs. You could possibly save an excellent chunk of change by DIYing residence repairs relatively than paying knowledgeable — if it’s one thing you’ll be able to confidently deal with. Knowledgeable might be nonetheless a good suggestion when you’re not educated on the repair.

- DIY cleaners. Alongside the identical traces, you could get monetary savings by forgoing store-bought cleaners to make your personal. It’s possible you’ll be shocked at how far one bottle of white vinegar and a few lemon can get you! Do your analysis and see what you may make at residence that’s simply as efficient.

- Use half as a lot laundry detergent. These days, most detergents come concentrated. By chopping down on the quantity of detergent you utilize, you may make your product stretch longer and in the end spend much less cash on it.

- Put your payments on autopay. This may help guarantee your mortgage, insurance coverage or utility payments are paid on time and in full, so you’ll be able to keep away from potential late cost charges — which might additionally hurt your credit score.

- Keep away from paper merchandise. A technique it can save you some cash is by selecting washable dishrags and napkins over paper towels. As a bonus, you’ll additionally contribute to decrease demand for paper merchandise.

Change your money-saving mindset

Saving cash and budgeting efficiently can take persistence. You received’t develop into wealthy in a single day, however making an earnest effort to alter your unconscious spending habits places you one step nearer to monetary freedom.