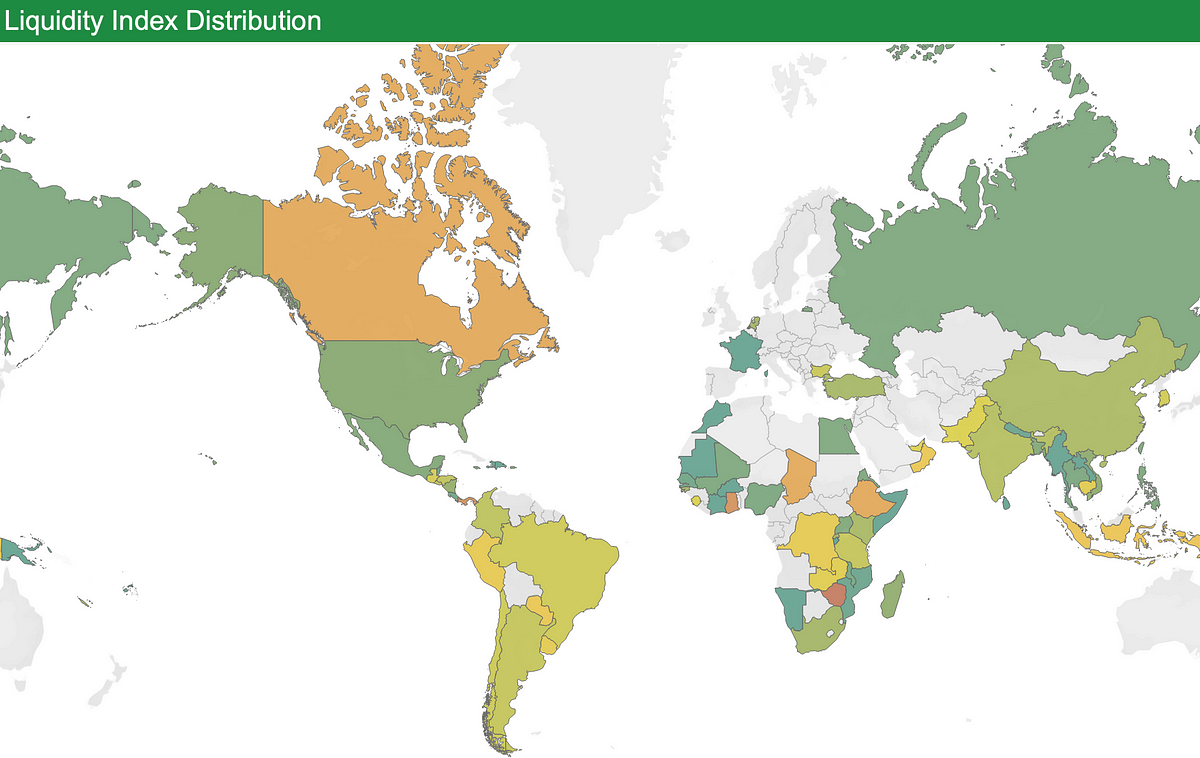

AlliedOffsets is thrilled to announce the implementation of an progressive metric of liquidity for the voluntary carbon market (VCM) on all initiatives within the AlliedOffsets database. This new method goals to judge and rank every undertaking’s liquidity on a scale of 0 to 10, considering varied standards associated to how actively every undertaking is traded within the VCM. By way of a complete evaluation, we’ve assigned a grade to every undertaking, enabling customers to establish credit which can be most simply obtainable to buy.

To find out the liquidity for initiatives, a complete analysis course of was carried out. A number of attributes had been thought of, and every was assigned a weight. The attributes and their corresponding weights are as follows:

- Attribute 1 (Retirements Final Twelve Months (LTM)): 10% weight

- Attribute 2 (Distinct Retirements LTM): 5% weight

- Attribute 3 (Distinct Patrons): 5% weight

- Attribute 4 (Distinct Brokers): 10% weight

- Attribute 5 (Quantity costs Acquired by AlliedOffsets from varied sources LTM): 20% weight

- Attribute 6 (Issuances Final 5 years): 10% weight

- Attribute 7 (Complete Rankings from any of six score businesses): 10% weight

- Attribute 8 (Retirements Final 3 months): 20% weight

- Attribute 9 (Is the most recent classic throughout the final 3 years): 10% weight

Every attribute was given a percentile after which mixed with the weighted attributes as talked about above, following which a weighted percentile rating rating was obtained for every undertaking. The scores had been then once more remodeled into percentiles. The ultimate liquidity stage of seven, 8, 9, or 10 is given in keeping with the standards as indicated within the part under. This percentile transformation ensured that the grades had been distributed evenly throughout the initiatives, permitting for a good illustration of their exercise ranges.

Not all initiatives have had issuances or retirements lately, which means the above standards applies solely to probably the most energetic initiatives out there. Those who have much less exercise are handled otherwise — learn on under!

We have now devised an in depth set of standards that covers a broad spectrum of indicators. Every criterion represents a vital facet of the undertaking’s environmental impression and potential for sustainability. Let’s delve into the liquidity stage scale and the related descriptions.

Liquidity Stage 0: Nothing Retired in Previous 2 Years

Initiatives on this class haven’t retired any credit throughout the previous two years. This might imply that there was no current market curiosity in a undertaking, or that the undertaking has solely just lately issued credit.

Liquidity Stage 1: Nothing Retired in Final Twelve Months (LTM), however in Yr Earlier than That

Initiatives on this class didn’t retire any credit throughout the final twelve months however have proven some exercise within the yr previous that interval. This may occasionally point out initiatives which have come to a detailed or have misplaced market curiosity.

Liquidity Stage 2: Retirements LTM is Much less Than 10k

Initiatives on this class have retired credit throughout the final twelve months, however the whole retirement quantity is lower than 10,000 credit. These initiatives could also be small or have modest market engagement.

Liquidity Stage 3: Retirements LTM is Much less Than 20k

Initiatives on this class exhibit a barely larger stage of exercise, with retirements within the final twelve months reaching as much as 20,000 credit.

Liquidity Stage 4: Retirements LTM is Much less Than 50k

Initiatives on this class have retired credit totalling lower than 50,000 throughout the final twelve months.

Liquidity Stage 5: Retirements LTM is Much less Than 100k Credit, and (Distinctive Retirement Corporates <= 2 and Lively Brokers <= 2)

Initiatives on this class have retired credit amounting to lower than 100,000 throughout the final twelve months. Moreover, they’ve engaged solely with a restricted variety of distinctive retiring consumers and energetic brokers.

Liquidity Stage 6: Retirements LTM of Much less Than 100k

Initiatives on this class have retired credit totalling lower than 100,000 throughout the final twelve months, however have been traded by greater than two brokers or retired by greater than two corporations.

Liquidity Stage 7: AlliedOffsets Scoring System Lowest Twenty fifth Percentile

Initiatives on this class have undergone a complete analysis utilizing AlliedOffsets’ scoring system. Their efficiency falls throughout the lowest Twenty fifth percentile when in comparison with different initiatives.

Liquidity Stage 8: AlliedOffsets Scoring System Twenty fifth-Fiftieth Percentile

Initiatives on this class have achieved scores that place them throughout the Twenty fifth to Fiftieth percentile vary in AlliedOffsets’ scoring system.

Liquidity Stage 9: AlliedOffsets Scoring System Fiftieth-Seventy fifth Percentile

Initiatives on this class have achieved scores that place them throughout the Fiftieth to Seventy fifth percentile vary in AlliedOffsets’ scoring system.

Liquidity Stage 10: AlliedOffsets Scoring System Seventy fifth-One hundredth Percentile

Initiatives on this class have achieved scores that place them throughout the Seventy fifth to One hundredth percentile vary in AlliedOffsets’ scoring system.

AlliedOffsets’ new Liquidity Index system supplies a complete analysis framework for assessing a undertaking’s market exercise and engagement. By assigning liquidity ranges starting from 0 to 10, primarily based on varied standards and the AlliedOffsets scoring system, with this stakeholders can achieve beneficial insights into how liquid the undertaking is.

It’s necessary to notice that our focus on this has been on assessing the extent of energetic buying and selling for a specific undertaking, relatively than conducting complete undertaking evaluations. Whereas undertaking evaluations embody a broader scope, liquidity evaluation performs an important function in assessing the extent of energetic buying and selling for a particular undertaking. By inspecting liquidity, merchants and traders can higher perceive the market dynamics, make knowledgeable selections, and capitalise on the alternatives offered throughout the undertaking.