“Small worth” is without doubt one of the market’s most inefficiently priced corners, and it has lengthy been the house of famously profitable and iconoclastic traders, from Joel Tillinghast together with his love of low-priced shares to Chuck Royce, who obsessive about tiny blue chip corporations. So right here’s a simple query:

Over the previous quarter century, what has been essentially the most profitable small worth fund you can have purchased?

If you happen to’re one of many 5 folks nationwide who would have answered “Aegis Worth,” congratulations! You bought it!

Whereas the previous guides us, we should dwell sooner or later. Scott Barbee believes there could also be a once-in-a-generation wealth-creating alternative in sure Canadian power shares. Aegis Worth Fund has executed the work and owns a few of these shares. Barbee’s observe report over 25 years means we should always pay shut consideration to what he’s saying. If you happen to by no means purchase into his fund, it’s best to nonetheless learn the article to grasp how a grasp investor thinks by means of alternatives.

My synopsis of our lengthy and fascinating dialog will spotlight 5 points:

- The Aegis Worth observe report

- Barbee’s background and perspective

- The character of his investable universe, and,

- This uncommon and interesting alternative in a nook of the power market.

We’ll begin with the fund.

Introduction to Aegis Worth

Aegis Worth invests in a portfolio of about 70 very, very small North American corporations. They search for shares which can be “considerably undervalued” given basic accounting measures, together with e-book worth, revenues, or money stream. The managers contemplate themselves “deep worth” traders. As of July 2023, 62% of the portfolio is invested in Canadian shares and 24% within the US.

Many analysts contemplate microcaps to be a definite asset class quite than only a subset of small caps. Microcaps are usually lined, at most, by a single analyst. The shares in microcap portfolios are typically one-fifth to one-tenth the dimensions of these in small cap portfolios. They are typically thinly traded, have excessive insider possession, and usually tend to be acquired by a bigger agency, all of which implies that their inventory costs are topic to massive strikes that aren’t pushed by broader market forces. It’s not an area that rewards dilettantes.

Happily, Aegis is guided by one of many longest-tenured and most profitable groups within the area. Aegis has the best returns of any small-cap worth fund over the 25 years since launch and has been a prime 5 fund over the previous 20-, 15-, 10- and 5-year intervals. The Mutual Fund Observer has beforehand profiled the Aegis Worth fund and Scott Barbee in 2013 and 2009. Whereas badly dated, these profiles do discuss a bit extra concerning the supervisor’s course of and views.

I not too long ago had an extended dialog/Q&A with Barbee about his views in the marketplace, his lived historical past within the markets, the Aegis portfolio, and lots of issues in between. I loved his trustworthy, down-to-earth, conviction-driven thought course of, the solutions that come out of such evaluation, and what promise it holds for traders.

Scott Barbee on Scott Barbee

“My dad labored for Aramco, and I grew up in Saudi Arabia. I’m a mechanical engineer by coaching. Earlier than beginning Aegis, I labored for Chevron for a few summers and for Simmons & Firm, an oil service funding financial institution. Once I analysis power and treasured metals corporations – the fund owns a number of these proper now – a part of the evaluation, and one which I get pleasure from, is to get into the scope of engineering for the mining initiatives. This isn’t the form of work that may be outsourced to a pc or quantitative engine for algorithmic buying and selling methods. I’m typically a contrarian, however not at all times, understanding that typically the group will be right.”

“My dad labored for Aramco, and I grew up in Saudi Arabia. I’m a mechanical engineer by coaching. Earlier than beginning Aegis, I labored for Chevron for a few summers and for Simmons & Firm, an oil service funding financial institution. Once I analysis power and treasured metals corporations – the fund owns a number of these proper now – a part of the evaluation, and one which I get pleasure from, is to get into the scope of engineering for the mining initiatives. This isn’t the form of work that may be outsourced to a pc or quantitative engine for algorithmic buying and selling methods. I’m typically a contrarian, however not at all times, understanding that typically the group will be right.”

Scott Barbee on Aegis Worth Fund

“The fund began in 1997, on the tail finish of the mutual supervisor celeb standing period. Managers like Michael Value and Peter Lynch had been nonetheless commemorated. However since then, the mantle of the celeb managers seems to have moved to the hedge fund universe, which looks like the funding of alternative for the rich. In the meantime, retail traders have switched to index investing and don’t have a need for lively mutual funds. We’re an odd duck in that we do detailed work on shares as if we had been a hedge fund with out charging the efficiency charges.”

Aegis is a small, five-person workforce. As of June 2023, workers and their households have a mixed $48 million funding within the fund out of the fund’s whole belongings of $342 million. Barbee has been constantly managing the fund because the begin of the fund in 1997. There are advantages that come out of getting the identical individual run the fund efficiently for this lengthy. All traders make errors, and Mr. Barbee admits to his share of them. Good traders study from previous errors and shepherd the investments higher within the subsequent market cycle. Barbee is deeply self-aware, self-critical when required, and optimistic sufficient concerning the portfolio’s future to have the required psychological steadiness.

The fund has made traders cash since its inception by discovering and investing in shares of deep worth and small capitalization corporations within the USA and Canada. This specific phase of the market isn’t what David Snowball would name “low ulcer.” Somewhat that is the crossroads the place scamsters, accounting and steadiness sheet frauds, flawed enterprise fashions, fallen angels, and misunderstood corporations all meet. When the financial system goes bitter, traders within the zip code are liable to panic promoting. Barbee’s profitable observe report and the occasional massive drawdowns his fund has endured mirror the perils of this illiquid and extremely risky market phase.

“As a deep worth investor, if you happen to get it fallacious, you may get hit. It’s one factor to forecast Cisco earnings fallacious in 1999 and lose cash conventionally, but when a deep worth supervisor loses cash failing to identify an accounting rip-off in a small mining inventory, that may actually harm their status,” mentioned Barbee.

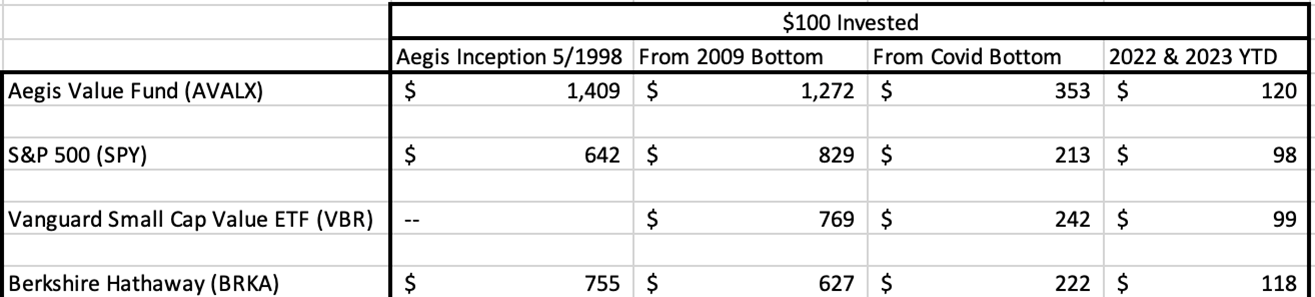

Efficiency for the bean counters

A low ulcer fund it isn’t, however, boy, is that this man good at sticking to his craft and compounding capital!!

A profitable commerce from the previous

Junior Gold miners

“Between 2012 to early 2016, there was about an 85% decline within the shares of junior gold miners. Given this collapse, we sensed all of the scamsters had left for greener pastures in crypto, hashish, or no matter. Who was left was a treasured metals billionaire geologist and different technically savvy traders amassing belongings on a budget. A whole lot of gold shares had been exhibiting up on our watchlist, and we may afford to be selective. As an engineer, I spoke to the administration groups that had been placing these belongings into manufacturing and figured the belongings had been more likely to work. At the moment, each conventional cyclical belongings and treasured metals had been being puked by CIOs (Chief Funding Officers) on account of their excessive volatility. We purchased these excessive volatility treasured metallic discards believing these shares provided a possibility for sturdy returns uncorrelated with the remainder of the portfolio.”

To be right about deep worth, the client of shares has to consider that the vendor’s view of the world is by some means fallacious. In any other case, why trouble shopping for? Barbee’s contrarian view helps. However he’s not shopping for shares in a random shotgun method, spraying cash all over. There’s a course of.

The Watchlist

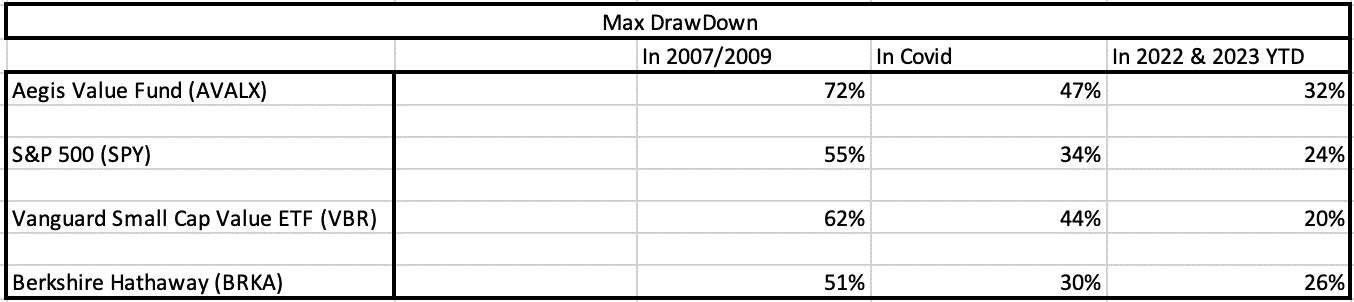

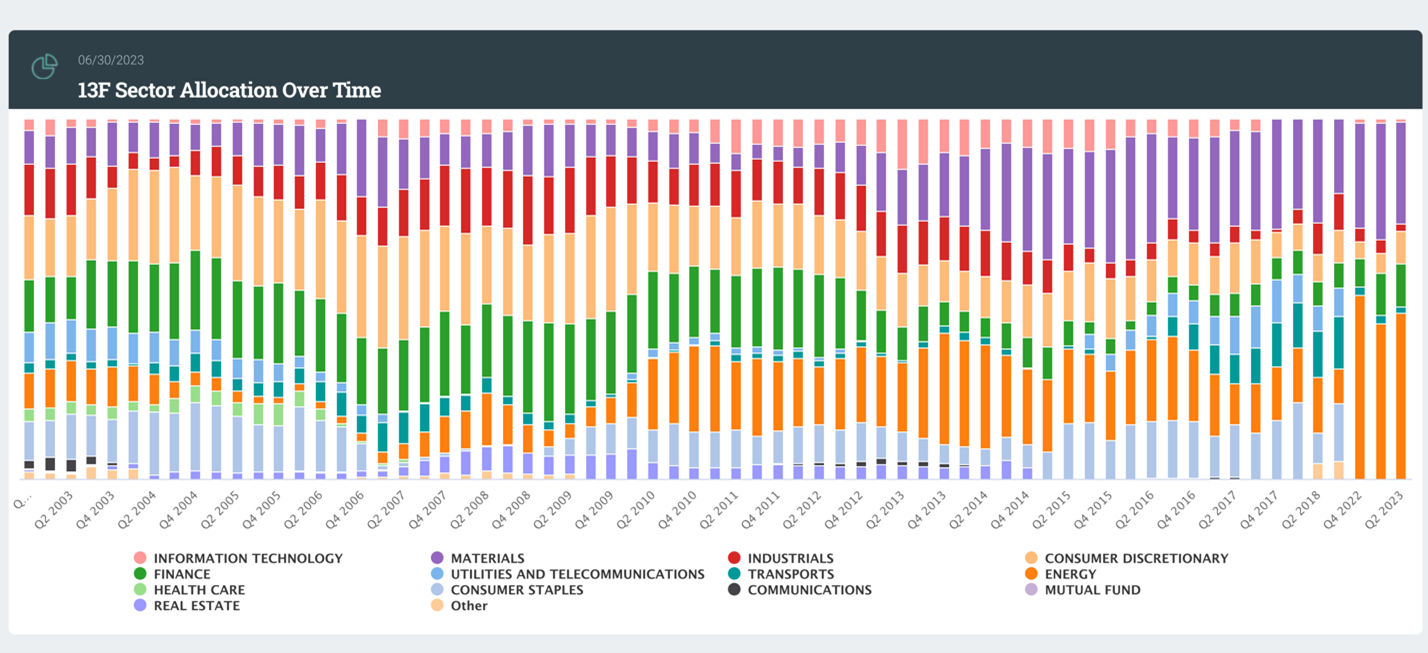

Barbee retains observe of what number of shares are exhibiting up in his deep worth universe watchlist. He shared the chart with the readers under.

“The variety of shares which present up as small-cap, deep worth, as of June 2023 are among the many highest because the 2008-2009 disaster and the Covid pandemic. Often, the variety of names on the watchlist is correlated to the excessive yield unfold. The extra distressed the excessive yield market, the larger the variety of shares on the checklist. However proper now, apparently, the excessive yield unfold could be very low. But, we’re seeing much more candidates.”

On condition that the inventory market is buying and selling near its all-time highs, I requested Barbee how he reconciles this massive variety of candidates. There are a number of causes, he says.

First, he factors to analysis by Cliff Asness at AQR that exhibits the worth issue, a measure of the valuation disparity between development and worth shares, is at traditionally excessive ranges. “Clearly, many development shares are excessive due to the Synthetic Intelligence (AI) enthusiasm. That must be sorted out. However the watchlist can also be unusually excessive at the moment as a result of many financial institution shares are buying and selling at a reduction to e-book worth. The held-to-maturity securities losses from larger rates of interest don’t hit the e-book worth instantly. Adjusted for these losses, the checklist could be smaller.”

The Macro view

Our dialog is making it clear that Barbee is nervous concerning the macroeconomic fundamentals. He very a lot considers the macro situation when choosing deep worth shares.

“Traditionally, we’d be keen to carry a bit additional cash, like we did in 1998-2000.” Presently, the fund holds about 4% in money. “However the degree of debt, fiscal imbalance, the quantity of debt coming due within the subsequent two years, and the weak spot within the financial system lead me to consider that we’re going to expertise extra inflation and greenback debasement within the subsequent few years. Presently, the Federal Reserve could be very hawkish and is keen to create harm to battle inflation. However the second the financial weak spot turns into clear for all to see, we suspect the Central Financial institution will grow to be much more dovish.”

“Are you able to inform me exactly the place you see the issue within the financial system outdoors of Industrial Actual Property (CRE),” I requested Barbee, “Who and the place goes to be in bother?”

Barbee believes that outdoors of CRE, the issue lies with Leveraged Loans of Non-public Fairness funds. He factors to analysis on PE buyouts by Verdad Advisers. From a Could 2022 report, Non-public Fairness: Nonetheless Overrated and Overvalued, we are able to see that PE companies buyouts multiples, and debt leverage used has dramatically gone up. “When the financial system slows,” says Barbee, “the PE companies are going to get hit twice – as soon as from slowing earnings and a second time from rising charges.”

I’ve learn a lot of his semi-annual reviews, and Barbee has constantly railed in opposition to high-priced mega cap development. Happily, he hasn’t shorted them, nor does he play in bonds. Barbee directs his power and views into honing his portfolio, which brings us to power corporations.

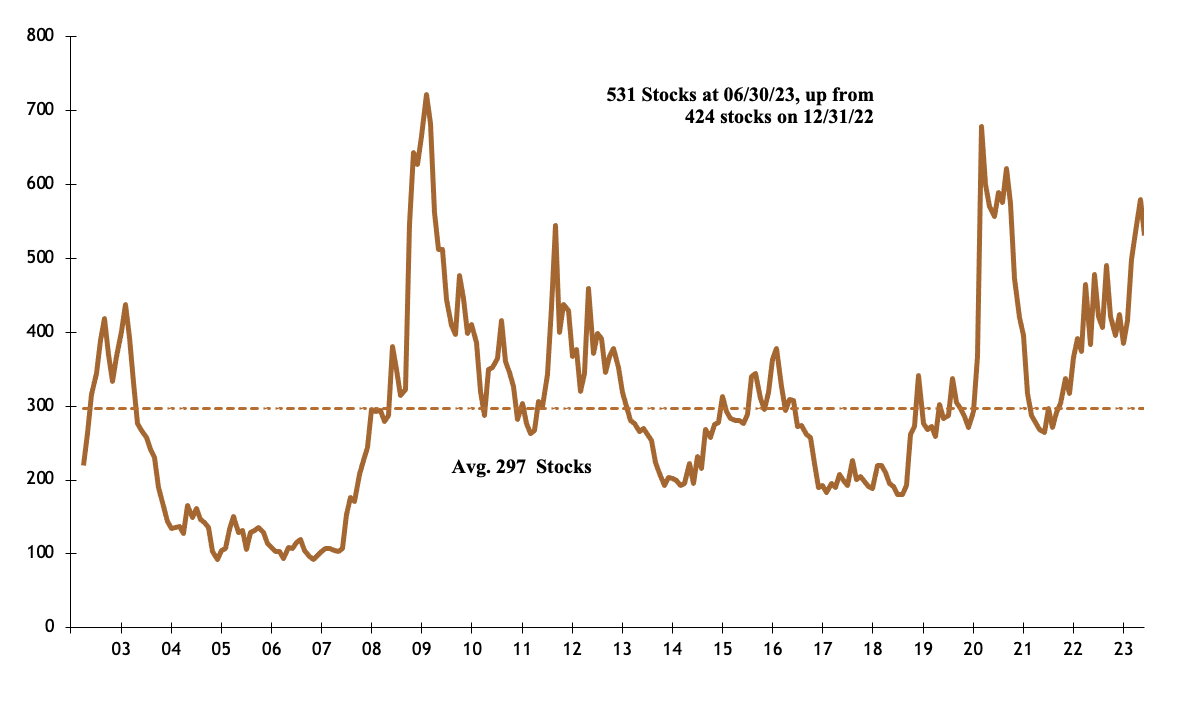

The Aegis portfolio

Power and Supplies shares make up virtually 88% of the fund.

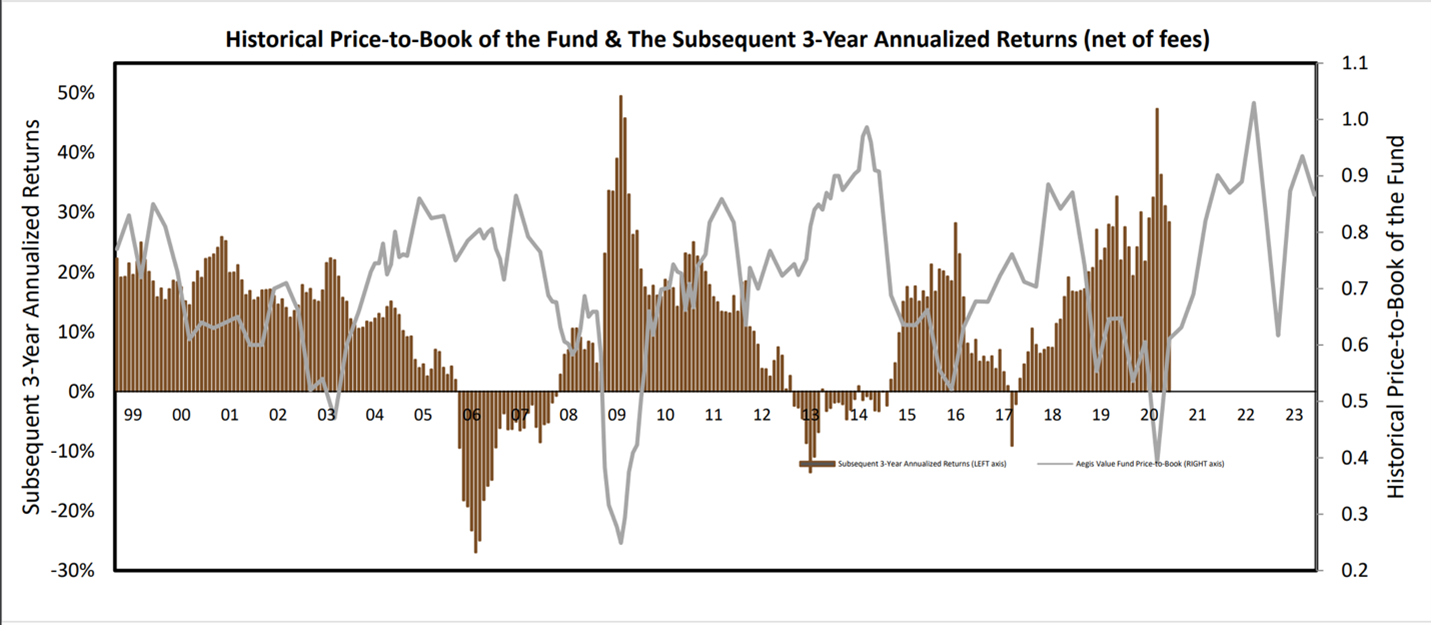

The chart under is from the Aegis fund’s presentation. Concentrate on the gray line which exhibits the Value to Guide worth of the fund’s positions. The funds historic common Value-to-Guide has hardly ever traded at a premium to Guide Worth. Proper now, the P/BV of the fund’s positions stand at 0.87x (or a 13% low cost to Guide).

Comparatively, the S&P 500’s Value to Historic Guide Worth at present stands at 4.3x (the index trades at 430% premium to the e-book worth).

“Though the Aegis fund’s e-book worth is far decrease than the broader markets’, how do you clarify the comparatively excessive e-book worth of the positions within the fund proper now in comparison with historical past,” I requested. There are implications for future returns when the fund’s P/BV is that prime (despite the fact that its a lot decrease than the S&P).

“Guide worth isn’t an indicator you employ by itself,” began Barbee. “It’s a must to take a look at it within the context of leverage held by the corporate in addition to the longevity of the belongings held by the corporate,” which led to his concentrate on the businesses the portfolio holds.

“The upper P/BV might mirror the excessive inflation now we have skilled within the latest previous. The Guide Values will not be valued larger to regulate for the substitute value of the belongings.”

I requested how he thinks the state of affairs will work itself out. Will corporations mark their e-book values larger?

Barbee factors to a chunk Warren Buffett wrote in 1977, How Inflation Swindles the Fairness Investor, after which explains the fund’s place in power shares.

“Does the corporate actually have low-cost debt? Are the belongings actually long-term in nature? How a lot leverage does the corporate have? To beat the inflation swindler, I just like the fund’s power holdings. Proper now, in power, the group could be fallacious.

- Buyers predict a recession and a decline in crude oil consumption through the recession. Persons are enthusiastic about the newest pandemic pushed recession. However if you happen to return to earlier recessions, there may be little or no dent in power use.

- We have now China and India attempting to ascend into wealthier, extra industrialized nations, and that pattern isn’t going away.

- The concept of ample renewables is good to speak about however troublesome to execute. Over the past ten years, $3.8 trillion has been spent on various power. But, fossil fuels as a proportion of power consumption have declined from 82% of whole use to 81%!

- Banks are forcing power corporations to cut back leverage

- ESG is inflicting many traders to divest from power corporations

- The perverse impact of financial institution + ESG led deleveraging is that larger rates of interest haven’t been painful for power corporations (in contrast to the ache in CRE and PE Leveraged Loans).

- Due to these non-economic actors being concerned within the power area, power poverty is a much more doubtless drawback.

- Shale oil wells fracking manufacturing knowledge present peaking manufacturing.

- China remains to be opening up slowly. What occurs when development hurries up there?

- Russia doesn’t have entry to Western oil manufacturing experience. They will get by for the primary yr or so, however then manufacturing begins slowing.

- We have now gone from 97 million barrels per day of Liquid Gasoline consumption in 2021 to 102 in 2023.

- (This one bought me): From 2007 to 2023, cumulative inflation has been 45%. In the present day’s 70$ value of Oil is ~$45 in 2007 {dollars}. Do you keep in mind the worth of oil roughly traded at $120 in 2007?

- Power corporations are slimmer at the moment, extra environment friendly, and regardless of the a lot decrease oil value, have Free Money Movement yield within the excessive teenagers and low EBITDA multiples. They’re utilizing money stream to pay down debt after which repurchase shares. These are massively accretive transactions to current shareholders.

- At at the moment’s oil costs, many power corporations may repay their debt and purchase again all their inventory inside 5 to 7 years out of projected money flows.

- A number of Canadian shares, like MEG Power, within the portfolio have reserve lives of 25+ years.

Aegis has discovered corporations with glorious fundamentals, the place I consider the group is fallacious, and the place there could also be a generational wealth constructing alternative.”

“What may go fallacious within the thesis?” I requested.

“There may very well be one other pandemic, there may very well be huge enhancements in battery expertise, or there may very well be a heavy melancholy. In 2014 to 2016, the portfolio carried out very poorly. The portfolio was down 55%. We held levered power service corporations. Now, we maintain corporations with extraordinarily long-life belongings and considerably much less, and in lots of instances zero, monetary leverage.”

Conclusion

It was an intense dialogue, an intensive and detailed funding perspective from a fund supervisor devoted to his craft. Many individuals within the funding world consider the group is fallacious. In spite of everything, one wants a sure degree of ego to purchase and promote shares – keep in mind the environment friendly market speculation. You may have a blue sky, God is nice, Cathie Wooden view of the world. Or you’ll be able to scour the markets for small, low cost corporations, which have all of the components to compound capital. That is what Scott Barbee does. And it’s labored for the fund’s long-term returns.

The really troublesome factor, one even Scott Barbee doesn’t know, is how huge the subsequent drawdown within the fund goes to be. I get the sense he is aware of bearing volatility is a part of his job. That there’s $48 million of workers and household cash in a $320 million fund goes a good distance in offering confidence that Barbee believes in his means to compound capital. I consider so too. I’m an investor within the fund.