This yr, the US federal tax deadline is April 18, 2023. In case you aren’t already ready to file, you continue to have a while to get began. Whether or not you put together your taxes by yourself or rent knowledgeable, you may discover that submitting after a crowdfunding marketing campaign is a bit more complicated than submitting private earnings taxes. With a purpose to precisely report crowdfunded earnings, you could want very particular knowledge about once you earned cash and the place that cash got here from. Whereas we are able to’t supply accounting recommendation — and all the time suggest that you simply seek the advice of with a tax lawyer, accounting adviser, or your native tax authority — there are just a few points that the crowdfunding creators we’ve labored with usually run into, and that it’s best to take into accout whereas preparing for tax season.

Crowdfunding earnings have to be reported in your tax returns

You will have to pay tax after crowdfunding if backers obtain one thing of worth in trade for pledging, which is mostly the case when elevating cash by reward-based crowdfunding. Crowdfunded cash obtained as a present is often not thought-about taxable earnings. While you file your taxes, you need to be reporting the entire earnings you made by your Kickstarter, Indiegogo, or Crowdfunding by BackerKit initiatives for the yr. There are critical penalties, together with fines and prosecution, for not reporting all enterprise earnings or for incorrectly reporting earnings. We suggest that if you happen to’re a crowdfunding creator who has raised funds by Kickstarter, Indiegogo, or Crowdfunding by BackerKit, you converse to a tax skilled to make sure that you’re assembly all your tax obligations.

How can crowdfunding creators decide how a lot cash to report on tax returns?

The crowdfunding platform you employ will ship a 1099-Okay type to you if you happen to raised greater than $20,000 with greater than 200 backers, and you’ve got a US checking account. The shape will element the gross quantity of income you earned from crowdfunding transactions, and help you in reporting your earnings.

Nevertheless, the 1099-Okay type doesn’t inform the total story about how a lot cash you, because the marketing campaign organizer, must report. Listed here are a few the reason why:

- Even if you happen to don’t meet the thresholds for receiving the shape, you’re nonetheless required to report your crowdfunding earnings.

- In accordance with the Inner Income Service (IRS) web site, the shape doesn’t “embrace any changes for credit, money equivalents, low cost quantities, charges, refunded quantities or another quantities.”

- Challenge transactions that have been generated outdoors of Kickstarter or Indiegogo gained’t be reported on the 1099-Okay that you simply obtain from them, however you’ll nonetheless should pay taxes on these funds.

- A number of the cash included within the type could also be tax-deductible.

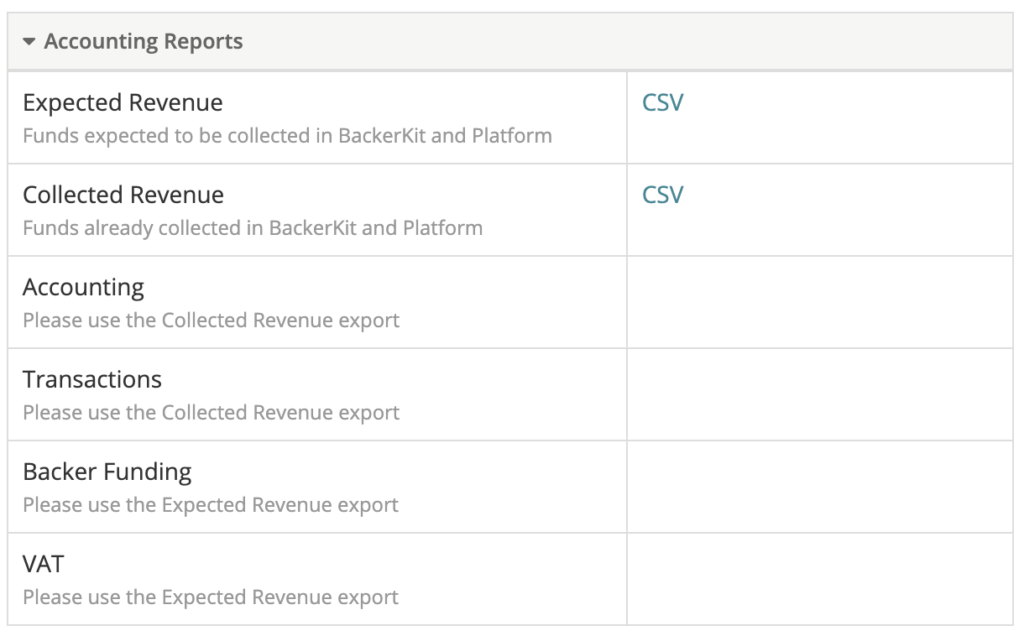

To see what your true taxable earnings is, it helps to get a breakdown of the cash you made. In case you have been preserving very clear data all through your marketing campaign about how all your funds have been being allotted, you should utilize that as a information. However if you happen to haven’t achieved that, you don’t want to fret. With BackerKit Accounting Stories, you may see the entire cash you raised by Kickstarter or Indiegogo campaigns in addition to cash raised by BackerKit.

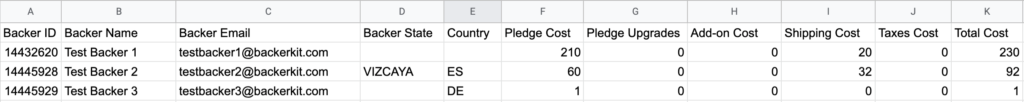

Obtain the Anticipated Income Report back to get an in depth breakdown of the place your income is coming from. Together with backer identification knowledge, like e mail and placement, this report reveals you the pledge degree value, pledge degree upgrades, add-on value, delivery value, tax value and complete value for every backer.

This report particulars the anticipated income to your backers in BackerKit, which means that is what your challenge is anticipating to gather based mostly on the present backer knowledge (no matter survey completion) in BackerKit. The report might be extra correct after you’ve efficiently charged your backers in BackerKit.

This report may also be useful all year long for bookkeeping functions. For instance, in some states, all delivery costs are thought-about taxable. In different states, delivery costs aren’t taxable. With the Anticipated Income Report, you may see which state cash is coming from and the way a lot of that cash is allotted for delivery, so you may decide if funds are taxable.

Determine which accounting methodology you’re utilizing

There are two accounting strategies: accrual accounting and money foundation accounting. With the accrual methodology, you file income once you present items or companies. In case you’re utilizing money foundation, nevertheless, you file income once you obtain cash, even if you happen to haven’t delivered the products or companies but.

While you pay taxes, you’ll must classify earnings based mostly on the accounting methodology you’re utilizing. In case you’re utilizing the money methodology, and also you gather cash out of your backers through the 2020 tax yr, however gained’t ship out rewards till later in 2021, you’ll should report the cash in your 2020 tax returns. In case you’re utilizing the accrual methodology, and also you gather cash through the 2020 tax yr, however don’t ship till the 2021 tax yr, you gained’t should report that earnings in your 2020 tax returns. As a substitute, you’ll report the earnings the next tax yr.

Crowdfunding creators usually use the accrual methodology. It permits you to offset among the prices related to delivery and manufacturing that may happen a number of months after you’ve completed your marketing campaign.

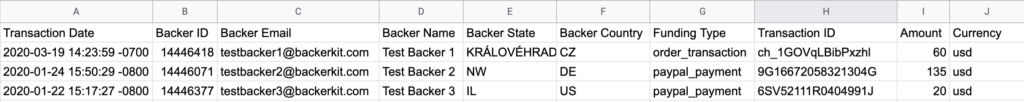

Whatever the methodology that you simply’re utilizing, you’ll want to know when transactions occurred. To do that in BackerKit, you may check out the Collected Income Report. That is an Accounting Report that reveals you the entire transactions that occurred in BackerKit. Additionally, towards the underside of the report, Kickstarter or Indiegogo transactions might be listed within the part titled “platform_pledge.” The report shows the backer ID, backer e mail, backer state, backer nation, transaction ID, transaction date, transaction quantity, and transaction supply.

Making certain you manage to pay for to cowl taxes

In the case of paying taxes, nobody needs to dip into funds that weren’t already earmarked for that objective. As a creator, you could want that cash to cowl different features of your challenge, like manufacturing prices. You may be sure to manage to pay for available to cowl your taxes by doing the next:

- Issue the taxes you’ll should pay into your funding aim. You must seek the advice of with an accountant and search for the federal tax charges to get an thought of what you’ll owe.

- Take a while to analysis the advantages of the accrual methodology of accounting. As talked about earlier, you could possibly write off bills that happen after you’ve collected cash out of your backers. This might relieve a few of your tax burden.

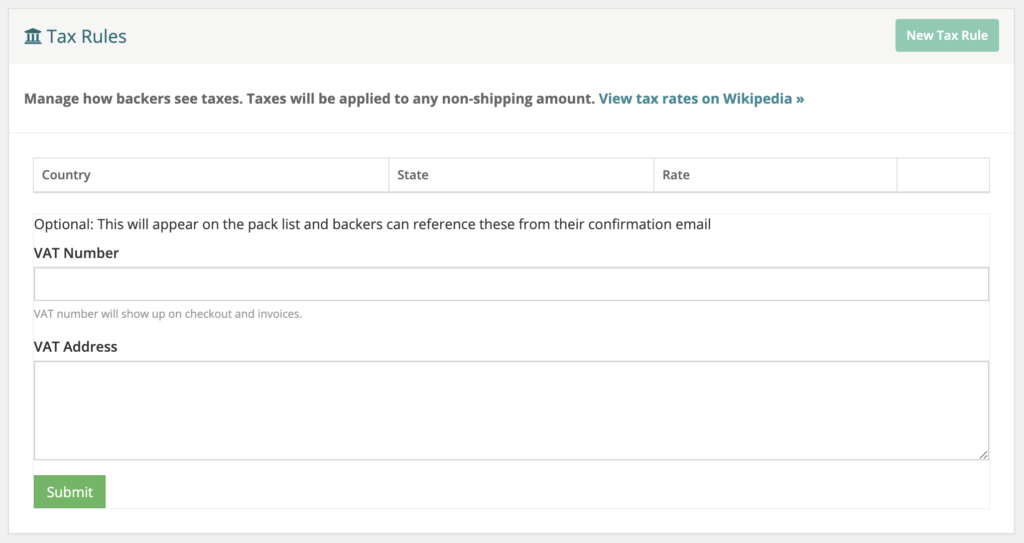

- Acquire extra taxes in BackerKit. Utilizing the Tax Guidelines function, you may cost a further proportion based mostly on the overall value of the backer’s pledge degree plus the price of any add-ons chosen in BackerKit (minus delivery).

This function helps you to set a tax charge based mostly on nation and/or state. Doing this may increasingly enhance the quantity a backer will owe, which provides you with extra funds when paying earnings tax. One added bonus: In case you have backers within the EU, it’s also possible to add your VAT quantity and VAT handle within the Tax Guidelines part. This info will present up in your pack record and backers’ affirmation screens and emails.

What about gross sales tax?

Relying on the place you’re situated, you could must pay gross sales tax. Usually, crowdfunding creators will solely should pay gross sales tax on transactions if they’ve a big connection to the placement of the backer. So if you happen to reside in California, you’ll have to pay gross sales tax on the entire transactions from backers in California.

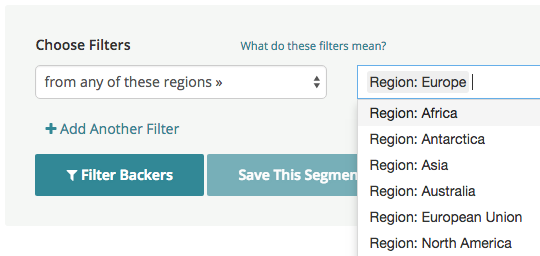

To determine your gross sales tax obligation, you will have to establish the place backers are situated.

Making an attempt to manually divide backers up by location may be difficult — particularly when you have a lot of US and worldwide backers. One technique to make this course of simpler is with BackerKit’s Segments software. Segments assist you to zero in on particular backer knowledge factors.

Use the software to separate up your backers into smaller teams based mostly on standards resembling location, the objects they bought, or pledge degree.

Tax season may be nerve-racking. However once you’re ready, you may face it with confidence. Contact our crew to be taught extra about these BackerKit tax instruments and different options that may show you how to keep organized and handle your crowdfunding campaigns.

Disclaimer: BackerKit doesn’t present tax recommendation. The data offered right here is for informational functions solely, and doesn’t represent tax, authorized, or accounting recommendation. Seek the advice of a tax lawyer, accounting adviser, or your native tax authority concerning crowdfunding tax implications and obligations that pertain to your challenge.

Editor’s Be aware: This weblog put up was initially revealed in 2021. It has been up to date for relevance and accuracy.