Editors Notice: The title of this submit has been modified from the unique. August 17, 2023, 10:35 a.m.

Inflation within the U.S. has skilled unusually giant actions in the previous couple of years, beginning with a steep rise between the spring of 2021 and June 2022, adopted by a comparatively speedy decline over the previous twelve months. This marks a stark departure from an prolonged interval of low and secure inflation. Economists and policymakers have expressed differing views about which elements contributed to those giant actions (as reported within the media right here, right here, right here, and right here), resulting in fierce debates in coverage circles, tutorial journals, and the press. We all know little, nevertheless, in regards to the client’s perspective on what precipitated these sudden actions in inflation. On this submit, we discover this query utilizing a particular module of the Federal Reserve Financial institution of New York’s Survey of Shopper Expectations (SCE) by which shoppers had been requested what they assume contributed to the latest actions in inflation. We discover that buyers assume supply-side points had been an important issue behind the 2021-22 inflation surge, whereas they regard Federal Reserve insurance policies as an important issue behind the latest and anticipated future decline in inflation.

The SCE is a month-to-month, nationally consultant, internet-based survey of a rotating panel of roughly 1,300 family heads that has been carried out by the New York Fed since June 2013. Along with its common month-to-month survey containing a set core set of questions, the SCE conducts occasional “particular surveys” of a subset of former SCE panelists fielded on an advert hoc foundation to deal with well timed policy-relevant questions. Right here, we give attention to a particular survey fielded from June 7 to June 20, 2023, with 2,155 respondents. Within the survey, we requested respondents what they assume the twelve-month fee of inflation was at three distinct time limits: (1) earlier than the COVID-19 pandemic (in 2019), (2) over the twelve-month interval between June 2021 and June 2022, and (3) over the previous twelve months (between June 2022 and June 2023). As well as, we elicited respondents’ expectations for the speed of inflation over the following twelve months (between June 2023 and June 2024).

We used the responses for inflation perceptions and future expectations to ask tailor-made questions on which elements respondents assume contributed to the modifications in inflation over three separate durations: between 2019 and June 2022 (when precise inflation surged), between June 2022 and at the moment (when inflation began declining), and between at the moment and one yr from now. We offered an inventory of doable elements and requested respondents to fee the extent to which they consider every contributed (or will contribute) to the perceived (or anticipated) change within the fee of inflation over a given interval utilizing a Likert scale between 1 (in no way necessary) and 5 (essential).

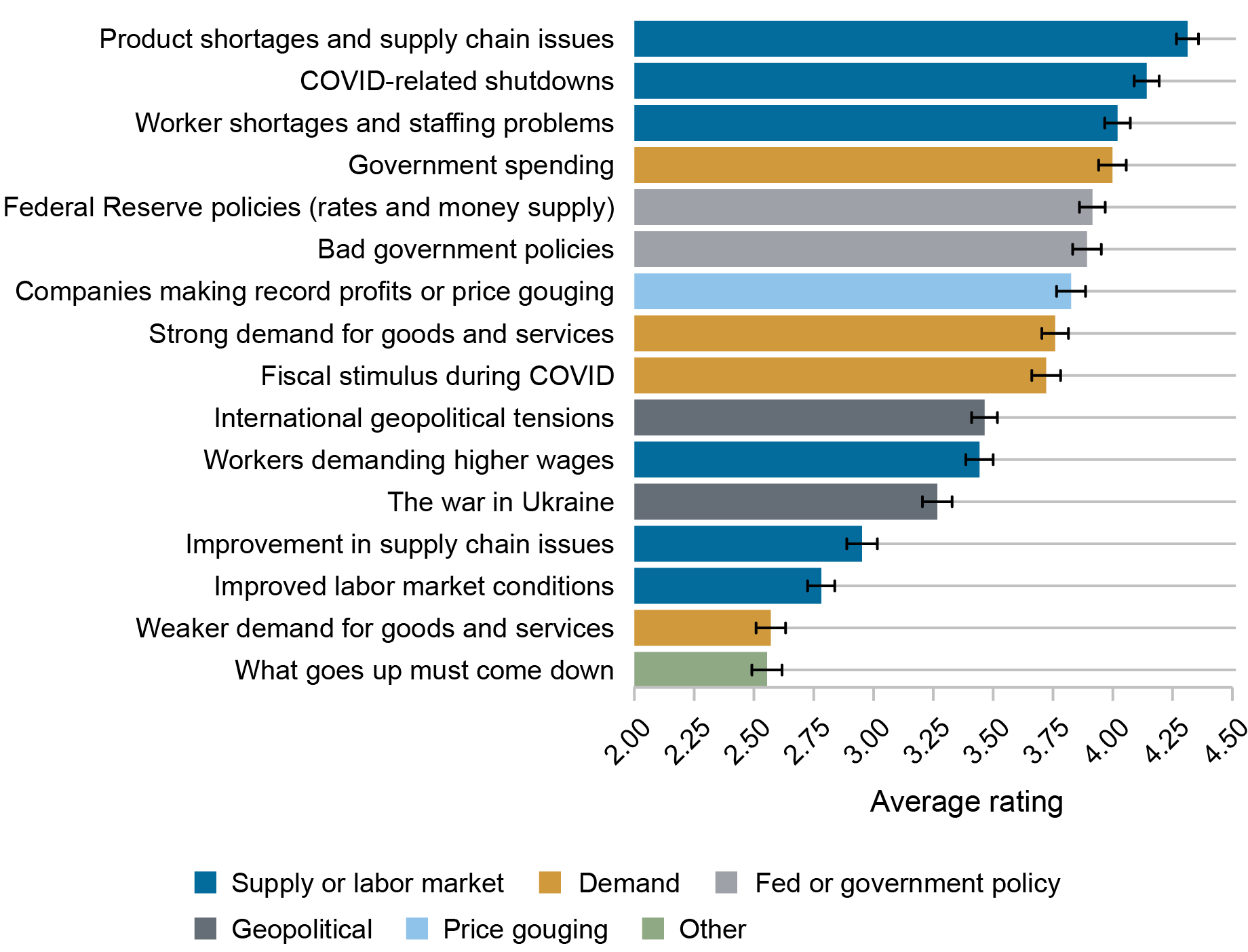

Beginning with the earliest interval, we discover that the majority respondents (80 %) assume that inflation rose between 2019 and June 2022. As proven within the chart beneath, the highest three elements respondents rated as an important contributors to the rise are all supply-related: “Product shortages and provide chain points,” “COVID-related shutdowns,” and “Employee shortages and staffing issues.” Particularly, 86 % of those respondents rated “Product shortages and provide chain points” as the very best of the sixteen elements they had been requested to fee. This result’s per the view that the surge in inflation over this era was as a consequence of binding capability constraints (see as an example right here). The relative consensus amongst shoppers that supply-side elements had been the highest-rated contributors to the 2021-22 surge in inflation is sort of placing in comparison with the divergence of views that also seems to persist amongst economists and practitioners, talked about within the first paragraph above.

Significance of Components in Contributing to the Inflation Improve between 2019 and June 2022

Supply: New York Fed Survey of Shopper Expectations.

Notes: The chart exhibits the typical significance ranking assigned to every issue as a contributor to the change in inflation among the many 1,698 respondents who perceived a rise in inflation between 2019 and June 2022. A ranking of 1 means “in no way necessary” whereas a ranking of 5 means “essential.”

The following three elements ranked highest by shoppers within the chart above are a mix of demand-side and Federal Reserve or authorities insurance policies, indicating that buyers acknowledge that fiscal and financial coverage could have performed a task within the rise of inflation. The following issue, “Corporations making report earnings or value gouging,” is ranked considerably decrease, maybe surprisingly in mild of latest discussions of doable “greedflation” and value gouging (see as an example right here and right here). Equally, robust demand for items and providers and financial stimulus, which had been initially predicted to have giant impacts on inflation (see right here), weren’t ranked among the many most necessary contributors to the rise in inflation—per latest findings. Lastly, regardless of its impression on oil and meals costs, shoppers rated the battle in Ukraine as solely a modestly necessary contributor to inflation over this era. A number of the impact, nevertheless, could have been captured by different elements reminiscent of “Product shortages and provide chain points.”

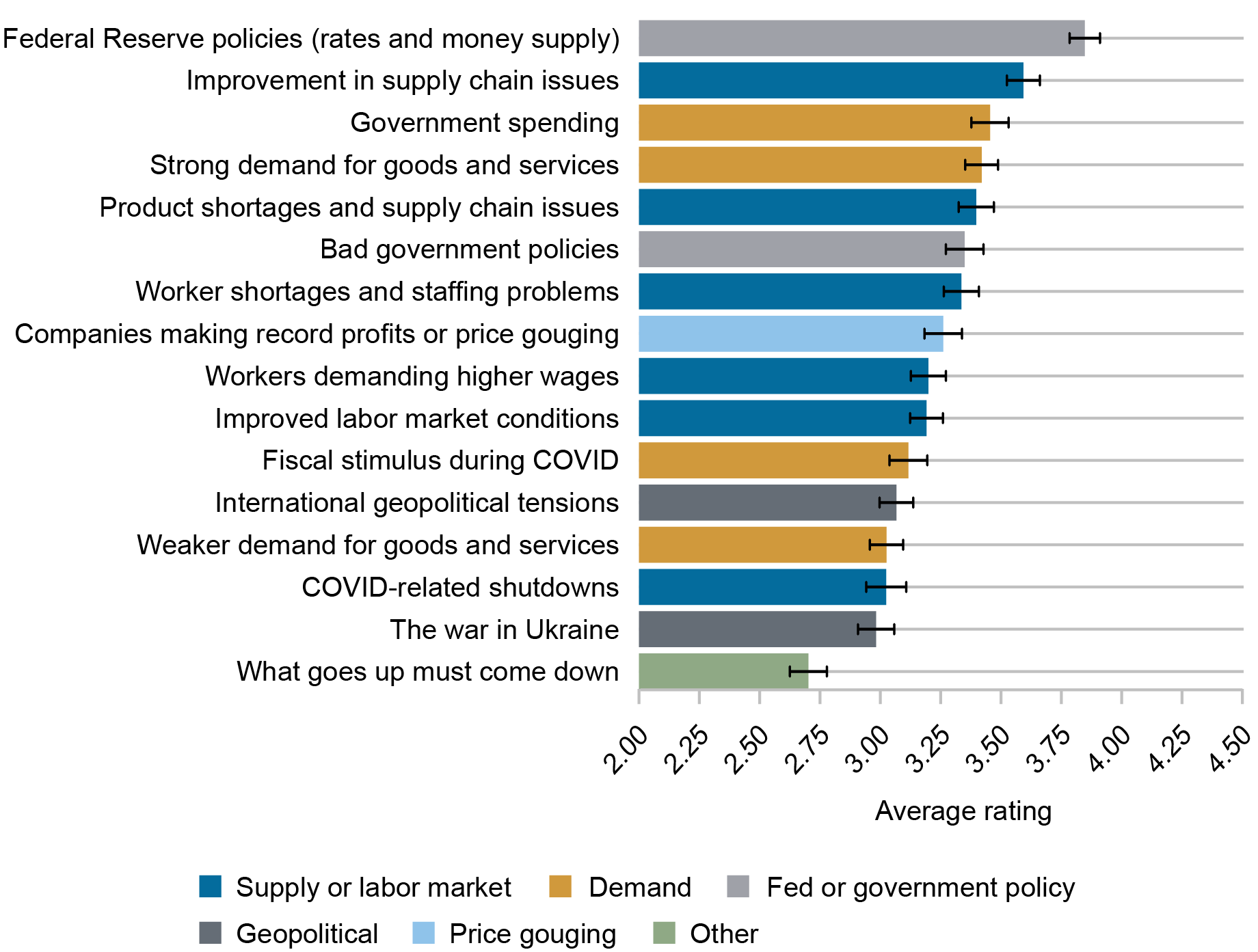

Turning now to the latest interval between June 2022 and June 2023, the chart beneath exhibits that respondents who perceived a lower or a stabilization in inflation over the previous yr attributed this modification firstly to “Federal Reserve insurance policies (charges and cash provide),” adopted by “Enchancment in provide chain points.”

Significance of Components in Contributing to the Inflation Lower between June 2022 and June 2023

Supply: New York Fed Survey of Shopper Expectations.

Notes: The chart exhibits the typical significance ranking assigned to every issue as a contributor to the change in inflation among the many 1,171 respondents who perceived a lower or no change in inflation from June 2022 to June 2023. A ranking of 1 means “in no way necessary” whereas a ranking of 5 means “essential.”

The following chart exhibits that the identical two elements had been additionally ranked highest by the 82 % of respondents who count on a decline or a stabilization in inflation over the approaching yr.

Significance of Components in Contributing to the Anticipated Inflation Lower between June 2023 and June 2024

Supply: New York Fed Survey of Shopper Expectations.

Notes: The chart exhibits the typical significance ranking assigned to every issue as a contributor to the change in inflation among the many 1,744 respondents who count on a lower or no change in inflation between June 2023 and June 2024. A ranking of 1 means “in no way necessary” whereas a ranking of 5 means “essential.”

Our outcomes counsel that buyers consider provide chain points—a deterioration first adopted by enhancements—was among the many fundamental causes behind the sharp inflation actions the U.S. economic system has skilled since 2020. That buyers cite Federal Reserve insurance policies as an important issue behind the latest and anticipated future lower in inflation could appear at odds with latest tutorial analysis at first. A number of research (see as an example right here and right here) counsel that American shoppers are usually imperfectly knowledgeable in regards to the insurance policies of the Federal Reserve (for instance, they know little in regards to the Federal Reserve’s inflation goal or ahead steering), which may restrict the effectiveness of financial coverage. Nevertheless, these research had been carried out earlier than the surge in inflation of 2021, at a time when inflation was low and secure. The authors of those research acknowledge that in such an setting, shoppers could also be extra inattentive to inflation and financial coverage. In distinction, in durations of excessive or altering inflation, shoppers could pay extra consideration to inflation and the actions of the Federal Reserve (for a latest research displaying proof on this, see right here). Our outcomes present help to this speculation. Certainly, we discover that buyers at the moment know sufficient in regards to the Federal Reserve to acknowledge its insurance policies as an important issue behind the latest and anticipated future decline in inflation.

Felix Aidala is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Olivier Armantier is the top of Shopper Conduct Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Fatima Boumahdi is a senior analysis analyst within the Financial institution’s Analysis and Statistics Group.

Gizem Kosar is a analysis economist in Shopper Conduct Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Devon Lall is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Jason Somerville is a analysis economist in Shopper Conduct Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Giorgio Topa is an financial analysis advisor in Labor and Product Market Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Wilbert van der Klaauw is the financial analysis advisor for Family and Public Coverage Analysis within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Learn how to cite this submit:

Felix Aidala, Olivier Armantier, Fatima Boumahdi, Gizem Kosar, Devon Lall, Jason Somerville, Giorgio Topa, and Wilbert van der Klaauw, “Customers’ Views on the Latest Actions in Inflation,” Federal Reserve Financial institution of New York Liberty Road Economics, August 17, 2023, https://libertystreeteconomics.newyorkfed.org/2023/08/consumers-perspectives-on-the-recent-movements-in-inflation-expectations/.

Disclaimer

The views expressed on this submit are these of the creator(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the creator(s).