Regardless of being the third most costly state within the US, California additional time legal guidelines are beneficiant to hourly staff.

However, managing additional time can get messy while you run a enterprise the place:

- Workers have versatile working hours

- Not each worker is paid by the hour

- Not everyone seems to be entitled to additional time pay

Since it may be simple to miscalculate additional time hours, understanding the exceptions, exemptions, and particular circumstances of California additional time legal guidelines is important for staying compliant and avoiding penalty charges.

On this article, we’ll take a look at which staff are entitled to and exempt from additional time pay, learn how to calculate funds, and the way Homebase may help you observe additional time.

Which staff are entitled to additional time in California?

Let’s begin by who has the precise to obtain additional time, and the way a lot.

Based on the State of California, non-exempt staff should earn x1.5 their hourly pay for added work when:

- They’re 18 years previous or older (or 16 to 17 once they don’t have any restrictions to work)

- They work greater than 8 hours a day, 40 hours every week, or 6 days a workweek

Staff are additionally entitled to double their common pay fee when:

- They work greater than 12 hours a day

- They work greater than 8 hours on their Seventh workday of the week

Because the California labor code 510 explains:

“(a) Eight hours of labor constitutes a day’s work. Any work in extra of eight hours in a single workday and any work in extra of 40 hours in anyone workweek and the primary eight hours labored on the seventh day of labor in anyone workweek shall be compensated on the fee of at least one and one-half instances the common fee of pay for an worker. Any work in extra of 12 hours in at some point shall be compensated on the fee of at least twice the common fee of pay for an worker. As well as, any work in extra of eight hours on any seventh day of a workweek shall be compensated on the fee of at least twice the common fee of pay of an worker.”

However what kind of staff are non-exempt?

In a nutshell, non-exempt staff are lined by the Industrial Welfare Fee Wage Orders, which incorporates hourly staff like:

- Cashiers

- Servers

- Retail associates

- Drivers

- Bartenders

- Cooks

- Janitors

- Guards

Word: Staff are solely entitled to additional time for the hours that they labored in the course of the week. For instance, engaged on a time without work solely counts as additional time if the worker labored the remainder of the week as regular. This implies they received’t obtain additional time in the event that they’re compensating for a sick day.

Which staff are exempt from additional time legal guidelines?

It’s the legislation — and never a person enterprise — that determines whether or not an worker is exempt or not.

The precise classes of exempt staff who should not eligible for additional time pay embrace:

- White-collar staff with government, administrative, {and professional} roles who earn not less than double the minimal wage

- Workers within the laptop software program business who earn greater than $41 per hour

- Salespeople who spend greater than half of their time outdoors of the enterprise location

- Authorities staff

- Taxicab drivers or any driver whose hours are regulated by the US Division of Transportation Code of Federal Regulation

- Skilled actors

Word: the small print and wage circumstances of each class are in depth and particular. It’s really helpful to seek the advice of an expert to determine in case your staff are exempt or non-exempt from additional time.

Minimal wage in California

You’ll be able to’t scale back additional time by paying a set wage to your staff.

To remain in compliance with the legislation, you additionally want to make sure the common charges of pay are over the minimal wage.

It’s because all charges of pay should meet the California authorized minimal wage, which grew to become $15.50 per hour in January 2023. Whatever the compensation kind ( hourly charges, salaries, commissions, and even “piecework earnings”), you will need to calculate the “common fee of pay” by dividing the entire compensation by the agreed common hours (i.e. their hourly wage).

This, so long as an worker works fewer hours than California’s authorized most. So if an worker works an agreed 30 common hours per week, they received’t be entitled to additional time till they exceed 40 hours per week or meet another additional time regulation.

Word: Within the occasion the place staff earn two or extra charges of pay in a single workweek, you will need to use a weighted common. To calculate it, divide the entire workweek earnings by the variety of hours the worker labored, and make it possible for it’s greater than the minimal wage.

How a lot is additional time pay in California?

Calculating additional time pay is straightforward, because the charges set by the California DIR say:

“1. One and one-half instances the worker’s common fee of pay for all hours labored in extra of eight hours as much as and together with 12 hours in any workday, and for the primary eight hours labored on the seventh consecutive day of labor in a workweek; and

2. Double the worker’s common fee of pay for all hours labored in extra of 12 hours in any workday and for all hours labored in extra of eight on the seventh consecutive day of labor in a workweek.”

In brief, you solely must multiply the common fee of pay by 1.5 or 2, observe what number of additional time hours have been labored, and add it to the entire wage.

Examples for calculating additional time pay

Though calculating additional time pay is straightforward more often than not, monitoring additional time hours can get tough in a couple of conditions.

For example, relying on the beginning of your workweeks and workdays, an worker won’t be entitled to additional time pay regardless of working extra hours or days in a row.

- For those who run a membership that begins its workdays at 6 PM, an worker won’t be entitled to additional time in the event that they work from 4 PM to 2 AM. It’s because the interval between 4 and 6 PM belongs to the earlier workday.

- For those who personal a restaurant that begins the workweek on Wednesdays, an worker that labored 8 hours from Monday to Sunday won’t be entitled to additional time. On this case, Monday and Tuesday belong to the earlier workweek schedule.

Word that there should be a official enterprise motive to start out your workdays and weeks at completely different instances. It’s not arbitrary.

Nonetheless, these staff would nonetheless be entitled to additional time pay in the event that they labored their regular schedule. Let’s take a look at these particular examples:

- If the membership worker labored their regular hours the day earlier than. The 2-hour interval they labored between 4 and 6 PM would rely as additional time for the day gone by. At a fee of $20/hr, they’d be entitled to (1.5 × $20/hr × 2hrs) + ($20/hr × 8 hrs) = $220 for that day.

- If the restaurant worker labored each common workday of the earlier workweek (Wed to Solar). Then they’d be entitled to obtain additional time for working Monday and Tuesday. With an hourly pay of $20/hr, the entire payroll for the week could be: ($20/hr × 40 hrs) + ($30/hr × 16 hrs) = $1280

As a enterprise proprietor, this implies you’ll be able to scale back labor prices by coordinating along with your staff to free some hours on their common timesheet. For instance, you possibly can have them work 6 hrs every workday to allow them to work a sixth day with out additional time.

Easy methods to observe additional time hours precisely

The toughest a part of calculating additional time pay is, by far, monitoring the hours appropriately.

There’s no approach round it, because the California DIR says that “an employer has the responsibility to maintain correct time data and should pay for work that the employer permits to be carried out and to which the employer advantages.”

Homebase customers have a bonus, because the app can observe worker work hours and additional time routinely. It gives free instruments to remain compliant with the legislation, in addition to save monumental quantities of time on managing hourly staff.

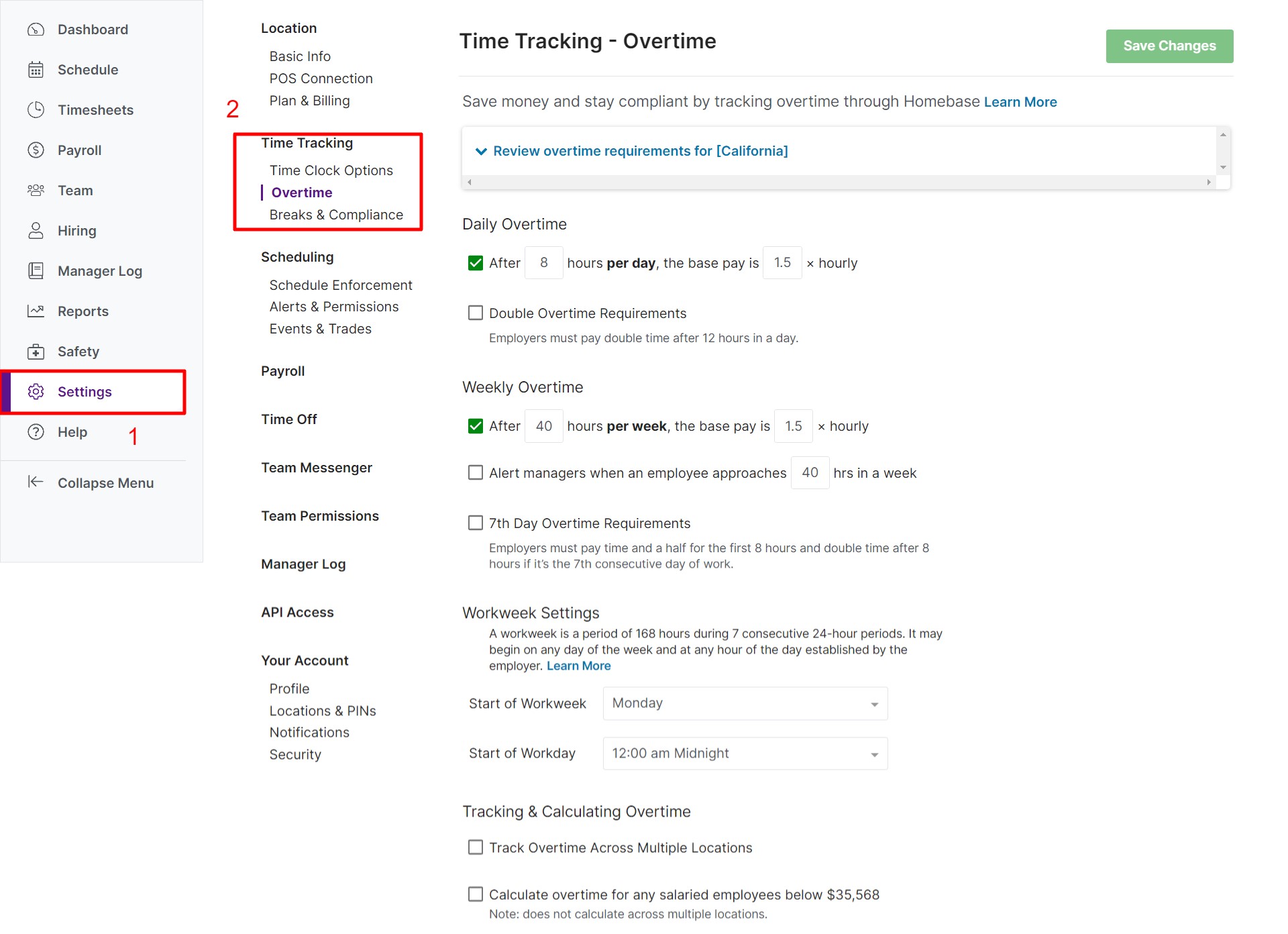

With Homebase, the method to arrange additional time monitoring is kind of easy:

- Click on “Settings” on the sidebar → Time monitoring → Extra time

- Set the additional time fee primarily based on the California legal guidelines we talked about earlier (x1.5)

- Test the double additional time necessities because it applies to California legal guidelines

- Test the Seventh-day additional time necessities

- Arrange vacation pay charges in the event that they apply to your enterprise

- Permit it to calculate the additional time pay for salaried staff

- Save modifications

These settings should not solely handy for enterprise house owners, however in addition they enhance retention for hourly staff by rising wage transparency and belief.

By utilizing Homebase to trace additional time hours, you additionally get a stress-free resolution for getting ready payroll and controlling labor prices.

What are the penalties for violating additional time legal guidelines?

The charges and damages you want to pay for not appropriately paying additional time can add up fairly rapidly.

Particularly, when you’ve gotten a number of staff and also you have been unaware of their additional time rights for too lengthy. For example:

- If an employer doesn’t pay on time, they should pay a injury price for each interval the place the worker wasn’t paid appropriately (along with the cash they owe). Based on the IWC wage orders, the injury charges are initially $50 per missed pay interval, nevertheless it will increase to $100 for subsequent violations.

- If an employer denies additional time pay, the worker can file a wage declare to the Division of Labor Requirements Enforcement (DLSE). Right here, the case can hopefully be resolved in a convention (if not, the case can escalate to a listening to the place the court docket can implement a judgment towards the employer).

- If the employer misclassified an worker as exempt, they will begin a lawsuit towards the employer to pay the owed cash, in addition to liquidated damages and lawyer’s charges.

If a number of staff should not receiving their rightful pay, they will additionally convey wage claims as class actions and symbolize a fair increased expense for the enterprise.

Extra time legal guidelines could be complicated — however they’re vital

California’s additional time legal guidelines could be difficult to grasp. However having to handle your workforce’s additional time hours with out getting a single element incorrect can take its toll on employers.

These legal guidelines are vital to guard the employees, and complying with them is important for his or her well-being and to keep away from going through authorized motion.

By managing additional time with Homebase’s free time clock calculator, you’ll be able to simply simply export or print timesheets that precisely calculate common hours, additional time, double additional time, complete pay, and extra.

With Homebase, you get assist staying compliant with California legal guidelines, save hours on administrative work, and even get new instruments to regulate your labor prices.

FAQs about California additional time legislation

Can staff be compelled to work additional time?

In easy phrases, employers are entitled to set a employee’s schedule, and in the event that they schedule additional time the employee should comply.

However there’s a restrict, staff are assured one relaxation day per workweek, to allow them to’t be compelled to work a seventh day in every week.

Can staff earn additional time when having a wage?

Having a wage doesn’t make you exempt from additional time. The exemptions are dictated by state legal guidelines or IWC wage orders, and so they rely on the class of the job and the wage.

Do staff have to just accept additional time pay?

Sure, staff can’t waive their rights to additional time pay. Even when they’re keen to take common compensation for these further hours, the employer should comply with the legislation and compensate the worker correctly.

Can employers postpone additional time pay?

Not by a lot, additional time wages can solely be delayed till the next payday after the worker earned them. Nonetheless, staff’ common wages nonetheless should be paid as traditional and never delayed.

Are my bonuses topic to additional time guidelines?

Provided that the bonuses are non-discretionary. They’re included within the calculation of the common fee of pay when:

- It’s a flat sum bonus.

- It’s a manufacturing bonus.

The additional time multiplier of 1.5 or 2 nonetheless applies to these charges when the worker works additional time in the course of the bonus-earning interval.

Different funds together with items, discretionary bonuses, or expense reimbursements are excluded from the common fee of pay

If an worker places in unauthorized additional time. Does the employer should pay additional time charges?

Sure, though employers can self-discipline an worker for working additional time with out authorization, the employer should pay for unauthorized additional time on the similar fee.

This, so long as the employer knew or “ought to have recognized” that the worker labored further hours.

Nonetheless, this isn’t the case if the worker doesn’t talk with the employer about working further hours deliberately to file a wage declare later.

Which states have the very best additional time legal guidelines?

California, together with New York, Illinois, Pennsylvania, and Colorado, has essentially the most beneficiant additional time legal guidelines for staff.

How can an worker get well unpaid additional time?

Both by submitting a wage declare, a lawsuit, or class motion if there’s multiple worker affected by unpaid additional time.

How lengthy do I’ve to assert unpaid additional time?

Usually, staff can file for unpaid additional time for both 2, 3, or 4 years after the pay interval, relying on whether or not they go to the Labor Commissioner or the court docket.

However after the pandemic, you’ll be able to declare unpaid wages that return to April 5, 2017.