Affle India Ltd. – Cellular Advert Participant

Affle was based by Mr. Anuj Khanna Sohum (CEO) in 2005-06. With moto of “Constructed to Final”, Mr. Sohum has efficiently navigated Affle by means of a number of trade and technological adjustments confronted by the dynamic ever evolving ad-tech trade over previous 15+ years. Affle is a world expertise firm with a proprietary shopper intelligence platform that delivers shopper engagement, acquisitions and transactions by means of related Cellular Promoting. The platform goals to reinforce returns on advertising and marketing funding by means of contextual cellular adverts and likewise by decreasing digital advert fraud. The corporate now has ~3.2 Bn related gadgets. Affle 2.0 goals to succeed in greater than 10 Bn related gadgets together with cellular sensible telephones, related TV, sensible wearables and out-of-home screens to allow built-in omnichannel on-line and offline shopper journeys.

Merchandise & Providers:

The Firm caters to 2 kinds of Platforms.

- Shopper Platform – Delivers shopper suggestions and conversions by means of related cellular promoting for main manufacturers and B2C corporations globally. This platform is subdivided into CPCU (Price Per Transformed Consumer) & Non-CPCU (Price per million impressions) fashions.

- Enterprise Platform – It supplies end-to-end options to enterprises for enhancing their engagement with cellular customers, corresponding to growing Apps, enabling offline to on-line commerce for offline companies with e-commerce aspirations and offering enterprise grade information analytics for on-line and offline corporations.

Subsidiaries: As on FY23, the corporate had 21 subsidiaries.

Key Rationale:

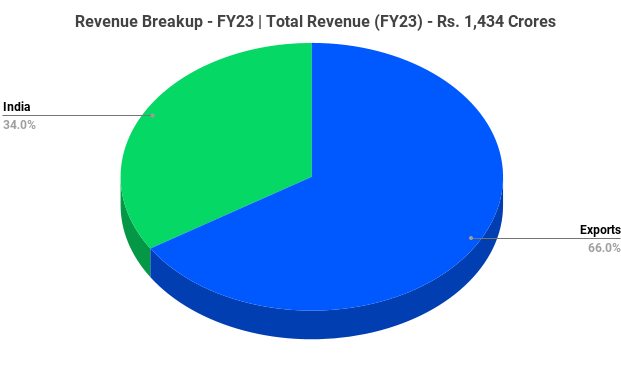

- Smartphone Period – Share of cellular in India’s digital media spends jumped to 76% in FY21 (vs 45% in FY19), rising at 45% CAGR to US$1.9 bn. Beneficial macro tendencies like i) big base of sensible cellphone customers in India & rising markets with decrease penetration in comparison with developed markets, ii) growing web information consumption and cellular display screen time pushed by decrease information prices and iii) rising adoption of m-commerce gave important enhance to cellular getting used as a most well-liked channel for promoting. Affle is properly positioned to experience this progress wave with >95% income coming from cellular promoting.

- Enterprise Mannequin – Affle’s Price Per Transformed Consumer (CPCU) is a differentiated enterprise mannequin in an trade which normally operates on Price per Media (CPM) (Media based mostly enterprise mannequin) or Price per Click on (CPC) mannequin. A CPCU mannequin implies that income is earned when a person is transformed right into a shopper by clicking on the advert adopted by a obtain or buy or registration; versus CPM / CPC which earn revenues on a “per 1000 views” foundation or merely “click on foundation”. Round 93% of the general income is derived from the CPCU mannequin of the corporate in Q1FY24. The corporate is at the moment specializing in excessive progress trade segments throughout E (E-Commerce, Edtech, Leisure), F (Fintech, FMCG, Foodtech), G (Gaming, Authorities, Grocery) and H (Healthtech, Hospitality & Journey). Income contribution from these 4 classes is round 90%+ in Q1FY24.

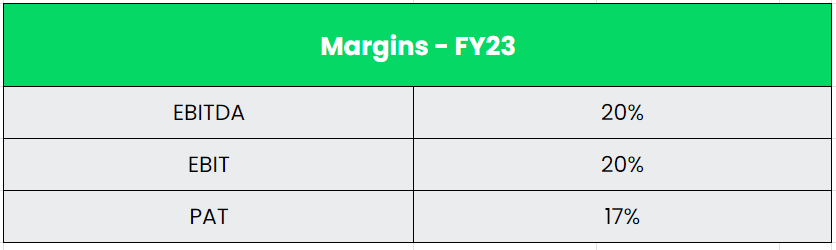

- Q1FY24 – In Q1FY24, Affle posted a income of Rs.407 crore, registering a progress of 14.3% on a QoQ foundation and 17% on a YoY foundation. Its consolidated EBITDA for the quarter grew by 9% QoQ and 15% YoY to Rs.78 crore, led by the sharp restoration within the worldwide enterprise. Nonetheless, the corporate’s EBITDA margins declined by 80bps QoQ to 19.2%. It reported a internet earnings of Rs.66 crore, up 6% QoQ. The CPCU enterprise delivered 68.7mn conversions in Q1FY24 at a CPCU price of Rs.55, totalling to a section topline of Rs.380 crore. The corporate’s India enterprise stood flat and reported a progress of 0.4% QoQ. On the Worldwide Enterprise entrance, the corporate reported a wholesome progress of twenty-two% QoQ, led by sturdy machine addition.

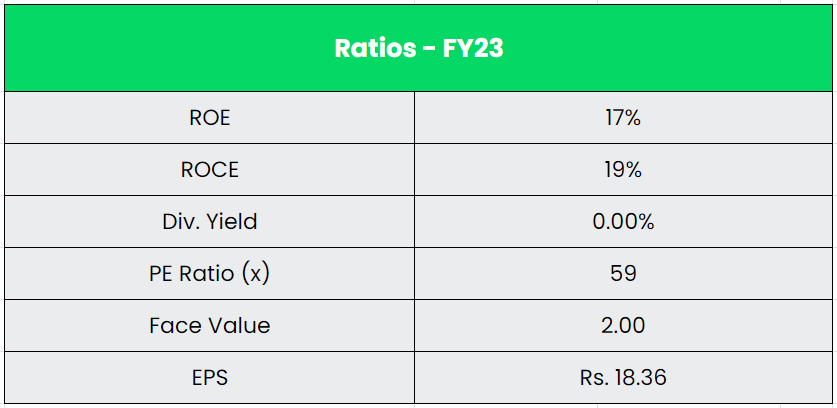

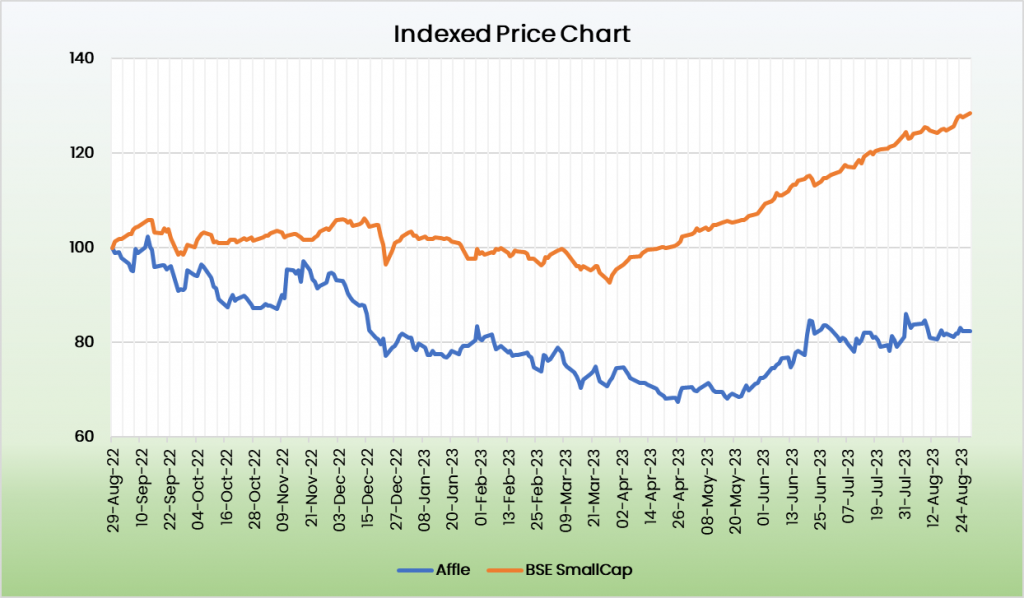

- Monetary Efficiency – The 5 12 months income and revenue CAGR stands at 54% and 54% respectively between FY18-23. The steadiness sheet of the corporate is robust with a debt-to-equity ratio of 0.1x. The Working Money move of the corporate has grown at a 44% CAGR from Rs.42 crore in FY18 to Rs.260 crore in FY23. The OCF/EBITDA ratio of the corporate stands at 90% in FY23 which signifies a robust money conversion from EBITDA.

Business:

India is the world’s second-largest telecommunications market with a subscriber base of 1,170.75 million in January 2023 and has registered sturdy progress within the final decade. The overall subscriber base, wi-fi subscriptions in addition to wired broadband subscriptions have grown persistently Tele-density stood at 84.51%, as of March 2023, whole broadband subscriptions grew to 846.57 million till March 2023. The aggregated information consumed as on thirty first December 2022 was 14,024,519 GB. As per GSMA, India is on its option to changing into the second-largest smartphone market globally by 2025 with round 1 Bn put in gadgets and is anticipated to have 920 Mn distinctive cellular subscribers by 2025 which can embody 88 Mn 5G connections. It is usually estimated that 5G expertise will contribute roughly $450 Bn to the Indian Financial system within the interval of 2023-2040. International Digital Promoting is using on a robust progress and it’s anticipated to succeed in $785 bn in 2025 from $381 bn in 2020 at a CAGR of 16%. Digital Advert spends as a % of whole Promoting expense in India is at a mere 29% in 2021 in comparison with China with 82%.

Development Drivers:

- Solely half the world is on-line with US/UK at ~80% smartphone penetration and Rising Markets trailing with a lot decrease ranges of smartphone penetration.

- In Union Funds 2023-24, the Division of Telecommunications was allotted Rs.97,579.05 crore (US$ 11.92 billion). Of this, US$ 48.88 million (Rs.400 crore) is for Analysis and Improvement, US$ 611.1 million (Rs.5,000 crore) is for Bharatnet.

- India is likely one of the highest customers of knowledge per day with roughly 5 hours of day by day time spend on smartphones. Lively web customers in India are anticipated to succeed in 900 Mn by 2025.

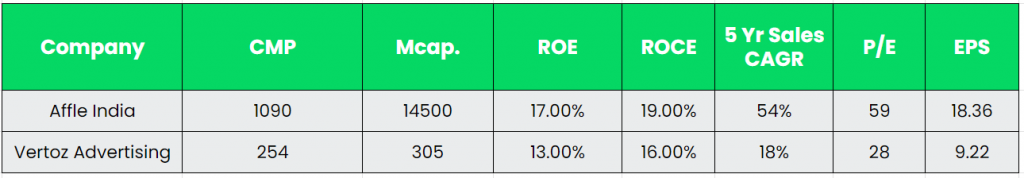

Opponents: Vertoz Promoting.

Peer Evaluation:

There isn’t any comparable listed peer as a result of they function in numerous geographies or service completely different elements of ad-tech worth chain. Vertoz, is the one Advert-tech peer listed in Indian Markets. It gives programmatic promoting platform; nonetheless, it derives 90% of income from worldwide markets and has income dimension of simply ~5-6% of Affle.

Outlook:

Administration continues to focus on upselling and cross-selling of AFFLE’s options, with distinctive advert placement throughout OEM and operator app shops. CPCU fashions present CTV (Join TV) options with family sync capabilities within the US and international rising markets. The corporate has additionally efficiently launched a full-funnel proposition on the iOS App Retailer, changing into a frontrunner on the Apple SKAN (StoreKit Advert Community) ecosystem. Administration indicated that AFFLE is more likely to obtain 20-25% progress in India and different rising markets in FY24, and expects related momentum in FY25. From a long-term perspective, the corporate expects to see multi-quarter tailwinds in machine additions along with increased shopper acquisition, which ought to enhance income potential. The corporate believes it’s well-positioned to counter short-term challenges and has taken decisive actions in areas corresponding to individuals, partnerships, merchandise and platforms, which it believes will yield ends in FY24, marked by mission ramp-ups in Q2 and turnaround in Q3FY24.

Valuation:

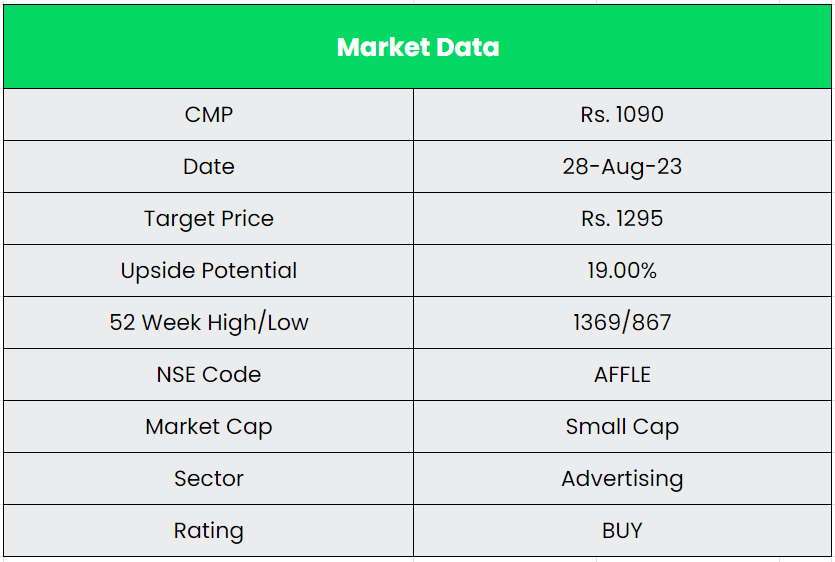

We consider Affle has a novel enterprise mannequin and a robust technique to penetrate the focused geographies and verticals. Additionally, the corporate has superior penetration within the worldwide enterprise and powerful income progress potential going forward. We suggest a BUY ranking within the inventory with the goal worth (TP) of Rs.1295, 47x FY25E EPS.

Dangers:

- Regulatory Threat – The digital promoting enterprise mannequin is extremely inclined to information privateness rules. Stricter rules or restrictions on entry to such direct or third-party information might improve the price of compliance, adversely influence stock and information value, and scale back the accuracy and efficacy of present algorithms.

- Aggressive Threat – The marketplace for cellular promoting options is extremely aggressive with a number of regional and international gamers. In addition to Google and Fb, there are a number of comparatively smaller gamers, corresponding to InMobi, Criteo, and many others. who compete with Affle throughout varied geographies.

- Financial Downturn – AdTech is inherently a cyclical enterprise and has a excessive correlation with financial progress. Downturns usually result in companies reducing down on their discretionary spend, particularly these associated to promoting.

Different articles it’s possible you’ll like

Publish Views:

461