Understanding and constructing credit score in a constructive manner takes self-discipline and a few schooling. Do you recall being taught in class, the way to construct your credit score scores? Did your lecturers let you know the way large of a job credit score would play in your life as you bought older? Truthfully, it’s most likely possible that even whereas going by the method of making use of for a bank card or automotive mortgage, you had been nonetheless uncertain of what your credit score scores actually meant.

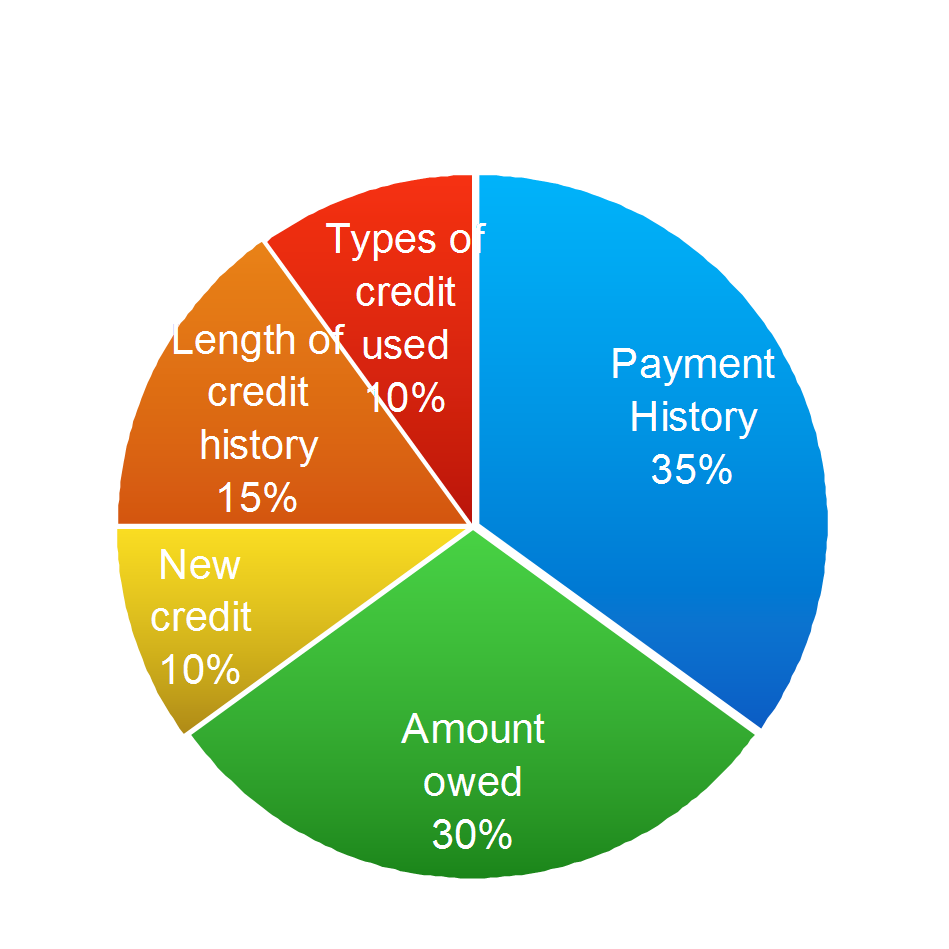

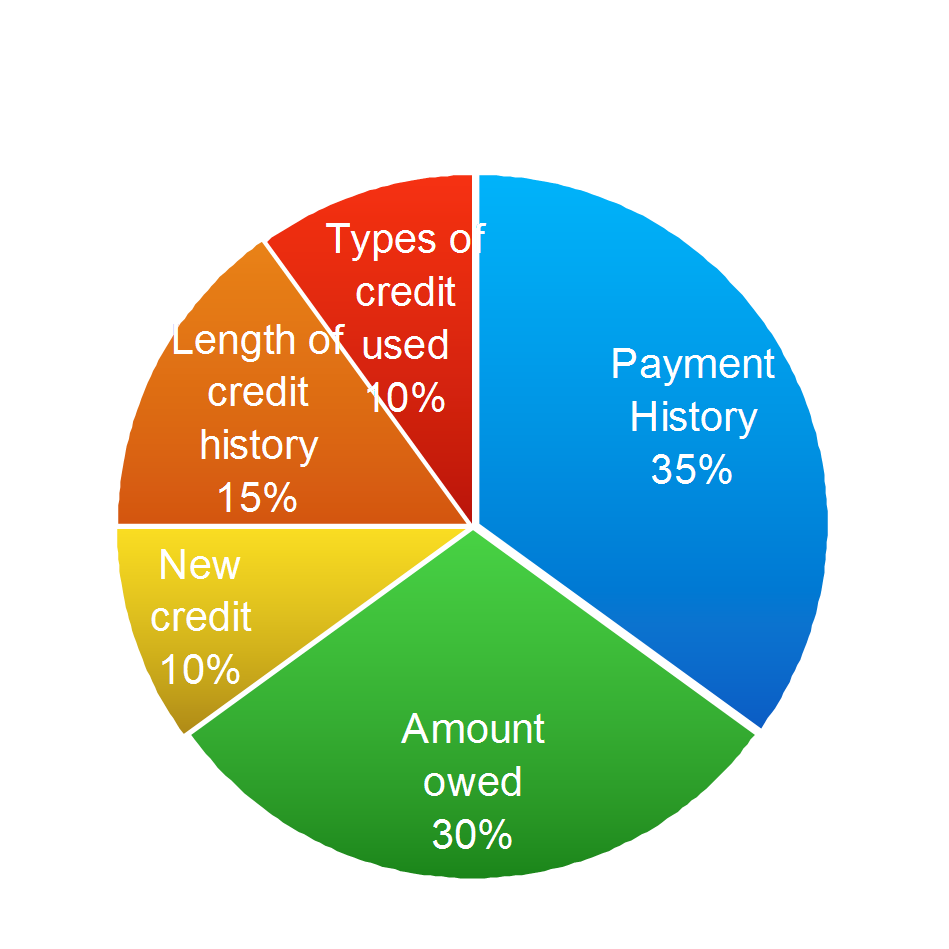

So what’s a credit score rating manufactured from? Your FICO is set by the classes under on the pie chart. Fee historical past and quantities owed in your credit score make up the 2 largest parts of your scores. What if you happen to should not have bank cards? There are a couple of different choices for you, in an effort to nonetheless fulfill elements of the FICO scoring mannequin.

The Significance Of Credit score

Are you able to think about not accessing a financial institution that would lend you cash in your house or automotive? Credit score is so vital for everybody, whether or not they have a bank card or not. A lender or banking establishment pulls your credit score so as to see how dependable and certain you might be to default in your mortgage. In case your cost historical past is unhealthy or you might be missing credit score historical past, it’s onerous for them to lend to somebody that they can’t be certain of. In case you are somebody that has no credit score rating, that’s virtually as unhealthy as having unhealthy scores. It’s onerous to justify lending to you when they don’t seem to be certain how you employ your cash or pay your payments.

The Typical Manner To Construct Credit score-Credit score Playing cards

In case you are opening your first bank card, your financial institution is often open to issuing you a bank card with them. This bank card is to not take in your subsequent buying spree, however small purchases like filling up your car. Many individuals open up bank card for “emergencies” solely, whereas some use them and reside outdoors of their means. Credit score can find yourself getting you into giant quantities of debt if you’re not cautious and able to setting limits for your self. So what are a couple of different methods to start out getting a rating, with out the cardboard in hand?

Different Choices Moreover Credit score Playing cards

Change into a certified person

Dad and mom making an attempt to assist their youngsters construct and set up credit score often enable for them to grow to be a certified person on a bank card. Previous to including your child on the bank card of your selecting, check out the size of historical past and the funds on the entire bank cards you’ve got. If in case you have an previous card, with no late funds and nice credit score historical past that is the very best one so as to add your little one to.

Younger adults making an attempt to determine credit score ought to discuss to folks or relations that may enable them to be added to a card as a certified person. Perceive that at no level do they provide you entry to the bank card however reasonably, you might be simply now benefiting from their constructive historical past whereas having to make no effort or open up new credit score traces.

Report Month-to-month Payments

Are you presently renting and paying your payments on time? There are actually many firms that may enable so that you can have your hire reported. It may be very irritating to always pay payments that aren’t displaying as much as present your credit score worthiness, so many firms have listened to shoppers and now are serving to them out in an effort to finally get a mortgage.

JOIN A CREDIT UNION

A starter mortgage on the credit score union works about the identical as a secured bank card does. To be able to construct, the buyer deposits their very own cash to get began. The funds aren’t instant however secured in a financial savings account till the time period is full. Making funds on this credit score constructing mortgage are most vital as once more, constructive cost historical past makes up 35% of the FICO pie chart. These are often shorter phrases (12-36 months) simply to start constructing credit score. Usually instances, proof of revenue is required as nicely.

Whereas it could appear a bank card is the one solution to construct credit score rapidly, that’s not at all times the case. There are different avenues to take reasonably than signing up for the primary bank card that’s dropped in your mailbox. For those who don’t belief your self to keep away from these bank card solicitations go to this website to maintain from receiving unsolicited mail and bank cards filling up your mailbox.

Do you’ve got questions on your credit score report? If you need to talk with considered one of our attorneys or credit score advisors and undergo a free session please give us a name at 1-800-994-3070 we might be comfortable to assist.

A Notice From The Writer: The opinions you learn right here come from our editorial crew. Our content material is correct to the very best of our information once we initially put up it.