It’s simple to put in writing a funds that you just suppose is ideal till you’re 5 days in and also you understand you forgot so as to add in room for an upcoming birthday or a seasonal exercise with your loved ones. When these forgotten funds objects are lacking out of your funds, all of a sudden budgeting feels inconceivable.

Should you really feel like giving up and dropping out, you’re not alone. We’ve been there. One of many largest causes you’re blowing your funds is since you aren’t creating a practical funds.

When a funds isn’t real looking, it is actually because you’re not budgeting sufficient cash for a funds class otherwise you’re leaving a class out of your funds altogether. This free cheat sheet will assist you to kickstart your funds and repay debt quick.

In 2023, set your self up for fulfillment and funds and ensure these 15 lacking funds objects are in your month-to-month funds.

15 Frequent Lacking Price range Objects

1. Items

It may be simple to miss gift-giving once you sit down to put in writing your month-to-month funds. So usually I might sit down, write out what I believed was a flawless funds, after which understand I had forgotten a few present I wanted for an upcoming occasion.

Maintain observe of those dates and reference them once you sit all the way down to construct your funds:

- Birthday Items

- Anniversary Items

- Commencement Items

- Christmas Items

- Finish of the Yr Instructor Items

- Valentine’s Day Items

- Mom’s Day Items

- Father’s Day Items

Even higher, arrange a gift-giving sinking fund! This lets you get monetary savings (even $20 every month goes a good distance) and canopy the price of presents once they come up.

2. Automobile Upkeep

I hate to be the bearer of unhealthy information, however right here it’s … vehicles break. They don’t seem to be constructed to final perpetually.

They require oil modifications, tire replacements, registration prices, and so on. Should you put a set amount of cash every month right into a automobile upkeep sinking fund, then you’ll be able to offset (or fully cowl) these prices once they arrive.

Our household presently units apart $50 every month to pay for upcoming automobile bills. Whereas the quantity we’ve saved up won’t cowl the total restore value, it does assist take the sting off the price.

To remain forward of shock automobile payments, it’s at all times an excellent factor to ask your trusted mechanic about any upcoming upkeep your automobile wants together with a worth estimate.

This can assist alleviate the shock of upcoming upkeep payments.

3. Leisure Cash

Simply since you need to save extra and spend much less doesn’t imply that it’s a must to skip out on leisure totally. So many individuals suppose that if you find yourself on a funds which you could’t have any enjoyable.

Honestly, you’ll be able to have a whole lot of enjoyable however it’s a must to plan it out. Take into account setting apart some cash every month to do one thing enjoyable with your loved ones and pals.

4. Medical Payments

Are you overlooking any upcoming physician’s or dentist’s appointments? Copays and deductibles can get costly and could be a pressure on a funds if you’re unprepared.

Earlier than you sit all the way down to make your funds, test your calendar for any scheduled appointments.

Don’t hesitate to name the physician’s workplace upfront to find out the quantity that you may be charged. Preparation results in success!

5. Garments

Garments don’t final perpetually. Seasons change and kids will want new garments for college.

Simply since you live on a funds doesn’t imply which you could’t have new garments. Anticipate the necessity and plan for the price.

Relating to shopping for a whole lot of garments without delay (like back-to-school garments) take into consideration budgeting the price over a number of months to assist unfold out the massive expense. You possibly can even arrange a sinking fund that will help you cowl most (if not all) of the prices of the brand new garments.

6. Memberships

Don’t get caught off guard by yearly memberships or subscriptions. Many occasions these memberships are on autopay and also you don’t even understand they’re due till the cash has already been taken out of your account! (I’m talking for expertise right here!)

I like to recommend that you just preserve an inventory of your annual memberships with their renewal date in your funds binder so you’ll be able to reference them usually.

Frequent memberships & subscriptions to test:

- Wholesale Membership (like Costco, Sam’s Membership, or BJ’s Wholesale Membership)

- Amazon Prime

- Month-to-month Subscription Containers (like razors, magnificence bins, children bins, and pet bins)

7. Residence Upkeep

Having a house might be costly, however these bills don’t need to catch you off guard. Residence upkeep prices are a standard merchandise lacking from many individuals’s funds.

Not solely is there at all times a chance of huge objects breaking, however there may be additionally a whole lot of upkeep that comes with buying a house.

From changing filters to conserving the yard outdoors mowed and trimmed, the prices can pile up. Don’t overlook to funds every month for vital fixes. Together with residence upkeep prices in your funds will assist you to preserve your private home and funds in line.

Throughout my first 12 months of getting my funds again on observe, I at all times did not plan for the “extras” round every vacation.

Christmas playing cards and photos with St. Nick add up. And I don’t know when you purchased sweet final 12 months for Halloween, however these baggage should not low-cost!

Valentine’s flowers value cash too and the Easter bunny doesn’t convey eggs without spending a dime.

Don’t overlook these additional bills! To make budgeting for these additional bills simple, sit down and suppose by way of the whole lot you’ll do for subsequent vacation. In your thoughts, stroll by way of what you’ll be doing, consuming, and visiting. This can assist you to catch any funds objects you may be lacking.

9. Haircuts

For years he has refused, saying that I might butcher his hair. Properly, when my son was sufficiently old to justify a haircut by knowledgeable, I did what any frugal momma would do.

True story: I’ve begged my husband for years (years!) to let me lower his hair. I instructed him that it may save us $30 a month and that OF COURSE, I may lower his hair simply nearly as good as the woman at Sportclips.

I outfitted myself with a pair of scissors, clippers, and a how-to video on youtube. Inside minutes my son was bald on one facet and on his method to knowledgeable who may repair mommy’s mistake.

Evidently, our month-to-month funds consists of skilled haircuts for each particular person in our household.

10. Visitors

Are you forgetting to consider the price of internet hosting in a single day visitors? You’ll possible purchase additional meals for breakfast and snacks in addition to use additional electrical energy and water.

All of it provides up and must be accounted for. Plan for a rise in your grocery funds this month and a rise in your utility payments subsequent month.

11. Private Spending Cash

Probably the greatest hacks to remain on funds is to recollect so as to add private cash to your funds. Lots of people really feel like they shouldn’t funds for private cash (particularly in the event that they’re in a whole lot of debt), however everybody must have this class of their funds.

While you funds for private cash, you don’t really feel such as you’re being disadvantaged of spending cash on your self. Private spending cash means that you can spend on no matter you need, no questions requested.

It’s vital to do not forget that deprivation results in burnout. Spending cash helps you reside on a funds and never deprive your self of what you need on the identical time.

Lots of people at all times ask me how a lot to funds for this class.

That is determined by your private alternative, your revenue, and your cash targets. Should you’re making an attempt to repay your debt quick, you might need to have a smaller quantity for this class.

I personally funds $25/month per particular person. You possibly can funds $20 – $50 (or extra) relying on what you need, your revenue, and your cash targets.

12. Child’s Bills

Child’s bills can add up rapidly. You possibly can simply get nickeled and dimed together with your child’s bills.

Frequent bills for teenagers:

- Discipline Journeys

- College Lunches & Snacks

- Misc College Charges (T-shirts, Yearbooks, Fundraisers, E-book Gala’s, and so on)

- Summer season Camps

- Sports activities Charges

Verify your child’s college and extracurricular calendars earlier than you write your funds on your subsequent pay interval.

13. Trip Fund

Should you plan on taking a trip, it’s essential to add it to your funds. That is one other frequent sinking fund class. Even when you’re touring on a funds or having a staycation, you’ll be able to add it to your funds.

Simply determine what you need your funds to be and divide by the variety of months till your trip. That’s how a lot it’s essential to save in your sinking fund.

14. Pet Bills

When you have an older pet or one with medical wants, you want a pet fund. Vet payments can get costly rapidly (particularly when you don’t have pet insurance coverage)

You don’t need to be caught off guard not having the ability to pay on your pet’s medication or surgical procedure.

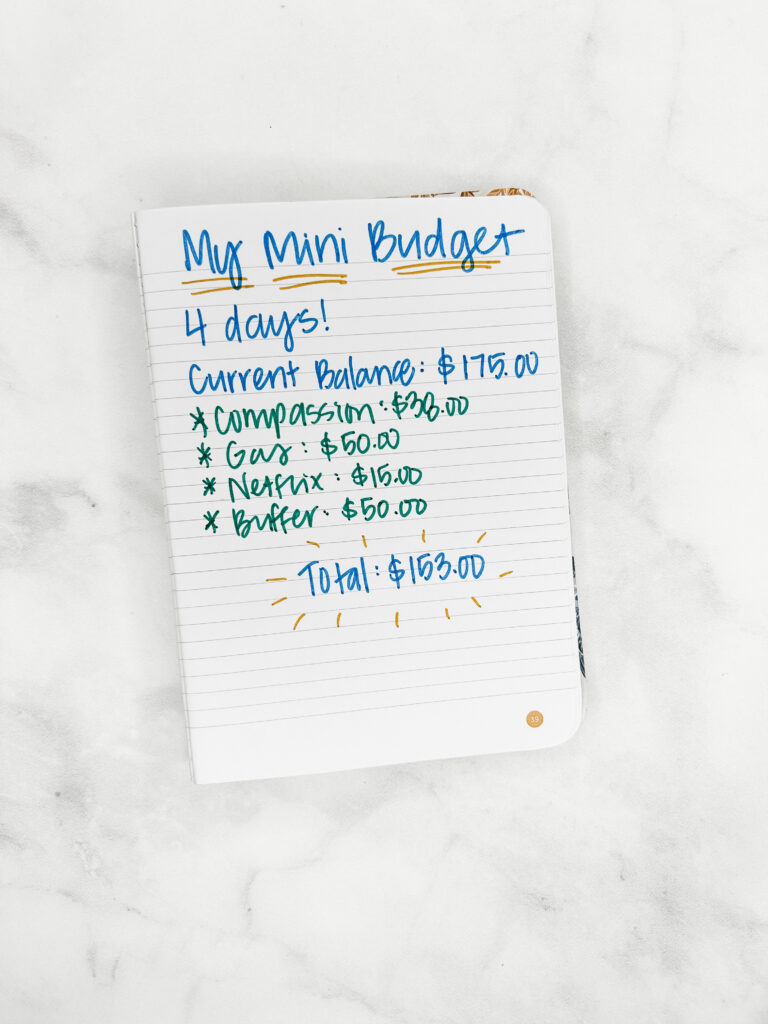

15. A Buffer In Your Price range

One of many MOST frequent bills or objects lacking from a funds can be a very powerful…a buffer. Your buffer class will assist soak up the price of smaller surprising bills that come up.

In the end, it helps you from dipping into your financial savings or worrying about over drafting out of your checking account.

A buffer might be sued to cowl small surprising bills like a area journey your youngster forgot to let you know about till the final minute. It could possibly additionally cowl the price of variable payments that you just didn’t know could be larger. As an example, in case your electrical energy invoice is $125.00 however you solely budgeted $105.00…your buffer can cowl this value!

The buffer class is often about $100 per 30 days or pay interval. Select a buffer quantity that you’re comfy with and add it to your funds.

Causes You Want To Trim Your Price range

Practically 63% of Individuals stay paycheck to paycheck. While you stay paycheck to paycheck, life can all of a sudden develop into actually aggravating. It looks like your cash is operating you rather than the opposite means round.

There are a many causes you would possibly must trim your funds. Under are just some of them.

1. You need to save extra money

Saving extra money is so vital. While you get monetary savings it means that you can construct wealth, have an emergency fund, and extra.

Saving cash helps shield you. You by no means know once you may need an surprising occasion like your youngster having surgical procedure or your transmission going out in your automobile.

When you’ve the security internet of an emergency fund, it prevents you from going into debt to pay for unplanned bills that come up.

2. You need to repay debt sooner

You could need to trim your funds so you’ll be able to contribute extra money in direction of debt funds. Should you’re simply paying the minimal debt funds, it could actually appear to be you’re spinning your wheels like you’re by no means gonna develop into debt free.

While you discover small methods to chop again your funds to release extra cash, you’ll be able to put the additional in direction of your debt. It could not appear to be rather a lot once you release cash, however each little bit provides up!

If one among your targets is to repay debt quick, then you definitely’re going to like my Free Budgeting & Debt Payoff Cheat Sheet. On this cheat sheet you’ll learn to discover extra money in your funds every month in addition to the quickest method to repay debt. Get your copy right here.

3. You need to spend much less in a single space of your funds

You would possibly need to simply spend much less in a sure funds class. Possibly you spend $800 a month on meals for 3 individuals and also you need to spend $600.

Or perhaps you spend an excessive amount of on eating places.

Regardless of the motive, you would possibly need to simply spend much less and trim again a sure class.

4. You need to discover contentment

We stay in a tradition of on the spot gratification. Everybody needs the whole lot proper now. This will breed discontentment. You’re consistently searching for the shiny new object and easy methods to get it proper now.

While you focus extra on what you’ve and loving and accepting your present life, you observe gratitude and contentment. This in flip places you in a greater temper and makes you happier.

5. You need to preserve extra of your cash

You’re employed onerous on your cash and perhaps you simply need to preserve extra of it in your checking account and cease dwelling paycheck to paycheck.

Just like the statistic from earlier, 63% of Individuals stay paycheck to paycheck. It’s so disheartening to work all day lengthy to earn cash after which don’t have anything to indicate for it.

Trimming your funds to provide you extra wiggle room for the belongings you need to spend cash on…like that trip you’re at all times dreaming about.

6. It’s essential to improve your financial savings

If the previous few years have taught us something, it’s that setting apart cash is crucial to monetary success. By trimming your funds, you’ll have extra cash so as to add to your emergency fund.

Price range Trimming Advantages

You may be considering…why would I need to lower issues OUT of my funds! Gained’t my life be boring and fewer enjoyable if I do that?

Whereas that’s how many individuals suppose, slicing again in areas of your funds (and easily dwelling on a funds on the whole) have many advantages!

Under are 3 advantages you’ll get pleasure from:

1. You develop into extra content material in life

While you trim your funds and stay on much less, you can begin to search out extra contentment in your life. The extra content material you’re, the much less you’ll need for what you don’t have.

While you’re not content material and also you’re specializing in what’s not going proper, it may be simple to have a shortage mindset with cash.

While you’re in a shortage mindset, it makes you are feeling like your cash isn’t sufficient and also you would possibly even develop into anxious or fearful when you concentrate on your cash. Chopping again on bills frees you as much as discover contentment in what you’ve.

2. You study to be extra disciplined

Trimming your funds helps you learn to be extra disciplined together with your cash. You learn to prepare dinner at residence as an alternative of hitting up the drive-thru 4 occasions every week.

Self-discipline is delayed gratification and helps you not stay within the spur of the second like impulse spending or overspending.

3. You meet your cash targets sooner

While you trim your funds, it frees up cash so that you could use it to achieve your cash targets.

Possibly you need to absolutely fund your IRA or your emergency fund. Or perhaps you need to get out of debt by the tip of the 12 months. Irrespective of your purpose, you may get there sooner once you’re prepared to chop again in your bills or improve your revenue!

The Backside Line

It’s vital to account for each expense to create a practical funds. Ensure that these 15 frequent forgotten funds objects are in your funds so that you could meet your cash targets.

Additionally, don’t overlook to test in in your funds and the place your cash goes so that you could stay a extra content material life.