Discover ways to handle your cash like a professional (and preserve extra of it). This monetary information will clarify every thing about fiscal responsibility- within the easiest way attainable.

Comply with these money-saving steps and also you’ll be extra fiscally accountable this yr!

What Is Fiscal Accountability?

Fiscal duty is a political time period that refers to how the federal government balances the nationwide funds. This time period also can have private implications for our lives and our households too.

Let’s have a look at each of them so we perceive this time period just a little extra.

The That means Behind Fiscal Accountability In Politics

When politicians use the time period “fiscal duty”, they’re speaking in regards to the proposed spending of your tax {dollars}. They’re chargeable for utilizing the cash you ship them in one of the simplest ways attainable.

They do that by way of:

- Rising or reducing taxes

- Spending on issues that profit the nation

- Encouraging financial development within the nation

Private Monetary Accountability

This time period can have private implications too. After we discuss private fiscal duty, we’re how our actions with cash have an effect on our total life.

Similar to how politicians are chargeable for balancing the nationwide funds, we’re chargeable for balancing our private funds. We should encourage our personal private financial development, and make our cash work for us.

The Significance Of Being Fiscally Accountable

Now that you understand that “fiscal” means cash and “accountable” means being accountable, why do now we have to care a lot about our cash?

Aside from the truth that nothing in life is free, it’s actually vital to know that your actions at this time actually do have an effect on how you’ll stay in 5, 10, even 30 years down the street.

Making ready now for the longer term may imply the distinction between concern about pay primary payments and having the liberty to journey to see the world.

While you maintain your self accountable on your monetary choices, you make higher ones.

- The place is your cash going?

- How can it’s working higher for you in order that sometime you received’t should work if you bodily can’t?

Each determination you make at this time – out of your job, to your funds, and even your every day spending habits – has an impact in your life years down the street.

That’s what this information goes to indicate you. You’ll uncover 11 secrets and techniques to non-public fiscal duty that will provide you with a greater life sooner or later.

How To Be Fiscally Accountable This Yr

Comply with these steps and you can be in your option to being an proprietor of your funds and your future! You don’t should do them on this actual order, however it’s best to attempt to do all 11 of them.

They’re crucial items within the private finance puzzle that can ultimately provide you with much less stress and extra freedom.

1. Set Quick and Lengthy Time period Objectives

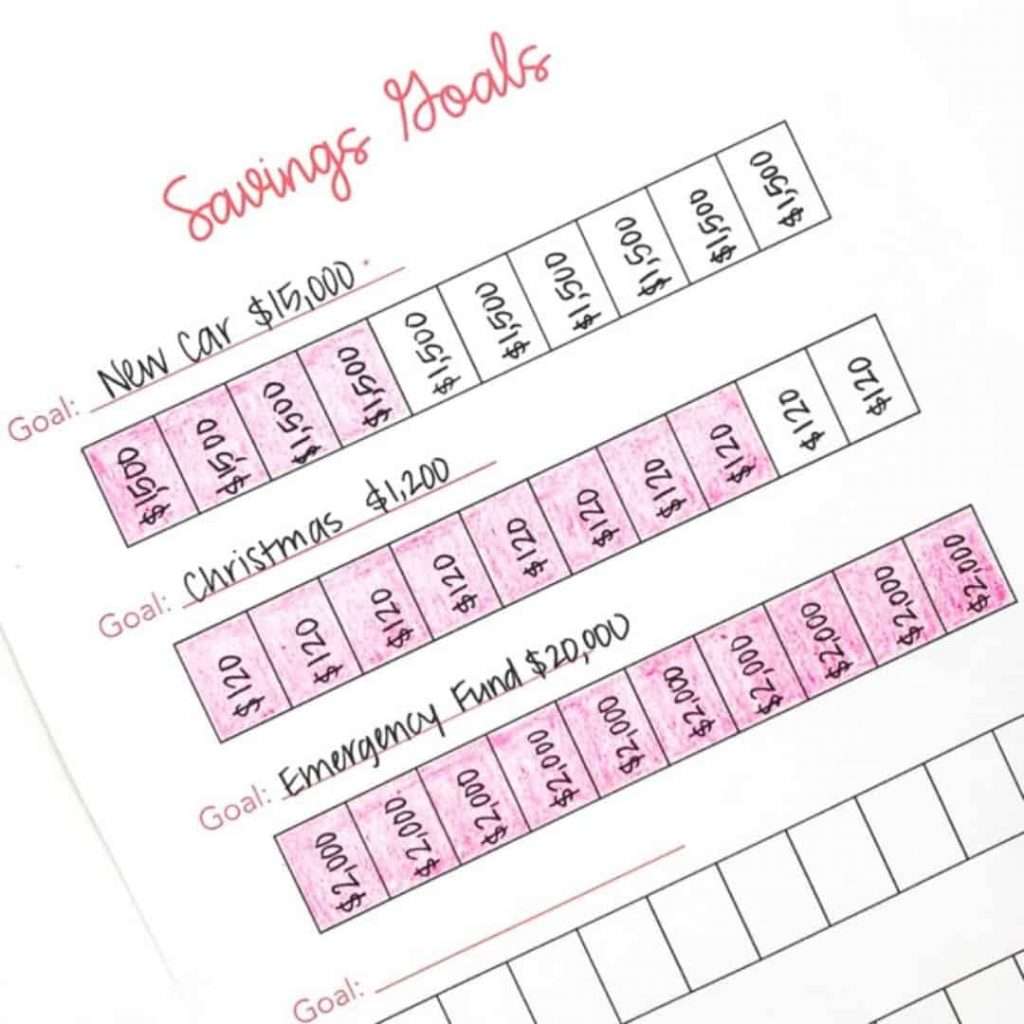

This actually does must be step one. Set your monetary objectives – and make each short-term and long-term ones.

Begin together with your short-term objectives. These are issues you’ll be able to accomplish in per week, a month, or perhaps a yr.

Quick Time period Objectives

Some examples of short-term monetary objectives are:

- Repay a small debt

- Set a funds

- Stick with the funds

- Put a sure amount of cash into financial savings

- Give extra money to charity

Give your self deadlines for these objectives in an effort to return and see in case you’ve met your objectives or not. If you’re married or have a accomplice, do that collectively so you’ll be able to assist preserve one another accountable.

Lengthy Time period Objectives

After you set your short-term objectives, make your long-term ones. Write them down someplace which you can return and look and remind your self what you’re working in the direction of.

These objectives ought to inspire you to stay to your short-term ones. Some examples embrace:

- Repay all money owed

- Have sufficient passive earnings to have the ability to journey

- Keep a passive earnings

- Set up a retirement plan

2. Create A Funds

Subsequent, it’s essential to create a funds! Budgets are important when working in the direction of fiscally accountable and they are often as detailed or as normal as you need, so long as they let you management your cash, not the opposite approach round.

I’ve a lot of assets for you if that is your first time establishing a funds like:

Principally, your funds ought to embrace your earnings and your bills and provide you with an understanding of how you’ll spend what you’ve gotten.

That is one of the simplest ways to handle your cash!

It helps you spend solely what you at present have and makes you conscious of what number of payments you’ve gotten every month. Understanding this can make it easier to make smarter choices (perhaps even reduce on stuff you don’t want) so you should utilize your cash in smarter methods.

3. Frequently Educate Your self About Cash

Nobody is born realizing deal with cash. It’s one thing all of us should study. As you uncover extra about your self and the way you spend or save, it’s also possible to study new habits.

After you grasp sticking to a funds, continue to learn about different monetary conditions. Possibly ask your self:

- What’s investing?

- What counts as passive earnings?

- How can I work smarter not more durable?

There are tons of books and on-line programs (this one is my private favourite – and tremendous reasonably priced too!) on the market that may make it easier to flip your month-to-month earnings into future wealth with out you working extra hours.

A really actual a part of monetary duty is studying develop your wealth – and it is vitally attainable.

4. Reside Frugally Inside Your Means

One other behavior that you simply’ll must study as a way to be fiscally accountable is to stay inside your means. For this reason establishing a funds is so vital!

Ideally, you’ll arrange your funds, solely spend what’s in it, after which have cash left over for charitable giving, investments, and financial savings.

One factor that’s actually vital to know is that it’s attainable to be a poor rich particular person. Regardless of how a lot earnings you earn, in case you spend greater than you earn, you received’t find the money for left over for retirement or future plans.

For this reason a funds is essential. Set a plan for a way a lot you’ll spend in your bills after which save the remaining.

5. Construct Up Your Financial savings

I extremely suggest establishing your financial savings account when attainable! Nevertheless you get monetary savings, simply do it.

In the event you take pleasure in challenges then strive one among these 21 money-saving challenges.

When you’ve gotten cash in financial savings, you can be geared up to deal with shock bills like massive medical payments or automobile repairs.

One other approach to economize is to create sinking funds. These are quantities of cash in your financial savings account that you’ll use for particular functions. For instance, if you understand your roof will solely final 10 years, it’s best to save up a sinking fund for the quantity of a brand new roof in order that when it comes time you’ll be able to afford to exchange it.

You also needs to preserve a minimum of 3 months price of cash in an emergency fund. That is cash you’ll be able to depend on and stay on in case you unexpectedly can not work!

6. Pay Off Debt

Debt will maintain you again in so some ways. Be good together with your cash and pay it off. Don’t carry the debt for too lengthy or else you’ll run the danger of owing greater than you’ll be able to afford to pay again!

Piece of advice- Preserve your cash and apply it to issues that you simply take pleasure in, not on curiosity funds for bank cards or loans.

7. Begin Investing

One other key a part of fiscal duty is studying arrange passive earnings. That is the concept behind investments.

The very best factor to spend money on are retirement accounts! They’re low-risk and can offer you an earnings after you retire.

There are a lot of varieties of retirement accounts obtainable. It’s finest to do the analysis and select which one is finest for you.

Index funds are a well-liked option to make investments as a result of they’re comprised of a listing of funds from the inventory market. Wish to study extra about construct wealth by investing in index funds? Take a look at this tremendous reasonably priced course. I’ve personally taken it and cherished it!

Actual property is a well-liked funding that has the potential to repay years down the street.

8. Calculate and Perceive Your Internet Value

As you continue to learn about handle your funds, discover ways to calculate your web price.

What’s web price? It’s principally property minus liabilities.

Property are something of worth that may be transformed into money. Some fashionable varieties of property are:

- Money in financial institution accounts

- Actual Property

- Funding Accounts

Liabilities are issues that value you cash and don’t have money worth. Some examples are:

- Credit score Card Debt

- Automotive Loans

- Mortgages

So the home you personal is an asset as a result of you’ll be able to promote it, however the mortgage you owe is a legal responsibility.

Understanding your web price will make it easier to perceive how your life will look financially if you get to retirement. When you have extra liabilities than property, you’ve gotten a detrimental web price and also you’ll most likely should work longer to stay and pay your payments.

9. Get The Proper Insurance coverage

One other factor that can shield your funds is ensuring you’ve gotten incredible insurance coverage!

The very best insurance coverage will shield you from monetary wreck when unhealthy issues occur. Not if they occur however when they occur, as a result of they’ll.

These are the primary sorts of insurance coverage you want:

- Medical Insurance coverage

- Automotive Insurance coverage

- Householders or Rental Insurance coverage

- Incapacity Insurance coverage

- Life Insurance coverage

Continue learning about insurance coverage and be sure you are protected so {that a} catastrophe doesn’t wreck you financially. It additionally pays to buy round for higher charges! My husband and I really ended up saving tons of of {dollars} yearly just by reducing our house owner’s insurance coverage. Take a look at and examine completely different dwelling insurance coverage charges under:

10. Proceed To Optimize Your Funds

The extra you develop and find out about being fiscally accountable, the extra you’ll have to tweak your funds and alter the way you method cash and spend it.

Earn a living administration a life-style selection! It isn’t a “set it and overlook it” sort of factor. Continue learning and adjusting and your monetary state of affairs will enhance too.

11. Construct Generational Wealth

Lastly, a really actual a part of wealth is realizing how a lot it is possible for you to to go all the way down to your loved ones sometime.

Have a look at your web price and your investments. Will you’ve gotten something to go alongside to them?

This information explains construct generational wealth. Dig into it and depart a legacy that can profit your youngsters and their youngsters.

How To Be Fiscally Accountable: Remaining Ideas

Being fiscally accountable is about a lot extra than simply staying inside a funds. It’s all about making ready for the longer term and ensuring that you’re getting essentially the most out of your cash.

Continue learning extra about put together and also you’ll quickly understand how rewarding it’s!