Wage development has moderated notably following its post-pandemic surge, nevertheless it stays robust in comparison with the wage development prevailing throughout the low-inflation pre-COVID years. Will the moderation proceed, or will it stall? And what does it say concerning the present state of the labor market? On this put up, we use our personal measure of wage development persistence – known as Development Wage Inflation (TWIn in brief) – to have a look at these questions. Our predominant discovering is that, after a speedy decline from 7 % at its peak in late 2021 to round 5 % in early 2023, TWin has modified little in current months, indicating that the moderation in nominal wage development might have stalled. We additionally present that our measure of development wage inflation and labor market tightness comove very intently. Therefore, the current habits of TWIn is per a still-tight labor market.

TWIn: Measuring the Persistence of Wage Inflation

To get well the persistent (“core”) part of wage inflation, we depend on a framework that mixes worker-level knowledge with time collection filtering strategies. Right here, we briefly summarize the methodology. Further particulars might be present in our earlier Liberty Avenue Financials put up and in this paper.

We begin from month-to-month knowledge on wage development throughout seven completely different industries from the Present Inhabitants Survey (CPS). Following the well-established methodology of the Atlanta Fed Wage Progress Tracker, we outline wage development because the median % change within the hourly wage of people noticed twelve months aside. We then estimate a mannequin through which wage development in every {industry} is decomposed into the sum of a persistent part and a noise time period that captures transitory variation and measurement error. Each persistent and noise parts are additional break up into widespread and industry-specific phrases to accommodate potential cross-sectional correlation.

Importantly, we estimate the persistence of unobserved month-to-month wage development from year-over-year wage modifications. Our measure due to this fact tends to guide year-over-year wage modifications, that are influenced by wages previously twelve months by building. This produces a well timed measure of wage development, helpful to detect turning factors in actual time.

Will Robust Wage Progress Final?

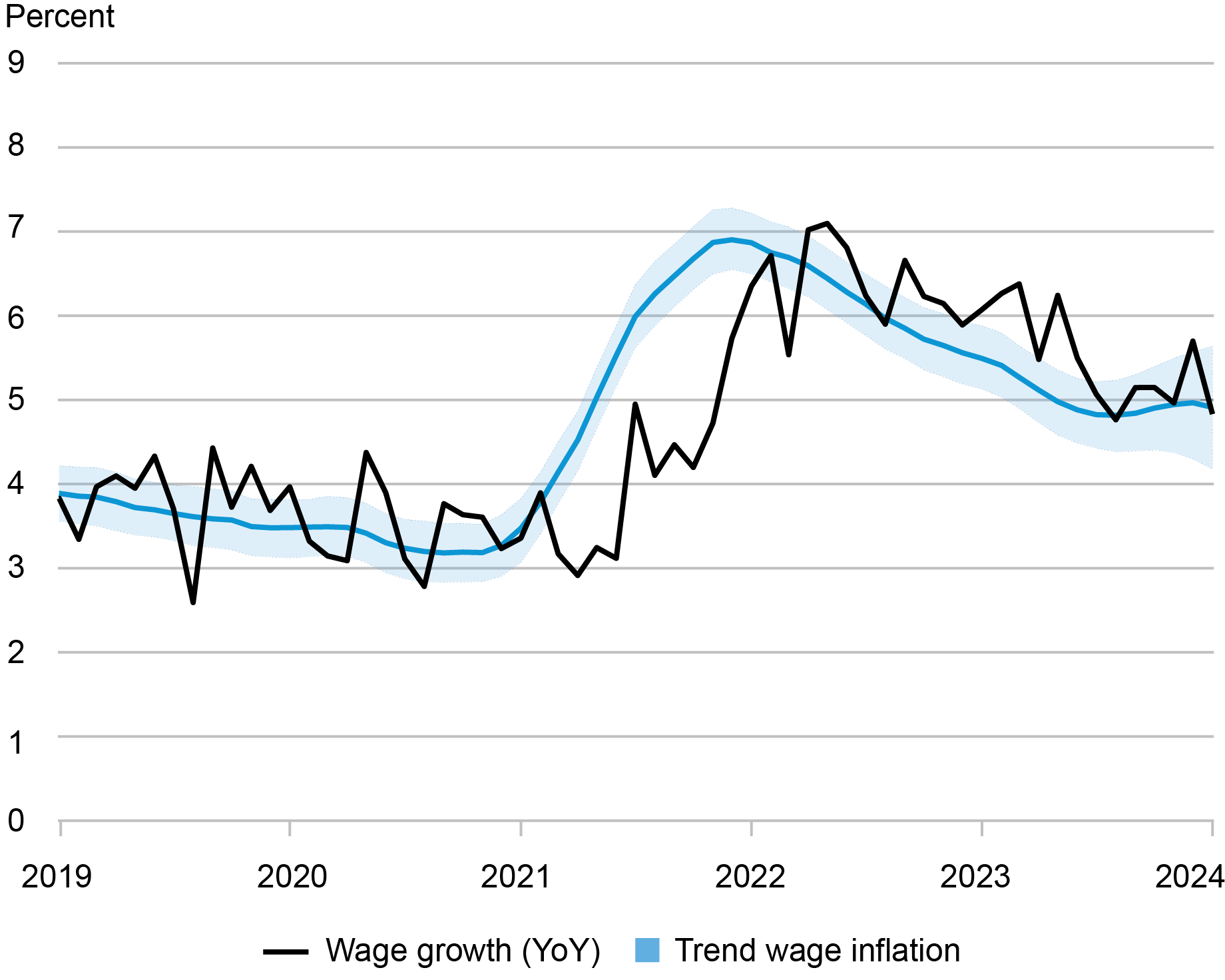

The chart beneath reveals our estimated development (stable blue line) along with the realized twelve-month wage development outlined as described above (black line). The shaded space across the development is a 68 % confidence band that captures the uncertainty related to the estimates. We spotlight two predominant takeaways.

Wage Progress as Measured by TWIn Peaked in Late 2021, Then Moderated

First, after remaining steady between 2019 and 2020, the development elevated markedly in the beginning of 2021, practically doubling over the course of the 12 months. As such, a big chunk of the wage development we noticed over the course of 2021 seems to have been persistent. It’s value stressing as soon as extra that the development extracted by the mannequin is expressed by way of annualized month-to-month wage development, which explains why it leads the precise year-over-year wage development collection within the chart.

Second, the mannequin means that the development might have peaked within the early months of 2022, after which began declining. The moderation in TWIn flattened out mid-2023 and has remained stagnant since. Nevertheless, the shaded areas nonetheless illustrate appreciable uncertainty. The current slowdown estimated by our mannequin signifies it can’t be dominated out that wage development will proceed to be markedly larger within the near-term than it was earlier than the pandemic.

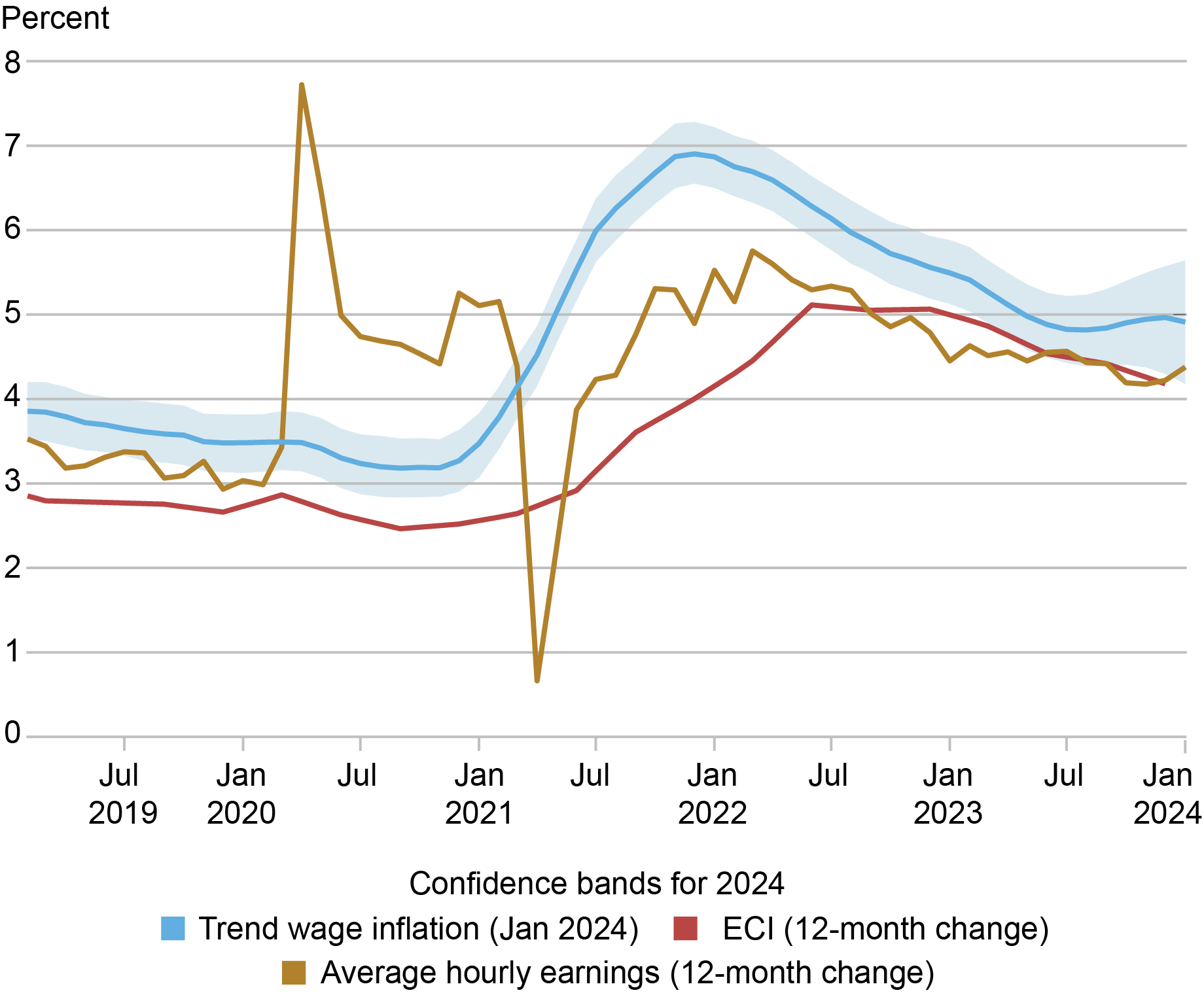

Nevertheless, different indicators of wage development have been sending combined indicators in current months, as we present within the chart beneath. The employment value index (ECI), proven in pink, has been trending downward, although the newest knowledge level for this measure is for the final quarter of 2023. The deceleration in common hourly earnings has stalled lately and the expansion fee even ticked up in January. Lastly, as mentioned, TWIn has been largely flat within the final six months. These combined indicators reinforce the purpose on the uncertainty round our TWIn estimates transferring ahead.

Different Indicators of Wage Progress Are Sending Combined Indicators

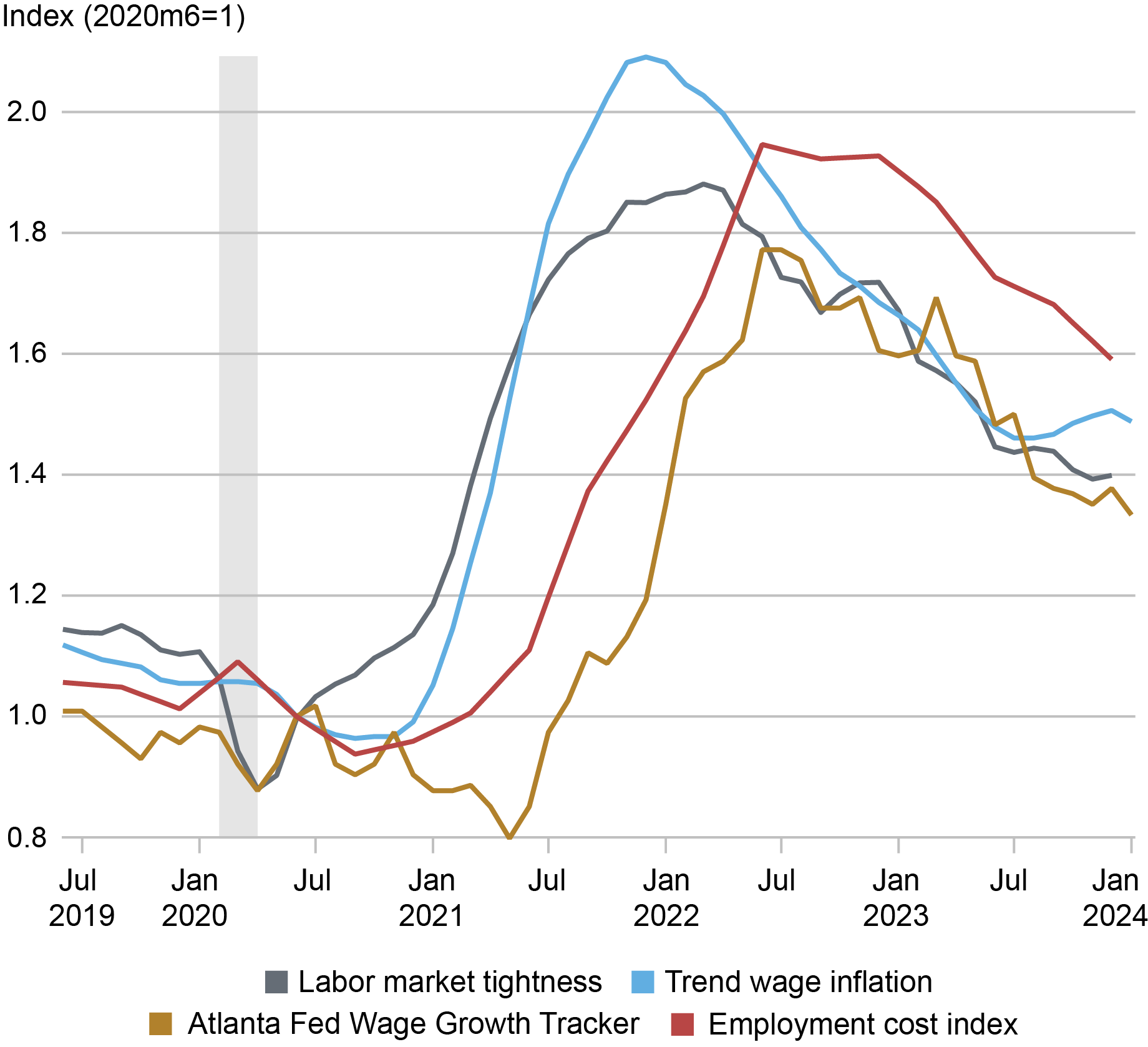

Wage Progress Persistence as a Sign of the Labor Market

Our filtering strategy to time aggregation delivers a measure of wage inflation that’s timelier than options. We present this within the chart beneath, which compares the current evolution of our measure (blue), the employment value index (pink), and the Atlanta Fed Wage Progress Tracker (gold). Our measure of Development Wage Inflation all the time leads different measures of wage development: importantly, it’s higher aligned to labor market tightness. We illustrate this level within the chart the place the gray line denotes labor market tightness, outlined as job openings divided by the labor power.

TWIn and Labor Market Tightness Are inclined to Transfer in Tandem

Our measure of Development Wage Inflation due to this fact represents an extra sign on the present state of the labor market. When labor market circumstances are tight – that’s, when there are quite a lot of vacant jobs relative to job seekers – wage development is excessive, as companies have to put up larger wages to draw and retain staff. TWIn and labor market tightness each peaked towards the top of 2021. Thereafter, each measures have steadily fallen, because the imbalance between job openings and job seekers has steadily diminished.

What are the implications of persistent nominal wage development? Initially, TWIn provides to different indicators pointing to a still-tight labor market. Many labor market indicators, akin to job vacancies or the speed at which unemployed staff discover jobs, are nonetheless at or above their pre-pandemic stage. As well as, persistently elevated nominal wage development might have repercussions for value inflation, though it could even be the results of wages in nominal phrases catching up with beforehand excessive value inflation. Our strategy presents a option to look underneath the hood of short-run, noisy fluctuations in wage development. Whereas appreciable uncertainty stays, our estimates level to persistent wage development that’s nonetheless above its pre-pandemic ranges.

Martín Almuzara is a analysis economist in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Richard Audoly is a analysis economist in Labor and Product Market Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Augustin Belin is a analysis analyst in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Davide Melcangi is a analysis economist in Labor and Product Market Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

The right way to cite this put up:

Martin Almuzara, Richard Audoly, Augustin Belin, and Davide Melcangi, “Will the Moderation in Wage Progress Proceed? ,” Federal Reserve Financial institution of New York Liberty Avenue Economics, March 7, 2024, https://libertystreeteconomics.newyorkfed.org/2024/03/will-the-moderation-in-wage-growth-continue/.

Disclaimer

The views expressed on this put up are these of the creator(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the creator(s).