Chase IHG Premier

It’s about that point. Virtually a 12 months in the past, I got here to the conclusion that IHG One Rewards isn’t in our long run plans. At that time, we determined to place ourselves to complete up with this system over the subsequent 12 months or so. However the future of our two Chase IHG Premier playing cards remained unsure. Within the meantime, I held out hope one thing would change with this system or card to persuade us to carry onto them. However now, it’s determination time – my card’s $89 annual charge just lately hit, with my spouse’s shut behind. Right here’s why we’ve determined to shut our Premier playing cards.

Overvalued Free Night time Certificates

Maybe the simplest justification for paying the Premier’s annual charge is the anniversary free night time certificates my spouse and I every obtain. This model of the cert permits uncapped level topoffs, a considerable improve from the legacy IHG card’s incapability so as to add factors for a keep at a nicer property.

That’s most likely an incredible profit for some, however because it seems, not for us. For the previous few years, we’ve ended up utilizing our free night time certs on the identical Outer Banks property throughout off-season. Nightly money charges are just like the cardboard’s annual charge, anyway. On high of this, the dates for our certs solely overlap for a couple of months, making them harder to line up for a two-night keep. We’d be higher off paying the money fee, given the pliability of reserving any time we wished, or perhaps even under no circumstances!

However it’s possible you’ll be questioning why we’re not pondering greater with the Premier’s supposedly enticing certs.

IHG’s a One-Trick Pony

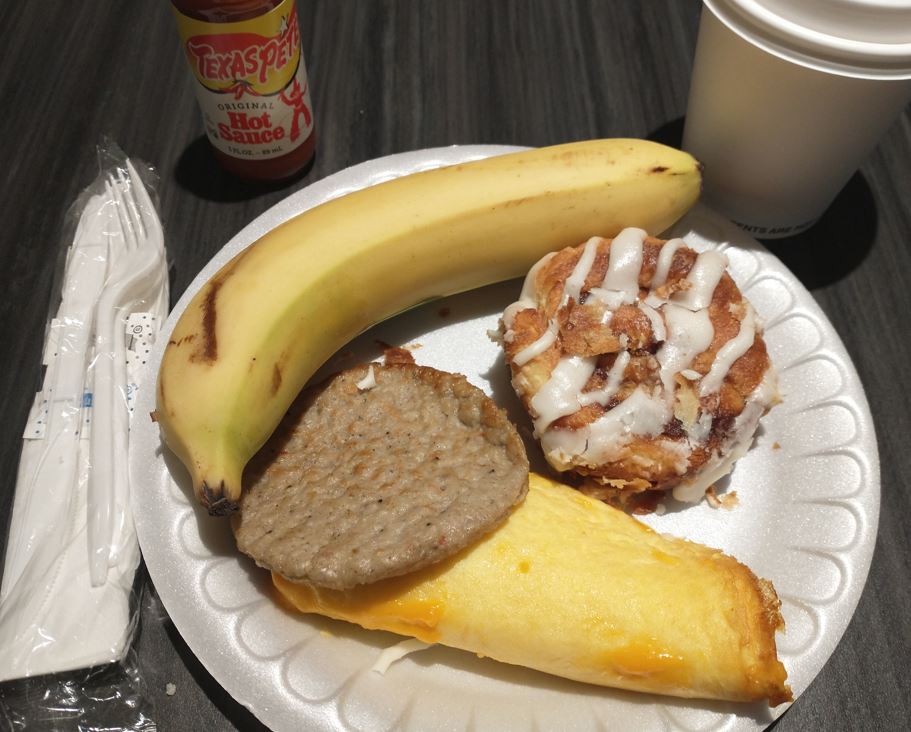

For our present life season, we discover ourselves largely staying in Vacation Inn Specific properties on IHG Rewards stays. I’ve established a (most likely) unhealthy relationship with their cinnamon rolls. I can solely keep in mind our household staying at a distinct IHG model as soon as prior to now a number of years – a Vacation Inn, which just about felt like an Specific property, anyway.

Once more, many others most likely keep throughout a number of IHG manufacturers, and investing in this system is extra comprehensible. That’s simply not the case for us.

We Don’t Journey Sufficient

Between my solo quick solo journeys and a number of other household holidays yearly, our award lodging wants are met with different packages’ currencies. I can’t recall the final time we really redeemed a large quantity of IHG factors. Burning Hilton, Marriott, and Alternative currencies retains us busy sufficient. In the meantime, our IHG level balances develop mildew.

Elite Standing Means Virtually Nothing

For the way we use this system, the Platinum elite standing which comes with the Chase IHG Premier card is just about meaningless. First off, since we primarily keep at a restricted service model like Vacation Inn Specific, there’s minimal elite providing. And the little these properties can do, like offering a room improve, infrequently occurs for us. Since we solely guide award stays, the accelerated incomes on paid nights may as nicely not exist for us, both.

Illogical Chase IHG Premier Spend

On paper or display, the IHG Premier’s earn charges appears enticing: 5x gasoline, eating, and journey, and 3x in all places else. However IHG redemption charges are very unpredictable and proceed to be devalued in our expertise. People can do higher spending on different playing cards, even throughout momentary spend gives. I’m presently eligible for 5x and 7x IHG factors on sure classes, and even that doesn’t make sense once I think about my different choices.

My spouse and I every spent slightly within the 5x grocery class to get to a pleasant, spherical quantity for our IHG balances prior to approaching redemptions. However now, we’re performed and able to transfer on.

Conclusion

In my opinion, the IHG program might be probably the most unpredictable lodge program on the market, and never in a great way. It’s not one we wish to lean into, even with a easy Chase IHG Premier annual charge fee. The one method I can see us not cancelling is that if both of us obtain a retention provide, however I don’t foresee that occuring. We’ve tried that for years with no luck. And we don’t take closing these playing cards calmly. We’ve got no intentions on being eligible for brand spanking new Chase accounts ever once more, and we’re okay with that deal. However we will now not squint and justify a bank card annual charge tied to such a wild card program.

How are you feeling about IHG One Rewards and associated bank cards lately?

Decrease Spend – Chase Ink Enterprise Most well-liked® 100K!

Chase Ink Enterprise Most well-liked® earns 3X Final Rewards factors in a broad vary of enterprise classes on the primary $150K in spend per 12 months. Proper now earn 100K Chase Final Rewards factors after $15K $8K spend within the first 3 months with a $95 annual charge.

Be taught extra about this card and its options!

Opinions, critiques, analyses & suggestions are the writer’s alone, and haven’t been reviewed, endorsed or accredited by any of those entities.