Regardless of 5% short-term rates of interest and stickier inflation than some folks would really like and the Fed probably pushing again rate of interest cuts for a couple of months and the brand new True Detective seasons being a large disappointment…the S&P 500 continues to take out new all-time highs.

By my rely there have already been a baker’s dozen in 2024 alone.1

Listed below are the brand new highs by 12 months since 2015:

- 2015: 10

- 2016: 18

- 2017: 62

- 2018: 18

- 2019: 35

- 2020: 32

- 2021: 70

- 2022: 1

- 2023: 0

- 2024: 13

That’s almost 260 new highs over the previous 10 years or so. Not unhealthy in any respect.

In fact, if we lengthen this again somewhat longer there was an prolonged stretch of no new highs following the Nice Monetary Disaster.

The S&P 500 peaked in October of 2007, bottomed in March of 2009 and didn’t attain new highs once more till March of 2013. Which means no new all-time highs for five-and-a-half years.

The inventory market could be feast or famine.

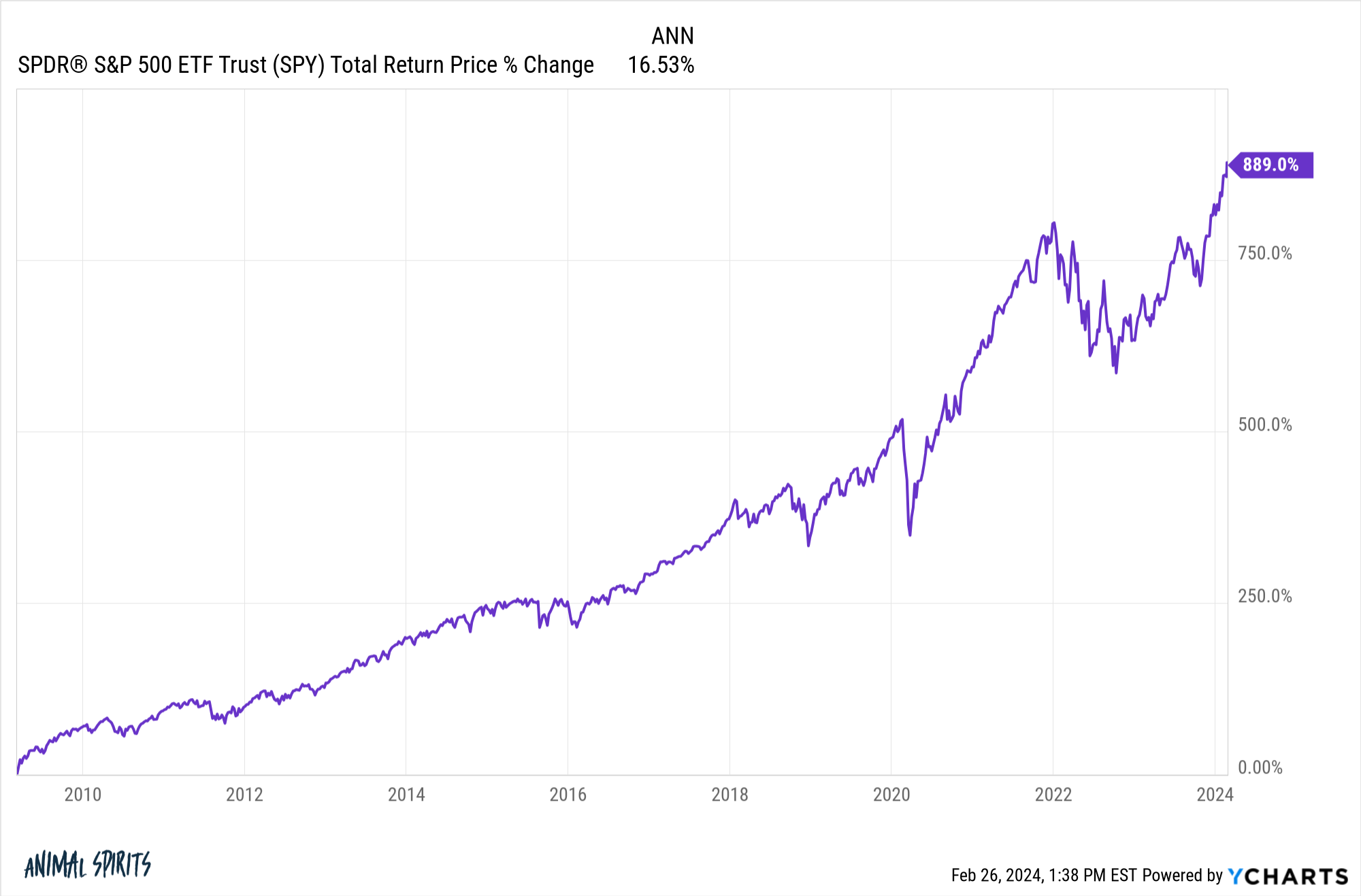

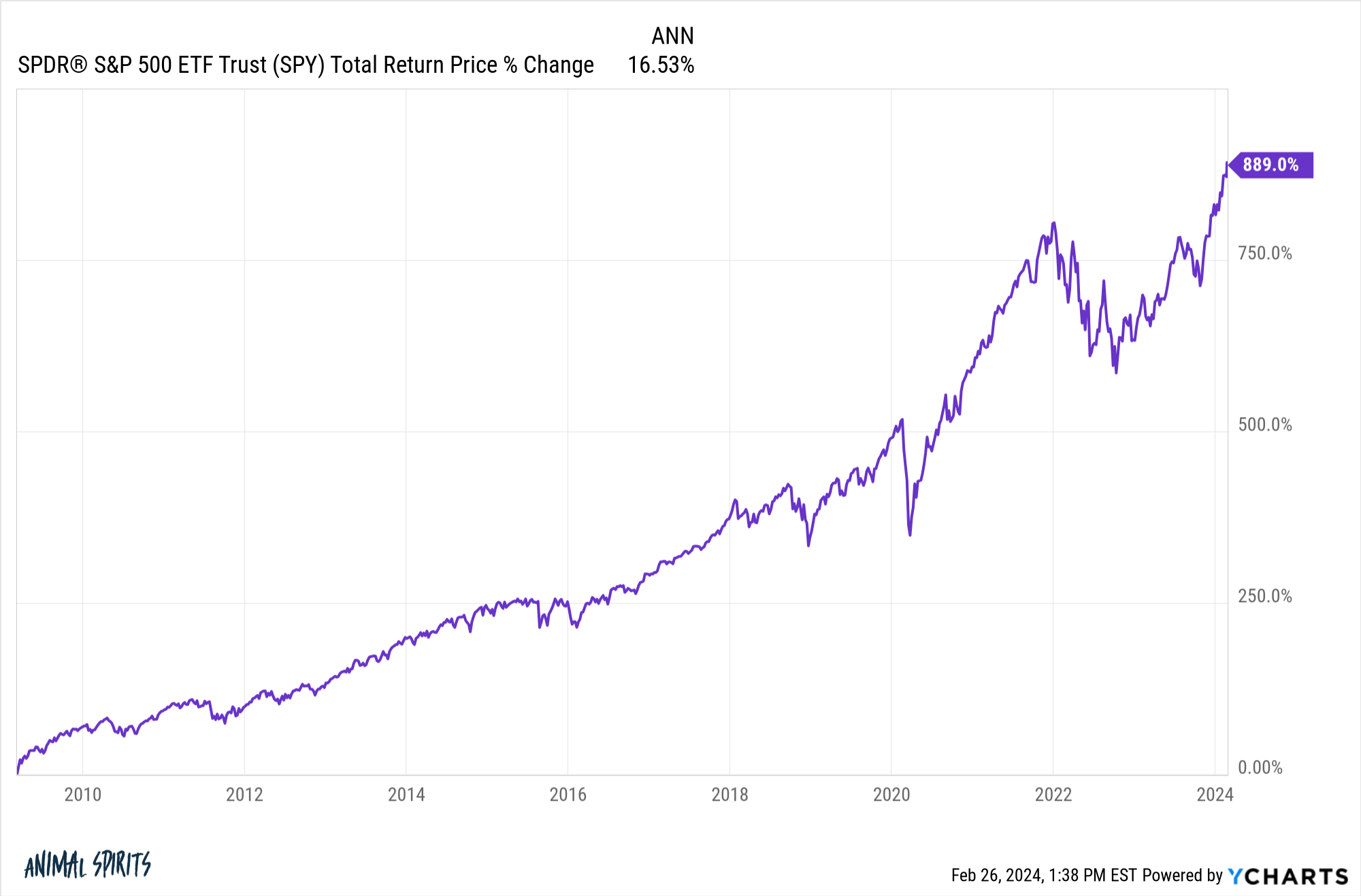

Returns from the underside in March of 2009 are otherworldly at this level:

That’s a complete return (with dividends reinvested) of virtually 900% because the Nice Monetary Disaster lows. That’s near 17% per 12 months for a decade-and-a-half.

And other people have been calling it a bubble the complete approach up.

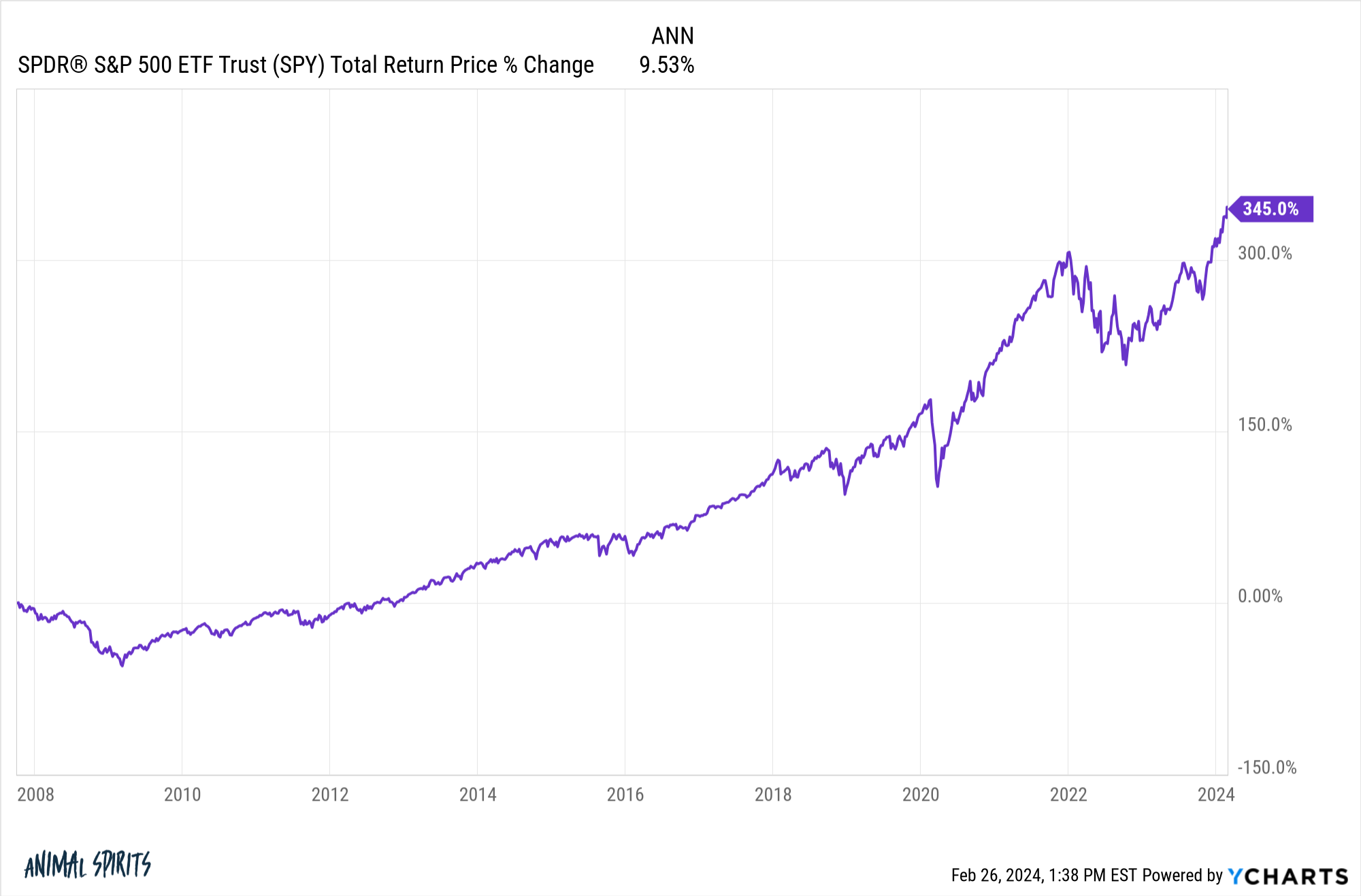

Certain Ben, returns look nice from the depths of a 55% crash however what if you happen to weren’t that fortunate? What if you happen to put your cash to work on the highs earlier than the crash?

Your cash acquired lower in half after which some from 2007-2009. You additionally would have misplaced greater than 19% within the 2018 correction, 34% through the Covid crash and 25% within the 2022 inflation bear market.

If you happen to had the unlucky timing of top-ticking the inventory market proper earlier than it acquired lower in half after which some, your returns would nonetheless look fairly good over the long-haul:

From the market peak simply earlier than the monetary disaster ripped your face off, the S&P 500 is up simply shy of 350% in whole. That’s ok for annual returns of 9.5% per 12 months, which is actually the long-term common over the previous 100 years.

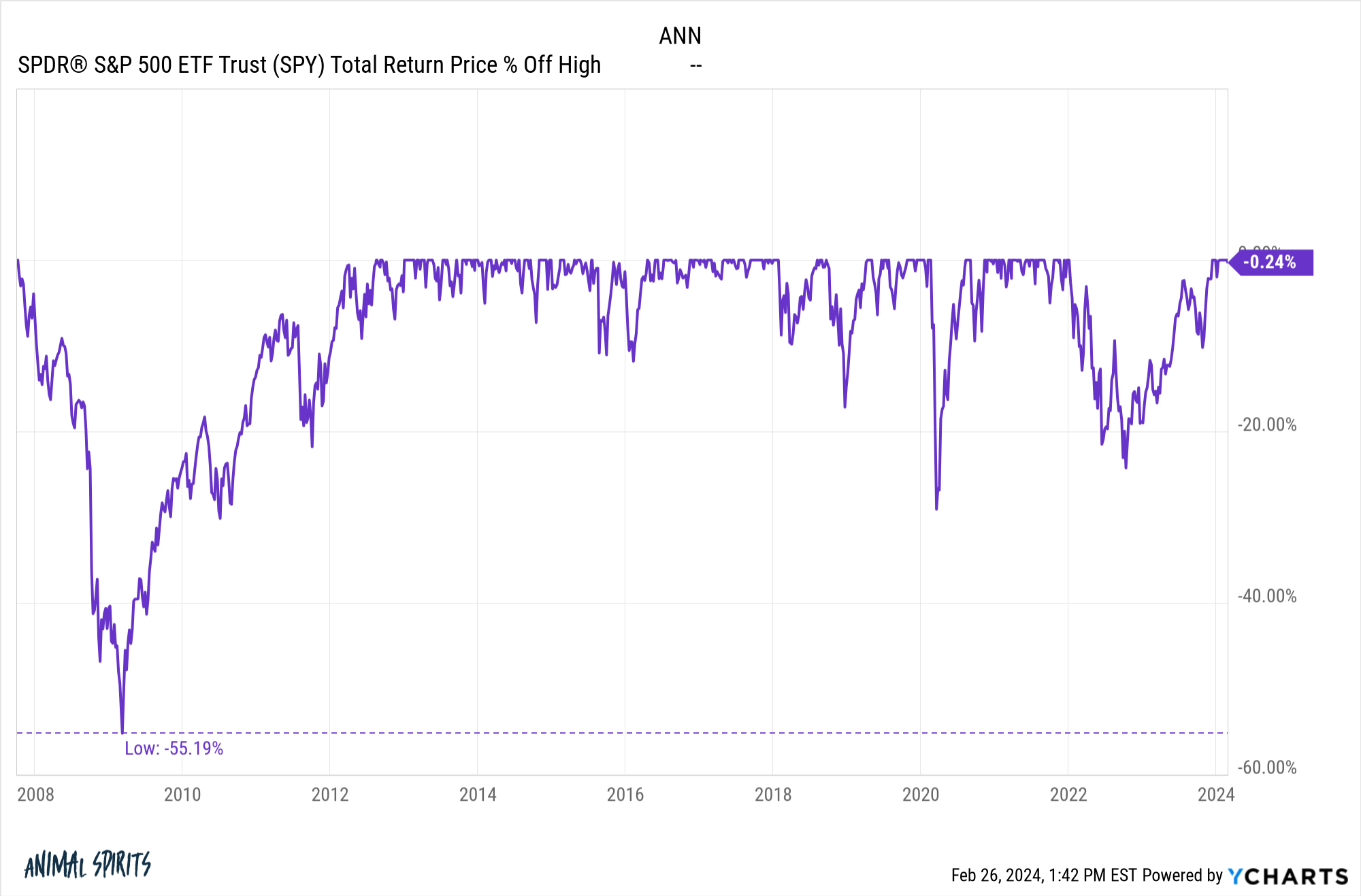

In fact, you’ll have needed to sit via some slightly uncomfortable

That is the drawdown profile buyers have skilled because the peak in October of 2007:

One of the best protection in opposition to vital losses within the inventory market is a protracted sufficient time horizon.

Clearly, nobody is nice sufficient to place all of their cash in on the backside or unfortunate sufficient to place all of their cash in on the high on a constant foundation.

Nevertheless it’s price declaring that the long-run within the inventory market is fairly much like what we’ve seen since 2007.

There are crashes, bear markets, and corrections every so often.

There are durations of time when the inventory market kind of goes nowhere.

And there are rip-roaring bull markets.

Shake it up, put all of it collectively, and that is the expertise you get when investing within the inventory market over longer time frames.

The historic 9-10% annual return within the inventory market isn’t merely made up of the good things. These outcomes embody some fairly gnarly durations of volatility.

And one of many foremost causes we get to expertise bull markets just like the one we live via at the moment is as a result of there may be all the time the prospect of a crash like we skilled in 2008.

You don’t get the nice with out the unhealthy.

You don’t get the positive factors with out the losses.

You don’t get the reward with out the danger.

Additional Studying:

What If You Solely Invested at Market Peaks?

1Typically I search for an excuse to make use of this as a substitute of 13. Form of like how TV critics prefer to say the penultimate episode versus second-to-last.

This content material, which comprises security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here will likely be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.