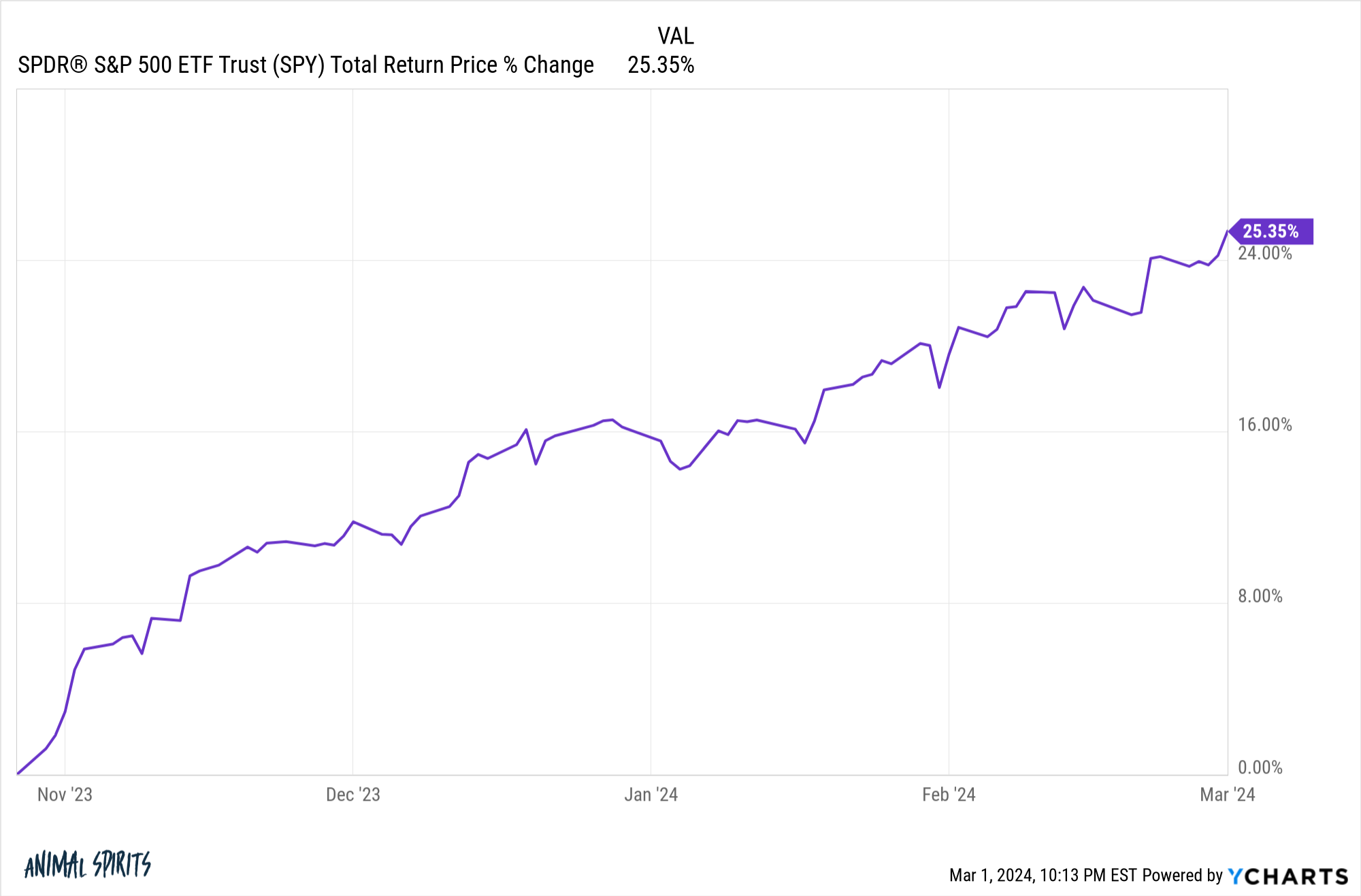

From the underside of the fast 10% correction in late-October of final 12 months, the S&P 500 is up greater than 25%:

Markets usually transfer quick which is why timing them might be so difficult. The market clearly can’t sustain this tempo without end.

New highs within the inventory market are inclined to result in extra new highs however typically the inventory market wants a breather, even in a bull market.

Nobody can predict the timing or magnitude of corrections within the inventory market. It’s far too unpredictable for that.

But it surely does really feel like a correction could be wholesome sooner or later. I do know corrections by no means really feel wholesome within the warmth of the battle however they are often useful to keep away from complacency and provides buyers a greater entry level.

Buyers give attention to the crashes and bear markets for good motive — they’re painful to reside via.

However what if we take out the massive downturns and give attention to the corrections as a substitute? , the wholesome ones.

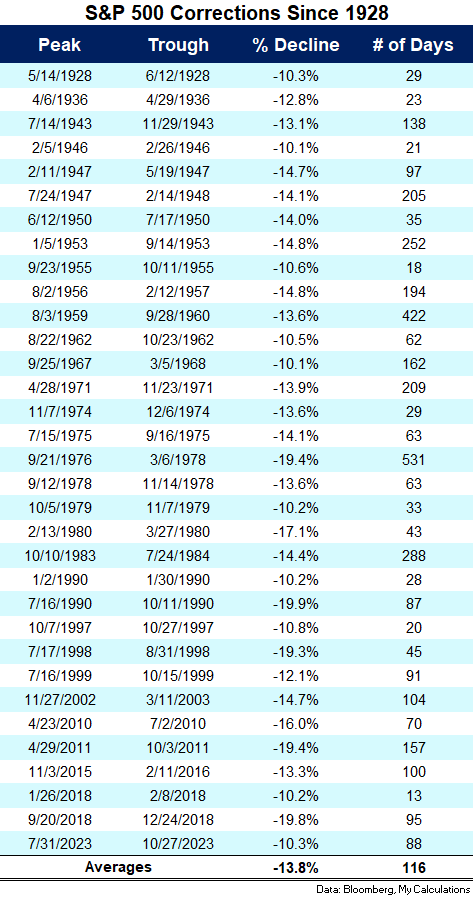

Right here’s a take a look at the double-digit corrections that by no means obtained to the bear market stage (down 20% or worse) since 1928:

By my depend we’re taking a look at 33 corrections over the previous 97 years. The common wholesome correction was a lack of 13.8%, lasting 116 days from peak-to-trough, on common.

I’m positive most of those corrections felt like they had been going to show right into a bear market on the time however a wholesome correction is extra probably than a crash more often than not.

Unhealthy markets happen throughout unhealthy occasions however shorter-term downtrends can even happen throughout longer-term uptrends.

The 2010s was a wonderful run for the S&P 500, but you continue to had 4 double-digit corrections.

The late-Nineteen Nineties is without doubt one of the greatest stretches of beneficial properties in historical past:

- 1995: +37%

- 1996: +23%

- 1997: +33%

- 1998: +28%

- 1999: +21%

Regardless of these insane returns, three separate double-digit corrections had been sprinkled into this five-year interval.

The Fifties is probably the most underappreciated bull market of all-time.1 The U.S. inventory market was up almost 20% yearly on the last decade. There have been 4 corrections throughout these beneficial properties together with a minor bear market close to the top of the last decade.

The S&P 500 is up round 70% in complete (13.5% annualized) within the 2020s up to now even though we’ve skilled two bear markets.

Two steps ahead, one step again.

I’m by no means going to attempt to predict a inventory market downturn as a result of I don’t have the power to try this.

Nevertheless, it is very important put together your self for the truth that corrections are a pure a part of the inventory market, in good occasions and unhealthy.

A wholesome correction within the coming months is perhaps a great factor if it helps stave off an unhealthy correction down the road.

Additional Studying:

How Usually Do Bear Markets Happen?

1Primarily as a result of nobody was actually invested in shares on the time. The Nice Melancholy crash was too scary.

This content material, which comprises security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here will probably be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or provide to supply funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.