How Do Destructive Objects Have an effect on Me?

Destructive objects in your credit score report could possibly be what separates you from that residence mortgage you hoped for or an honest financing for a car. The excellent news is that should you occur to have these damaging objects in your credit score report, there are nonetheless wats to mitigate their results and even have them eliminated! Here’s a quick overview of how lengthy it might take for every damaging merchandise to fall off your report!

How Can I Construct My Credit score?

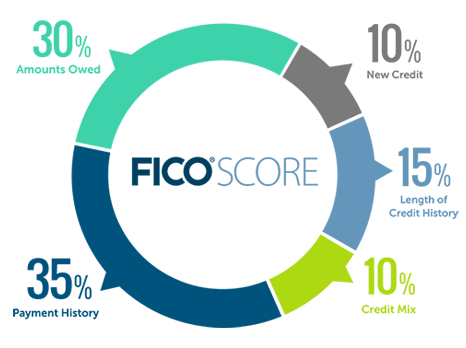

Everybody’s credit score is exclusive to them and constructing your credit score could require extra consideration in a single facet over one other. Your Fico rating is fabricated from primarily of 5 completely different items of credit score knowledge: Cost Historical past, Quantity Owed, Credit score Historical past, New Credit score and Credit score Combine. Every of those catagories holds a selected weight to your last rating and if you’re discovered wanting in a single space, then you could possibly be harming the opposite 4!

Every catagory of credit score will construct off of one another, however with out correct understanding of every catagory, you aren’t reaching your full credit score potential.

Cost Historical past- Cost historical past is self explanitor: Every fee you make towards a borrowed quantity might be relayed to the bureaus and listed in your report. Every on time and late fee will present individually below the objects profile.

Quantity Owed- Every account open in your report holds a selected weight dependant on the quantity owed and the kind of account it’s. It’s essential take note of your credit score utilzation fee in your present playing cards, your present money owed owed and what number of open accounts with balances do you’ve gotten.

Credit score Historical past- Credit score historical past offers with how lengthy you’ve gotten had your accounts open and a mean age of your open acounts.

New Credit score- New credit score takes under consideration how just lately you’ve gotten utilized for credit score up to now 12 months.

Credit score Combine- Your credit score combine is made up of the completely different accounts listed on the report. That is anyplace from bank cards to mortgages!

New To Constructing Credit score? Listed here are 5 Straightforward Steps To Get You Began!

Assortment Accounts, Late Funds and Extra: Seven Years

Assortment accounts, charge- offs, paid pupil mortgage default, late funds can all keep in your credit score report for 7 years.

Some damaging objects that dangle in your credit score report for seven years can influence your rating greater than others. Older damaging objects which might be adopted by distinctive credit score historical past maintain quite a bit much less weight on an total rating. Many lenders will assess your rating to see you’re a secure threat and can view your credit score historical past to see if you’re a accountable borrower.

Credit score restore might help decrease or take away the influence of a few of these objects and might even assist decide the legitimacy of the objects in your report! The creditor ought to be capable to decide the present steadiness of the account, the preliminary settlement between you and your collectors, the suitable to peruse the debt and fee historical past. If the creditor is unable to provide this info, the percentages of you getting the objects eliminated early are elevated exponentially!

Onerous Inquiries: Two Years

Onerous inquiries normally keep on a credit score report for about 2 years. Most individuals have inquired on their reviews as a result of they’re extraordinarily laborious to keep away from as they happen when lenders run your credit score rating. The easiest way to reduce how typically laborious inquiries land in your report is by researching prior to creating an inquiry and submitting loans purposes with a single firm at a time. The excellent news is that if you’re evaluating charges between lenders in a short while body, a number of inquiries will solely be counted as a single inquiry!

Chapter 7 Bankruptcies: 10 Years

A chapter 7 chapter sits in your credit score report for about 10 years. The easiest way to try to have a chapter 7 chapter eliminated out of your credit score report earlier than the ten-year mark is to bear credit score restore. The credit score restore course of is to guarantee that the data is precisely recorded and all accounts that observe the chapter are taken care of accordingly.

Within the Finish

Collectors don’t all the time ship correct info to the bureaus and accounts can maintain a lot of discrepancies that could possibly be harming your rating!

Inquire without cost credit score overview & session.

Contact: 1-800-994-3070