In the end, the numbers had been going to contract. Broadly talking, the pandemic has been a gamechanger for automation broadly and robotics particularly. However not even these classes are immune from macro tendencies. Per new numbers from the Affiliation for Advancing Automation (A3) — whose job it’s to trace such issues — North American robotic orders declined a considerable 37% year-over-year for Q2 (April to July).

The determine, which features a 20% drop in worth, is the second consecutive decline. The 2 quarters mixed characterize a 29% drop from H1 of 2022. This most up-to-date half noticed a complete of 16,856 robots. There are quite a lot of components at play right here, in fact.

Earlier than you go fully doom and gloom, take into account that 2022 was a document 12 months, with 44,196 orders. It was an 11% soar over the earlier document — 2021. The fuller story right here is notable regression from document progress, dovetailing with the form of macroeconomic headwinds which have adversely impacted practically each business.

“During the last 5 years, we’ve seen a gentle acceleration of robotic orders as all industries have struggled with a labor scarcity and extra non-automotive firms acknowledge the great worth automation supplies,” says A3’s Alex Shikany. ”After this post-COVID surge, nevertheless, we’re seeing a disadvantage in purchases, exacerbated by the sluggish financial system and excessive rates of interest. Whereas many firms proceed to automate, others simply don’t have the capital to speculate proper now, regardless of their wrestle to seek out staff prepared to do lots of the boring, soiled and harmful jobs that stay unfilled.”

Need the highest robotics information in your inbox every week? Signal up for Actuator right here.

At the same time as an everlasting pessimist, I don’t see a lot trigger for panic in these figures. Simply as robotic investing was ultimately impacted by a slowdown in enterprise capital, it’s an essential reminder that there are few — if any — really recession-proof industries (relying on the way you outline the time period, I suppose). I’m no economist, however I really feel strongly that — taking the lengthy view — we’re coping with a bump within the highway. You’d be laborious pressed to seek out somebody who genuinely doesn’t see automation as an inevitability (with all the great and unhealthy it brings).

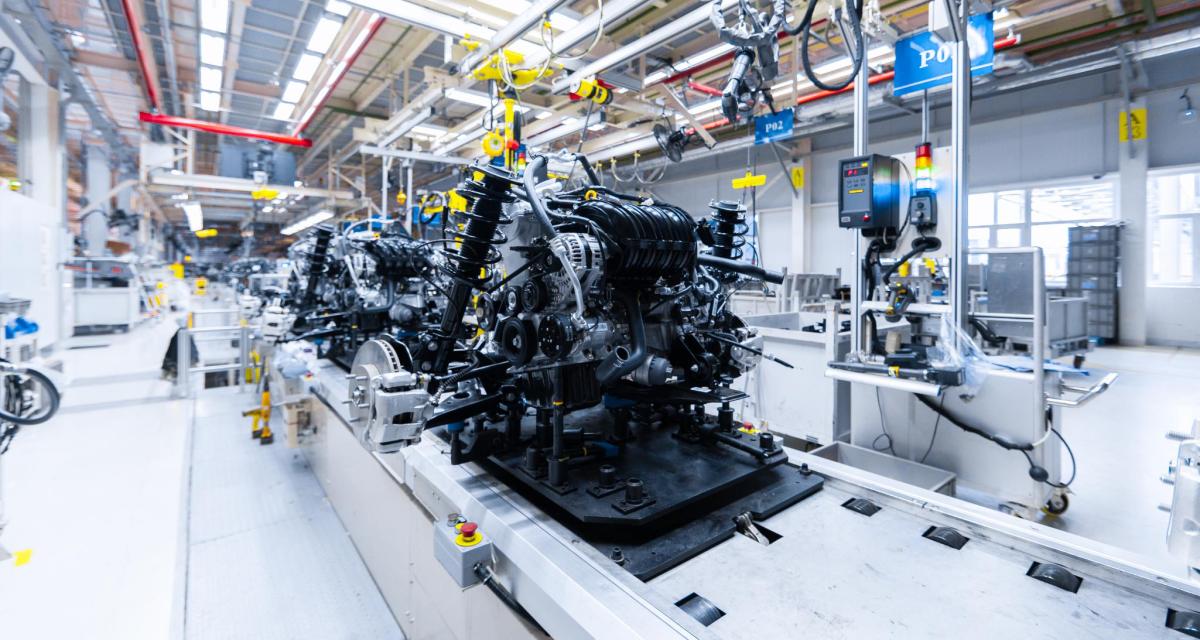

An attention-grabbing wrinkle (and possible silver lining) is the truth that non-automotive robotics comprised a majority of orders, at 52%. Whereas each side of the coin noticed a decline, the determine was way more dramatic with a jaw dropping 49% to non-automotive’s 21%. I say silver lining right here as a result of automotive is an area that’s been established for many years. Non-automotive has a far better progress potential.

Says A3, “The strongest demand in Q2 got here from the semiconductor & electronics industries, adopted by life sciences/pharma and biomedical, plastics & rubber and metals, with automotive parts, meals & shopper items and automotive OEMs displaying the largest drops.”

Automotive has, in fact, seen its personal struggles prior to now 12 months, between chip shortages, manufacturing shutdowns and slowed spending.