Anna is a 35-year-old particular eduction trainer of center faculty college students with extreme and profound disabilities. She lives in rural Illinois and is presently engaged on finishing her grasp’s diploma in training. Sooner or later, she’d like to maneuver into a special instructing place that’s hopefully extra profitable since she doesn’t make sufficient at her present job. To make ends meet every month, she works a part-time retail job and receives monetary help from her mother and father. Anna envisions a debt-free future and would really like our assist charting a path to get there.

Anna is a 35-year-old particular eduction trainer of center faculty college students with extreme and profound disabilities. She lives in rural Illinois and is presently engaged on finishing her grasp’s diploma in training. Sooner or later, she’d like to maneuver into a special instructing place that’s hopefully extra profitable since she doesn’t make sufficient at her present job. To make ends meet every month, she works a part-time retail job and receives monetary help from her mother and father. Anna envisions a debt-free future and would really like our assist charting a path to get there.

What’s a Reader Case Examine?

Case Research deal with monetary and life dilemmas that readers of Frugalwoods ship in requesting recommendation. Then, we (that’d be me and YOU, pricey reader) learn by way of their scenario and supply recommendation, encouragement, perception and suggestions within the feedback part.

For an instance, try the final case examine. Case Research are up to date by individuals (on the finish of the submit) a number of months after the Case is featured. Go to this web page for hyperlinks to all up to date Case Research.

Can I Be A Reader Case Examine?

There are 4 choices for people inquisitive about receiving a holistic Frugalwoods monetary session:

- Apply to be an on-the-blog Case Examine topic right here.

- Rent me for a personal monetary session right here.

- Schedule an hourlong name with me right here.

→Unsure which choice is best for you? Schedule a free 15-minute chat with me to be taught extra. Refer a good friend to me right here.

Please observe that area is proscribed for all the above and most particularly for on-the-blog Case Research. I do my finest to accommodate everybody who applies, however there are a restricted variety of slots accessible every month.

The Aim Of Reader Case Research

Reader Case Research spotlight a various vary of economic conditions, ages, ethnicities, areas, targets, careers, incomes, household compositions and extra!

Reader Case Research spotlight a various vary of economic conditions, ages, ethnicities, areas, targets, careers, incomes, household compositions and extra!

The Case Examine collection started in 2016 and, to this point, there’ve been 100 Case Research. I’ve featured of us with annual incomes starting from $17k to $200k+ and internet worths starting from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured homosexual, straight, queer, bisexual and polyamorous folks. I’ve featured girls, non-binary of us and males. I’ve featured transgender and cisgender folks. I’ve had cat folks and canine folks. I’ve featured of us from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured folks with PhDs and folks with highschool diplomas. I’ve featured folks of their early 20’s and folks of their late 60’s. I’ve featured of us who stay on farms and folk who stay in New York Metropolis.

Reader Case Examine Pointers

I in all probability don’t have to say the next since you all are the kindest, most well mannered commenters on the web, however please observe that Frugalwoods is a judgement-free zone the place we endeavor to assist each other, not condemn.

There’s no room for rudeness right here. The aim is to create a supportive surroundings the place all of us acknowledge we’re human, we’re flawed, however we select to be right here collectively, workshopping our cash and our lives with optimistic, proactive options and concepts.

And a disclaimer that I’m not a skilled monetary skilled and I encourage folks to not make severe monetary selections based mostly solely on what one individual on the web advises.

I encourage everybody to do their very own analysis to find out one of the best plan of action for his or her funds. I’m not a monetary advisor and I’m not your monetary advisor.

With that I’ll let Anna, in the present day’s Case Examine topic, take it from right here!

Anna’s Story

Hello Frugalwoods neighborhood! My title is Anna, I’m 35 and I stay in rural Illinois. I’m a particular training trainer for center faculty college students with extreme/profound disabilities. I’m fortunately single (for now) and I’ve a robust relationship with my rapid household. My hobbies–or quite, vocations–embrace theatre, singing, dancing, working, hanging out with household and associates and crafts. I additionally work a part-time job in retail to assist make ends meet.

Hello Frugalwoods neighborhood! My title is Anna, I’m 35 and I stay in rural Illinois. I’m a particular training trainer for center faculty college students with extreme/profound disabilities. I’m fortunately single (for now) and I’ve a robust relationship with my rapid household. My hobbies–or quite, vocations–embrace theatre, singing, dancing, working, hanging out with household and associates and crafts. I additionally work a part-time job in retail to assist make ends meet.

What feels most urgent proper now? What brings you to submit a Case Examine?

I’m finishing my grasp’s diploma in training, which is tied into my instructing licensure program. I presently have debt that I want to have repaid in about ten years. Ideally, I’d wish to repay my bank card debt even sooner. I want to have an emergency fund, however by no means appear to have the ability to discover the cash to place into it. Proper now, I really feel underpaid for the work that I do. I really feel that with no kids or pets of my very own, and with me on the lookout for a higher-paying instructing job for subsequent 12 months, now’s the time to take cost of my funds. I’ve felt overwhelmed by one of the best ways to strategy them. I’d wish to discover a less expensive approach to handle all the pieces.

What’s one of the best a part of your present way of life/routine?

I really like the flexibleness of being single! I really like that I’m able to go on brief day journeys on the weekends and never have to fret about baby-sitting or pet-sitting. I like not having to fret about home repairs (that’s the fantastic thing about renting–my landlord takes care of all that!). As a trainer, I get pleasure from my summers off as they allow me to pursue different issues. Sooner or later, I want to journey for prolonged intervals of time, most definitely throughout the summer season months.

What’s the worst a part of your present way of life/routine?

My present office. Over the previous 12 months, issues have grow to be poisonous with modifications within the faculty administration and an elevated workload with out compensation. That is taking a toll on my psychological well being. I’m so exhausted on the finish of the day (between working full-time and going to highschool part-time) that I would not have vitality for a lot else, together with a social life. I’m hoping {that a} completely different work surroundings and a special scholar inhabitants (comparable to in useful resource particular training) will likely be a greater match for me. Once I’m completed with graduate faculty in August, I’m hoping I’ll have extra of a social life plus extra money to repay my debt.

The place Anna Needs to be in Ten Years:

- Funds: debt free.

- Way of life: comparable flexibility to that of being single; nevertheless, a particular somebody could be good.

- Profession: well-established within the training discipline.

Anna’s Funds

Earnings

| Merchandise | Web Quantity Per Month | Notes |

| Particular Schooling Educating | $2,200 | Deductions:

American Constancy Life Insurance coverage $30, Trainer’s Retirement System $158, Medicare $25, Union Dues $35, Equitable Annuities Retirement $50, Whole: $298 |

| Parental assist | $700 | My mother and father have been very, very beneficiant in serving to me out. |

| Half-time job (in retail) | $500 | This varies by month |

| Month-to-month subtotal: | $3,400 | |

| Annual complete: | $40,800 |

Money owed

| Item | Excellent mortgage stability | Curiosity Fee | Mortgage Interval/Payoff Phrases | Month-to-month required cost |

| Scholar Loans | $79,000 | 4% curiosity | 10 12 months trainer mortgage forgiveness | Unsure-I’m on the earnings pushed compensation plan; mortgage funds are on maintain till August. |

| Capitol One | $9,500 | 19.49% | $291; I pay $425 | |

| Chase Visa | $3,500 | 19.49% | $88; I pay $150 | |

| PayPal credit score | $3,225 | 26% | $60; I pay $150 | |

| Loft retailer card | $2,200 | 29.24% | $72; I pay $150 | |

| Goal Card | $1,850 | 27.15% | $60; I pay $150 | |

| Retailer Card #2 | $1,835 | 30% | $50; I pay $150 | |

| Retailer Card #1 | $1,120 | 30% | $50; I pay $150 | |

| Whole: | $102,230 | $671; I pay $1,325 |

Belongings

| Merchandise | Quantity | Notes | Curiosity/sort of securities held | Title of financial institution/brokerage | Expense Ratio | Account Kind |

| IRA | $6,032 | IRA account | Wells Fargo | Not Positive | Retirement Investments | |

| Office Retirement Account | $2,150 | Employer-sponsored retirement account | American Constancy | Not Positive | Retirement | |

| Checking Account-Native Financial institution #1 | $300 | Native Financial institution | Not Positive | Money | ||

| Financial savings Account-Native Financial institution #1 | $105 | Native Financial institution | Not Positive | Money | ||

| Checking Account-Native Financial institution #2 | $100 | Native Financial institution | Not Positive | Money | ||

| Financial savings Account-Native Financial institution #2 | $50 | Native Financial institution | Not Positive | Money | ||

| Whole: | $8,737 |

Autos

| Automobile make, mannequin, 12 months | Valued at | Mileage | Paid off? |

| Nissan Altima 2013 | $9,000 | 130,000 | Sure |

Bills

| Merchandise | Quantity | Notes |

| Credit score Card Funds | $1,325 | |

| Groceries/Family Provides/Classroom Provides/Prescriptions | $700 | Varies; looks like my classroom is a endless expenditure |

| Lease | $525 | |

| Clothes/sneakers/equipment | $200 | Some months are greater than others. That is my common. |

| Electrical energy/gasoline | $150 | Differs every month; that is the common |

| Gasoline for automobile | $150 | |

| Singing classes | $100 | |

| Web | $63 | Month-to-month Quantity |

| Dance lessons | $60 | |

| Eating places | $50 | Consists of espresso outlets |

| Subscriptions (Hulu, Disney +, Discovery +, HBO Max) | $50 | |

| Haircuts/shade | $40 | Common every month; I just lately realized find out how to minimize and shade my hair. I’m going to the salon each different month. |

| Medical co-pays and prescription remedy | $40 | Yearly Common |

| Fitness center membership | $31 | |

| Renter’s Insurance coverage-State Farm | $9 | Rental Insurance coverage |

| Cell Cellphone-Verizon | $0 | I’m beneath my mother and father’ plan; they pay it for now. |

| Automobile Insurance coverage-State Farm | $0 | I’m beneath my mother and father’ plan; they pay it for now. |

| Month-to-month subtotal: | $3,493 | |

| Annual complete: | $41,916 |

Anna’s Questions for you:

- What are probably the most cost-effective methods for me to handle my funds?

- What non-teaching areas in training can former lecturers enter into?

Liz Frugalwoods’ Suggestions

I commend Anna for taking the onerous, however necessary, step of dealing with her monetary actuality. She provided such a clear-eyed view in her remark, “I really feel that with no kids or pets of my very own, and with me on the lookout for a higher-paying instructing job for subsequent 12 months, now’s the time to take cost of my funds.” I agree. And I might add that anytime is the fitting time to take cost of your funds. Approach to go, Anna!

I commend Anna for taking the onerous, however necessary, step of dealing with her monetary actuality. She provided such a clear-eyed view in her remark, “I really feel that with no kids or pets of my very own, and with me on the lookout for a higher-paying instructing job for subsequent 12 months, now’s the time to take cost of my funds.” I agree. And I might add that anytime is the fitting time to take cost of your funds. Approach to go, Anna!

Earnings Vs. Bills

As I’m fond of claiming, there are solely two main variables in our monetary lives: what is available in and what goes out. These are the 2 variables we will most simply modify and in Anna’s case, I recommend she concentrate on each variables.

Earnings

Anna famous she’ll be finishing her grasp’s diploma after which will search for a better-paying job. That feels like a superb plan. She’s appropriate that she’s simply not being paid sufficient–and particularly not sufficient for the necessary, difficult work she does. I’ve stated it earlier than and I’ll say it once more: WE SHOULD PAY TEACHERS MORE. Lecturers do one of many hardest jobs beneath among the hardest circumstances and they aren’t paid sufficient. Full cease. Since Anna’s already in course of on discovering the next earnings, let’s flip our consideration to variable #2.

Bills

Anna’s price range is fairly meagre because it stands, however her earnings is equally meagre, which implies–if she needs to make progress on her acknowledged targets of build up an emergency fund and paying down her money owed–she has to cut back her spending. We will’t magic cash from anyplace else, it’s obtained to return from spending much less every month.

Anna’s price range is fairly meagre because it stands, however her earnings is equally meagre, which implies–if she needs to make progress on her acknowledged targets of build up an emergency fund and paying down her money owed–she has to cut back her spending. We will’t magic cash from anyplace else, it’s obtained to return from spending much less every month.

Fortunate for Anna, she has very low fastened bills!

Anytime an individual needs to spend much less, I encourage them to outline all of their bills as Mounted, Reduceable or Discretionary:

- Mounted bills are belongings you can’t change. Examples: your mortgage and debt funds.

- Reduceable bills are crucial for human survival, however you management how a lot you spend on them. Examples: groceries, gasoline for the automobile, utilities.

- Discretionary bills are issues that may be eradicated fully. Examples: journey, haircuts, consuming out.

Let’s check out how Anna’s bills break down between these three classes in addition to my proposed new spending quantities:

| Merchandise | Quantity | Notes | Class | Proposed New Quantity | Liz’s Notes |

| Credit score Card Funds | $1,325 | Mounted | $1,325 | We’ll focus on this in a second. | |

| Groceries/Family Provides/Classroom Provides/Prescriptions | $700 | Varies; looks like my classroom is a endless expenditure | Reduceable | $450 | I recommend Anna get away these classes so she will get a greater sense of what she’s really spending in every. It is a fairly large catch-all at this level. |

| Lease | $525 | Mounted | $525 | That is so good and low!! Wohoo! | |

| Clothes/sneakers/equipment | $200 | Some months are greater than others. That is my common. | Discretionary | $0 | This must be eradicated whereas Anna’s working in direction of her targets of being debt-free and having an emergency fund. |

| Electrical energy/gasoline | $150 | Differs every month; that is the common | Reduceable | $65 | This discount received’t be simple, however I encourage Anna to research vitality saving round her dwelling. One technique is to make use of a killowatt monitor to see which home equipment are utilizing probably the most electrical energy. Many public libraries have them accessible to borrow. |

| Gasoline for automobile | $150 | Reduceable | $65 | ||

| Singing classes | $100 | Discretionary | $0 | This must be eradicated whereas Anna’s working in direction of her targets of being debt-free and having an emergency fund. | |

| Web | $63 | Month-to-month Quantity | Mounted | $63 | |

| Dance lessons | $60 | Discretionary | $0 | This must be eradicated whereas Anna’s working in direction of her targets of being debt-free and having an emergency fund. | |

| Eating places | $50 | Consists of espresso outlets | Discretionary | $0 | This must be eradicated whereas Anna’s working in direction of her targets of being debt-free and having an emergency fund. |

| Subscriptions (Hulu, Disney +, Discovery +, HBO Max) | $50 | Discretionary | $0 | This must be eradicated whereas Anna’s working in direction of her targets of being debt-free and having an emergency fund. | |

| Haircuts/shade | $40 | Common every month; I just lately realized find out how to minimize and shade my hair. I’m going to the salon each different month. | Discretionary | $0 | This must be eradicated whereas Anna’s working in direction of her targets of being debt-free and having an emergency fund. |

| Co-Pays and prescription drugs | $40 | Yearly Common | Mounted | $40 | |

| Fitness center membership | $31 | Discretionary | $0 | This must be eradicated whereas Anna’s working in direction of her targets of being debt-free and having an emergency fund. | |

| Renter’s Insurance coverage-State Farm | $9 | Rental Insurance coverage | Mounted | $9 | |

| Cell Cellphone-Verizon | $0 | I’m beneath my mother and father’ plan; they pay it for now. | Mounted | $0 | If Anna goes off her mother and father’ plan sooner or later, she ought to get onto an MVNO, which’ll value her ~$15 a month. |

| Automobile Insurance coverage-State Farm | $0 | I’m beneath my mother and father’ plan; they pay it for now. | Mounted | $0 | |

| Present Month-to-month subtotal: | $3,493 | Proposed Month-to-month subtotal: | $2,542 | ||

| Present Annual complete: | $41,916 | Proposed Annual complete: | $30,504 |

What I’ve proposed here’s a very austere, naked bones price range and I’m not saying it’s going to be enjoyable. Nevertheless, at Anna’s present earnings degree, and with the quantity of debt she has, that is her solely choice. One outlet Anna would possibly take into account is the age-old tactic of barter and commerce. For instance: might she supply to employees the desk on the dance studio in change at no cost lessons? Might she clear her voice trainer’s home in change at no cost classes? Might she tutor her hair stylist’s child in change at no cost haircuts? The chances are infinite! Try this submit for an entire host of concepts: How Barter and Commerce Enhances Frugality and Group

This Can Be Non permanent

Whereas spending this little is Anna’s solely choice, I would like her to keep in mind that it’s her solely choice for proper now. The above doesn’t have to be her perpetually price range. It simply must be her proper now price range.

Whereas spending this little is Anna’s solely choice, I would like her to keep in mind that it’s her solely choice for proper now. The above doesn’t have to be her perpetually price range. It simply must be her proper now price range.

Anna can take into account including luxuries again in as soon as she:

- Pays off all of her high-interest bank card debt

- Saves up an emergency fund

- Can simply afford her month-to-month scholar mortgage repayments

- Will increase her retirement contributions

- Finds a higher-paying job

- Is ready to cease receiving monetary assist from her mother and father within the type of money, automobile insurance coverage and cell hone protection (until this can be a longterm association along with her mother and father)

Debt Payoff Plan

Let’s flip our consideration to what Anna ought to do with the additional cash she’s going to avoid wasting each month. The worst factor about money owed are their rates of interest. Each month that you simply don’t repay high-interest debt, you slip additional and additional into debt. Anna must cease this downward spiral as quickly as doable as a result of it has the ability to balloon into one thing worse. The rates of interest on her bank cards are eye-wateringly excessive and I strongly encourage her to focus all of her monetary vitality on paying them off.

Since rates of interest are the true killer with debt, I’ve sorted Anna’s money owed in line with their rate of interest:

| Item | Excellent mortgage stability | Curiosity Fee (highest first) | Mortgage Interval/Payoff Phrases | Month-to-month required cost |

| Retailer Card #1 | $1,120 | 30% | $50; I pay $150 | |

| Retailer Card #2 | $1,835 | 30% | $50; I pay $150 | |

| Loft retailer card | $2,200 | 29.24% | $72; I pay $150 | |

| Goal Card | $1,850 | 27.15% | $60; I pay $150 | |

| PayPal credit score | $3,225 | 26% | $60; I pay $150 | |

| Chase Visa | $3,500 | 19.49% | $88; I pay $150 | |

| Capitol One | $9,500 | 19.49% | $291; I pay $425 | |

| Scholar Loans | $79,000 | 4% | 10 12 months trainer mortgage forgiveness | Unsure-I’m on the earnings pushed compensation plan; mortgage funds are on maintain till August. |

| Whole: | $102,230 | $671; I pay $1,325 |

I recommend that Anna begin on the high of the checklist–with the 30% rate of interest money owed–and work her means down, paying them off in interest-rate order.

If she’s capable of comply with the above naked bones price range I outlined, she’ll have an extra $858 to place in direction of debt compensation with every month. That’s $3,400 of earnings – $2,542 in bills.

Cease Overpaying On All Seven Money owed

I additionally recommend Anna cease overpaying on all of her money owed and as a substitute focus her efforts on one debt at a time. This would possibly sound counterintuitive, however the issue is that Anna’s spreading her payoff capabilities over seven completely different money owed and consequently, not making a lot progress on any of them due to their astronomical rates of interest. She nonetheless must pay the minimal required every month on each debt aside from the one on the chopping block.

I additionally recommend Anna cease overpaying on all of her money owed and as a substitute focus her efforts on one debt at a time. This would possibly sound counterintuitive, however the issue is that Anna’s spreading her payoff capabilities over seven completely different money owed and consequently, not making a lot progress on any of them due to their astronomical rates of interest. She nonetheless must pay the minimal required every month on each debt aside from the one on the chopping block.

If she makes the minimal month-to-month required cost on money owed #2-7, she’ll pay $621 per 30 days as a substitute of the $1,325 she paying proper now throughout all seven money owed.

Right here’s What I would like Anna to do Beginning Subsequent Month

Month 1 of Anna’s Debt Payoff Journey:

- Pay the minimal required $621 throughout money owed #2-7

- Put all different cash into paying off debt #1:

- The $858 from decreasing her bills

- The $704 that was going into money owed #2-7

- That provides her $1,562 to place in direction of debt #1, which can MORE than pay it off in ONE SINGLE MONTH!

Now we transfer onto debt #2 (which, reminder, is the debt with the subsequent highest rate of interest):

Month 2 of Anna’s Debt Payoff:

- Pay the minimal required $571 throughout the money owed #3-7

- Put all different cash into paying off debt #2:

- The $858 from decreasing her bills

- The $754 that was going into money owed #1 and #3-7

- The $150 that went towards paying off debt #1

- That provides her $1,762 to place in direction of debt #2, which (coupled with the leftover financial savings from month #1) ought to repay debt #2 in ONE SINGLE MONTH!

Now we’re at month 3 and Anna has already paid off two of her money owed!

In month 3–and going ahead–I would like Anna to proceed on with what I’ve outlined above. As she pays off every debt, she ought to roll that quantity into paying off the subsequent debt. That is how she’ll have a good looking cascade all the way down to debt-free dwelling. By focusing her cash on one debt at a time, she is going to have the ability to pay all of them off in flip. If her earnings will increase, she ought to improve her debt re-payments till they’re all gone.

In month 3–and going ahead–I would like Anna to proceed on with what I’ve outlined above. As she pays off every debt, she ought to roll that quantity into paying off the subsequent debt. That is how she’ll have a good looking cascade all the way down to debt-free dwelling. By focusing her cash on one debt at a time, she is going to have the ability to pay all of them off in flip. If her earnings will increase, she ought to improve her debt re-payments till they’re all gone.

Cancel The Credit score Playing cards

One other key factor of this debt payoff technique is that Anna should keep away from taking over extra debt. To facilitate that, I recommend Anna cancel every bank card after she pays it off. She must get out of the cycle of dwelling above her means and funding her way of life with bank card debt. Cancelling the playing cards–and never opening extra–will allow her to limit her spending to the cash she really has. I like to recommend she transfer to paying for all the pieces with money, examine or debt card.

Scholar Loans

I’m much less involved about Anna’s scholar loans as a result of the rate of interest is so low. My query right here is whether or not or not Anna has explored the Public Service Mortgage Forgiveness (PSLF) program? This program forgives federal scholar loans after a specified variety of funds in case your employer qualifies for this system (which most public faculty lecturers do).

If she doesn’t qualify for PSLF, Anna ought to plan to pay her scholar loans off in line with schedule. If she comes into an enormous chunk of cash, she will throw it on the loans. But when her earnings stays comparatively constant, she will plan to simply pay these off on schedule. The caveat is the rate of interest. If her loans have a set rate of interest, that’s nice because it means the speed won’t ever change. If, nevertheless, her loans have a variable rate of interest, it’s doable the speed will improve dramatically sooner or later. If that have been to occur, Anna would wish to put extra money into paying them off as rapidly as doable since, once more, excessive rates of interest are the true killer.

Emergency Fund

We’ve targeted solely on the debt-payoff aspect of issues, however constructing an emergency fund is equally necessary as a result of it serves as your buffer from going into debt. Anna has $550 saved in money proper now, which is a good begin. Something saved is best than nothing saved!

We’ve targeted solely on the debt-payoff aspect of issues, however constructing an emergency fund is equally necessary as a result of it serves as your buffer from going into debt. Anna has $550 saved in money proper now, which is a good begin. Something saved is best than nothing saved!

→An emergency fund ought to cowl 3 to six months’ value of your spending.

At Anna’s present month-to-month spend fee of $3,493, she ought to goal an emergency fund of $10,479 to $20,958. Nevertheless, since an emergency fund is calibrated on what you spend each month, the much less you spend, the much less it is advisable to save up. If Anna strikes to the proposed barebones price range of $2,542 per 30 days with a view to repay her debt ASAP, she will goal an emergency fund extra within the vary of $7,626 to $15,252.

Your emergency fund is there for you if:

- You unexpectedly lose your job

- One thing horrible goes fallacious with your home that must be fastened ASAP

- Your automobile breaks down and should be repaired

- You’re hit with an surprising medical invoice

- Your canine will get quilled by a porcupine and has to go to the emergency vet

An emergency fund will not be for EXPECTED bills, comparable to:

- Routine upkeep on a automobile, comparable to oil modifications and brake pads

- Anticipated dwelling repairs, comparable to boiler servicing/chimney sweeping

- Deliberate medical bills

An emergency fund’s cause for existence is to forestall you from sliding into debt ought to the unexpected occur. It’s your personal private security internet. It’s additionally why it’s so crucial to trace your spending each month. When you don’t know what you spend, you received’t understand how a lot it is advisable to save. I take advantage of and suggest the free expense monitoring service from Empower (affiliate hyperlink).

How To Construct An Emergency Fund

As Anna pays off every debt, I encourage her so as to add a bit of cash into her emergency fund. Whereas Anna wants an emergency fund (everybody wants an emergency fund!), she falls right into a “much less dangerous” class by way of emergency fund precedence. Right here’s why:

As Anna pays off every debt, I encourage her so as to add a bit of cash into her emergency fund. Whereas Anna wants an emergency fund (everybody wants an emergency fund!), she falls right into a “much less dangerous” class by way of emergency fund precedence. Right here’s why:

- She’s a renter, so she’s not on the hook for home repairs and upkeep

- She’s single and has no children, so there’s nobody counting on her financially

- She doesn’t have any pets, so there’s no chance of surprising vet bills

- She has a steady job with constant earnings

- Her mother and father are evidently close by and capable of assist her out financially

Given all of those elements, I’m much less involved along with her lack of emergency fund than along with her debt’s rates of interest. She nonetheless wants to avoid wasting up extra money, but when it have been me, I’d prioritize wiping out these high-interest money owed.

Asset Overview

Let’s check out what Anna has saved and invested.

1) Money: $550

As famous above, Anna is off to good begin along with her emergency fund. Along with saving extra money, I like to recommend she consolidate her 4 completely different accounts into two:

- a high-yield financial savings account (hold the vast majority of the cash in right here)

- an area checking account

Anna must benefit from each doable profit and a high-yield financial savings account will give her much-needed curiosity. For instance, as of this writing, the American Categorical Private Financial savings account earns a whopping 4.00% in curiosity.

2) Retirement: $8,182

Anna’s additionally off to a very good begin along with her retirement investments. She must beef these up, however the first precedence ought to be paying off the debt and constructing the emergency fund. After these two targets are knocked out, she ought to flip her consideration to growing her contributions to her retirement accounts. Assuming her office retirement account is a 403b, the IRS-permitted most contribution in 2023 is $22,500 per 12 months. The IRS-permitted max contribution to her IRA (particular person retirement account) in 2023 is $6,500 per 12 months. On the very least, Anna ought to guarantee she’s contributing sufficient to her employer-sponsored account to qualify for any match her employer affords.

Anna’s additionally off to a very good begin along with her retirement investments. She must beef these up, however the first precedence ought to be paying off the debt and constructing the emergency fund. After these two targets are knocked out, she ought to flip her consideration to growing her contributions to her retirement accounts. Assuming her office retirement account is a 403b, the IRS-permitted most contribution in 2023 is $22,500 per 12 months. The IRS-permitted max contribution to her IRA (particular person retirement account) in 2023 is $6,500 per 12 months. On the very least, Anna ought to guarantee she’s contributing sufficient to her employer-sponsored account to qualify for any match her employer affords.

Subsequent up:

→Discover Your Expense Ratios

One thing lacking from Anna’s spreadsheet are the expense ratios for these investments. Expense ratios are the share you pay to the brokerage for investing your cash and, since they’re charges, you need them to be as little as doable.

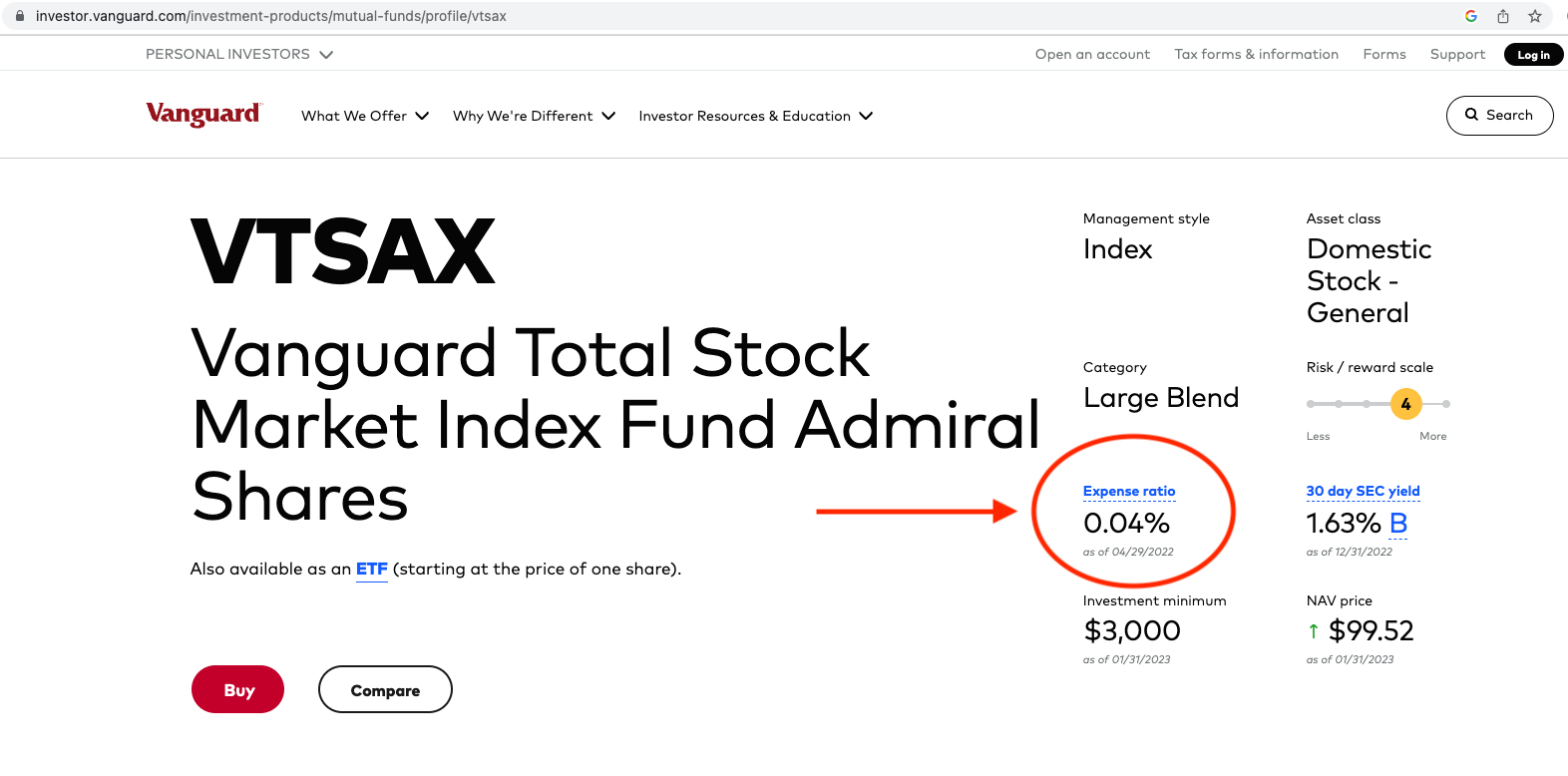

In gentle of their significance to her total long-term monetary well being, I encourage Anna to find the expense ratios for each of her retirement investments. I’ll use Vanguard’s complete market low-fee index fund (VTSAX) for example of find out how to discover an expense ratio.

You’re going to love this as a result of it’s a three-step course of:

1. Google the inventory ticker (on this case I typed in “VTSAX”)

2. Go to the fund overview web page

3. Have a look at the expense ratio

Screenshot under for reference:

And finished! Woohoo! To offer Anna a way of whether or not or not her investments have affordable expense ratios, the next three funds are thought of to have low expense ratios:

And finished! Woohoo! To offer Anna a way of whether or not or not her investments have affordable expense ratios, the next three funds are thought of to have low expense ratios:

- Constancy’s Whole Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Whole Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Whole Market Index Fund (VTSAX) has an expense ratio of 0.04%

What To Do If You Discover Excessive Expense Ratios

You should use this calculator from Financial institution Fee to find out what you’ll pay in charges over the lifetime of your investments, based mostly on their expense ratios. When you discover that your investments have excessive expense ratios, it will likely be properly value your time to research whether or not or not you may transfer them to lower-fee funds. This isn’t all the time doable with employer-sponsored 403bs/401ks as you’re beholden to no matter funds your employer affords. However, it’s nonetheless value wanting by way of all accessible funds to pick those with the bottom expense ratios.

You should use this calculator from Financial institution Fee to find out what you’ll pay in charges over the lifetime of your investments, based mostly on their expense ratios. When you discover that your investments have excessive expense ratios, it will likely be properly value your time to research whether or not or not you may transfer them to lower-fee funds. This isn’t all the time doable with employer-sponsored 403bs/401ks as you’re beholden to no matter funds your employer affords. However, it’s nonetheless value wanting by way of all accessible funds to pick those with the bottom expense ratios.

Anna’s IRA is totally beneath her management, which implies she will choose what brokerage that is saved at in addition to the funds it’s invested in. I extremely suggest the guide, The Easy Path to Wealth: Your Street Map to Monetary Independence And a Wealthy, Free Life, by: JL Collins, for anybody inquisitive about deepening their information round investing. It’s well-written and simple to grasp.

Pension Plan?

Most public faculty lecturers have some kind of pension plan by way of the state. Anna didn’t point out having one, so she ought to do some digging to find out if she has entry to a pension. She will begin along with her HR division or trainer’s union rep.

Life Insurance coverage?

I famous that Anna has a pre-tax deduction for all times insurance coverage and I’m questioning why? Usually, life insurance coverage is for folks with dependents. In different phrases, life insurance coverage is necessary for a household the place the demise of a father or mother would go away the remaining father or mother and youngsters with out enough earnings. Life insurance coverage will not be usually advisable for people who’re single and with out dependents. Anna’s not paying an enormous sum of money for this every month, nevertheless it’s nonetheless cash that would as a substitute go in direction of her priorities of paying off debt, constructing an emergency fund and saving for retirement.

Abstract:

Scale back spending ASAP with a view to funnel extra money into debt pay-off.

Scale back spending ASAP with a view to funnel extra money into debt pay-off.- Cease overpaying on all seven money owed and as a substitute concentrate on paying off the money owed one by one, so as of highest rate of interest first.

- As soon as the primary debt is paid off, put your cash in direction of paying off the subsequent highest-interest fee debt and so forth till all are paid off. Proceed to pay the minimal required month-to-month cost on all money owed.

- Cancel every bank card as soon as it’s paid off.

- Don’t tackle extra debt.

- Consolidate your money accounts right into a high-yield financial savings account.

- As soon as all of those money owed are paid off, Anna can begin to construct an emergency fund that’s 3-6 months’ value of her bills.

- As soon as the money owed are paid off and an emergency fund is saved, Anna ought to improve her retirement contributions.

- Find the expense ratios on her two retirement investments. Change brokerages/funds if the charges are excessive.

- Just a few issues to analysis:

- Does Anna have a pension plan?

- Can she cancel the life insurance coverage?

- Does she qualify for PSLF scholar mortgage compensation?

- What alternatives does she have for growing her earnings?

Okay Frugalwoods nation, what recommendation do you will have for Anna? We’ll each reply to feedback, so please be at liberty to ask questions!

Would you want your personal Case Examine to look right here on Frugalwoods? Apply to be an on-the-blog Case Examine topic right here. Rent me for a personal monetary session right here. Schedule an hourlong or 30-minute name with me, refer a good friend to me right here, schedule a free 15-minute name to be taught extra or e mail me with questions (liz@frugalwoods.com).

By no means Miss A Story

Signal as much as get new Frugalwoods tales in your e mail inbox.