Threats to your funding portfolio can come from anyplace, together with politics, the financial system, and even your individual thoughts. Understanding the threats to your investments is step one to combating them.

Birch Gold, an organization that helps traders purchase and promote gold, polled its traders about their ideas on the best threats to their well-being.

We mixed a number of the Birch Gold responses with different sources to ship these high 10 threats to your funding portfolio.

1. Your Personal Conduct

Within the fashionable period, the largest menace to your portfolio is your conduct. With a 24/7 Information Cycle, it’s straightforward to assume that it’s by no means a great time to speculate. The over-cautious might hoard money, which is assured to lose worth to inflation over time. Extra reckless traders might purchase into meme shares, over-invest in cryptocurrencies, or speculate on NFTs on the peak of their costs solely to see their funding costs drop like a rock.

Even in case you don’t undergo from an excessive amount of or too little warning, it’s possible you’ll make some traditional funding errors. For instance, it’s possible you’ll find yourself shopping for when hype and costs are at a peak and promoting when public sentiment and costs are at their lowest.

Most individuals can’t strategy their funding portfolio with full stoicism, so the very best different is to arrange pointers to maintain your conduct in verify. In the event you’re liable to reckless investing, take a small portion of your funding portfolio and designate it for giant bets. Make investments the remainder of your portfolio for the long term.

Investing set quantities at common intervals, known as dollar-cost averaging, can preserve you from shopping for at all-time highs. It additionally ensures that you simply aren’t merely saving but additionally investing. A well-diversified portfolio may preserve your conduct in verify. In case your portfolio contains quite a lot of asset varieties, your portfolio is much less prone to expertise wild swings in worth. This could preserve you from panic promoting when costs drop.

2. Inflation

Inflation is colloquially outlined as an excessive amount of cash chasing too few items. For many years, the USA loved low inflation, however in 2022 inflation rocked customers whereas the inventory market struggled. That 12 months was a sobering take a look at how a lot harm inflation can do to an funding portfolio.

Here is what inflation has ranged over the previous couple of years based on the Federal Reserve:

Over the long term, your funding portfolio wants to provide returns increased than the speed of inflation, otherwise you’ll lose shopping for energy over time. Excessive charges of inflation can shortly erode the worth of your funding portfolio. Since 1960, the common inflation fee in the USA has been 3.8% per 12 months.

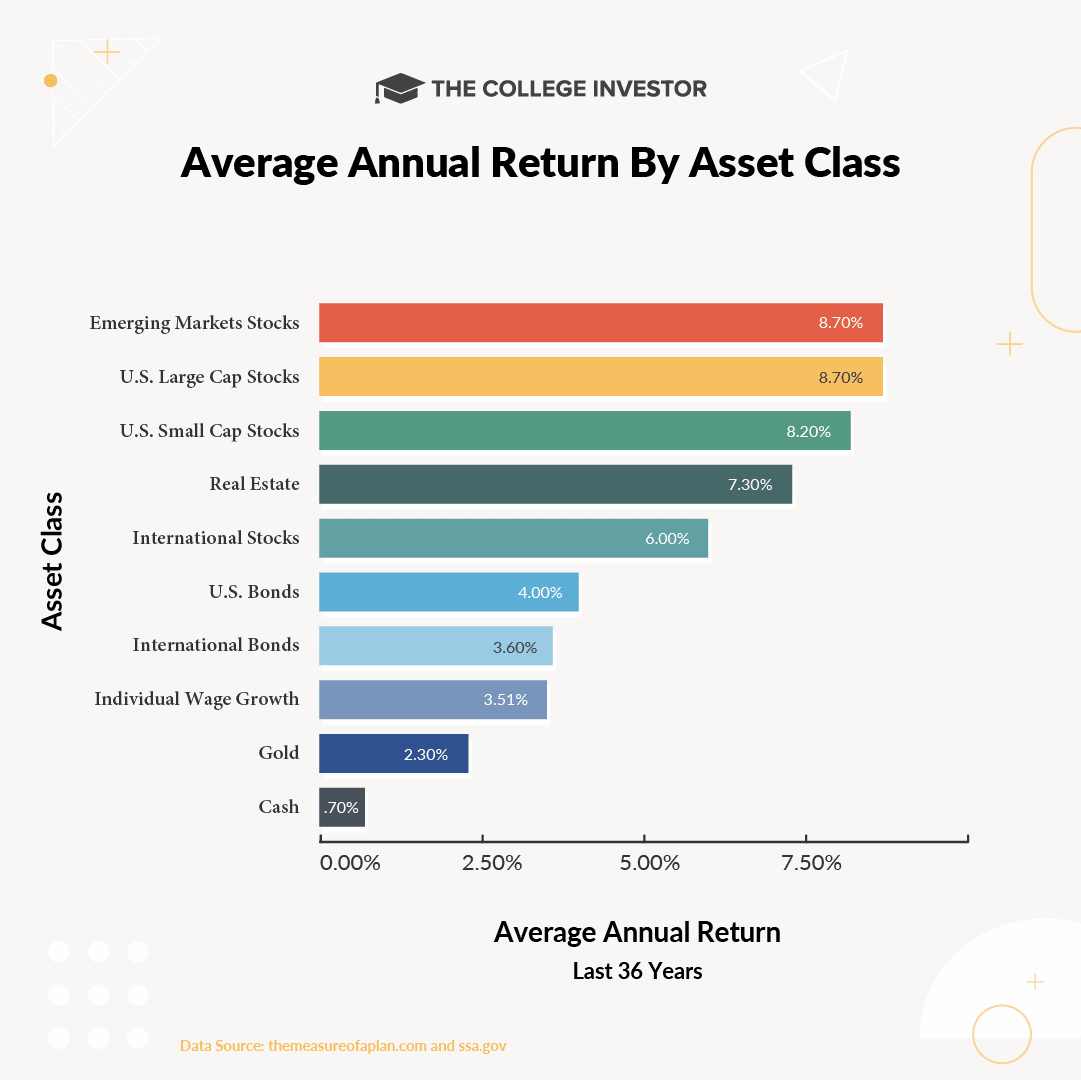

To constrain the impression of inflation, your funding portfolio wants to incorporate asset courses that usually outperform inflation (like shares) and property that act as a hedge towards inflation (like actual property and valuable metals).

3. Financial Downturns

An financial downturn is usually a double menace to your funding portfolio. Throughout a downturn, you’re extra prone to lose your revenue, so it’s possible you’ll must dip into your funding portfolio to fund your residing bills. Moreover, the inventory market is commonly a “main indicator” of a nasty financial system. The worth of your investments might tumble proper earlier than you should withdraw cash out of your portfolio.

Most traders know that the financial system goes by means of cycles that embrace growth durations and recessions, however financial downturns are by no means predictable in size or severity. Promoting property in an financial downturn means it’s possible you’ll promote at low costs as an alternative of excessive costs. To counteract this danger, many traders attempt to spend money on some defensive shares or different “counter-cyclical” property the place costs are inclined to rise when the financial system heads right into a tailspin.

4. Inventory Market Volatility

Inventory costs appear to rise and fall for no motive. Generally excellent news for a corporation ends in inventory costs rising. Different instances, the excellent news results in a value drop. This head-scratching volatility poses a serious menace to traders, particularly those that purchase and promote particular person shares.

Whereas inventory market volatility is hard to deal with if you’re saving and investing, it’s much more devastating if you should withdraw cash out of your portfolio. Retirees who depend on their portfolio to cowl bills might should promote property to cowl their residing bills even when inventory costs fall.

When you’ve got cash you recognize you will want inside the subsequent 5 years think about investing it in additional secure investments, fairly than the inventory market. That method you will not be compelled to promote when costs are down.

5. Politically Motivated Spending Payments

Whether or not you are concerned extra about Trumponomics or Bidenomics, politically motivated spending payments could also be a menace to your funding portfolio. When the Federal authorities spends in a deficit, the nationwide debt will increase. This implies extra taxpayer {dollars} go to servicing authorities debt.

Though the USA has not skilled a debt emergency for the reason that Civil Battle, different nations have had debt emergencies within the fashionable period. These international locations with fashionable economies skilled financial volatility, financial stagnation, and different woes as a result of their nationwide debt load bought out of hand. Underneath the fallacious circumstances, the USA financial system might expertise related points.

6. Excessive Strain “Funding” Gross sales Conditions

Many traders save and make investments diligently for years which ends up in a good nest egg. However when these traders go in search of monetary recommendation, they may find yourself in high-pressure gross sales conditions.

Monetary “Advisors” might discuss you into fee-loaded entire life insurance coverage insurance policies or pricey annuities. In the event you purchase a fee-loaded product that isn’t best for you, it’s possible you’ll find yourself spending 1000’s of {dollars} unwinding the choice. In the event you follow the product, it’s possible you’ll personal underperforming property for years earlier than you’ll be able to cease paying for the product.

All the time make certain that you totally perceive any funding earlier than you progress ahead. In case you are feeling pressured by a quick speaking advisor, inform them you should give it some thought and get a second opinion.

7. Job Loss

Roughly 6 million individuals lose or go away their jobs each single month in the USA. Whereas a lot of these job separations are associated to leaving a job for a greater job, others are layoffs or terminations.

In the event you’ve misplaced a job, you can spend weeks or months in search of your subsequent full-time function. Throughout this time, it’s possible you’ll must faucet into your funding portfolio to fund your residing bills. In the event you’ve bought a seven-figure funding portfolio, pulling a couple of thousand {dollars} from the portfolio received’t do you any long-term hurt. Alternatively, if you should liquidate a big proportion of your portfolio, it might take years to your portfolio to get better.

Many individuals can mitigate the danger of job loss by growing a number of streams of revenue, saving an emergency fund, and chopping to a easy finances when their revenue is low.

8. Lack of An Emergency Fund

An emergency fund is your funding portfolio’s first line of protection. Positive, it will possibly provide help to by means of a job loss, however may cowl an enormous vary of bills. An enormous stash of money can come in useful when you should cowl an surprising medical invoice, pay for a brand new windshield, or cowl the water invoice if you don’t have a gentle revenue.

When you’ve got money, you’ll be able to pay for surprising bills with out having to promote property or tackle debt.

9. Rising Healthcare Prices

Basic inflation is a comparatively new concern for a lot of traders, however rising healthcare prices have been a priority for years. In keeping with Constancy’s Retiree Well being Care Value Estimate, a 65-year-old who retired in 2023 can anticipate to pay $157,500 in healthcare prices throughout their retirement. This represents important spending for an individual relying totally on their funding portfolio and Social Safety.

Whereas most individuals will prioritize health-related spending over rising an funding portfolio, you will need to plan for healthcare prices that might rise sooner than the overall fee of inflation.

10. Inadequate Diversification

Famed investor, Harry Markowitz mentioned, “Diversification is the one free lunch in investing.” He mentioned this as a result of well-diversified portfolios expertise much less volatility than stocks-only portfolios, and a well-diversified portfolio might carry out higher than one with solely shares.

Investing in quite a lot of asset courses together with shares, bonds, actual property, valuable metals, and options can preserve your portfolio rising even when one or two asset courses are declining.

Closing Ideas

Though every certainly one of these threats can harm your funding portfolio, you’ll be able to defend your wealth. Creating financial resilience with an emergency fund, a number of streams of revenue, and the power to chop your spending goes a long-way in direction of conserving your funding portfolio in place.

From an funding standpoint, controlling your conduct, sustaining correct diversification, and utilizing examined funding methods can assist you throughout financial growth instances and through busts.