So now’s the time. You’ve been dreaming of changing into a home-owner. Hanging out by yourself. Constructing your personal fairness. Not eager to proceed contributing to your landlord’s wealth in your month-to-month hire funds! This thrilling information and a significant constructive life stage! However what in case you are like tens of millions of Individuals that don’t have a credit score rating that can enable you this life altering objective? The nice information is that your credit score state of affairs might change… quickly. Quickly as inside 30 days!! Sound unimaginable? A current research by the Mortgage Credit score Potential Index (MCPI) reveals simply how a 30-day turnaround in scores is feasible. And ¾ of mortgage purposes pulled in 2023 are proof {that a} majority of the “No’s” to a mortgage mortgage can shortly grow to be a “Sure.”

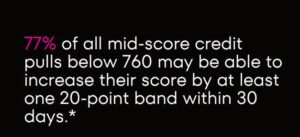

So, how is that this potential? Appears like a pipe dream. I actuality, it’s all arithmetic. It’s all in an algorithm. We’re speaking about Credit score Optimization. Optimizing your utilization ratios in your revolving traces of credit score. MCPI’s report means that 77% of all mortgage purposes in 2023 might increase their credit score scores by 20 factors in lower than 30 days. Why is that this knowledge vital? Properly, for those who’re at a 560, these 20 factors might aid you qualify for FHA mortgage and capable of begin your house search. In case you’re at a 640, possibly these 20 factors can get you a greater rate of interest saving you hundreds of {dollars} within the lifetime of the mortgage.

These 20 factors are the minimal. Many Individuals with “Mid-score credit score pulls under 760 could possibly improve their scores by at least one 20-point band width.” That being stated, getting essentially the most of your Credit score Optimization might probably achieve you way more than 20 factors.

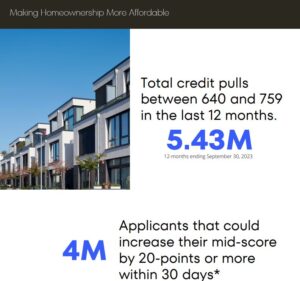

“Whole credit score pulls between 640 and 759 within the final 12 months are 5.43 million. Of these candidates that would improve their mid-score by 20 factors or extra inside 30 days stand at 4 million.” That’s a whole lot of potential householders or those that might considerably scale back their rates of interest on these loans.

So, how does one go about getting essentially the most correct data and true steering to aide them in Optimizing their Credit score? I’ve that reply…… please contemplate visiting our companions at Credit score Armor. That is an incredible monitoring web site that can information you thru the Credit score Optimization course of by using their “Rating Increase” product. This product will let you know what number of factors you’ll achieve for “X” quantity of {dollars} you pay your revolving traces of credit score. However the BEST a part of this product is “Rating Increase” will let you know the precise date your collectors report back to the three Bureaus. This is a vital date, if you wish to be one of many 77% that may enhance their scores within the subsequent 30-days. Simply be sure you pay your commerce line down 4 days earlier than they report back to the Bureaus, and you may be rewarded on the subsequent month’s credit score report.

This web site permits the patron to reap the benefits of their very own monetary future. Look into it. You’ll be happy that you just did. www.creditarmor.com