Dealer’s software accredited inside an hour by financial institution

Macquarie Financial institution has outlined its method to the dealer business in 2024 whereas explaining the choice to make out-of-cycle rate of interest cuts earlier than the Reserve Financial institution’s February money price announcement.

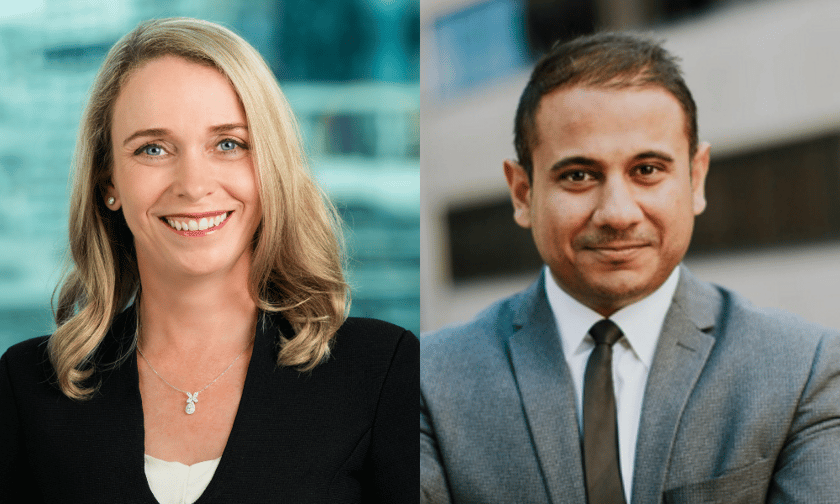

Underlining the significance of brokers within the mortgage panorama, Wendy Brown (pictured above left), head of dealer gross sales at Macquarie Financial institution, highlighted their very important position in facilitating homeownership.

“As a dedicated companion to the dealer business in Australia, our focus is on offering one of the best digital experiences to brokers and their shoppers all through the house mortgage journey,” Brown stated.

Macquarie Financial institution explains rate of interest cuts

On Jan. 30, the financial institution issued brokers a brand new price card that included slashed charges to some mounted and variable mortgage merchandise.

On a variable price aspect, the financial institution has lowered charges for brand new dwelling loans by a mean of 10 foundation factors throughout LVRs.

Macquarie made two will increase to variable charges during the last six months, most lately in December, and this newest replace successfully unwinds that December enhance.

On the mounted price aspect, Macquarie additionally made a variety of decreases on the finish of January throughout LVRs.

For instance, its mounted price product was slashed by 38 foundation factors primarily based on owner-occupier and funding loans accessible for $500,000 at 80% LVR.

It’s understood that the swap charges coming down was behind the lower in mounted charges.

Swap charges are rates of interest on contracts the place two events trade future money flows. They’re necessary as a result of banks use them to handle their very own borrowing prices by hedging threat.

When swap charges go down, it turns into cheaper for banks to hedge their fixed-rate mortgage choices, making it doable for them to cut back the fixed-rate curiosity they cost debtors.

Utility turnaround time beneath an hour

Persevering with on from final 12 months, Macquarie Financial institution will prioritise know-how investments in its platform this 12 months, Brown stated.

This focus goals to “constantly ship market-leading turnaround instances,” in response to Brown, boosting confidence and readability for brokers and shoppers all through the mortgage software course of.

Mortgage dealer Raj Ladher (pictured above proper) from Equilibria Finance skilled this firsthand, describing himself as “blown away” by the pace. He shared a timeline on social media:

- 10:36am: Mortgage software submitted.

- 11:18am: SMS from assessor advising he’ll name to debate software.

- 11:27am: Utility conditionally accredited, topic to anticipated gadgets.

“Whereas rates of interest are essential,” Ladher stated, “the method itself can also be a significant component, particularly when shoppers are negotiating property purchases.”

Robin Chakravarty, enterprise growth supervisor at Macquarie, appreciated the suggestions.

“Right here at Macquarie, we delight ourselves in delivering business main SLA. Nonetheless, it is usually the standard of the submission that additionally helps in delivering this service,” Chakravarty stated.

Brown echoed this sentiment, saying the financial institution’s digital expertise for brokers is supported by its BDM groups.

“We take a relationship-focused method that means our groups are dedicated to constructing deep, lasting and clear connections with brokers – understanding their companies and processes in order that we will present the absolute best help and additional improve the expertise our dealer companions have once they interact with us,” Brown stated.

Macquarie Financial institution provides brokers employees entry to portal

Past its platform, Brown unveiled plans for brokers in 2024, emphasising elevated efficiencies, digital management, and dealer feedback-driven enhancements.

Brown highlighted the event of latest options designed to “give our dealer companions larger management and efficiencies,” releasing them to deal with shoppers and enterprise progress.

Now we have an all the time -on method when it comes to suggestions and this informs the areas that we deal with and make enhancements to,” Brown stated.

“Whether or not that’s on our Dealer Portal, our Assist Centre or elsewhere throughout our digital expertise, we’re proactive in understanding dealer wants and designing enhancements that get to the center of what they inform us they need most.”

Responding to dealer requests, Macquarie Financial institution applied help employees entry to the Dealer Portal.

“Brokers have advised us that by giving help employees entry to Dealer Portal it could considerably enhance how their enterprise runs, so we now have developed our portal to incorporate entry for help groups which is driving significant efficiencies for dealer companies throughout Australia.”

Associated Tales

Sustain with the most recent information and occasions

Be a part of our mailing checklist, it’s free!