We’re conscious of the truth that sure Funding (or) Saving schemes have a lock-in interval. ‘Lock-in interval’ is a standard phenomenon particularly with widespread Tax saving Schemes. These schemes are like PPF, ELSS mutual funds, NSC, 5 12 months Tax saving Fastened Deposit, Senior citizen Financial savings Scheme and so on.,

What’s a Lock-in interval? – It’s a interval throughout which an investor is restricted from promoting or withdrawing a specific funding.

For instance: An funding in ELSS Mutual fund has a lock-in interval of three years. The models allotted below these schemes can’t be redeemed earlier than 3 years. Equally, the lock-in interval that’s relevant on PPF (Public Provident Fund) accounts is 15 years.

One other widespread product that comes with a lock-in interval are ULIP (Unit Linked Insurance coverage Plan);

Instance: Shetty purchased a ULIP plan to economize for his long-term purpose. A ULIP coverage comes with the lock-in interval of 5 years. Throughout this time, Mr Shetty can’t withdraw the invested funds. The lock-in interval saved him motivated to repeatedly pay the premium and reap excessive advantages.

On this submit, let’s perceive concerning the ‘lock-in interval’ on numerous saving & funding choices and its applicability on the unlucky demise of an investor (through the lock in interval).

Lock in Interval of assorted widespread Saving & Funding Choices

The short-term Fastened Deposits supplied by banks are those that include the least lock-in interval, might be as little as 7 days or a month.

Many of the Tax saving schemes include lock-in interval. On the subject of the most effective tax saving possibility with the shortest locking interval, ELSS (Fairness Linked Financial savings Scheme) ranks on the high of the checklist.

Let’s take a look in any respect the favored saving and funding choices in India and their lock-in-periods. (For a few of these schemes, maturity interval is their lock-in interval. Most of those schemes permit the buyers to make untimely withdrawal or untimely closure of accounts, however on sure standards and/or penalty.)

| Saving (or) Funding Possibility | Lock-in-period | Untimely withdrawal Allowed? |

| Financial institution / Put up Workplace Fastened Time period Deposits | 7 days (Minimal) | Sure (with penalty) |

| Mahila Samman Financial savings Certificates | 2 years | Sure (after 6 months) |

| Fairness Linked Financial savings Scheme (Mutual Funds) | 3 years | No |

| Nationwide Financial savings Certificates (NSC) | 5 years | No |

| Unit Linked Insurance coverage Plan | 5 years | Sure (with costs) |

| Tax Saving Fastened Deposit | 5 years | No |

| Put up Workplace Month-to-month Revenue Scheme (PO MIS) | 5 years | 1 12 months (with costs) |

| Senior Citizen Financial savings Scheme (Sr CSS) | 5 years | 1 12 months (with costs) |

| Part 54EC Capital Acquire Bonds | 5 years | Sure (exemption will get revoked) |

| Govt of India (RBI) Floating Fee Bonds | 7 years | Sure (after 4/5/6 years for senior residents with penalty) |

| Sovereign Gold Bonds (SGB) | 8 years | Sure (from fifth 12 months) |

| Tax Free Bonds (TFB) | 10 years | Might be redeemed by way of Secondary market |

| Public Provident Fund (PPF) | 15 years | 5 years (Partial withdrawal) |

| Sukanya Samriddhi Lady Little one Scheme (SSS) | 21 years (most) | Sure (for Schooling/Mariage) |

| Nationwide Pension System (NPS – Tier 1) | 60 years (age) | 3 years (partial withdrawal) |

| Non-Convertible Debentures (NCD) | 90 days (minimal) | Might be redeemed by way of Secondary market |

| Firm Fastened Deposits | 1 12 months (minimal) | Sure (with penalty) |

Can lock-in interval apply on demise of the Investor / Holder?

Allow us to now perceive the principles & pointers pertaining to ‘lock-in interval’ and whether or not nominee/legal-heir(s) can withdraw the investments earlier than the lock-in interval ends?

Public Provident Fund

- The lock-in interval on PPF account is 15 years.

- Untimely withdrawal is allowed in case of unlucky demise of the PF subscriber.

- The authorized heirs or nominee can withdraw your complete stability out there in PPF account, however have to provide sure paperwork to make a demise declare. So, the nominee(s) can withdraw PPF deposits through the lock-in interval.

- The HUF account won’t be closed earlier than maturity on the demise of the Karta however it’ll proceed by the brand new Karta appointed by the HUF.

- If the subscriber dies throughout a 12 months, his executors can’t deposit any sum from the earnings of the deceased to his PPF account after his demise. In the event that they accomplish that, the quantity deposited shall neither carry curiosity nor shall this quantity be eligible for tax rebate. This quantity will likely be refunded with out curiosity to the nominee/authorized inheritor, because the case could also be, on the time of closure of the account.

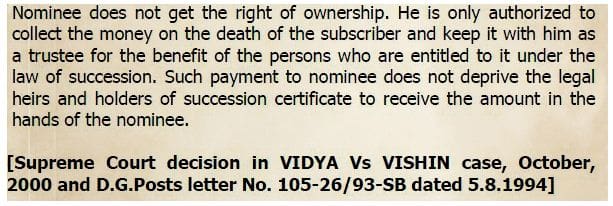

- Kindly do word that the Nominee doesn’t get the precise of possession. He/she is barely approved to gather the cash on the demise of the subscriber and hold it with him as a trustee for the good thing about the individuals who’re entitled to it below the regulation of succession.

Nationwide Financial savings Certificates (NSC)

NSCs have a lock-in interval of 5 years. Nonetheless, untimely encashment is permitted below Sec. 16(1) solely on the next three contingencies:

- On the demise of the holder or any of the holders within the case of joint holders

- On forfeiture by a pledgee being a Gazetted Authorities Officer when the pledge is in conformity with these guidelines (or)

- When ordered by a courtroom of regulation.

In case of the holder’s demise, the nominee can encash the NSC earlier than or after the maturity (i.e. 5 years). The quantity payable is at a proportionate charge.

5 12 months Tax Saving Fastened Deposit

Tax saving FDs have a lock-in interval of 5 years. Nonetheless, in case of demise of the depositor earlier than the maturity of time period deposit, levy of penalty can be exempted and nominee/authorized inheritor will likely be allowed untimely cost even earlier than the lock-in-period.

Associated article : Untimely withdrawal of Joint Account deposits on the demise of one of many Account holders

54EC Tax Saving Bonds

54EC Bonds have a lock-in interval of 5 years. To avail the profit below Part 54EC of the Revenue Tax Act, 1961, the funding made within the Bonds must be held for a interval of a minimum of 5 years from the Deemed Date of Allotment. The Bonds are for tenure of 5 years and are ‘Non-transferable & Non-negotiable’ and can’t be supplied as a safety for any mortgage or advance.

Nonetheless, Transmission of the Bonds to the authorized heirs in case of demise of the Bondholder/Beneficiary to the Bonds is allowed. However, they should be held for your complete 5 years time period, curiosity earnings is taxable within the palms of nominees/authorized heirs.

Associated Article : Capital Good points Tax Exemption Choices on Sale of Home or Plot | Newest Guidelines

ELSS Tax saving Mutual Fund Schemes

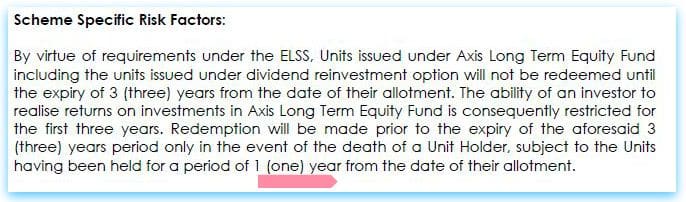

ELSS mutual funds have a lock-in interval of three years. Within the occasion of demise of the investor, the nominee or the authorized inheritor can withdraw the quantity, just one 12 months after the date of allotment of models to the deceased (authentic investor / unit-holder).

For instance : If the investor dies eight months after buying the models, the nominee has to attend for a minimum of 4 extra months to have the ability to promote the models (if he/she desires to redeem..).

Kindly word that nominee can get the models transferred to him/her a lot earlier however can’t promote these till 1 12 months is over. Basically, the lock-in interval goes down from 3 years to 1 12 months within the occasion of demise of the unique investor. This info might be present in any of the ELSS funds ‘scheme info paperwork’.

Senior Citizen Financial savings Scheme

Sr.CSS has a maturity interval of 5 years. Nonetheless, within the unlucky occasion of demise of the deposit holder, the account might be closed instantly (if no joint ac holder exists) and the nominee can obtain the deposit quantity as per the principles. Similar is the case with Put up workplace Month-to-month Revenue Scheme.

Sukanya Samriddhi Account

The maturity interval below this scheme is 21 years from the date of account opening. The account might be prematurely closed, in case of the unlucky demise of the woman baby (account holder), the mum or dad or authorized guardian can declare for the accrued quantity together with the curiosity accrued on the account. The stability can be instantly handed over to the nominee of the account. (Learn : ‘Sukanya Samriddhi Deposit Scheme – Evaluation‘)

Nationwide Pension System (NPS)

The exit age below NPS is 60 years (subscriber’s age). Nonetheless, within the occasion of demise of the contributor, your complete accrued pension wealth can be paid to the nominee/authorized inheritor of the subscriber and there wouldn’t be any buy of annuity/month-to-month pension.

Sovereign Gold Bonds

The nominee/nominees to the bond could strategy the respective Receiving Workplace with their declare. If the bonds are in demat kind, nominee can contact the respective depositary participant.

Govt of India (RBI) Floating Fee Bonds

These bonds have a maturity interval of seven years. On the demise of the bond holder, they are often transferred to nominee’s identify however payable after maturity interval solely.

Firm Fastened Deposits & NCDs

The maturity interval (lock-in interval) could range for various Deposit Schemes/Points. It might be famous that deposit quantity will likely be payable solely on the date of maturity and never earlier on the date of demise of the investor. Nonetheless, the surviving individual or the authorized inheritor can request the corporate for a untimely cost of the deposit and that is the prerogative of the corporate to simply accept or decline such request. It will depend on the precise Difficulty/Scheme’s phrases & situations.

Mahila Samman Financial savings Certificates

Within the occasion of the account holder’s demise, the account might be closed prematurely. Within the case of an early closure as a result of aforementioned circumstances, curiosity on the scheme’s regular charge will likely be supplied.

Proceed studying:

(Put up first revealed on : 14-Aug-2023) (Invitation to affix our Telegram Channel..click on right here..)