There are two varieties of inflation charges that matter.

Economists and market observers care in regards to the authorities reported knowledge — CPI, core PCE, ex-shelter, no matter your most well-liked technique is.

On a regular basis People solely care about two worth factors — fuel and grocery retailer costs.

Why is that this the case?

These are the costs you expertise frequently. Gasoline costs are spelled out on large indicators with large numbers. We see these numbers day by day once we drive by or replenish the tank.

We go to the grocery retailer commonly, so most individuals have a fairly good sense of what they typically pay when shopping for groceries.

When costs on the pump or grocery retailer change, individuals discover. Lately, individuals have seen greater grocery retailer costs. There are tons of viral movies of individuals complaining about greater costs on groceries.

That’s as a result of meals costs are a lot greater.

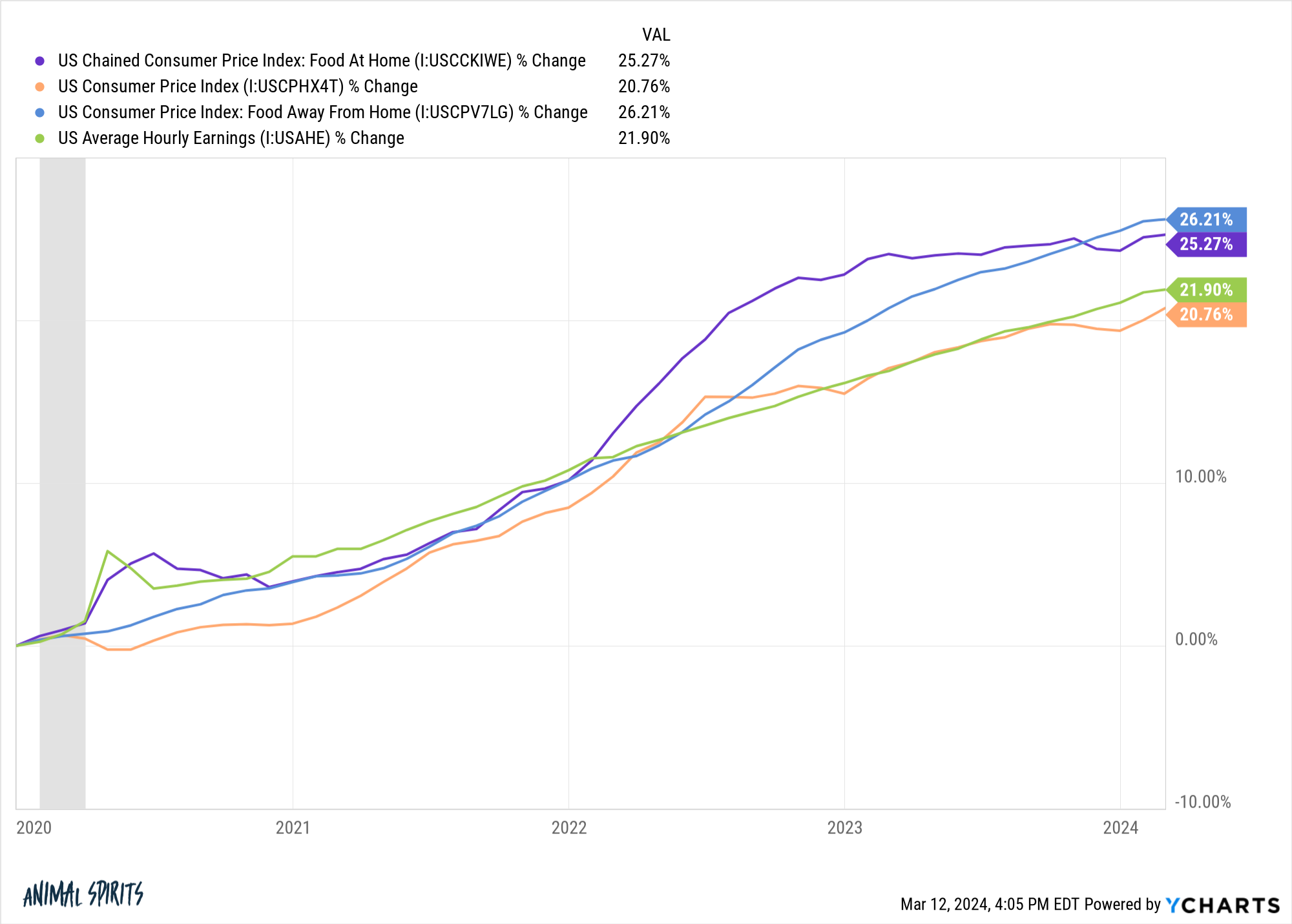

Meals inflation has been greater than the general CPI basket for the reason that begin of 2020. This chart exhibits the inflation in meals at house (groceries), the general CPI, meals away from house (eating places) and wage development:

Earnings have truly grown at a sooner tempo than total inflation, however meals on the grocery retailer and eating places have grown sooner than wages.

It also needs to be famous that wages for restaurant employees have outpaced each inflation and meals costs. Common hourly wages for restaurant employees are up almost 30% since 2020. One of many causes you’re paying extra for meals is as a result of service wages have lastly elevated.

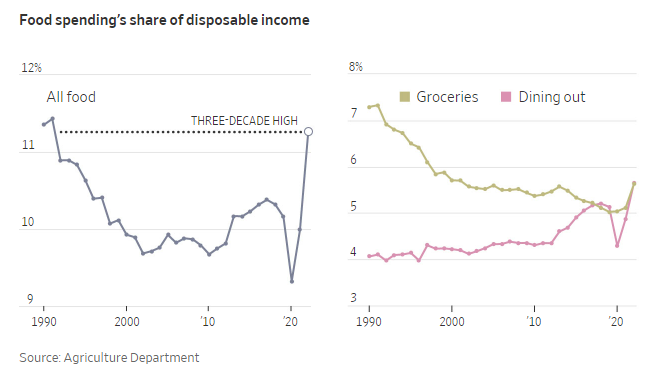

Whatever the cause, greater costs are placing a pressure on many family budgets. The Wall Avenue Journal notes households haven’t spent this a lot of their price range on meals in over 30 years:

To be truthful, this quantity is up simply 1% from the pre-pandemic days in 2019. That’s no enjoyable but it surely’s not the top of the world if you happen to zoom out a bit. I’d argue this can be a borderline chart crime with such a truncated y-axis.

In reality, households right now spend far much less on meals and different requirements than earlier generations.

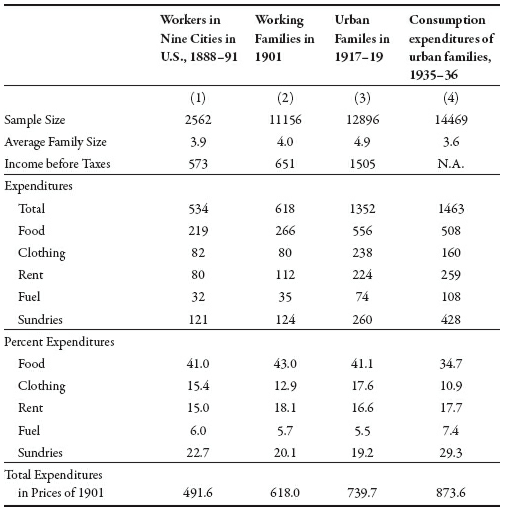

Robert Gordon wrote in regards to the first giant scale American price range research carried out by the BLS:

The overall share of spending on meals and clothes throughout these 4 time durations was 56%, 56%, 59% and 46%, respectively.1

In the newest BLS Shopper Expenditures report, these line objects added as much as a little bit greater than 15%.

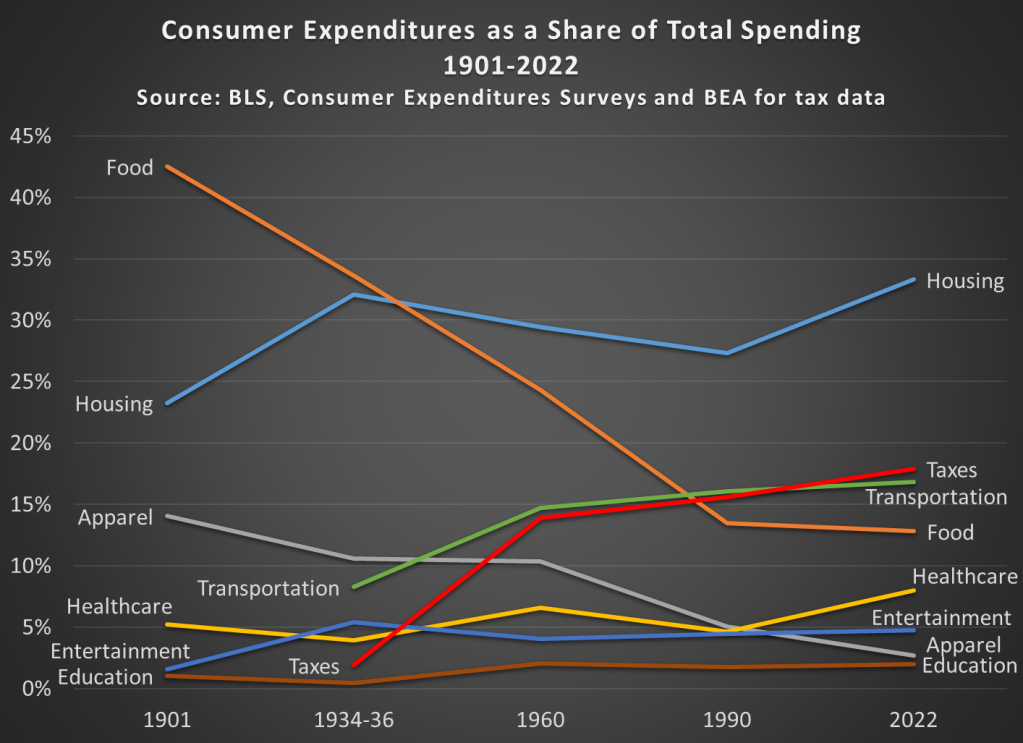

Jeremy Horpedahl broke down the adjustments in family spending for the reason that flip of the twentieth century which provides you a greater concept in regards to the evolution of family spending over time:

Whereas the meals share of disposable revenue has risen lately, it’s been in a large drawdown for many years. So it actually is determined by your body of reference.

Folks solely discover when issues are getting worse. Nobody ever pays consideration when issues get higher.

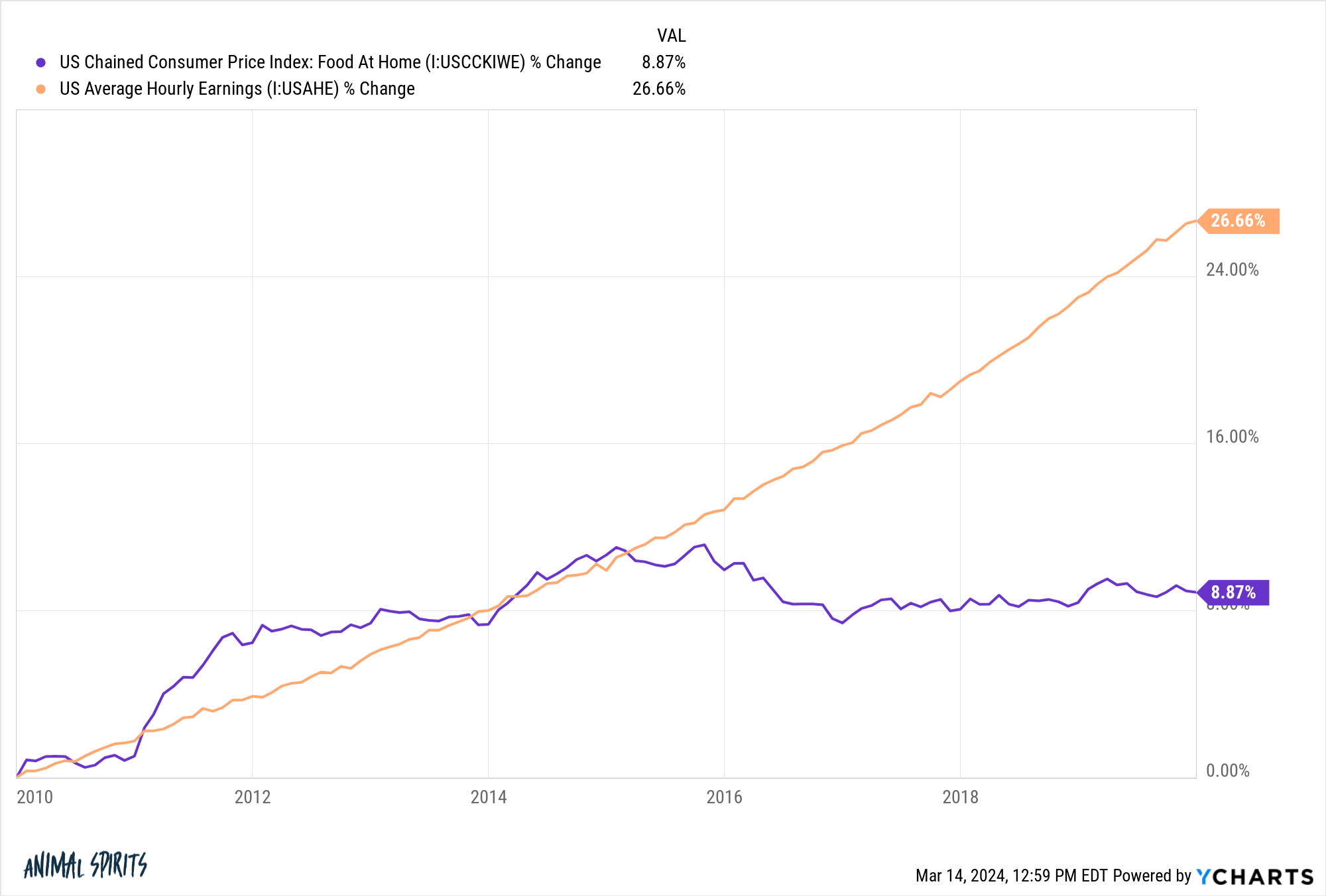

Simply have a look at wages versus grocery retailer costs within the 2010s:

Wages far outpaced costs on the grocery retailer however there have been no viral movies of individuals giving thanks.

It is sensible that we complain when issues worsen however don’t have a good time when issues get higher — losses sting twice as unhealthy as good points make you’re feeling good. Inflation is a lack of buying energy.2

I’m not making an attempt to gloss over the truth that many households are fighting greater costs are the grocery retailer. Meals is a necessity. Not everybody’s wages have saved tempo with inflation. The averages don’t all the time inform the entire story for each particular person’s circumstances.

It’s additionally price noting we now have so many extra “requirements” in our budgets lately that folks prior to now didn’t need to cope with.

Everybody has to have a smartphone, which requires a month-to-month price. The Web is now a necessity for most individuals. That’s one other new invoice that’s comparatively new.

Up to now individuals both didn’t have TV or had an antenna that gave them free entry to a few channels. Now, all of us pay for cable or streaming companies (or each).

Most households had been fortunate to have a single TV again within the Fifties and 60s. Now we’ve screens all over the place — flatscreen TVs, iPads, laptops, desktops, iPhones.

My level is that households have much more “requirements” than they did prior to now. Are you able to think about how a lot you can save every month if you happen to simply subtracted your cellphone invoice, web, and cable/streaming subscriptions? In all probability sufficient to cowl the grocery invoice after which some.

Plus, extra younger individuals have scholar loans than ever earlier than, and everybody pays extra for healthcare than prior to now.

I feel this is likely one of the causes greater meals costs are so painful for thus many households. There are such a lot of different budgetary line objects lately that a rise in grocery retailer costs turns into much more painful.

The excellent news to your price range is the inflation fee in meals costs is subsiding. Within the 12 months ending February 2024, CPI for meals at house grew simply 1%, properly under the general inflation fee of three.2%. And wages are outpacing inflation by a wholesome clip too.

Michael and I talked about inflation, grocery retailer costs and far more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Now right here’s what I’ve been studying currently:

Books:

1Additionally, if you wish to know why costs had been so low prior to now, simply have a look at how low disposable incomes had been. 5-cent sweet bars sound nice till you understand most households had been making like $1,000 a yr.

2Possibly the final 4 years is simply costs taking part in catch-up to some extent. Because the begin of 2010, wage development is much greater than meals worth development — 54% to 37%.