With mortgage charges exceeding 7% once more and residential costs reaching new heights, some critics are sounding the alarm.

The argument is that we’ve received an unhealthy housing market, during which the standard American can’t afford a median-priced dwelling.

And when funds are out of attain, it’s only a matter of time earlier than issues appropriate. It’s, in any case, unsustainable.

Some are even arguing that it’s 2008 (or no matter early 2000s yr you wish to use) another time.

However is the housing market actually getting ready to one other crash, or is housing merely unaffordable for brand spanking new entrants?

What May Trigger the Subsequent Housing Crash?

Over the previous few years, I’ve been compiling a listing of housing market threat components. Simply concepts that pop in my head about what might trigger the subsequent housing crash.

I’m going to debate them to see what sort of menace they pose to the steadiness of the housing market.

That is what my record seems like for the time being:

- Single-family dwelling buyers promoting

- Local weather-related points

- Spike in mortgage charges

- Overbuilding (dwelling builders going too far)

- Crypto bust (bitcoin, NFTs, and many others.)

- Forbearance ending (COVID-related job losses)

- Mass unemployment (recession)

- Contentious presidential election

- Mother and pop landlords in over heads

- Airbnb and STR saturation (particularly in trip markets)

- Improve in overextended householders (excessive DTIs, HELOCs, and many others.)

- Pupil loans turned again on (coupled with excessive excellent debt)

- Purchase now, pay later (lot of kicking the can down the highway)

The Spike in Mortgage Charges

I had this on my record from some time again, and this one really got here to fruition. The 30-year fastened jumped from round 3% to over 7% within the span of lower than a yr.

Charges have since bounced round, however typically stay near 7%, relying on the week or month in query.

Nonetheless, this hasn’t had the anticipated impact on dwelling costs. Many appear to assume that there’s an inverse relationship between dwelling costs and mortgage charges.

However guess what? They will rise collectively, fall collectively, or go in reverse instructions. There’s no clear correlation.

Nonetheless, markedly larger mortgage charges can put a halt to dwelling gross sales in a rush, and clearly crush mortgage refinance demand.

When it comes to dwelling costs, the speed of appreciation has actually slowed, however property values have continued to rise.

Per Zillow, the standard U.S. dwelling worth elevated 1.4% from Could to June to a brand new peak of $350,213.

That was practically 1% larger than the prior June and simply sufficient to beat the earlier Zillow Residence Worth Index (ZHVI) document set in July 2022.

What’s extra, Zillow expects dwelling value progress of 5.5% in 2023, after beginning the yr with a forecast of -0.7%.

They are saying that charge of appreciation is “roughly in keeping with a traditional yr earlier than data have been shattered throughout the pandemic.”

So we’ll transfer on from the excessive mortgage charge argument.

Overbuilding and a Flood of Provide

The subsequent threat issue is oversupply, which might absolutely result in an enormous drop in dwelling costs.

In spite of everything, with housing affordability so low for the time being, a sudden flood of provide must lead to dramatic value cuts.

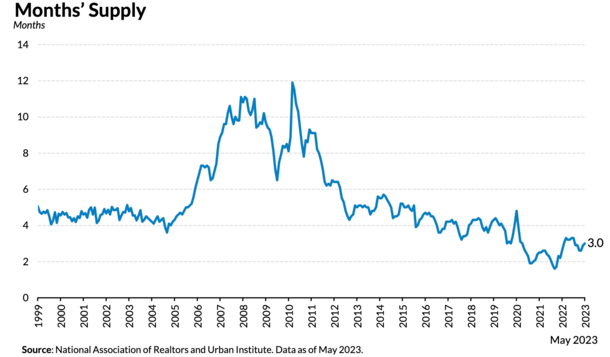

However the issue is there’s little or no stock, with months’ provide close to document lows. And it’s a couple of quarter of what it was throughout the lead as much as the housing disaster.

Simply have a look at the chart above from the City Institute. If you wish to say it’s 2008 another time, then we have to get stock up in a rush, near double-digit months’ provide.

As a substitute, we have now barely any stock because of a scarcity of housing inventory and a phenomenon generally known as the mortgage charge lock-in impact.

In the end, right this moment’s home-owner simply isn’t promoting as a result of they’ve a brilliant low fastened mortgage charge and no good possibility to switch it.

However New Development Isn’t Conserving Up with Demand

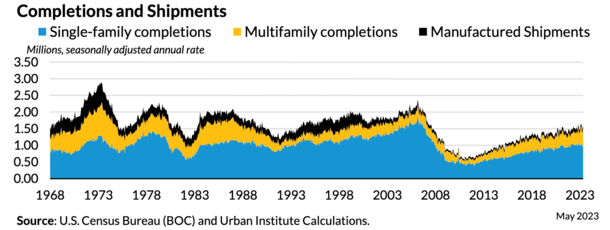

On the identical time, new building isn’t maintaining with demand. As you may see from the chart under, completions are on the rise.

However new residential manufacturing, together with each single-family and multifamily completions in addition to manufactured housing shipments, was solely up 2.2% from a yr earlier.

And at 1.60 million items in Could 2023, manufacturing is simply 67.2% of its March 2006 degree of two.38 million items.

The opposite nice worry is that mother and pop landlords will flood the market with their Airbnb listings and different short-term leases.

However this argument has failed to indicate any legs and these listings nonetheless solely account for a tiny sliver of the general market.

What you could possibly see are sure high-density pockets hit if a lot of hosts resolve to promote on the identical time.

So particular hotspot trip areas. However this wouldn’t be a nationwide dwelling value decline because of the sale of short-term leases.

And most of those house owners are in superb fairness positions, that means we aren’t speaking a couple of repeat of 2008, dominated by quick gross sales and foreclosures.

A Decline in Mortgage High quality?

Some housing bears are arguing that there’s been a decline in credit score high quality.

The overall concept is latest dwelling consumers are taking out dwelling loans with little or nothing down. And with very excessive debt-to-income ratios (DTIs) in addition.

Or they’re counting on short-term charge buydowns, which is able to ultimately reset larger, much like a few of these adjustable-rate mortgages of yesteryear.

And whereas a few of that’s actually true, particularly some government-backed lending like FHA loans and VA loans, it’s nonetheless a small share of the general market.

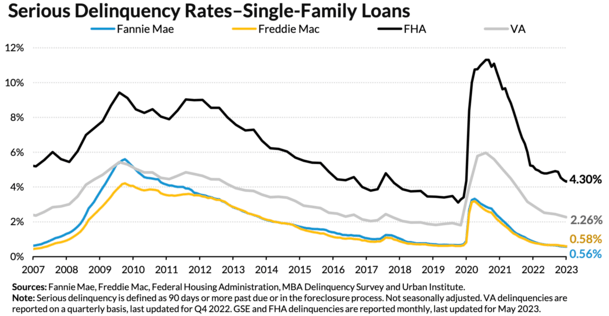

If we have a look at critical delinquency charges, which is 90 days or extra late or in foreclosures, the numbers are near all-time low.

The one slighted elevated delinquency charge might be attributed to FHA loans. However even then, it pales compared to what we noticed a decade in the past.

On my record was the top of COVID-19 forbearance, however as seen within the chart, that appeared to work itself fairly shortly.

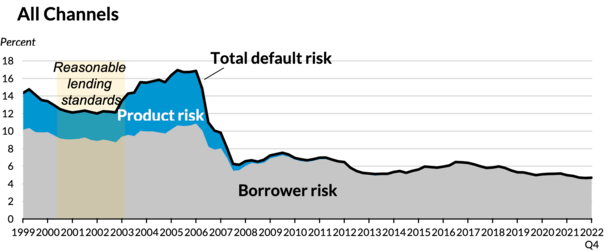

On the identical time, lending requirements are evening and day in comparison with what they have been within the early 2000s. See chart under.

Since 2012, mortgage underwriting has been fairly stable, thanks in no small half to the Certified Mortgage (QM) rule.

The vast majority of loans originated over the previous decade have been absolutely underwritten, high-FICO, fixed-rate mortgages.

And whereas cash-out refis, HELOCs, and dwelling fairness mortgage lending has elevated, it’s a drop within the bucket relative to 2006.

Within the prior decade, most dwelling loans have been acknowledged earnings or no doc, typically with zero down and marginal credit score scores. Usually with a piggyback second mortgage with a double-digit rate of interest.

And worse but, featured unique options, resembling an interest-only interval, an adjustable-rate, or unfavourable amortization.

What About Mass Unemployment?

It’s principally agreed upon that we’d like a surge of stock to create one other housing disaster.

One hypothetical method to get there’s through mass unemployment. However job report after job report has defied expectations so far.

We even made it by means of COVID with none lasting results in that division. If something, the labor market has confirmed to be too resilient.

This has really triggered mortgage charges to rise, and keep elevated, regardless of the Fed’s many charge hikes over the previous yr and alter.

However in some unspecified time in the future, the labor market might take a success and job losses might mount, doubtlessly as a recession unfolds.

The factor is, if that have been to materialize, we’d seemingly see some form of federal help for householders, much like HAMP and HARP.

So this argument form of resolves itself, assuming the federal government steps in to assist. And that form of atmosphere would additionally seemingly be accompanied by low mortgage charges.

Keep in mind, dangerous financial information tends to result in decrease rates of interest.

Possibly the Housing Market Simply Slowly Normalizes

Whereas everybody desires to name the subsequent housing crash, perhaps one simply isn’t within the playing cards.

Arguably, we already had a serious pullback a yr in the past, with what was then known as a housing correction.

Not simply outlined like a inventory market correction, it’s principally the top of a housing growth, or a reversal in dwelling costs.

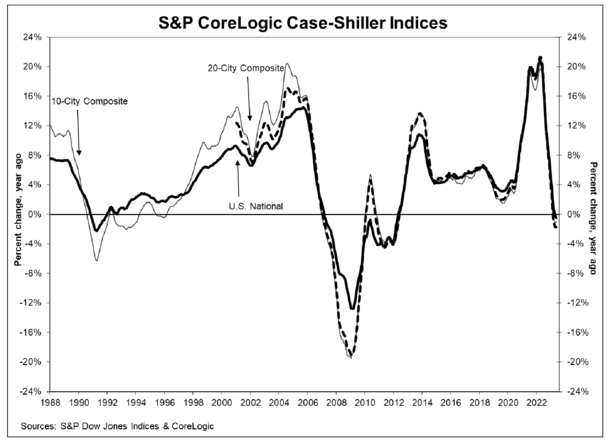

We did lately see dwelling costs go unfavourable (year-over-year) for the primary time since 2012, which made for good headlines.

But it surely seems to be short-lived, with 4 straight month-to-month beneficial properties and a optimistic outlook forward.

As a substitute of a crash, we would simply see moderating value appreciation, larger wages (incomes), and decrease mortgage charges.

If provide begins to extend because of the house builders and maybe much less lock-in (with decrease mortgage charges), costs might ease as properly.

We might have a scenario the place dwelling costs don’t enhance all that a lot, which might permit incomes to catch up, particularly if inflation persists.

The housing market might have simply gotten forward of itself, because of the pandemic and people document low mortgage charges.

Just a few years of stagnation might clean these document years of appreciation and make housing inexpensive once more.

The place We Stand Proper Now

- There’s not extra housing provide (really very quick provide)

- There’s not widespread use of inventive financing (some low/0% down and non-QM merchandise exist)

- Hypothesis was rampant the previous few years however might have lastly cooled off because of charge hikes

- Residence costs are traditionally out of attain for the common American

- Unemployment is low and wages look like rising

- This sounds extra like an affordability disaster than a housing bubble

- However there’s nonetheless motive to be cautious transferring ahead

In conclusion, the present financial disaster, if we are able to even name it that, wasn’t housing-driven prefer it was in 2008. That’s the massive distinction this time round.

Nonetheless, affordability is a serious drawback, and there’s some emergence of inventive financing, resembling short-term buydowns and 0 down merchandise.

So it’s positively an space to look at as time goes on. But when mortgage charges ease again to cheap ranges, e.g. 5-6%, we might see a extra balanced housing market.

As at all times, keep in mind that actual property is native, and efficiency will range by market. Some areas will maintain up higher than others, relying on demand, stock, and affordability.

Learn extra: When will the subsequent housing crash happen?