Almost all the nation’s massive banks slashed their marketed mounted mortgage charges this week, in some circumstances by as a lot as 70 foundation factors (or 0.70%).

As we reported final month, numerous lenders have been dropping mounted mortgage charges to deliver them in step with funding prices following a pointy decline in bond yields, which lead mounted mortgage fee pricing.

This week, most massive banks, in addition to HSBC, lowered charges throughout all mortgage phrases, together with marketed 5-year charges, with insured (these with a down fee of lower than 20%) averaging 5.24% and uninsured at round 5.65%.

Nonetheless, we hear that well-qualified shoppers at choose banks are being provided high-ratio 5-year charges as little as 4.99% if they’re closing within the subsequent 30 days.

Different mortgage lenders have additionally been busy dropping charges, together with some on-line deep-discount brokers. As of Friday, Butler Mortgage was providing the bottom insured 5-year mounted fee of 4.69%, though that’s not out there in all provinces.

Ron Butler instructed CMT that the speed includes no restrictions or hidden penalties. For these wanting a shorter time period, Butler additionally presently has the bottom high-ratio 3-year mounted, now priced at 4.99%.

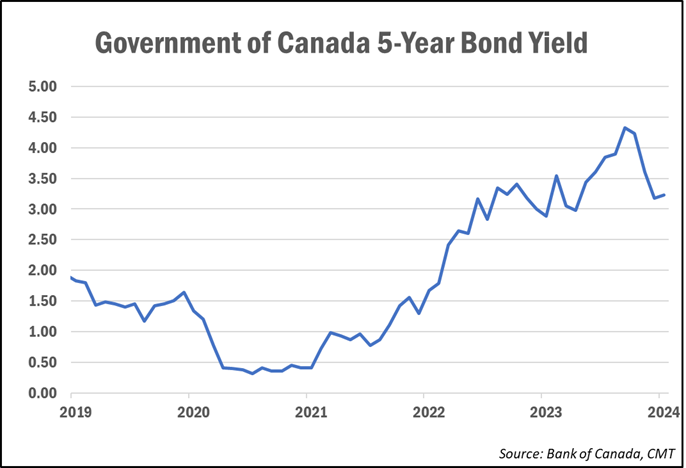

Charges have been falling steadily since October, mirroring the decline in Authorities of Canada bond yields, which have fallen over a full proportion level since peaking in early October.

Observers say the most recent fee transfer by all the massive banks this week is just to deliver their pricing in step with the present stage of bond yields.

“Charge cuts are all as a result of unfold being so excessive for thus lengthy I believe,” Ryan Sims, a TMG The Mortgage Group dealer and former funding banker, instructed CMT. “They had been raking it in, and bond yields had stayed down for thus lengthy, they wanted to regulate.”

Nonetheless, ought to yields begin to pattern again up, Sims mentioned debtors shouldn’t rule out the likelihood that charges pattern increased once more.

Variable charges anticipated to fall later this 12 months

Whereas mounted charges may proceed to fall additional, not less than one fee professional famous that bond yields—upon which mounted mortgage charges are priced—are foward-looking and have fallen in anticipation of financial coverage loosening later this 12 months. In consequence, additional fixed-rate cuts going ahead could possibly be restricted.

“Our present mounted mortgage charges have already priced in substantial fee cuts by the U.S. Federal Reserve and the BoC in 2024,” Dave Larock of Built-in Mortgage Planners wrote in a current weblog publish. “That reduces the potential for additional decreases.”

Variable mortgage charges, that are presently priced anyplace from 100 to 150 foundation factors above comparable mounted charges, are anticipated to fall all year long because the Financial institution of Canada delivers anticipated fee cuts.

“Anybody selecting a variable fee in the present day should consider that their fee will fall beneath in the present day’s out there mounted charges, and with sufficient time left on their time period to recoup the upper preliminary price plus some extra saving,” Larock famous.

“Meaning charges must begin falling considerably, and comparatively quickly,” he added. “I count on each issues to occur.”

Bond markets are presently pricing in a 74% likelihood of a quarter-point fee lower on the Financial institution’s March assembly, and a 30% likelihood of a further 50 bps in June. By September, markets see a 64% likelihood of 100-bps value of cuts to the present benchmark fee of 5.00%.

“When you’re out there for a mortgage in the present day, variable charges are value contemplating in the event you can tolerate fee threat and are ready to be affected person,” Larock wrote.

For these not keen to tackle the chance of a variable-rate simply but, Butler says a 1-year mounted fee is “optimum” proper now because it buys debtors time to reassess the speed setting in 12 months.

“For these renewing and who could have fee considerations, take a 3-year mounted to get a greater fee,” he recommended.