You’ve seen my plan for increase my retirement earnings (right here), and also you’ve despatched within the questions. On this article, I dive deeper into how I intend to receives a commission $5,000 per 30 days in retirement from my CPF funds alone, in addition to the steps I’m presently taking to get there.

Let’s begin with a fast recap – after we retire, most of us will nonetheless have bills to pay for. I’ve categorised them as follows:

- Fastened bills (price of dwelling)

- Journey bills to abroad nations

- Sudden bills (e.g. medical payments, substitute prices for residence home equipment attributable to extended use, and many others)

The quantity we’ll want in retirement all boils right down to how a lot our bills add as much as. Should you requested me, the perfect resolution includes planning for the anticipated prices of dwelling (my wants) and journey bills (my desires), whereas I depend on insurance coverage or my emergency funds for the sudden bills.

In securing the funds for my price of dwelling, I look to my assured retirement pot i.e. my CPF financial savings, which might and will likely be used to primarily cowl my mounted dwelling bills.

Enjoyable reality: A number of years in the past (in 2017), I did an estimate right here on this weblog about how a lot my desired retirement life-style (as a single in my 20s) could price me once I flip 65, which labored out to be S$1,800 – S$3,000 then.

Issues have modified since then. Inflation has gone up, and so have my spending patterns – I now spend extra when eating out and I’ve additionally elevated my bills on magnificence companies and self-importance merchandise.

So listed here are my newest estimates (based mostly on right this moment’s costs) as an alternative:

ESSENTIAL dwelling bills (per 30 days): S$2,900

| Sorts of Bills | Class | $ In the present day |

| Day by day requirements | Meals and groceries – family | $900 |

| Utilities (electrical energy & water) – family | $300 | |

| Public transport – self | $200 | |

| Telco & web – self | $200 | |

| Self-care | Eating out | $600 |

| Motion pictures | $100 | |

| Purchasing | $300 | |

| [New!] Magnificence companies | $300 |

You might have observed that not solely did I enhance the numbers for every merchandise, however I’ve additionally added 1 new class vs. my unique pre-kids model. For instance:

- Eating out: Again in 2017, $30 was once ample for me for a meal and drink at a pleasant café with pals. In my retirement years I’d like to have the ability to proceed the custom of eating out with my youngsters. I additionally don’t need them to really feel obligated to foot the invoice. Factoring the rise in price, I’ve estimated S$600 for this class for now.

- Magnificence companies: In my 20s, I didn’t care an excessive amount of about skincare or magnificence dietary supplements. Nonetheless, upon coming into my 30s, it takes much more effort for me to take care of my appears to be like and well being! I now take multi-vitamins, collagen dietary supplements, probiotics and fibre repeatedly.

By the point I’m in my 60s, my youngsters could be of their mid-30s and are more likely to be working for a while so I received’t have to fret about setting apart cash in my retirement for his or her college or tuition charges.

Be aware: when you nonetheless must financially assist your youngsters’s schooling in retirement, remember to issue that into your monetary plans!

And naturally, if cash isn’t an issue, I’d additionally like to journey and discover the world in my retirement years. In probably the most preferrred scenario, this is able to be my journey plans:

IDEAL Leisure bills (per 12 months): ~S$16,000

| A 1-week trip in Asia every quarter | $1,500 x 4 = $6,000 |

| A 2-week trip out of Asia yearly | $10,000 |

I’m conscious that this plan is sort of “luxurious” and that over time, it should price extra. If sooner or later, there’s a must be extra prudent, this would be the class I’ll evaluation.

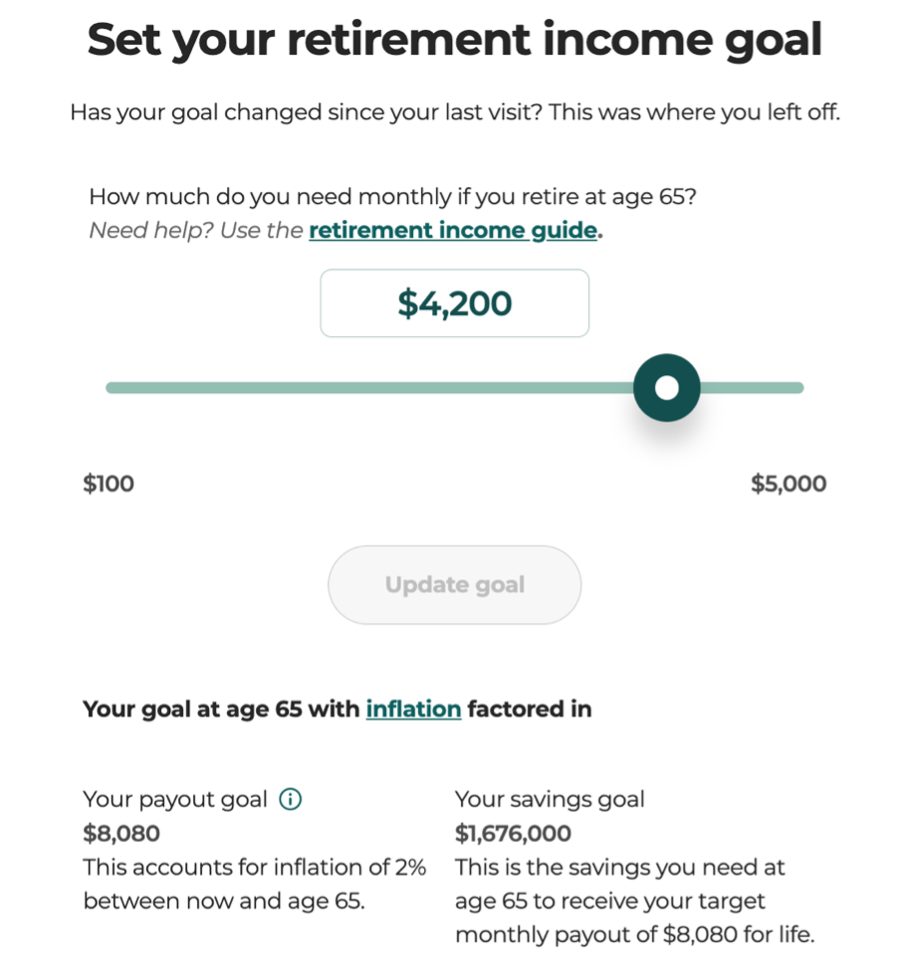

Including each classes will quantity to $50,800 of bills in a 12 months, or roughly S$4,200 a month.

Based mostly on these estimates, I ought to thus plan to have at the very least S$4,200 / month in retirement if I need to take pleasure in such a way of life (one that features 5 journeys overseas every year).

That is based mostly on right this moment’s {dollars}, which implies if I assume a 2% yearly inflation fee between now till I hit age 65, it interprets to at the very least $8,000 a month in retirement.

Hmm, that’s rather a lot.

What if I took journey out of the equation, and used the $2,900 projected determine for my estimated price of dwelling as an alternative?

With that, the determine now modifications to $5,500 per 30 days in retirement once I flip 65.

Sounds extra sensible, so let’s work with that first.

The following query is, can I get to that with my CPF financial savings?

How can I get $5,000 month-to-month from CPF?

To reply this query, I used the CPF planner – retirement earnings (“CPF Planner”) to inform me whether or not I’m on observe.

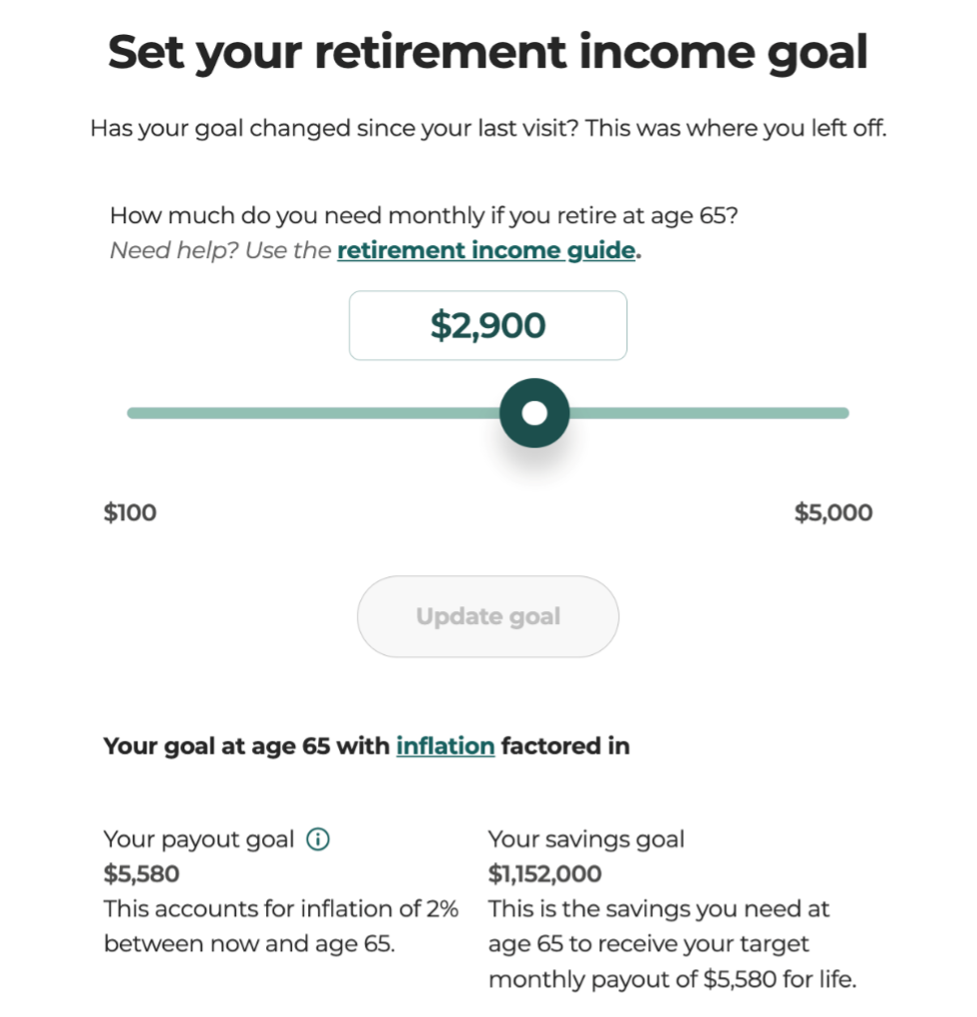

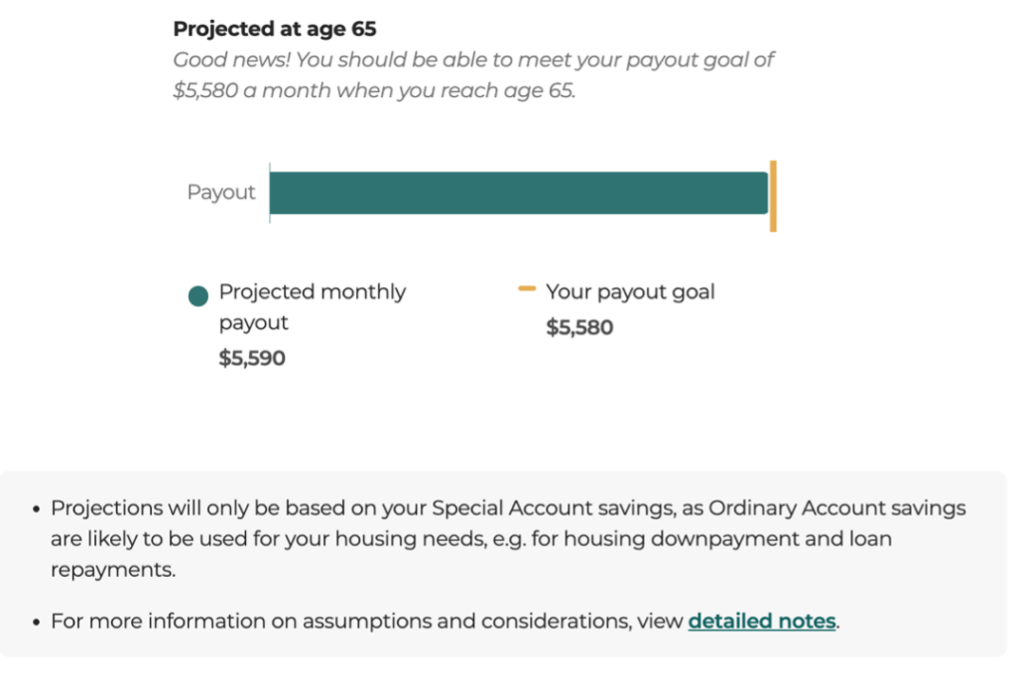

I keyed in my estimated bills of $2,900 (based mostly on right this moment’s {dollars}) into the calculator, and with inflation factored, it quantities to $5,580. To attain that payout objective, I used to be knowledgeable that I wanted to work in the direction of a financial savings objective of $1,152,000.

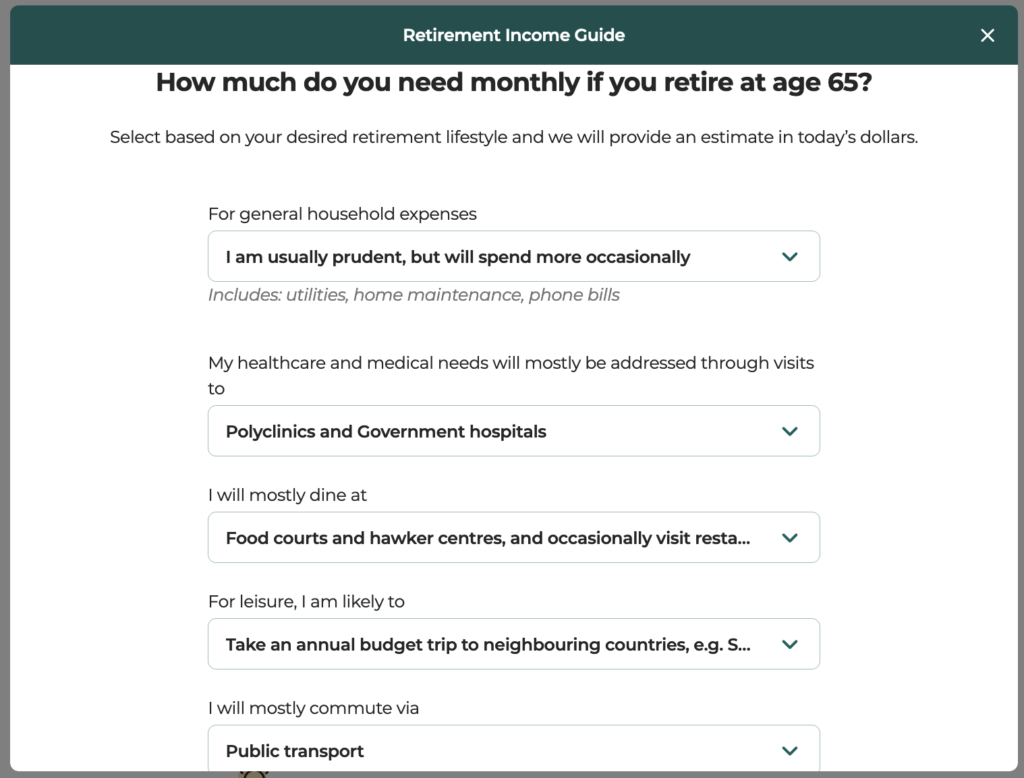

Sidenote: Should you’ve no thought how a lot you’ll want, you’ll be able to estimate by clicking on the “retirement earnings information” (see screenshot under). It can information you to derive a retirement life-style that you just favor.

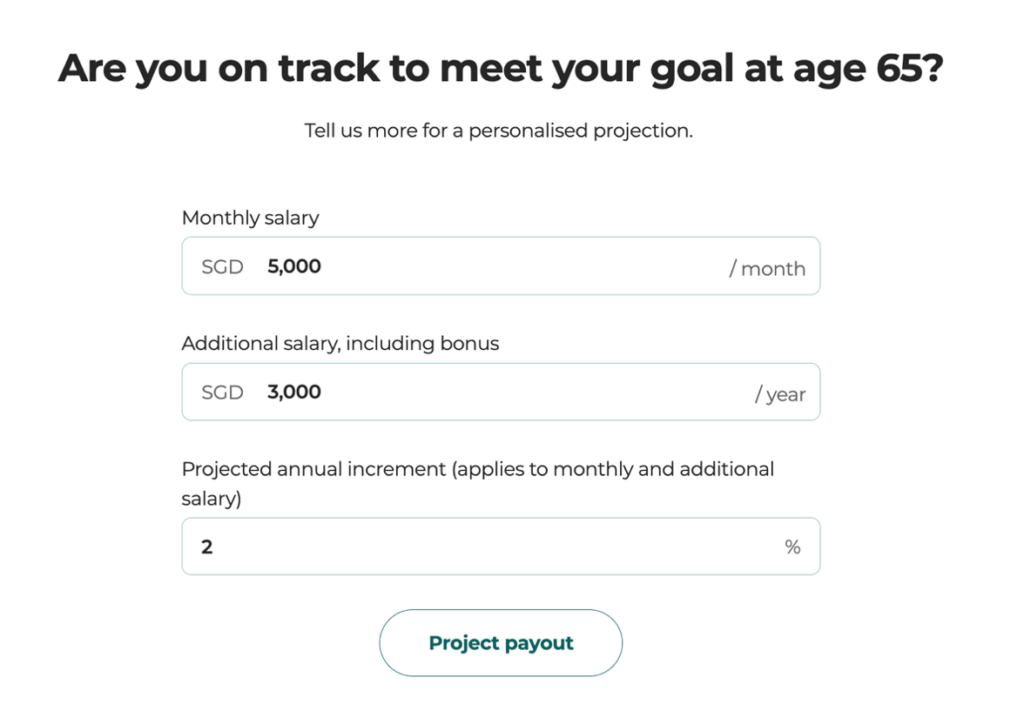

I then proceeded to enter my estimated employment earnings (throughout my working years from now till age 65) in order that the calculator can undertaking whether or not my CPF contributions will likely be ample to get me to my objective.

I’ve used $5,000 as a benchmark, which was how a lot I used to be drawing in my final job. Though I’ve by no means acquired a bonus in my whole working life (sure, no 13th month bonus both), I’ll assume that my fortunate stars will assist me discover a future boss who will give me a S$3,000 yearly bonus every year…in any other case, I’ll merely have to seek out different means to get this for myself (equivalent to via a aspect hustle, and many others).

I’ve projected a 2% annual increment consistent with historic inflation charges, though to be sincere, the one occasions I’ve gotten a wage increment was once I switched to a different firm.

Fortunately, the CPF planner projected that I ought to be capable to meet my payout objective – based mostly on my present CPF financial savings. For these of you who’re questioning, my Particular Account presently has >90% of right this moment’s Full Retirement Sum (2023).

Okay, however what about if I had been to account for my desired journey life-style bills on this calculation too?

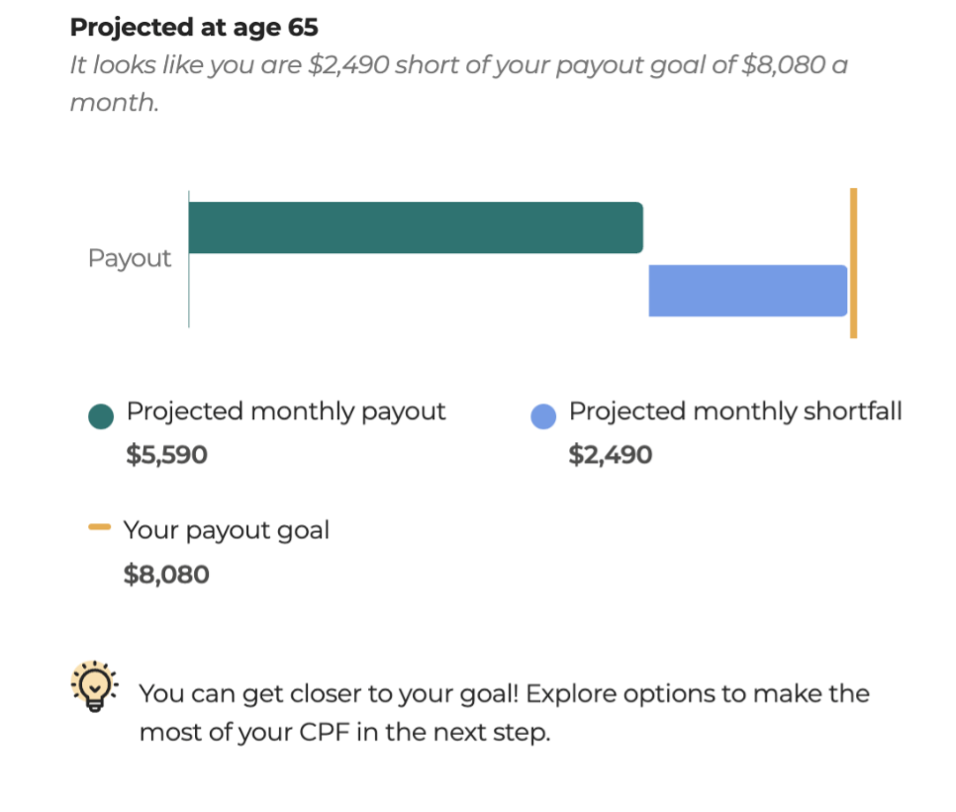

Utilizing S$4,200 a month (in right this moment’s {dollars}), the calculator knowledgeable that my CPF financial savings could be inadequate in assembly my desired retirement life-style.

So, what’s going to it take for me to satisfy my dream retirement objectives?

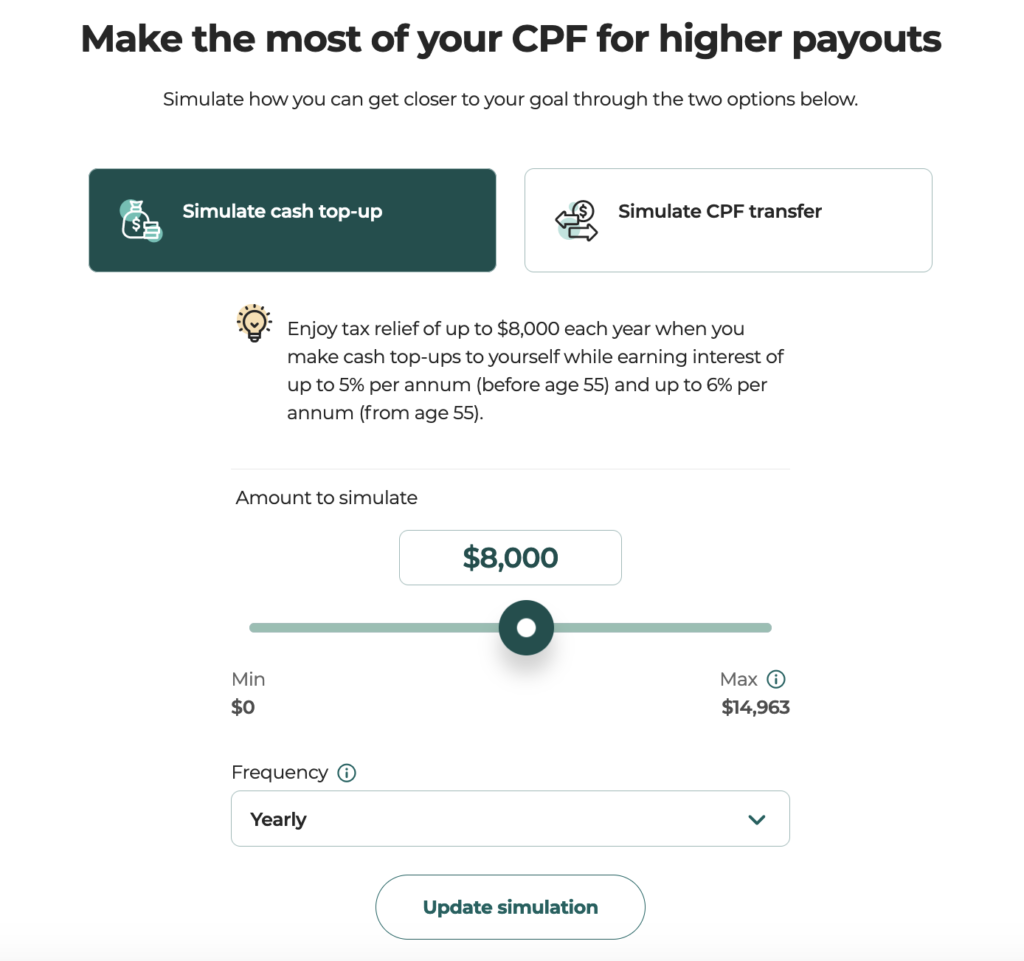

Effectively, that is the place the CPF planner can simulate eventualities ought to we determine to take lively steps to work in the direction of it, for instance, if we had been to switch our Abnormal Account (OA) funds to our Particular Account (SA), or if we had been to make a money top-up through the Retirement Sum Topping Up (RSTU) scheme.

Sidenote: I’ve already been periodically transferring my OA funds into my SA since my mid-20s, so there are little or no funds in my OA (the quantity I’ve saved in there may be principally for liquidity functions i.e. ample solely to pay for 12 months of our housing mortgage). For me, transferring all the funds out is not going to make a lot of a distinction to my retirement plan, so I’ll must do a money top-up as an alternative.

Do you know that you may get hold of tax reliefs if you select to prime up your CPF? The sum has since elevated in 2022, from S$7,000 to S$8,000.

See my projection under:

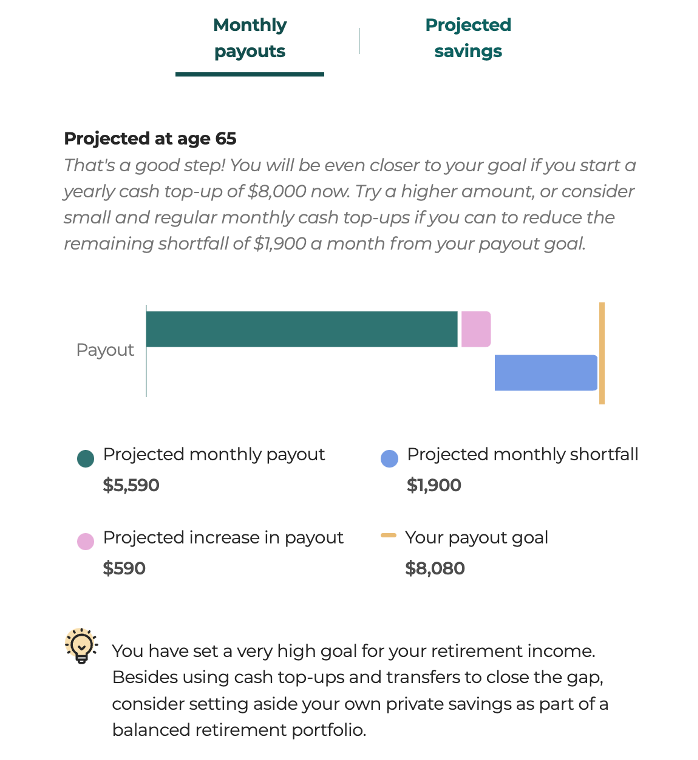

Do be aware that the topping up projections are topic to prevailing top-up limits. If you’re incomes a better earnings and/or near the present FRS (like me), even a $8,000 voluntary money top-up yearly could not undergo in full every year.

Thus, even when I had been to proceed my present apply of topping up S$8,000 yearly, it is not going to get me nearer to financing my 5x yearly journey aspirations. I might want to both regulate my expectations or fund my travels from different sources of retirement earnings.

Therefore, the CPF planner makes it clear that whereas my present CPF financial savings are ample to finance my primary retirement wants, it is not going to be sufficient to totally finance the extent of my journey aspirations in retirement – I might want to fund that from one thing aside from my CPF as properly.

Which is why I’m working laborious on increase further sources of retirement earnings – keep tuned to my weblog for extra particulars on how.

Conclusion

Utilizing the CPF planner, I can loosen up, figuring out that my CPF financial savings will likely be ample to pay for my mounted bills in my retirement years.

But when I had been to hope for my CPF funds to pay for my 5 journey journeys a 12 months, that will likely be an excessive amount of. With that extent of journey, my present CPF financial savings received’t be sufficient to fund my desired journey life-style in my retirement years. Even when I had been to make a voluntary money top-up of S$8,000 yearly with out fail, it should nonetheless be inadequate.

The device then goes on to advocate that I additionally use my non-public financial savings as a part of a balanced retirement portfolio, which I absolutely agree with.

In fact, there are a number of limitations to this device, together with:

- A 2% inflation fee is utilized to the preliminary retirement earnings objective that you just enter (in right this moment’s {dollars}) to compute your payout objective at age 65.

- Should you didn’t enter your personal quantity for that web page, however used the projected quantity based mostly on the retirement earnings information as an alternative, you must be aware that the retirement life-style decisions offered are based mostly on expenditure from the Family Expenditure Survey 2017/18. This will likely or is probably not an correct reflection of your personal spending ranges and habits.

- Since projections are based mostly on the salary-related particulars you offered, the device assumes that you just stay employed all through the projection interval. Within the occasion of any extended unemployment, your finish outcomes could fluctuate from the preliminary estimations that you just obtained from the planner. For the self-employed or gig employees, or anybody whose wage fluctuates significantly, the accuracy of the estimated projection could fluctuate over a chronic time frame.

In time to come back, I hope to see the device being refreshed with choices for us to mess around with inflation charges – particularly now that inflation has remained far above the two% fee for nearly 2 years now.

In any case, as a salaried Singaporean employee, your CPF is probably going going to be your first, if not your greatest, retirement pot. It’ll be worthwhile to be sure you optimise your CPF for the very best returns (equivalent to making voluntary money top-ups and transferring your Abnormal Account funds into your Particular Account) and to work in the direction of your most popular payout to satisfy your retirement objectives.

Click on right here to test whether or not your CPF is on observe!

Disclosure: This text is written in collaboration with CPF Board, who has a nifty CPF planner – retirement earnings device to assist Singaporeans visualise and plan for his or her retirement.