These are the freefincal handpicked listing of mutual funds for Jan-Mar 2024. New and previous buyers can use it in response to their particular wants. The listing known as “PlumbLine” and has been printed since September 2017 for learners to accompany the freefincal robo advisor software.

Most necessary! Plumbline is a mixture of my opinions + pores and skin within the sport (the place I make investments) plus quantitative picks (performance-based). For a portfolio replace, see Portfolio Audit 2023: The Annual Evaluate of My Purpose-based Investments.

It’s not meant to fulfill everybody! It’s supposed to match up with my integrity. Readers new to Plumbline ought to learn the next two sections fastidiously earlier than continuing to the fund names.

The target is to determine “some” funds for each attainable funding length as a part of a diversified portfolio.

If you wish to select fairness mutual funds in classes of your selection by constant efficiency alone, or if you wish to select debt funds by the standard of their portfolio, you should use our month-to-month fairness mutual fund, mutual debt fund, index fund or ETF screeners.

What’s Plumbline, and the way ought to I take advantage of it?

A plumbline is an alignment gadget that fixes the vertical or the horizontal. This listing known as Plumbline and signifies the necessity for fund decisions to align with particular necessities.

1: PlumbLine is a boring listing of mutual funds up to date each quarter. There are many good mutual funds that aren’t a part of Plumbline. In case your funds are totally different, you’re in all probability higher off. Don’t worry about it.

2: Don’t use PlumbLine to substantiate your decisions! PlumbLine is supposed for buyers who’ve used the freefincal robo advisory software.

3: If the funds within the listing change tomorrow, you’ll have to take a name on what it’s essential do primarily based on the fund efficiency from the date you invested. I can not enable you right here apart from speaking about evaluate.

4: This can be a handpicked listing and will likely be topic to my biases. I make investments with a bias to get issues completed and analyze with out bias to current information. So please bear this distinction in thoughts.

5: This can be a goal-based listing and never a category-based listing. That’s, you’ll not discover one fund per class. You will see at the very least one fund per want (objective and risk-taking potential)

Disclaimer: By itself, this listing has no which means, and except you have a look at it from the precise perspective and context, it is not going to enable you. The hope is that the robo-advisor software will present such a perspective that you just nonetheless should course of and interpret. Lastly, I’m solely human and greater than able to making errors.

Additionally, I’m a below-average investor and fund picker or analyzer. I’m not a fan of wanting into the fund portfolio. I choose funds with a slim funding mandate. I’m certain you’ll agree that the majority picks are lame and apparent, and this listing is a no brainer and nothing particular. If the funds right here cease performing sooner or later or have credit score default points, all I can do is modify the listing (if required). Be aware: All statements about low or excessive threat are relative to different forms of funds and never absolute.

The creator/editor or freefincal is not going to be in any manner liable for your funding decisions, capital features or losses. If a PlumbLIne fund is current in your portfolio, it means nothing. It means nothing if none of your funds is within the PlumbLine listing. Mutual funds (and mutual fund suggestions) are topic to ignorance and market dangers. Please learn and perceive all scheme-related paperwork earlier than investing.

FAQ on Plumbline

1. “Why are X, Y or Z funds not a part of Plumbline?” —> Plumbline is my listing. Don’t count on me to make an inventory that matches your expectations.

2. “The funds you’ve gotten listed are usually not even 4-star funds”. —> I don’t care. Star scores are injurious to your psychological and monetary well being. Comparisons with Plumbline are injurious to peace of thoughts.

3. “Plumbline doesn’t characteristic the highest funds out of your month-to-month screener “. —> Yeah, as a result of I don’t at all times seek the advice of it. Plumbline is a qualitative + quantitative evaluation of a fund’s funding technique, mandate and efficiency.

4. “Your listing is biased and a fan of sure funds and sure AMCs”. –> Okay then, thanks for not utilizing it.

5. In case you are a brand new mutual fund investor, obtain this Free e-book: Mutual Fund FAQ 100 important Q & A for brand spanking new buyers!

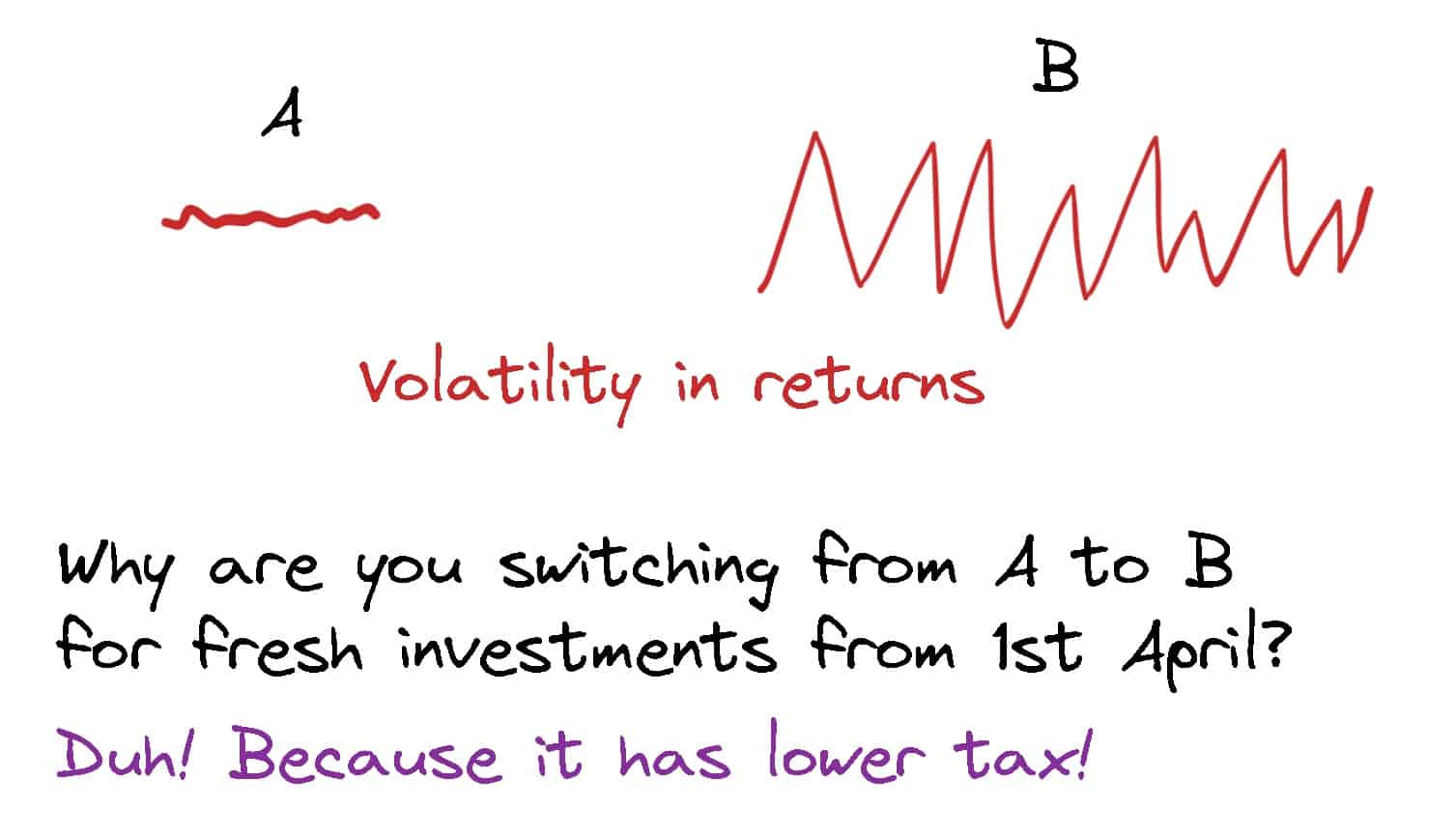

What in regards to the change in tax standing from 1st April 2023? Will it have an effect on the listing? Make investments merchandise ought to be chosen primarily based on want and if their threat is appropriate for a necessity, not due to a change in tax guidelines. Skilled buyers can contemplate choices, however all of them come at a value. Additionally see: New debt fund tax rule: How do I modify my funding technique?

Liquid Fund

- Funding Period Few months and above

- Fund identify Quantum Liquid fund Direct Plan-Progress Possibility, Parag Parikh Liquid Fund

- You may as well select funds from established AMCs like ICICI, SBI or HDFC.

- Nature Conservative: these funds spend money on short-term bonds as much as 91 days in maturity.

- Rate of interest threat: low. The NAV can fall if there’s a sudden demand-supply mismatch out there. For instance, in March 2020, the demand fell beneath provide. The NAV can even fall if the RBI charge out of the blue will increase considerably (e.g., July 2013). In each circumstances, restoration would often be swift.

- Credit score threat: low

- Appropriate for Use for parking cash

- Returns: a bit greater than an SB account

- Caveats: Debt fund portfolios change every month; whereas each funds are likely to keep away from credit score threat, buyers can sometimes examine the credit score high quality of the portfolio

- Disclosure: Invested in quantum liquid for emergencies. A small money section of my retirement portfolio can be right here.

- Additionally, Can I take advantage of liquid funds for long-term targets with fairness MFs?

- Professional tip: If the star ranking of a liquid fund bothers you, have a look at the credit score high quality of the portfolio. Sometimes, the upper the credit score high quality, the decrease the return and, subsequently, the star ranking. There is not going to be a lot return distinction on this class between a five-star ranking fund and a one-star rated fund. So select correctly.

Fairness Arbitrage

- Period 1Y and above (by no means use for shorter-term)

- Nature: These are hybrid funds now! They will make investments as much as 35% in bonds! The vast majority of the portfolio (65% plus) is arbitrage like “money and carry arbitrage” (linked beneath). The funds have debt fund-like volatility by building. Risky for lower than a yr. Quarterly returns could be adverse. Risky when the market is turbulent.

- Many arbitrage funds spend money on debt funds from the identical AMC to spice up returns. These debt funds could carry credit score threat!

- These funds at the moment are marketed as a “wealthy man’s liquid fund”!

- There may be nothing particular in regards to the fund talked about beneath. Greater than a advice, it’s talked about as a result of it’s what I take advantage of. For options, use our debt mutual fund screener.

- Fund identify ICICI Fairness Arbitrage Fund-Direct Plan Progress Possibility. (There may be nothing particular about this; different good/higher funds are within the class.)

- We will preserve an out for the providing from Parag Parikh AMC.

- Be aware: There is not going to be a lot distinction in threat and reward between a 5-star arbitrage fund and a 3-star rated one.

- Rate of interest threat: low Relevant to bond a part of the portfolio.

- Credit score threat is fairly low (relevant to the bond a part of the portfolio), however credit score occasions are definitely attainable. You need to use our debt fund screener to examine the bond high quality of those funds. The ICICI fund usually has a small publicity to AA-rated bonds sometimes. If that bothers you, then don’t make investments on this.

- Warning: After the SEBI recategorization, arbitrage funds solely want to carry 65% in derivatives. The remainder are in bonds. So, these funds could be topic to credit score and rate of interest dangers. Sometimes, the fairness allocation could drop decrease than 65%.

- Different dangers Unsure durations, like after a crash, may cut back arbitrage alternatives and returns. If you happen to select the funding length proper, the primary threat would be the fund delivering a lower-than-expected return. So count on much less!

- Appropriate for parking cash, medium-term targets and producing revenue. See: Producing tax-free revenue from arbitrage mutual funds.

- Returns Anticipate about 4-6% ish pre-tax.

- Con: Complicated product. It is advisable perceive how the product works. Do this: How Arbitrage Mutual Funds Work: A easy introduction.

- Disclosure: ICICI Fairness Arbitrage is a part of the debt portfolio for my son’s training objective. My spouse additionally makes use of it individually as a part of our emergency fund.

Cash market/ Extremely Quick-term

- Period 1Y and above

- Funds: ICICI Pru Cash Market Fund See Evaluate: When & use it. HDFC Cash Market Fund.

- That is one class the place there’s not a lot distinction within the credit standing profile of the fund portfolios. So there’s nothing particular in regards to the above funds.

- Nature: Conservative however count on day-to-day NAV ups and downs resulting from demand-supply fluctuations. These funds are invested within the cash market, the place money is the commodity. The bonds are short-term in nature (low-interest charge threat);

- Credit score threat is comparatively low, however defaults are attainable.

- Rate of interest threat: low (resulting from buyers pulling out from the debt market, these funds fell about 1% from 11-Twenty fifth March however recovered when RBI eliminated extra liquidity by shopping for bonds and decreasing charges by March 27 2020)

- Appropriate for saving cash, producing revenue, for short-medium time period targets

- Returns Anticipate FD-like returns

- Disclosure: I’ve not invested as it’s pointless for my wants.

Gilt Lengthy-Time period

Traders should respect that these funds are additionally dynamic bond funds and may have variable curiosity, length, and demand-supply dangers.

- HDFC Gilt Fund Direct Plan-Progress Possibility

- ICICI Pru Gilt Fund Direct Plan-Progress Possibility

- SBI Gilt Fund Direct Plan-Progress Possibility

- Every fund on this class would have its fashion. So, buyers should research the historical past of funding fashion from factsheets earlier than investing. See: How to decide on a gilt mutual fund.

- Appropriate just for long-term targets. For first-time buyers, 10Y or extra. The NAV will fluctuate quickly right here, too, however lower than the 10Y gilt class.

- It can provide years of poor returns! Solely for individuals who are affected person!

- Disclosure: I’m invested within the ICICI Gilt fund. See: Why I partially switched from ICICI Multi-Asset Fund to ICICI Gilt Fund.

Conservative Hybrid

- Period: Strictly long run, at the very least 10Y or extra, with correct asset allocation and periodic rebalancing.

- Parag Parikh Conservative Hybrid Fund Direct Plan-Progress Possibility

- It may be used as a substitute for gilt funds* as a debt part in a long run portfolio.

- *This fund invests in long-term state authorities bonds + a small quantity of fairness + a small quantity in REITs. Throughout inventory market crashes, the NAV will fall! So be ready for this. The NAV will likely be unstable even on regular days!

- Additionally see: Who ought to spend money on Parag Parikh Conservative Hybrid Fund?

- Disclosure: I’m invested on this fund for each long-term targets. See: Why I began to spend money on Parag Parikh Conservative Hybrid Fund.

- Be aware: I’ll direct future investments within the tax-efficient Parag Parikh Dynamic Asset Allocation Fund as a result of, for my wants, this new fund has an identical threat profile. I don’t suggest this to everybody. See: Parag Parikh Dynamic Asset Allocation Fund: Who ought to make investments?

“Worldwide” Fairness

(1) I don’t suppose buyers should spend money on worldwide fairness. All this discuss “diversification” is, properly, speak. Most buyers can not measure the impression of worldwide fairness of their portfolios. They need a slice of one thing shiny, ignoring that each the Nasdaq 100 and the S&P 500 have seen years of sideways markets up to now, and it may occur once more. Additionally see: Sensex vs. S&P 500 vs. Nasdaq 100: Which is best for the long run?

(2) Investing in worldwide fairness is sensible provided that it comes with low upkeep and advantageous taxation, e.g. Parag Parikh Flexicap Fund.

Fairness Tax planning

Earlier than finances 2023, we opined that this class was pointless. Now, it has grow to be a truth. RIP the previous tax regime. Welcome the brand new tax regime. Additionally see: Funds 2023 needs us to shift from tax-saving to wealth-creation mode – are we prepared?

Hybrid Funds (equity-oriented)

- Period: Deal with all such funds as pure fairness funds, so they’re strictly long-term. Use our robo software for allocation.

- The next funds have a constant monitor document in opposition to the Crisil Hybrid 65:35 Index.

- ICICI Prudential Fairness & Debt Fund – Direct Plan-Progress

- Canara Robeco Fairness Hybrid Fund – Direct Plan-Progress

- Mirae Asset Hybrid Fairness Fund

- SBI Fairness Hybrid Fund Direct Plan-Progress choice

- HDFC Hybrid Fairness -Direct Plan – Progress Possibility*

- *Its efficiency consistency is a bit decrease than these talked about above.

- ICICI Multi-asset Fund Direct Plan-Progress choice (this holds a minimal of 10% of gold and 10% of bonds always however is equity-oriented resulting from legacy; I’ve been an investor on this fund because it was ICICI Dynamic Fund. The fairness allocation will likely be decided utilizing an in-house mannequin much like what they publish in month-to-month factsheets and used for funds like ICICI Balanced Benefit).

- Those that wish to spend money on gold for “diversification” can contemplate this multi-asset fund.

- Threat is barely decrease than that of diversified fairness funds, so deal with them as pure fairness.

- Disclosure: I’m invested in HDFC Hybrid Fairness for retirement and ICICI Multi-asset for my son’s future portfolio.

Flexi-cap/ Massive midcap/Multi-cap

Index funds (giant cap)

- Period: Strictly long-term with correct asset allocation. Use our robo software for allocation.

- UTI Nifty Index Fund-Direct Plan-Progress Possibility or

- HDFC Sensex Index Fund-Direct Plan-Progress Possibility or

- HDFC Index Fund-NIFTY 50 Plan(G)-Direct Plan

- Who ought to use it? If you happen to want to undertake a passive investing technique (get rid of fund supervisor dangers) and wish to monitor a much less unstable large-cap index.

- Index funds don’t present draw back safety (fall decrease than the index) or upside efficiency (transfer greater than the index). Whether or not that is necessary or not is as much as you. I want to take a extra balanced strategy to passive investing as an alternative of assuming all energetic funds will fail to beat the index. No, they don’t, not even within the US right now: 582 US Massive cap funds outperformed the S&P 500 during the last ten years.

- What we do know for certain is that about 50% of funds in every class wrestle to beat the index. On the very least, this state of affairs is prone to proceed in future. Subsequently, select passive funds provided that you respect that choosing future energetic fund winners is inconceivable.

- Lively funds present draw back safety extra usually than they beat the index.

Please notice that to imagine draw back safety is ineffective if it doesn’t end in extra return is hindsight bias. Threat is within the journey. Returns are at all times in hindsight.

Index Fund Mix (giant + midcap)

Be aware about Nifty Subsequent 50: We nonetheless consider in Nifty Subsequent 50 as a passive mid cap funding even when many buyers have misplaced curiosity in it. Nevertheless, it may be irritating to carry. So if holding Nifty Subsequent 50 makes you uncomfortable, enhance publicity in Nifty or Sensex.

- Period: Strictly long-term with correct asset allocation. Use our robo software for allocation. 80% of Nifty 50 or Sensex + 20% of Nifty Subsequent 50

- Fund names: UTI Nifty Subsequent 50 direct plan progress choice or ICICI Nifty Subsequent 50 Direct Plan-Progress Possibility. Massive cap fund (Nifty/Sensex) as above.

- Who ought to use it? Solely those that respect Index investing advantages and people who is not going to chase after stars or evaluate with friends.

- Those that want to spend money on lower than 20% of Nifty Subsequent 50 can contemplate the Axis Nifty 100 Index fund. Learn the evaluate right here: Axis Nifty 100 Index Fund Efficiency Report.

- Why? See: Mix Nifty; Nifty Subsequent 50 funds to create giant, mid cap index portfolios.

Disclosure: I’m invested in UTI Low Volatility Index Fund – see UTI S&P BSE Low Volatility Index Fund Evaluate. Nevertheless, it requires extra time to think about a generic advice. So, it’s on our watchlist. Additionally, Why are you recommending index funds however not investing in them your self?

It ought to be no shock that there are not any energetic giant cap funds on our listing: Solely 5 Massive Cap funds have comfortably crushed the Nifty 100. So there isn’t a level in utilizing an energetic giant cap fund anymore.

Mid cap & Small Cap

Small cap funds could be fairly irritating to carry. They lose nearly all of the features from a bull run within the subsequent bear run. So our advice is to keep away from them altogether. See:

Sadly, opposite to widespread opinion, mid cap mutual fund managers wrestle to beat the index. See:

Subsequently, we keep away from recommending any particular funds right here. The little publicity to those classes from a Flexi-cap or aggressive hybrid fund is sufficient for many buyers, in my view.

You possibly can seek the advice of the newest fairness mutual fund screener if you need constant performers amongst energetic mid cap or small cap funds.

- If you happen to want to spend money on small cap funds, we consider blind SIPs are inefficient. Some methods to periodically guide revenue could also be vital. As well as, you might contemplate tactical entry.

- If you happen to want to purchase a mid cap fund:

- At present, we don’t suggest Midcap (or small cap) Index funds. See: Not all index funds are the identical! Past the highest 100 shares, monitoring errors are big!

- Period: Strictly long-term with correct asset allocation. Use our robo software for general allocation.

- Allocation: Don’t exceed 40-50% inside the fairness portion. Your midcap + smallcap allocation mustn’t exceed 40-50% of your fairness allocation. For instance, 60% giant cap + 30% midcap + 10% small cap (for those who should!). A big cap-dominated portfolio is beneficial.

Closing Remarks

The fund names talked about above are of little use in case your investments are usually not aligned with targets and also you have no idea consider them in a structured method. We suggest that buyers determine their targets, select an acceptable asset allocation plan, and contemplate investments. Here’s a information: How one can carry out a portfolio audit? Right here is an instance of how Avadhoot Joshi evaluates his funding portfolio.

Do share this text with your pals utilizing the buttons beneath.

🔥Take pleasure in large reductions on our programs, robo-advisory software and unique investor circle! 🔥& be part of our neighborhood of 5000+ customers!

Use our Robo-advisory Device for a start-to-finish monetary plan! ⇐ Greater than 1,000 buyers and advisors use this!

New Device! => Monitor your mutual funds and inventory investments with this Google Sheet!

Podcast: Let’s Get RICH With PATTU! Each single Indian CAN develop their wealth!

You possibly can watch podcast episodes on the OfSpin Media Pals YouTube Channel.

- Do you’ve gotten a remark in regards to the above article? Attain out to us on Twitter: @freefincal or @pattufreefincal

- Have a query? Subscribe to our publication with the shape beneath.

- Hit ‘reply’ to any e-mail from us! We don’t supply customized funding recommendation. We will write an in depth article with out mentioning your identify if in case you have a generic query.

Be a part of over 32,000 readers and get free cash administration options delivered to your inbox! Subscribe to get posts through e-mail!

Discover the location! Search amongst our 2000+ articles for data and perception!

About The Writer

Dr. M. Pattabiraman(PhD) is the founder, managing editor and first creator of freefincal. He’s an affiliate professor on the Indian Institute of Know-how, Madras. He has over ten years of expertise publishing information evaluation, analysis and monetary product growth. Join with him through Twitter, Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You could be wealthy too with goal-based investing (CNBC TV18) for DIY buyers. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on numerous cash administration subjects. He’s a patron and co-founder of “Price-only India,” an organisation selling unbiased, commission-free funding recommendation.

Dr. M. Pattabiraman(PhD) is the founder, managing editor and first creator of freefincal. He’s an affiliate professor on the Indian Institute of Know-how, Madras. He has over ten years of expertise publishing information evaluation, analysis and monetary product growth. Join with him through Twitter, Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You could be wealthy too with goal-based investing (CNBC TV18) for DIY buyers. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on numerous cash administration subjects. He’s a patron and co-founder of “Price-only India,” an organisation selling unbiased, commission-free funding recommendation.

Our flagship course! Be taught to handle your portfolio like a professional to realize your targets no matter market situations! ⇐ Greater than 3,000 buyers and advisors are a part of our unique neighborhood! Get readability on plan on your targets and obtain the required corpus it doesn’t matter what the market situation is!! Watch the primary lecture at no cost! One-time fee! No recurring charges! Life-long entry to movies! Scale back worry, uncertainty and doubt whereas investing! Learn to plan on your targets earlier than and after retirement with confidence.

Our new course! Improve your revenue by getting individuals to pay on your expertise! ⇐ Greater than 700 salaried workers, entrepreneurs and monetary advisors are a part of our unique neighborhood! Learn to get individuals to pay on your expertise! Whether or not you’re a skilled or small enterprise proprietor who needs extra shoppers through on-line visibility or a salaried individual wanting a facet revenue or passive revenue, we are going to present you obtain this by showcasing your expertise and constructing a neighborhood that trusts you and pays you! (watch 1st lecture at no cost). One-time fee! No recurring charges! Life-long entry to movies!

Our new guide for youths: “Chinchu will get a superpower!” is now out there!

Most investor issues could be traced to a scarcity of knowledgeable decision-making. We have all made unhealthy selections and cash errors once we began incomes and spent years undoing these errors. Why ought to our youngsters undergo the identical ache? What is that this guide about? As mother and father, what wouldn’t it be if we needed to groom one potential in our youngsters that’s key not solely to cash administration and investing however to any side of life? My reply: Sound Choice Making. So on this guide, we meet Chinchu, who’s about to show 10. What he needs for his birthday and the way his mother and father plan for it and train him a number of key concepts of decision-making and cash administration is the narrative. What readers say!

Should-read guide even for adults! That is one thing that each dad or mum ought to train their children proper from their younger age. The significance of cash administration and determination making primarily based on their needs and wishes. Very properly written in easy phrases. – Arun.

Purchase the guide: Chinchu will get a superpower on your little one!

How one can revenue from content material writing: Our new e book is for these concerned about getting facet revenue through content material writing. It’s out there at a 50% low cost for Rs. 500 solely!

Wish to examine if the market is overvalued or undervalued? Use our market valuation software (it can work with any index!), or get the Tactical Purchase/Promote timing software!

We publish month-to-month mutual fund screeners and momentum, low-volatility inventory screeners.

About freefincal & it is content material coverage. Freefincal is a Information Media Group devoted to offering unique evaluation, experiences, evaluations and insights on mutual funds, shares, investing, retirement and private finance developments. We achieve this with out battle of curiosity and bias. Comply with us on Google Information. Freefincal serves greater than three million readers a yr (5 million web page views) with articles primarily based solely on factual data and detailed evaluation by its authors. All statements made will likely be verified with credible and educated sources earlier than publication. Freefincal doesn’t publish paid articles, promotions, PR, satire or opinions with out information. All opinions will likely be inferences backed by verifiable, reproducible proof/information. Contact data: letters {at} freefincal {dot} com (sponsored posts or paid collaborations is not going to be entertained)

Join with us on social media

Our publications

You Can Be Wealthy Too with Purpose-Based mostly Investing

Printed by CNBC TV18, this guide is supposed that can assist you ask the precise questions and search the right solutions, and because it comes with 9 on-line calculators, you may also create customized options on your life-style! Get it now.

Printed by CNBC TV18, this guide is supposed that can assist you ask the precise questions and search the right solutions, and because it comes with 9 on-line calculators, you may also create customized options on your life-style! Get it now.

Gamechanger: Overlook Startups, Be a part of Company & Nonetheless Stay the Wealthy Life You Need

This guide is supposed for younger earners to get their fundamentals proper from day one! It is going to additionally enable you journey to unique locations at a low price! Get it or present it to a younger earner.

This guide is supposed for younger earners to get their fundamentals proper from day one! It is going to additionally enable you journey to unique locations at a low price! Get it or present it to a younger earner.

Your Final Information to Journey

That is an in-depth dive evaluation into trip planning, discovering low cost flights, finances lodging, what to do when travelling, and the way travelling slowly is best financially and psychologically, with hyperlinks to the online pages and hand-holding at each step. Get the pdf for Rs 300 (immediate obtain)

That is an in-depth dive evaluation into trip planning, discovering low cost flights, finances lodging, what to do when travelling, and the way travelling slowly is best financially and psychologically, with hyperlinks to the online pages and hand-holding at each step. Get the pdf for Rs 300 (immediate obtain)