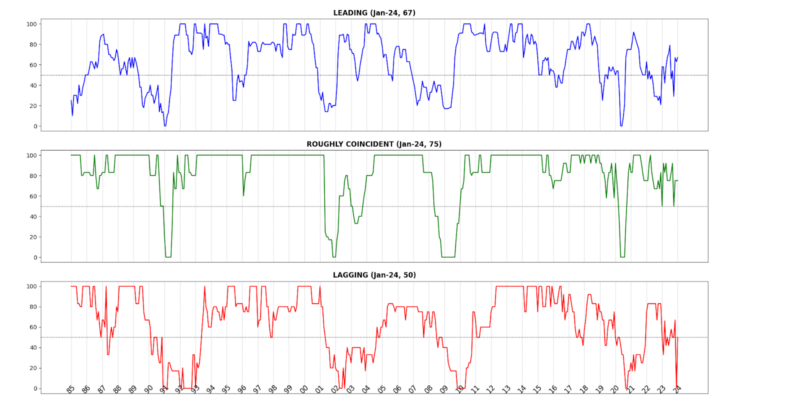

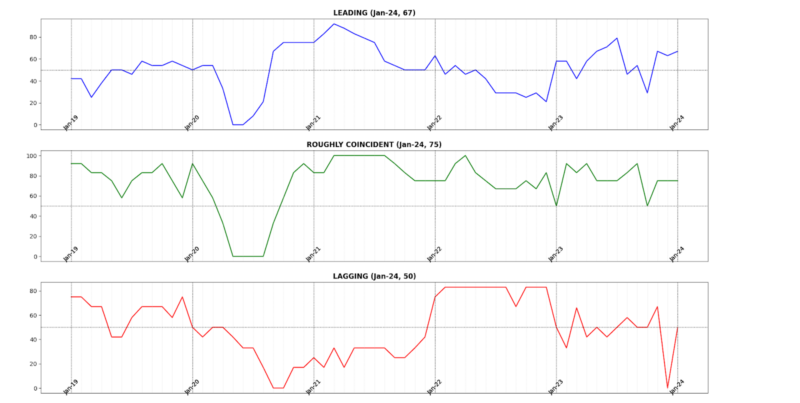

In January 2023, two of the AIER Enterprise Circumstances Month-to-month returned to the expansionary ranges which characterised the final six to eight months. The Main Indicator returned to its November 2023 stage of 67 after dipping to 63, whereas the Roughly Coincident Indicator spent a 3rd month on the 75. The Lagging Indicator, which plunged from 67 In November 2023 to 0 in December returned to 50, once more exemplifying the excessive noise-to-signal ratio in post-pandemic financial information.

Main Indicator (67)

Among the many elements of the Main Indicator, seven rose, 5 declined, and two have been impartial.

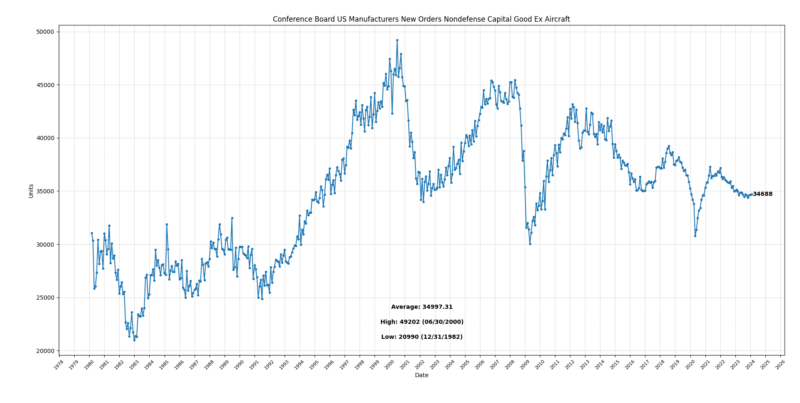

Rising have been the College of Michigan Client Expectations Index (14.4 p.c), United States Heavy Vehicles Gross sales (10.5 p.c), 1-to-10 12 months US Treasury unfold (10.4 p.c), Convention Board US Main Index of Inventory Costs (2.6 p.c), Stock/Gross sales Ratio: Whole Enterprise (0.7 p.c), FINRA Buyer Debit Balances in Margin Accounts (0.2 p.c), and the Convention Board US Main Index Manufacturing, New Orders, Client Items and Supplies (0.1 p.c). The US Common Weekly Hours All Workers Manufacturing and Convention Board US Producers New Orders Nondefense Capital Good Ex Plane have been each impartial. Adjusted Retail and Meals Service Gross sales fell (-1.1 p.c), as did US New Privately Owned Housing Items Began by Construction (-5.9 p.c) and US Preliminary Jobless Claims (-13.6 p.c).

At 67, the Main Indicator suggests persevering with enlargement, if reasonably. It additionally did so through the spring and summer season of 2023 earlier than spending the autumn in impartial and contractionary territory, rebounding in November.

Roughly Coincident (75) and Lagging Indicators (50)

The Convention Board Client Confidence Current Scenario rose by 5.2 p.c, as did its Coincident Private Revenue Much less Switch Funds (0.2 p.c), Coincident Manufacturing and Commerce Gross sales (0.2 p.c), and US Workers on Nonfarm Payrolls (0.1 p.c). The US Labor Drive Participation Fee was unchanged, whereas the Industrial Manufacturing index fell (-0.5 p.c).

The Lagging Indicator had two rising, two falling, and one impartial part. The Convention Board US Lagging Avg Length of Unemployment rose 6.7 p.c as US Business Paper Positioned High 30 Day Yields rose 0.4 p.c. The Convention Board US Lagging Business and Industrial Loans and the Census Bureau’s Non-public Development Spending (Nonresidential) each slid -0.1 p.c from December 2023 to January 2024. US CPI City Shoppers Much less Meals and Power was unchanged.

The Roughly Coincident Indicator has been probably the most constant of the three Enterprise Circumstances Month-to-month indicators, remaining at an expansionary stage of 75 or above all through a lot of 2022 and all of 2023 aside from January and October 2023. The Lagging Indicator, having remained at largely impartial ranges all through 2023 earlier than collapsing to zero in December 2023, is probably going probably the most buffeted by persevering with financial misalignments.

Dialogue

The continued discourse surrounding the US economic system has just lately centered on the resilience and sustainability of client spending. Amidst a backdrop of escalating costs, rising rates of interest, and diminishing post-pandemic financial savings, the vigor of client expenditure has been an ongoing shock.

But in February 2024, headline retail gross sales witnessed a extra subdued resurgence than anticipated, thought primarily to owe to a weather-induced uptick following January’s gross sales hunch. Notably, gross sales progress was largely credited to demand for constructing supplies and backyard tools. Elsewhere the consumption information confirmed solely marginal enchancment, reinforcing the notion that buyers are approaching the boundaries of their spending capability amidst dwindling financial savings, apprehensions about borrowing amidst elevated rates of interest, or an outright lack of ability to entry credit score – as the recognition of Purchase-Now-Pay-Later plans through the 2023 vacation season instructed. It thus seems that February’s retail gross sales figures sign the lengthy awaited waning of spending momentum, notably inside the providers sector, which aligns with the prognosis of a decelerated consumption progress trajectory forward.

The underestimated resilience of consumption has relied on the interaction of the labor market’s restoration from pandemic insurance policies, customers’ propensity to faucet into financial savings and credit score, and elevated curiosity earnings. Nonetheless, these three pillars seem poised to transition into headwinds as 2024 attracts on. Analyzing future client exercise might make use of two distinct analytical methodologies: a top-down or bottom-up strategy. The highest-down technique assesses spending dynamics based mostly on momentum and family wealth relative to earnings, whereas the bottom-up strategy examines consumption as a product of wage progress, private financial savings, and web curiosity affect. The highest-down strategy suggests a definite however delicate slowdown in consumption by year-end. The underside-up framework focuses on the implications of rising unemployment and Federal Reserve charge cuts on wages and wage progress, private financial savings, and curiosity earnings. When the Fed reduces charges – as it’s persevering with to venture that it’s going to do 3 times over the rest of 2024 – customers expertise a decline in web curiosity earnings as a result of sooner lower in curiosity versus borrowing prices. Concurrently, elevated unemployment and underemployment are inclined to immediate larger charges of saving. In consequence, consumption is anticipated to decelerate from the speedy tempo seen final 12 months, however until a big destructive financial occasion happens, it’s unlikely to plummet. In each eventualities, US client spending is prone to decline over the subsequent two or three quarters, requiring sources of US financial progress (as measured by GDP) to return from elsewhere.

The lengthy tail of pandemic disruptions are persevering with to obscure the financial panorama, but there are rising tendencies that warrant consideration, albeit usually deep inside stories that includes seemingly strong headline figures. Following a late-year and early-2024 slowdown, there are combined indications of a unbroken slowdown forward: restaurant bookings, intently linked with bank card transactions, initially dipped throughout January’s chilly spell however have since recovered. But, gasoline demand, which noticed a decline in late January, has rebounded, and air passenger visitors has proven enchancment in early March.

Truck demand, serving as a proxy for retail exercise, skilled fluctuations since late December however has proven a stronger upward pattern in March. Sentiment amongst field makers, one other indicator, stays guarded, with expectations of flat first-quarter demand in comparison with a 12 months earlier. The housing market stays delicate to modifications in mortgage charges, with a drop beneath 7 p.c in early March prompting a rise in house buy functions. Though iron and metal manufacturing noticed a slight rise in February, industrial manufacturing fell nicely in need of expectations in January on account of chilly climate impacting nondurable items manufacturing and mining. The stabilization of oil rig numbers in late 2023 and early 2024, following a big decline on account of oil worth drops and rising labor prices, is one other noteworthy growth. Whereas jobless claims point out minimal firing charges, persevering with claims have remained above pre-pandemic averages since late September, indicating a difficult job market surroundings for the unemployed.

Small-business house owners are experiencing a notable decline in optimism, pushed by revenue pressures arising from excessive labor prices and ongoing apprehensions about future situations, notably with respect to tax and regulatory insurance policies within the wake of the upcoming November elections. On either side, the signature financial factors of both ratcheting up taxes on companies or imposing double digit tariffs on overseas items, are taking a toll on entrepreneurial sentiment. The NFIB Small Enterprise Optimism index fell to 89.4 in February, beneath each the prior studying of 89.9 and the anticipated 90.5. Plans for job creation over the subsequent three months dropped to 12 p.c, the bottom since Could 2020, with important decreases in job openings noticed throughout varied sectors similar to transportation, agriculture, retail, and providers as in comparison with the identical interval in 2023. Regardless of a notable improve in job openings within the building sector, greater than half of small companies report problem filling vacant positions. Moreover, precise gross sales declined, and a web -7 p.c of householders plan to spend money on stock over the approaching quarter. Firm earnings are persevering with to deteriorate alongside dampened expectations for common enterprise situations and compensation plans, which fell to their lowest stage in three years (since March 2021). The proportion of householders elevating common promoting costs decreased to a web 21 p.c, marking the bottom studying since January 2021. Total, nearly all of Nationwide Federation of Unbiased Enterprise elements evinced a downturn in February, reflecting the prevailing financial surroundings and protracted tendencies. Sentiment has remained persistently beneath its 50-year common of 98 since August 2021.

Current information from each the Client Value Index and Producer Value Index point out that core and “supercore” PCE inflation, intently monitored by the Fed, moderated solely marginally in February. Nonetheless, and fulfilling the Nordhausian prognosis, Fed Chair Jerome Powell has expressed the potential of the FOMC implementing charge cuts “nicely earlier than” inflation reaches the 2-percent goal with market implied coverage charge markets strongly forecasting the primary reduce to return in June or July.

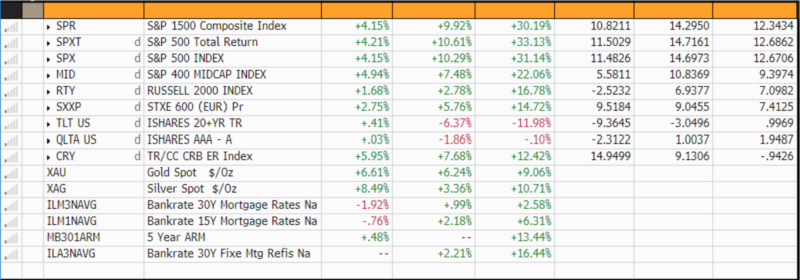

Solely the worth of gold, which just lately hit an all time report worth of $2,185.75 per ounce, seems appraised of the rising tenuousness of the US economic system. Along with a softening labor market and US client exercise lastly showing to hit a wall, the potential for shocks of an endogenous or exogenous nature elevated. (Within the former class, the S&P 500 is up practically 10 p.c for the reason that begin of the 12 months on extraordinarily slender breadth; within the latter, front-month West Texas Intermediate oil costs are presently buying and selling for lower than they did within the instant aftermath of the October seventh assaults.) Growing prospects for political instability and civil unrest because the November elections draw nearer should even be taken into consideration. For these and associated causes, our forecast for 2024 stays characterised by an expectation of financial contraction.

LEADING INDICATORS

ROUGHLY COINCIDENT INDICATORS

LAGGING INDICATORS