America is in a bizarre place demographically-speaking.

On the one hand, now we have 70 million child boomers reaching retirement age. They management many of the wealth. They management many of the housing market. And so they nonetheless management the thermostat while you go to their homes.

Then again, now we have 73 million millennials who’re of their prime family formation years. They don’t management almost as a lot wealth (however they may sometime). They don’t personal many of the homes (however they may sometime).

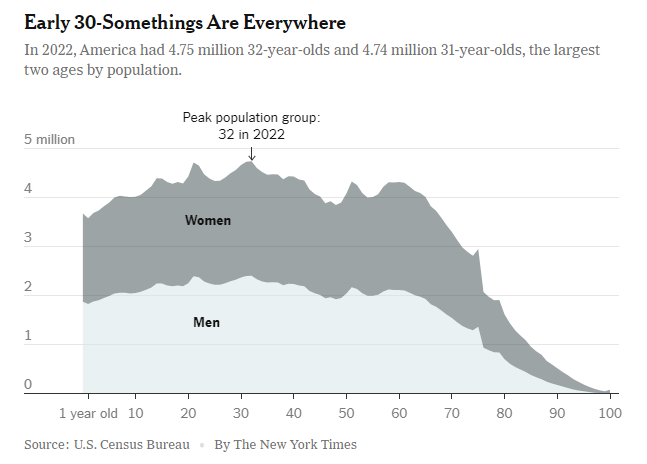

The 2 largest ages in america proper now are 31 and 32-year-olds (through The New York Instances):

Millennials aren’t children anymore. They’ve jobs. They stay within the suburbs. They’re shopping for homes (or need to). They’ve children.

And what do you do in your family formation years? You spend cash. Shifting is dear. Housing is dear. Youngsters are costly. Filling your home with stuff is dear.

In America we like to eat and the biggest demographic is coming into their prime consumption years. That is going to offer a ground underneath the economic system for years to come back.

The millennial homeownership price is roughly 50%. Gen X is greater than 70%, and child boomers are nearer to 80%. Loads of millennials will likely be trying to purchase properties within the years forward to fill that hole.

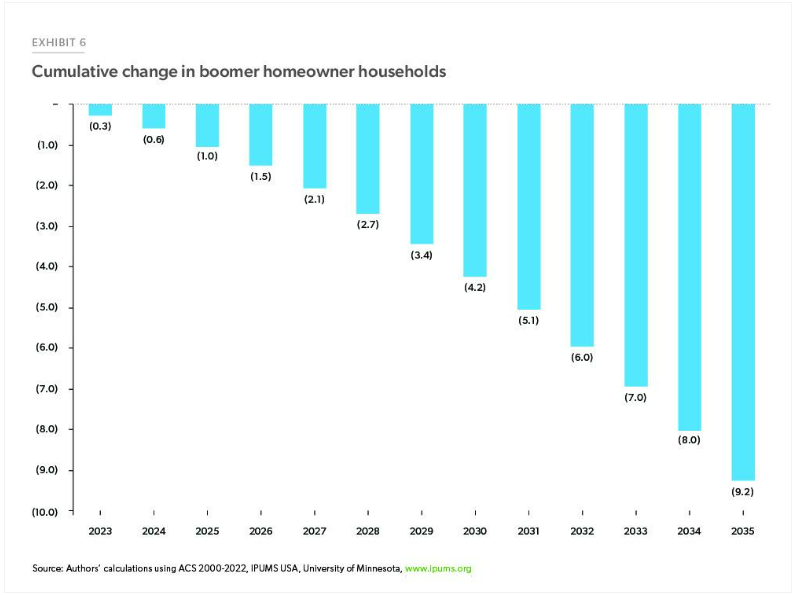

In a supply-constrained market the place we merely aren’t constructing sufficient properties, the hope is the child boomers will present that provide as they retire, downsize, use their dwelling fairness to fund retirement or finally die off.

In response to Freddie Mac, don’t depend on a wave of child boomer homes hitting the market. They estimate the overall variety of child boomer households will go from 32 million now to round 23 million by 2035 because the oldest boomers flip 90.

Over the subsequent 5 years that’s roughly 2.7 million properties that may change fingers:

That’s extra like a small breeze on the seaside than a tsunami.

However perhaps younger folks will get fortunate. Demographic tendencies don’t all the time observe the script.

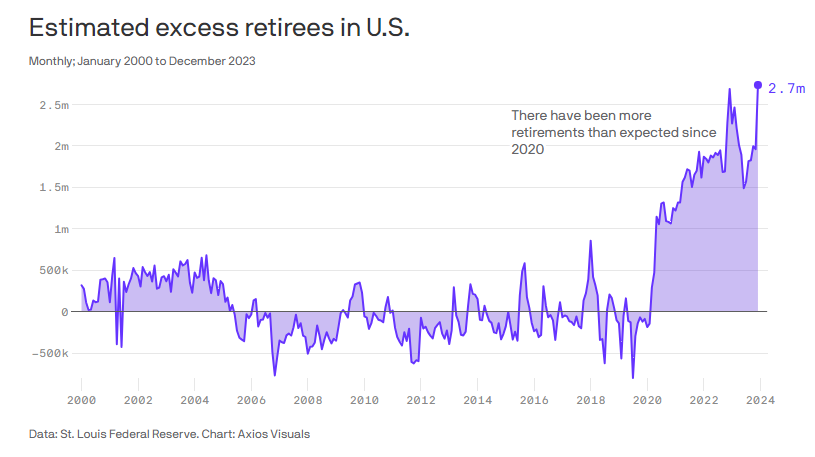

Simply have a look at the variety of child boomers who retired early following the pandemic (through Axios):

A rising inventory market, larger housing costs, and a few existential stuff from Covid gave us 2.7 million extra retirees than anticipated.

My preliminary thought right here is this might really assist the economic system. Youthful folks can step into the roles boomers are vacating. The newly retired will likely be spending among the cash they’ve been hoarding. Good luck discovering a deal on a cruise ship for the subsequent 20 years.

Early retirees aren’t the one ones who ought to really feel higher about their internet price.

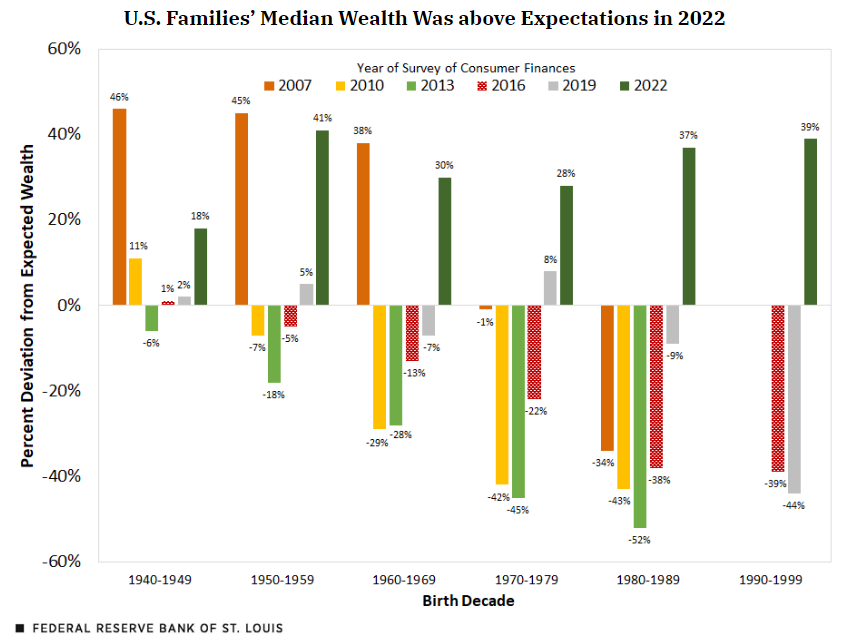

Again in 2019, I wrote a chunk about how younger folks have been 34% under their predicted wealth ranges primarily based on the expertise of earlier generations on the identical age. The Nice Monetary Disaster did a quantity on millennials.

The pandemic reversed that development after which some. These are the up to date numbers from the St. Louis Fed:

They clarify:

We discovered that the median wealth of older millennials (these born between 1980 and 1989) was 37% above expectations. The wealth of youthful millennials and older Gen Zers (these born between 1990 and 1999) was an analogous 39% above expectations.

So, in simply three years, we went from a state of affairs the place older millennials have been 34% under expectations to 37% above expectations–a 71% level swing!

Clearly, larger housing costs helped however for sure we’ve by no means seen something like this earlier than.

No matter their present place in life, millennials would be the richest technology in historical past. Knight Frank laid it out of their annual wealth report:

The swap will see $90tn of property transfer between generations within the US alone, “making prosperous millennials the richest technology in historical past”, Knight Frank mentioned in its 18th annual wealth report.

That’s some huge cash that will likely be altering fingers from child boomers to millennials within the a long time forward.

Then there’s the forgotten technology — Gex X.1

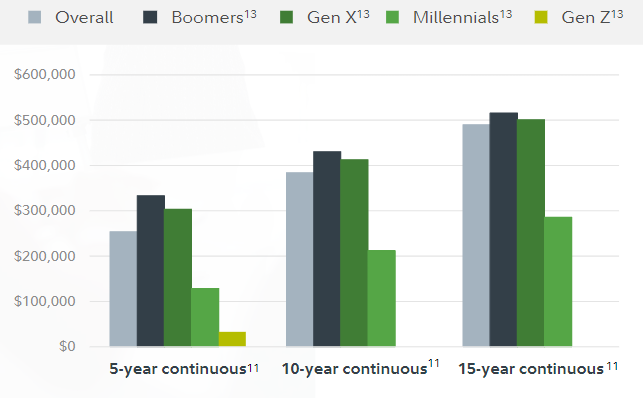

Right here’s a terrific stat about Gen X from the newest annual Constancy 401k replace:

The typical stability for Gen X employees who’ve been of their 401(okay) plan for 15 years straight topped half 1,000,000 {dollars} ($501,000) on the finish of 2023.

A very long time horizon wins once more!

It’s weird to assume a illness that unfold across the globe and fully upended our lives in quite a few methods has by some means made generations of individuals wealthier than they might have been if it by no means occurred.

Michael and I talked about all issues demographics and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

How Demographics Are Shaping the Housing Market

Now right here’s what I’ve been studying this week:

Books:

1If I’m being trustworthy I’m in all probability extra Gen X than millennials. I used to be born in 1981 so I’ve a foot in each camps.