Indian fintech startup CRED has reached an settlement to purchase mutual fund and inventory funding platform Kuvera as a part of an enlargement into wealth administration.

The $6.4 billion Bengaluru-headquartered startup mentioned it was attracted by Kuvera’s skilled group and experience in enabling prospects to take a position instantly in mutual funds and shares with advisory and monitoring instruments.

Kuvera, which manages belongings of over $1.4 billion for its 300,000 sturdy consumer base, has emerged as a platform-of-choice for a lot of of India’s prosperous traders. The typical month-to-month SIP contribution on the platform stands at 5,000 Indian rupees ($60), greater than twice the trade common, whereas whole mutual funding quantities over $14,450 are over 5 instances larger than the norm.

Kuvera will proceed to function as a standalone app following the acquisition, CRED mentioned, including that it’ll discover integrations sooner or later. Kuvera’s 50 folks group will be a part of CRED as a part of the acquisition.

“Via our engagement with CRED we realized that our core values of transparency, consumer worth and ease align superbly with one another,” mentioned Kuvera co-founder Gaurav Rastogi in a press release. “Along with CRED we see an thrilling alternative to fast-track constructing new merchandise and options for our neighborhood whereas additionally bringing a trusted wealth administration resolution to tens of millions extra.”

TechCrunch reported final 12 months that CRED was in talks to accumulate Kuvera. The deal includes each money and inventory, the corporations mentioned. They declined to share the exact worth of the deal. Kuvera had raised about $10 million in personal rounds previous to the acquisition. The U.S. asset supervisor big Constancy will develop into a shareholder of CRED following the acquisition.

“Excited to welcome Kuvera and their group into the high-trust CRED ecosystem,” CRED founder Kunal Shah mentioned in a press release.

“Kuvera is extraordinarily fashionable amongst financially savvy Indians; their merchandise and imaginative and prescient are aligned with CRED’s precept of investing for long-term worth creation reasonably than short-term leisure. Sit up for working and sharing learnings with the Kuvera group in our mutual intent to allow monetary progress.”

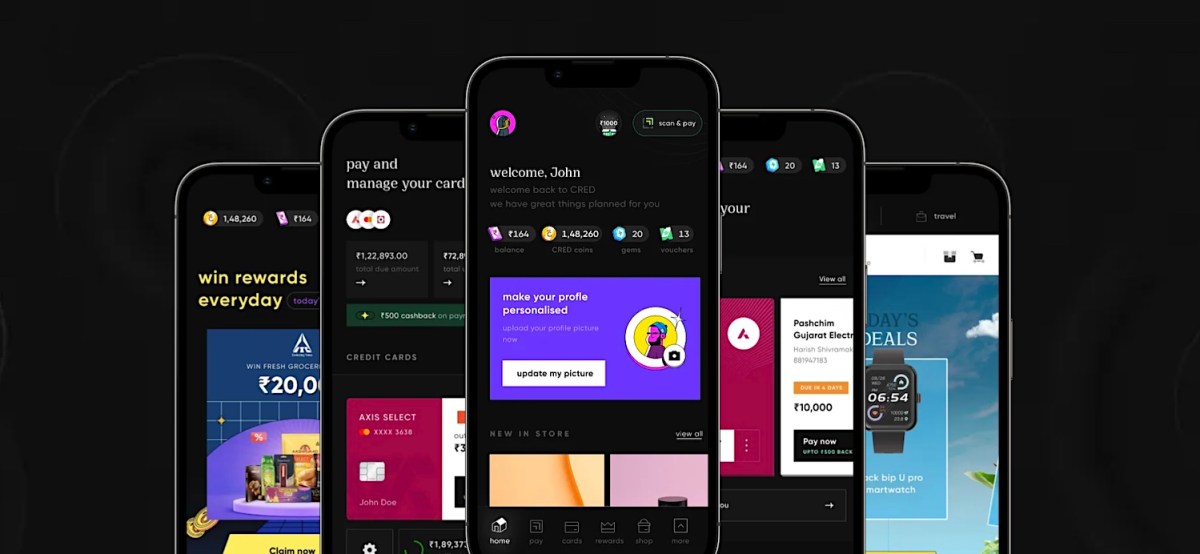

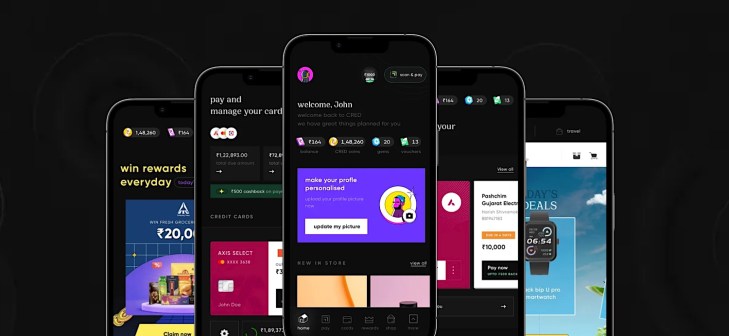

CRED’s curiosity in Kuvera comes at a time when the Indian fintech big, which serves a number of the nation’s most prosperous prospects, is increasing its choices. The eponymous app initially launched six years in the past with the function to assist members pay their bank card payments on time. It has since added scores of options that incentivize good monetary conduct and expanded to e-commerce and lending.

The startup has been eyeing broadening its wealth administration choices for a while. It held talks with Bengaluru-headquartered Smallcase in 2022, however the talks didn’t materialize right into a deal. (CRED has made a sequence of investments up to now three years, buying stakes in LiquiLoans and CredAvenue, and shopping for HapPay.)

Mutual funds generally is a profitable class for CRED, which processes a 3rd of all bank card funds in India by quantity.

The Indian mutual fund market is among the largest and fastest-growing on this planet. In accordance with the Affiliation of Mutual Funds in India (AMFI), the belongings underneath administration (AUM) of the Indian mutual fund trade stands at greater than $575 billion, up over 20% from a 12 months in the past. However the majority of individuals — about 90% of the inhabitants — nonetheless doesn’t spend money on mutual funds and shares.