The plan to make the follow extra widespread is encouraging, stated Andrew Graham, chief government of Borrowell.

“We’ve been saying for a few years now, how necessary it’s for shoppers to have the ability to report rental funds to construct up their credit score historical past, so I used to be happy to see the federal government taking some motion.”

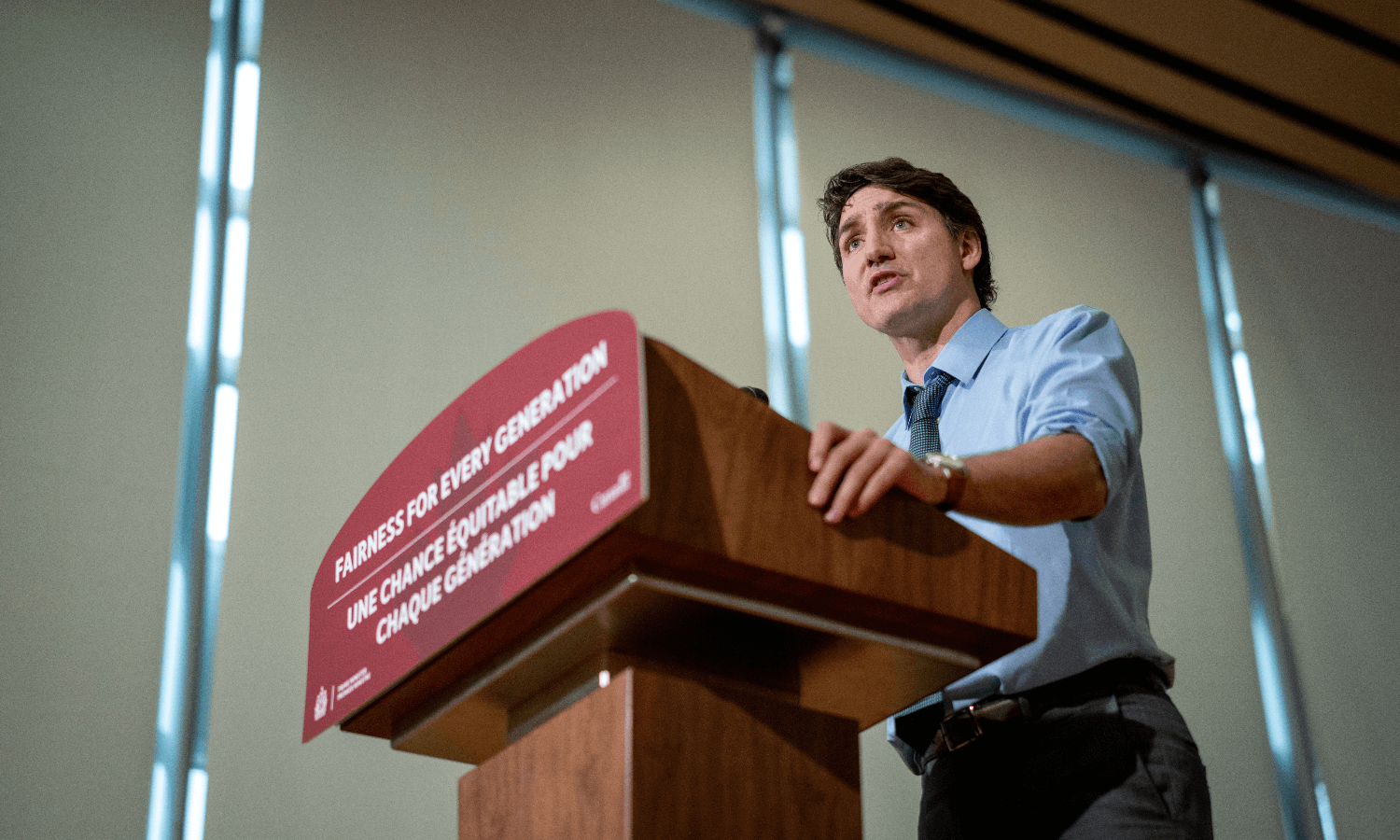

Prime Minister Justin Trudeau stated Wednesday that there’s one thing essentially unfair about paying $2,000 a month for lease, whereas these paying the identical quantity towards a mortgage earn fairness of their dwelling and construct their credit score rating.

He stated the federal government desires landlords, banks and credit score bureaus to ensure rental historical past is taken under consideration on credit score scores, giving younger first-time consumers a greater probability at getting a mortgage, with a decrease rate of interest.

Equifax Canada chief government Sue Hutchison stated the credit score company, which has already been working to incorporate lease funds, was excited to listen to in regards to the authorities’s announcement.

“We stay up for working with the governments, the banks and different lenders to make sure this necessary evolution within the credit score infrastructure in Canada is applied responsibly,” she stated in a press release.

Hire reporting, credit score bureaus and open banking

Graham stated open banking, which can enable shoppers to soundly share their banking knowledge to third-party monetary gamers like Borrowell, is essential to the success of this system.

“What we’ve been telling the federal government and, and albeit, anybody who will pay attention, is that what we actually want is open banking.”

Zac Killam, CEO of FrontLobby, which has been providing lease reporting to credit score bureaus since 2018, stated he helps any efforts to lift consciousness of the advantages.