Charge forecasts paint an image of cautious optimism

Canstar’s newest rate of interest replace has recognized a combined bag of fee changes inside the dwelling mortgage sector.

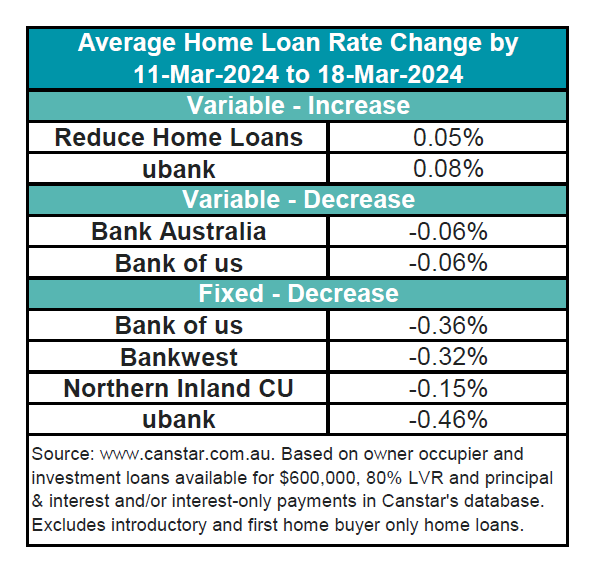

Two lenders have raised 9 owner-occupier and investor variable charges by a median of 0.07%. Conversely, two lenders decreased 10 owner-occupier and investor variable charges by a median of 0.06%.

Considerably, 4 lenders have decreased 64 owner-occupier and investor mounted charges by a median of 0.35%, signalling a shift in the direction of extra beneficial borrowing circumstances for some.

See which lenders moved their charges over the week of March 11-18 within the desk beneath.

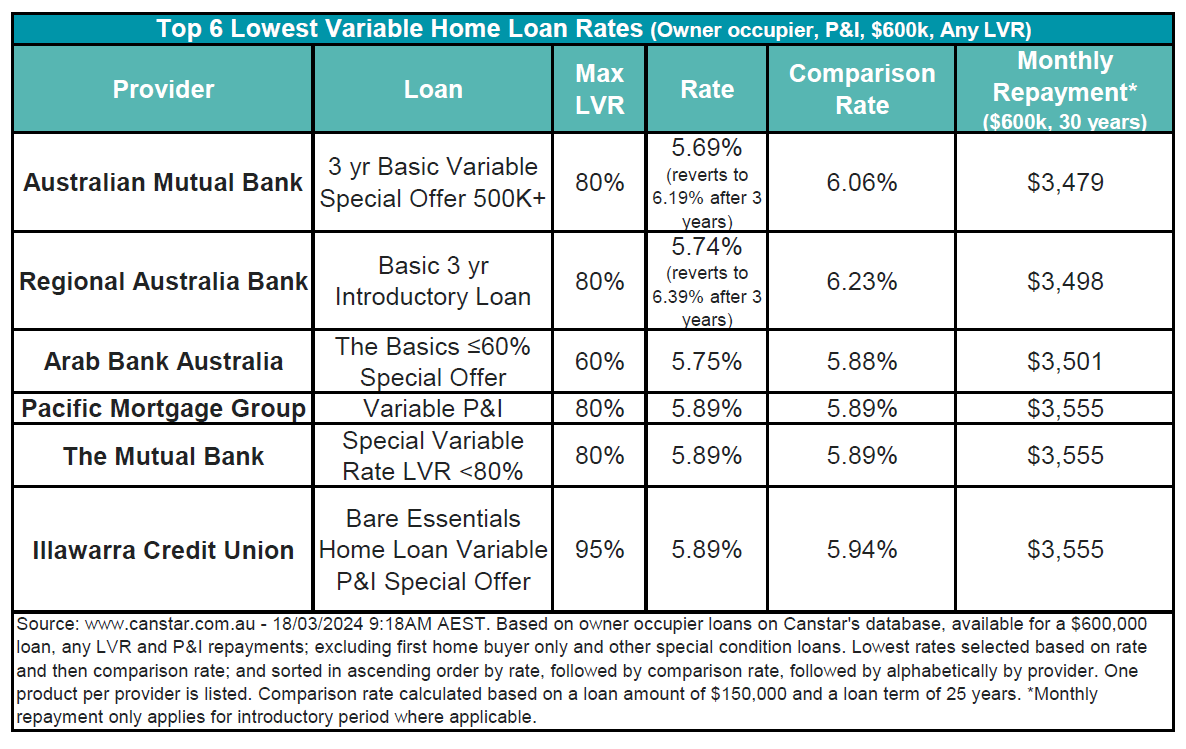

The typical variable rate of interest now stands at 6.9% for owner-occupiers with an 80% loan-to-value ratio (LVR), whereas the bottom variable fee accessible is 5.69%, provided as an introductory fee by Australian Mutual Financial institution. Canstar’s database maintains twenty charges beneath 5.75%, in keeping with the earlier week’s figures.

For lowest variable charges accessible on the Canstar database, see desk beneath.

Anticipated reduction for debtors

Steve Mickenbecker (pictured above), Canstar’s finance professional, provided insights into the broader implications of those fee actions.

“A fee lower of any form will probably be a welcome reduction for a lot of debtors battling larger repayments and the compounding cost-of-living disaster,” Mickenbecker mentioned, highlighting the potential for borrower financial savings if huge financial institution fee lower forecasts come to fruition.

Advising proactive borrower actions

Mikenbecker urged debtors to not passively await fee cuts however to actively search higher offers now.

“It’s time to search for a greater fee now and never await the Reserve Financial institution,” he mentioned, suggesting that refinancing to a lower-rate mortgage might provide instant monetary reduction and financial savings forward of the Reserve Financial institution’s actions.

- ANZ and Westpac anticipate the present money fee of 4.35% to peak, with the primary cuts anticipated round November and September, respectively, resulting in decrease charges into mid-2025.

- CommBank and NAB additionally see the present fee as the height, with predictions for preliminary cuts round September and the December quarter, respectively.

Because the monetary panorama continues to evolve, debtors are inspired to remain knowledgeable and contemplate their refinancing choices.

Get the most popular and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE each day e-newsletter.

Sustain with the newest information and occasions

Be a part of our mailing record, it’s free!