Whereas inflation expectations amongst companies are steadily falling, Canadian customers proceed to anticipate elevated value development within the close to time period.

The Financial institution of Canada’s two key surveys additionally discovered an general enchancment in sentiment within the first quarter amongst each customers and companies, regardless of the drag continued excessive rates of interest are putting on the economic system.

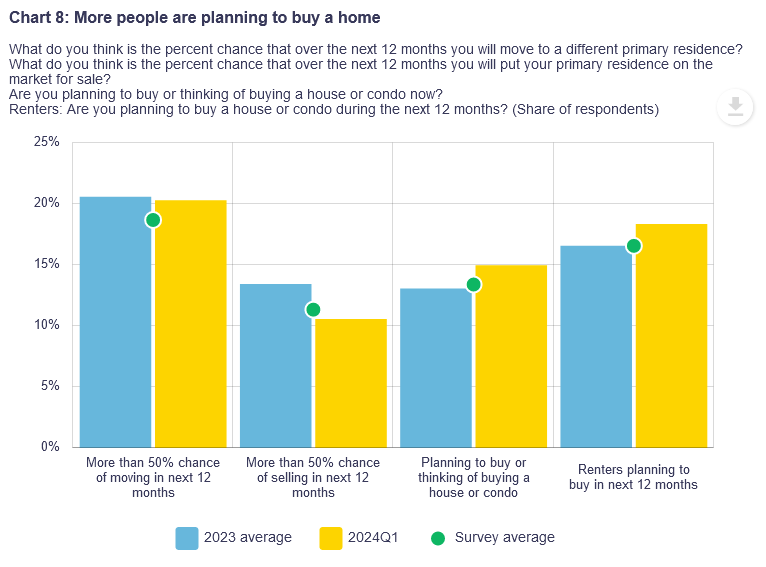

Among the many findings, the Financial institution additionally reported that extra customers are contemplating or planning to buy a house within the subsequent 12 months (extra particulars on that under).

Companies see pricing behaviour normalizing

Whereas demand stays weak, enterprise leaders report a returning sense of optimism, notably relating to enterprise circumstances, gross sales outlooks and employment intentions, in line with the Q1 Enterprise Outlook Survey, which is predicated on interviews with senior administration from roughly 100 companies.

“…companies hampered by decreased shopper spending over the previous 12 months anticipate their gross sales development to extend over the subsequent 12 months,” the report reads. “Amongst companies anticipating that gross sales development will enhance within the subsequent 12 months, round half pointed to their expectations that rates of interest will decline.”

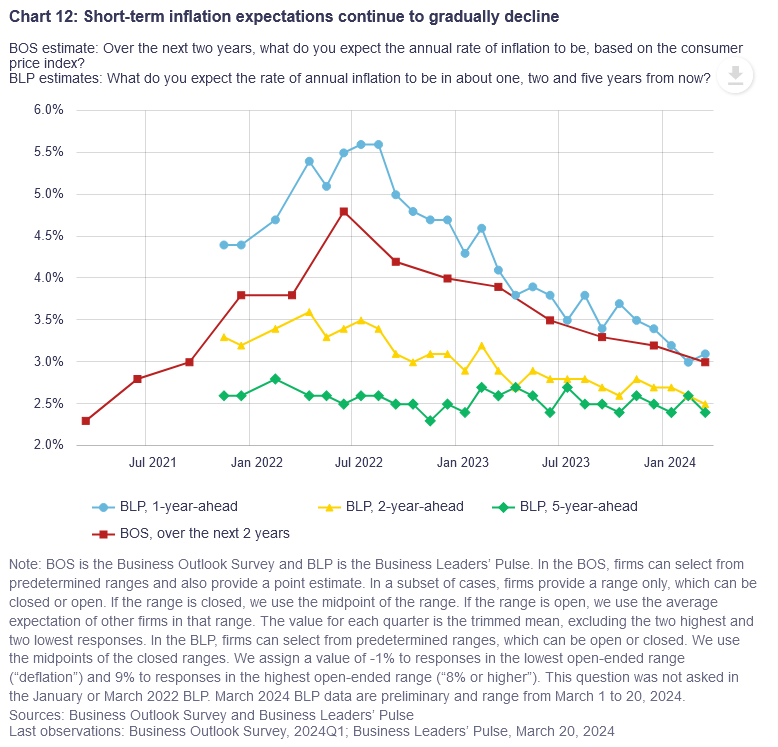

Inflation expectations amongst companies additionally continued to say no within the quarter, with companies believing present financial coverage is working to alleviate upward inflation pressures.

Particularly, simply 27% of companies now assume inflation will persist above 2% past three years from now. That’s down from 37% within the earlier quarter.

As of February, Canada’s headline inflation charge was 2.8%, now inside the Financial institution of Canada’s impartial goal vary of between 2-3%.

Companies additionally anticipate wage development to be slower within the subsequent 12 months in comparison with the previous 12 months. Nevertheless, anticipated wage development of 4.1% within the coming 12 months stays nicely above the historic common of three.1%.

“Companies’ pricing behaviour is constant to normalize,” The BoC famous in its report. “However the sluggish moderation in wage development and the gradual pass-through of excessive prices are retaining output value development elevated.”

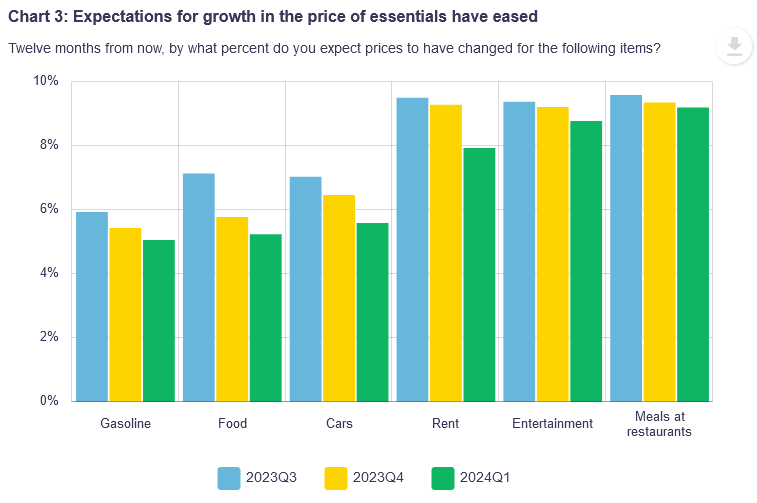

Shoppers anticipate near-term inflation to stay excessive

In the meantime, the Financial institution of Canada’s Q1 Survey of Shopper Expectations discovered that whereas customers imagine inflation has slowed, they proceed to anticipate near-term inflation to stay excessive.

“Shoppers steadily reported that their very own expertise with costs once they store is a key contributor to their perceptions of inflation,” the report famous, including that 60% of respondents mentioned meals costs weighed closely on their perceptions of inflation.

Shoppers additionally mentioned excessive rates of interest are contributing to their expectation that inflation will stay excessive within the close to time period.

“Shoppers nonetheless really feel the unfavorable results of inflation and rates of interest on their spending, and the price of dwelling stays their high monetary concern,” the report reads. “Nevertheless, the share of customers feeling worse off is barely smaller than it was final quarter—an indication that the unfavorable impacts of inflation and rates of interest are now not broadening.”

Extra individuals say they’re planning to purchase a house

As talked about above, the findings additionally revealed a rise within the proportion of respondents saying they’re contemplating or planning to buy a home or apartment within the coming 12 months (almost 15% vs. roughly the 2023 common of roughly 13%).

Nevertheless, the BoC cautioned that this improve is “seemingly pushed partly by newcomers, who sometimes have stronger shopping for intentions than different Canadians.”

Along with excessive mortgage prices, customers report that prime house costs, restricted provide and “appreciable issue” for renters to save lots of up a down fee as being key limitations to homeownership.