Expensive mates,

Thanks a lot on your persistence. Chip and I spent a few weeks within the Scottish Highlands and Shetland Islands, and we knew upfront that that might barely delay our August launch. Little did we perceive the depth of Scottish generosity, as our hosts shared a case of COVID with us as we left the nation. (It felt similar to 2021 once more!) The sickness left us utterly drained and endlessly exhausted, respectively. However we’ve now rallied and are delighted to share August with you.

Ideas for a Highlands journey

-

Go to the Highland Chocolatier in Grant Tully (pronounced “Grantly”). Iain Burnett has repeatedly been acknowledged for the most effective sweets or greatest chocolate truffles on the planet. Grant Tully is so small that it will have to triple in measurement to earn the designation “flyspeck.” It’s simply up the street from the market city of Pitlochry, which, Rick Steves assures us, is “an previous Gaelic phrase for ‘vacationer lure.’”

Yeah, just about. However actually, Highland Chocolatier:

-

Go again to the Highland Chocolatier

That’s “All Issues Chocolate”: scorching velvet ganache served as scorching chocolate, together with a slice of chocolate cake, chocolate truffle of your selection, and a pot of remarkable espresso.

-

Observe up with a go to to The (Unique) Cake Fridge. The Cake Fridge is an extension of a small café and bakery in Bixter, Shetland. It’s stocked 24/7 with bakery delights and operates completely on an honor system. You wander up, take stuff, depart cash, munch on!

-

Get better with a soothing afternoon tea in Cullen. Cullen is the house of Cullen Skink, a pleasant fish chowder, a hovering viaduct, some beautiful artwork …, and afternoon tea.

Do you sense a recurrent theme right here?

-

Carry layers. The daytime highs, on the peak of summer time, have been 60-62 levels F / 15 levels C. The wind is nearly fixed, and light-weight rain is an almost day by day incidence.

The Shetlands, particularly, are a land with out timber or shrubs. Besides in-town or across the occasional farmstead, there is no such thing as a plant taller than about eight inches.

Skinny soil, fixed (!) wind, storm-wracked seasons, and brief summers (they’re at 60 levels north latitude) conspire to supply a panorama that’s concurrently desolate and delightful.

-

Surrender on dodging haggis. It’s even within the potato chips.

-

Eat cheese. And strawberries.

Doesn’t that appear like a wholesome trace? We visited the Gourmand Cheese Co. in Aberdeen and heartily authorised of their Prima Donna Maturo and their angle, summarized by the mantra “nothing sells like samples.”

Should you’re there mid-summer, you’re going to listen to, “Scottish strawberries are the most effective on the planet.” Lots. It seems they’re proper. The strawberries from the Co-op Grocery in Lerwick, capital of Shetland, have been higher than any we’ve grown at house. Higher than any we’ve eaten wherever. Shiny purple all the best way to the middle, candy and aromatic. We’ve formally positioned our grocery retailer’s freakish Driscoll strawberries on the identical “don’t fly” listing as these mid-winter tomatoes that get strip-mined in Texas and shipped north.

-

Carry mountaineering footwear, and discover ruins. Within the Highlands, each city appears to have the ruins of a medieval church, cathedral, or monastery. Chip celebrated, particularly, the chance to climb a four-story tall spiral staircase – with a few of the steps created from recycled gravestones – up the south tower of the Elgin Cathedral.

The opposite putting characteristic was the deserted cottages, about one each tenth of a mile; one thing between the define of a basis in stone as much as 4 stone partitions, chimney however no remaining rooms, doorways, or home windows. To some extent, that’s a reminder of the hated Highland Clearances within the mid-18th and once more within the mid-Nineteenth centuries when the Scottish lairds and the English the Aristocracy made a lot of the nation homeless.

-

Rejoice anonymity. A minimum of as you cross them on the streets, the Scots make New Yorkers look like gregarious Minnesotans.

-

Rejoice one another. There isn’t any larger present than time and firm and no higher time to have a good time it than now.

Within the August Mutual Fund Observer …

For folk who’d favor that we get again all the way down to enterprise, Devesh shares his conversations with three distinctive traders:

- Andrew Foster, on the incoherence of “rising markets” and revenue anyway

- Amit Wadhwaney, on life past Synthetic Intelligence, Cryptocurrency, Quantum Mechanics, Electrical Autos, Digital Actuality, and Social Media

- Scott Barbee, essentially the most profitable small cap worth investor of the previous quarter century, on the prospect of a once-in-a-lifetime alternative in small cap vitality.

Lynn Bolin shares the proof that may information Vanguard traders’ subsequent chapter.

We notice, with disappointment, the passing of Robert Bruce of the Bruce Fund. His loss of life, and the MFO Dialogue Board’s reflection on it, give event for an prolonged take a look at the query: “What occurs in case your supervisor will get hit by a bus?” We take a look at the destiny of a half dozen funds (from Nicholas to Bruce) within the years after the departure of “the identify on the door.” Even with two facet journeys into the destiny of the Mathers Fund and Fasciano Fund, the proof is reassuring.

That’s complemented with an examination of greenhushing – the determined need of firms and traders to fake they’re not within the surroundings (after a decade of determined efforts to fake they have been), a Launch Alert for RiverPark Small Cap Progress, two-point-five distinctive funds within the pipeline, and The Shadow’s overview of the trade’s prime information.

Past that, a number of fast hits.

On Morningstar’s Radar

Morningstar maintains a “prospects listing,” that are the methods that perhaps, sometime, will warrant their analysts’ full consideration. In July, the Morningstar Prospects listing was revised so as to add a half-dozen promising funds.

- American Funds Rising Markets Bond Fund adopts a blended strategy between arduous and local-currency emerging-markets debt, which units it aside from most arduous currency-focused friends.

- Dimensional U.S. Excessive Profitability ETF launched in early 2022 and presents traders publicity to the market’s most worthwhile firms.

- Driehaus Small Cap Progress‘s veteran management use a examined strategy specializing in inflection factors to search out mispriced small progress shares.

- iShares Fallen Angels USD Bond ETF presents traders publicity to a traditionally high-performing part of the high-yield bond market.

- Lazard Worldwide High quality Progress launched in 2018 and presents traders publicity to high-quality, large-cap firms world wide.

- Vanguard Rising Markets Bond Fund‘s skilled managers run a smart course of at a discount worth.

And, likewise, a bunch of Prospect Checklist members simply turned former Prospect Checklist members:

- iShares ESG Conscious Goal Allocation Sequence viability is in query as a result of it has failed to achieve property in two years since launch; two of the exchange-traded funds have lower than $10 million.

- JOHCM World Earnings Builder was liquidated in Might as a result of it failed to collect property. (A bit. We wrote favorably of the technique.)

- Hartford Small Firm has a brand new, untested supervisor, Ranjit Ramachandran, following the departure of Steven Angeli, who was chargeable for the technique’s earlier success.

- Nuveen ESG Small-Cap ETF, Schwab Municipal Bond ETF, RPAR Threat Parity, and WisdomTree Rising Markets ex-State-Owned Enterprises Fund have been all booted for being boring and unimpressive.

FPA Crescent celebrates its 30th anniversary

Congratulations to Steve Romick and the crew at FPA for a outstanding 30-year run for FPA Crescent. Crescent seeks to generate “equity-like returns over the long-term, take much less danger than the market and keep away from everlasting impairment of capital.” That technique is opportunistic and has a powerful absolute worth bent; that’s, the managers would like to carry money fairly than put their shareholders prone to “everlasting impairment” by investing in overvalued securities. Presently, the fund holds 27% of its property in money.

Over the 30 years since launch, Crescent has nearly matched the whole returns of the S&P 500 (Morningstar calculates that $10,000 at inception is now value $169,700; the identical funding within the S&P 500 would have grown simply $1,300 extra, to $171,000) with a tiny fraction of the volatility (FPA captures about 54% of the S&P 500’s draw back).

Comparability of Lifetime Efficiency (07/1993-07/2023)

| APR | MAXDD | Recvry mo | STDEV | DSDEV | Ulcer Index | Sharpe Ratio | Sortino Ratio | Martin Ratio | |

| FPA Crescent | 9.8 | -28.8 | 22 | 11.0 | 7.3 | 6.1 | 0.68 | 1.03 | 1.23 |

| Versatile Portfolio Class Common | 7.5 | -37.0 | 52 | 10.9 | 7.5 | 9.0 | 0.48 | 0.70 | 0.65 |

| S&P 500 | 10.1 | -51.0 | 53 | 15.1 | 10.3 | 14.7 | 0.52 | 0.76 | 0.53 |

| FPACX in comparison with S&P | 97% | 56% | 41% | 73% | 71% | 230% | 130% | 135% | 232% |

By the use of full disclosure, FPA Crescent is the biggest single holding in my private portfolio and has been for properly over a decade.

Kinetics and Texas Pacific Land Turnaround

Devesh shares the next replace on a set of funds that he (and belatedly Morningstar) have fearful about: In November 2022’s MFO situation, within the article Kinetics Mutual Funds: 5 Star Funds with a Lone Star Threat, we wrote that traders in mutual funds run by Horizon Kinetics Asset Administration have been uncovered to a really profitable, however extremely concentrated place in Texas Pacific Land. Only one inventory, TPL, accounted for 46% of all property, and that was an illiquid, dangerous guess.

From the primary week of November to the tip of June 2023, TPL halved in worth from $2700 to $1300 per share. Two of Kinetics’ greatest funds, WWNPX and KSCOX, suffered drawdowns of between 30 and 40 %. An unsightly Board room battle is being fought out within the Delaware Chancery Courtroom between TPL’s Board of Instructions and TPL’s shareholders.

August 1st, 2023, will go down because the date within the historical past of Texas Pacific because the day Murray Stahl of Horizon Kinetics pulled a rabbit out of the hat. The Chairman of the Board of Administrators + 1 Director resigned, an implicit victory for the shareholders. Prior to now week, TPL is up 20% in worth, and the 2 above-mentioned funds are up 10% and seven%, respectively.

This modification within the course of the antiquated Board of Administrators of TPL can’t be overstated. It’s going to essentially alter TPL’s and Horizon funds’ returns for the higher henceforth. Nice work by Murray Stahl and the crew at Horizon! Nonetheless an excessive amount of focus danger, however could Woman Luck shine on you as soon as once more.

The dimensions of the fund universe is shrinking!

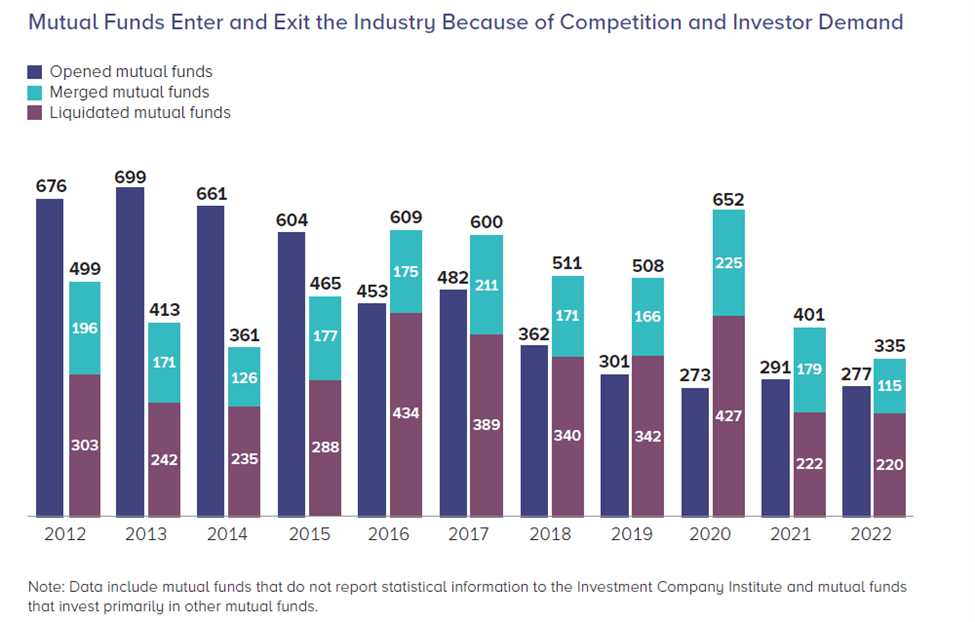

The Funding Firm Institute launched knowledge on fund and ETF launches and liquidations. The dimensions of the fund universe has contracted yearly since 2015, the final time that new fund launches exceeded the variety of liquidations and mergers.

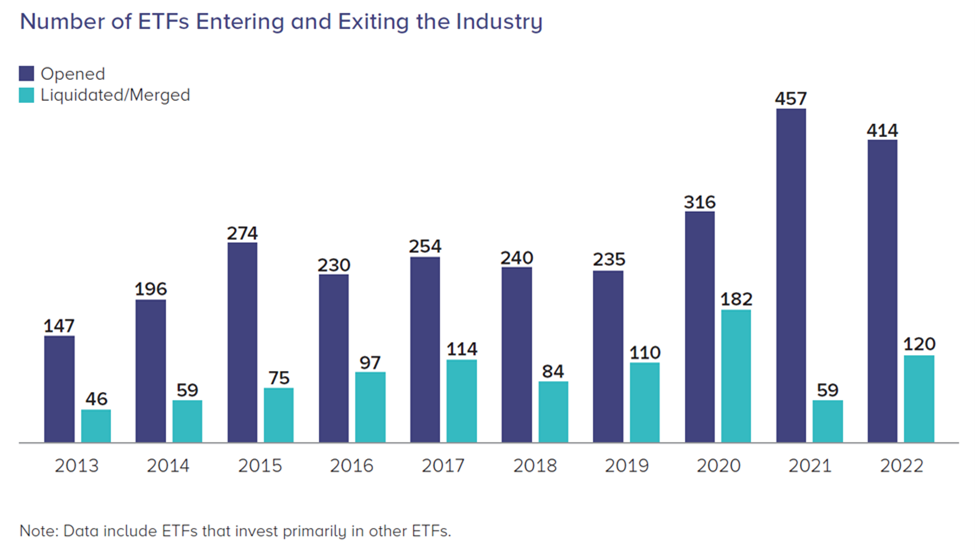

On the similar time, the variety of (largely completely pointless) ETFs has climbed as launches exceed liquidations and extra funds convert to ETFs.

Supply: Funding Firm Institute Reality Guide (2023)

The lively ETF house is perhaps on the verge of eruption

Vanguard patented a course of for creating an ETF share class of present mutual funds. For instance, Vanguard Dividend Appreciation Fund can also be supplied as Vanguard Dividend Appreciation ETF. Having the ability to create ETFs as a share class entails a lot much less paperwork and administrative trauma whereas concurrently permitting the brand new ETF to import a reported asset base and monitor file, each of that are necessary threshold points for a lot of gatekeepers.

That patent has now expired, permitting different fund firms to freely replicate the technique. Dimensional Fund Advisors (DFA), which “entered the ETF market lower than three years in the past and has seen jaw-dropping progress, turning into the biggest issuer of actively managed ETFs. Its 31 ETFs have $95bn in property beneath administration,” has now filed an software with the SEC to permit it to launch ETF variations of its funds (“Dimensional recordsdata for Vanguard-style ETF share lessons,” Monetary Instances, 7/14/2023). Emma Boyde, the FT correspondent, foresees that DFA’s success “might mark the beginning of a revolution within the US funds trade.”

Good beta, dumb funding

Morningstar revealed fascinating analysis in July on the efficiency of so-called “good beta” ETFs. The standard index is known as cap-weighted: the burden of every firm in a specific index is just a mirrored image of its inventory market capitalization. The corporate could also be a catastrophe, it might be crazily overpriced, but when market capitalization is big, it would routinely turn out to be the most important inventory within the index.

So individuals fear that market cap weighting created an undesirable bias towards giant cap, progress, and momentum in an index. On the day I’m writing, for instance, 25% of the S&P 500 is invested in simply six shares (Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla), virtually all in the identical nook of the financial system.

These considerations gave rise to intensive knowledge mining, all of which sought to reply the query, “What works?” Relying on the way you look, dividends work. Worth plus momentum works. Small plus high quality plus dividend progress works. Deleveraging and progress works. All of these statistical patterns are generated by “back-testing” (“If this have been 2003, what mixture of info would quit the most effective returns between now and 2023?”). Advisors prepared to imagine that what labored prior to now will certainly work sooner or later rolled out an limitless stream of so-called “good beta” ETFs to reap the benefits of these hidden market mysteries.

Morningstar’s analysis begins with a laconic, “Yeah, about that …” and finishes with a “not a lot.” Emma Boyde within the Monetary Instances summarizes it this manner:

Newly constructed indices typically flatter to deceive and quickly lose the majority of the power to outperform they demonstrated in backtesting, based on analysis from Morningstar.

Primarily based largely on backtested knowledge, a typical new index outperformed its corresponding Morningstar class index by 1.4 proportion factors a yr in the course of the 5 years earlier than any fund began monitoring it, the researchers discovered. However that extra whole return declined to only 0.39 proportion factors a yr over the 5 years after the fund launched. Threat-adjusted efficiency adopted an analogous downward development. (“New indices quickly lose skill to outperform, examine exhibits,” Monetary Instances, 7/23/2023, please respect the FT paywall if you happen to encounter one)

For these affected by insomnia, the unique Morningstar analysis will be accessed right here.

I really like Market reporting

Market is a collection of day by day packages about economics, tradition, and politics. That’s, they discuss politics by means of the lens of its interaction with economics. The tone tends to be breezy and accessible, although the evaluation and friends are fairly constantly stable and non-ideological. (The lead host, a former Navy fighter pilot, and International Service officer, stays surprised by Mr. Trump and his followers, however that tends to not bleed into protection the best way it would with MSNBC or Fox.)

One current “that’s cool!” second was a very clear description of the reason for an imminent disaster in $20 trillion industrial actual property. David Sherman thinks the disaster will probably be monumental however didn’t stroll by means of the difficulty. Market did: industrial RE loans are sometimes for 5 years. A file variety of loans are due for renegotiation within the subsequent yr. Virtually all of these loans will probably be at increased charges, and lots of of these loans will probably be for smaller quantities. Lenders will grind extra on debtors’ cash-flow assumptions and disaster administration plans. In consequence, a bunch of deeply indebted debtors could have to enter fireplace sale mode for a few of their properties, both slashing rents to keep up near-full occupancy or promoting properties for no matter they’ll recoup. This is not going to be a very good factor.

That walk-through helped so much.

You may discover it value your time to look into Market. It’s not NPR, although, like NPR, it’s listener-supported. (I contribute month-to-month.) The flagship present is Market. The day by day chat between hosts is Make Me Good. This system to assist youngsters perceive cash is Million Bazillion. The present about how cash messes with our lives is “That is Uncomfortable.”

Thanks, as ever …

Thanks most particularly to the generosity of the parents behind the Weeks Household Charitable Fund and to the long-suffering OJ, nonetheless hounded by Ted’s ghost on the dialogue board. To our latest subscriber, Stephen (howdy, sir!), and to The Devoted Few, whose month-to-month contributions hold spirits up and the lights on: S & F Funding Advisers, Wilson, Brian, Gregory, Doug, David, William, and William.

As ever,