Pricey pals,

It’s April. I spent a lot of the Easter weekend carrying a t-shirt out to work within the gardens. It was superb. At the moment, the forecast is for hail. Tomorrow? Snow.

Subsequent week? Oh, I don’t know … dragon hearth?

And nonetheless, it behooves us to be thankful for what now we have. The world’s most corrosive drive shouldn’t be greed. It’s envy, which is pushed by the sense that what now we have simply isn’t sufficient, and bitterness that others have extra. That’s a theme that Charlie Munger mirrored on repeatedly: “I’ve conquered envy in my very own life. I don’t envy anyone. I don’t give a rattling what another person has. However different persons are pushed loopy by it.” How loopy? Hmmm … suppose Biblically loopy: “If you wish to speak about future implications, a whole lot of what I see now jogs my memory of Sodom and Gomorrah. You get exercise feeding on itself, frenzies of envy and imitation” (2005).

It will definitely even contaminated his sidekick, Warren Buffett: “There is no such thing as a motive to have a look at the minuses in life. It could be loopy. We depend our blessings.” (Sure, I do know. Simpler mentioned if you happen to’re price $90 billion.)

The joyful secret to it’s that the blessings don’t must be giant to be able to be significant. Jancee Dunn, writing within the New York Instances “Properly” e-newsletter, mirrored on her anxious day on the Instances when she couldn’t work out find out how to log in to the corporate’s community, was terrified that somebody may overhear her fumbling on the telephone, and so snuck off to fulfill one of many Wizards within the IT division (Chip assures me that she hires solely wizards-in-training in IT.). Adnan The Wizard mounted her downside, commiserated, and shared a thought:

He advised me to think about a jar and prompt that I add a metaphorical penny to it each time I achieved one thing — even a process as small as discovering my method again to my desk.

Over time, he mentioned, you’ll refill the jar. You will notice that you’re transferring ahead, even while you don’t really feel that you’re, he added.

I nonetheless take into consideration that jar, particularly once I’m having a tough time. I nonetheless deposit “pennies.” (“Feeling Overwhelmed? Attempt Tallying Your Tiny Wins,” NYT.com, 3/29/2024)

And so, within the face of hail and uncertainty, I have fun my blessings: a loving household that I work to deserve, a significant calling and the belief of the households that make it potential, the sight of a bald eagle spiraling lazily above the tennis courts simply past my window, time with all of you of us, and the indicators that nature will give me one other likelihood this 12 months.

On this month’s Observer

One in every of my particular blessings is the flexibility to work with of us whose understanding of points is profound and sophisticated and whose willingness to translate that understanding in your profit appears boundless. Devesh, having spent knowledgeable lifetime buying and selling billions of {dollars} in choices, completes his Choices Trilogy for you this month. In March 2024, Devesh performed out latest developments in choices markets as he examined the virtually manic rush into such funds. This month completes the trilogy with a deeper dive into the workings of choices in 10 funds and a mirrored image on The Choices Conundrum, together with the query of whether or not you may not revenue extra with a Replicant Portfolio: an ultra-low-cost fairness index and T-bills.

Lynn presents two items this month. First, he updates his profile of Constancy New Millennium ETF (FMIL) by noting that … nicely, it’s gone. Constancy launched a collection of energetic ETFs final month, one among which absorbed and remodeled FMIL. Lynn shares his evaluation of the suite on provide. Second, he analyzes the choices of funds for long-term tax-efficient investing and comes up with two suggestions for you.

Lastly, The Shadow brings us updated on small victories for traders (umm, okay, a bit brief there this month), the business’s new methods for Inexperienced Flight (rename the fund, redescribe the technique, and, failing that, bail out), and we bid farewell to a near-record variety of funds.

My contribution this month facilities on this essay, the place we’ll take a look at the market’s illusory calm, two investments you actually wish to discover, one you would possibly pray to keep away from, and a bunch of iterations on the identical query: greed or envy, happiness or satisfaction?

I’ve two initiatives underway for you that try that will help you take into consideration methods for coping with unstable markets.

Infrastructure investing: as nationwide governments fail to decelerate the speed of local weather change, sub-national governments are more and more planning huge infrastructure expenditures to mitigate a number of the results on human communities. Infrastructure bills are inclined to function in a rhythm impartial of the inventory market, which makes them helpful for diversification. I’ve reached out to groups with three of essentially the most promising funds. To date, I’ve obtained one “we’ll get again to you” and two useless silences. (Actually, guys, take down the d**med “media contact” hyperlink if you happen to’re incapable of even a well mannered “no thanks.”) I’ll proceed these outreach efforts.

High quality investing: “high quality at an inexpensive worth” displays a exceptional market anomaly. The shares of high-quality companies are typically underpriced, stable in up-markets, and distinctive in risky ones. The online impact is greater long-term returns with decrease short-term volatility, which (idea says) shouldn’t occur. And it positively shouldn’t occur constantly. Nevertheless it does. A straightforward case could be made for the brand new GMO US High quality Fairness ETF; as a matter of reality, we have made it, Chip was satisfied to purchase it, and it has simply outperformed its five-star, $10 billion sibling. We’ve been working with a Morningstar strategist who recognized ten distinctive funds with an emphasis on high quality investing. He shared commentary on every, and we’re nonetheless understanding an understanding of what’s immediately quotable and attributable.

Somewhat than share half-complete initiatives, we’ve moved each to be featured tales in our Could 2024 problem.

And why, you ask, fear about investments for unstable markets when the present market is eminently steady and rising? (Properly, besides that the Magnificent Seven have been diminished to the Fabulous 4.)

“Markets have a false sense of safety”

The Wall Avenue Journal could be channeling their interior Devesh. They word that there’s been a flood of cash into options-backed funds and ETFs, however the information shouldn’t be all good. Jon Sindreu (3/8/2024) writes:

In case you purchased so-called structured merchandise just lately, you’ve gotten loads of firm. However is exactly their reputation that might make them – and maybe all the inventory market – riskier than they appear … The discount usually appeals to less-sophisticated traders who in any other case may not dabble in complicated derivatives. For banks they create in fats charges.

There follows a dialogue of 1 class of derivatives referred to as “autocallables.” At base, banks are the counterparties within the autocallable commerce, so that they have the inducement to hope for market stability, which, partially, is brought on by their very own want to purchase “insurance coverage” towards their publicity to those choices. Sindreu summarizes:

So autocallables look enticing as a result of the inventory market is calm, however the market is calm as a result of persons are shopping for so many autocallables. The suggestions loop is harking back to the one created by funds that immediately wagered towards volatility again in 2017 and 2018. When a bout of promoting broke the cycle, banks stopped hedging, volatility exploded and the market tanked.

His conclusion: you shouldn’t belief the Vix as a gauge of potential hassle. Quoting Jeffrey Yu of BNY Mellon, “Low volatility begets low volatility. Till one thing goes improper.”

Per week later, a second Journal author echoed the warning:

The inventory market is calmer than it has been in years. Some fear {that a} widespread technique is contributing to the tranquility.

Measures of market volatility have fallen to ranges final seen in 2018 …

Traders are in search of safety from potential losses by pouring cash into [covered-call ETFs] … property in such funds has topped $67 billion, up from $7 billion on the finish of 2020.

Their argument is that this form of herd commerce (in volatility ETFs) “blew up in spectacular vogue six years in the past.” The choices commerce now exceeds shares in worth, with each covered-call place essentially matched over an reverse place in “name overwrites.” The priority is that this can be a complicated, leveraged construction that could be catastrophically susceptible to an exterior shock that causes a cascading rush to the exits. (See Charley Grant, “Standard guess weighs on volatility,” WSJ, 3/26/2024, B1. It’s on-line with a paywall and a barely totally different title.)

Each are good items and remind us that the most effective time to patch the roof is earlier than the rain begins. Our Could options are aimed in that course.

Excellent news, good guys, GoodHaven

Morningstar Journal featured GoodHaven Fund, which we profiled in July 2023 (“The Rise of GoodHaven Fund“), in their March 2024 problem. Our fast abstract: exceptional turnaround. Distinctive portfolio. Disciplined supervisor.

Morningstar Journal featured GoodHaven Fund, which we profiled in July 2023 (“The Rise of GoodHaven Fund“), in their March 2024 problem. Our fast abstract: exceptional turnaround. Distinctive portfolio. Disciplined supervisor.

We, and so they, each word the supervisor’s principled determination to revamp his technique in late 2020. The thought was to focus extra on “particular conditions” provided that they had been demonstrably “particular” and “high quality at an inexpensive worth” technique moderately than specializing in purely statistical measures of cheapness.

It’s working.

Comparability of 3-Yr Efficiency (April 2021 – March 2024)

| APR | Max drawdown | Draw back deviation | Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

|

| GoodHaven | 17.3% | -17.8 | 10.1 | 6.6 | 0.86 | 1.44 | 2.19 |

| Multi-Cap Worth friends | 8.6 | -18.0 | 10.8 | 6.4 | 0.35 | 0.55 | 1.06 |

| S&P 500 | 11.5 | -23.9 | 11.6 | 10.0 | 0.50 | 0.75 | 0.88 |

Supply: MFO Premium fund screener and Lipper World knowledge feed

How you can learn that?

Returns: APR means the annual share return for the interval

Dangers: the utmost drawdown and draw back deviation (referred to as “unhealthy deviation”) measure draw back volatility for the interval. In these circumstances, decrease is best.

Danger-return stability: the Ulcer Index measures how far an funding falls and the way lengthy it takes to rebound. Smaller (as in “it gave me a smaller ulcer”) is best. The Sharpe, Sortino, and Martin ratios assess an funding’s returns towards an more and more excessive risk-management bar; that’s, Martin is rather more risk-averse than Sharpe. In every case, greater is best.

By these measures, GoodHaven has been a uniform and constant winner. Morningstar frets that the fund “could not have broad enchantment” as a result of it doesn’t match neatly right into a field. So I suppose if you happen to care about packing containers, you would possibly flip to The Container Retailer. In case you care extra about efficiency, you would possibly add GoodHaven to your due diligence record.

Microcap fairness funds price consideration

I contributed, in partnership with Mark Gill, to a bit entitled “Microcap Funds” within the March 6, 2024 problem of Backside Line. Backside Line is a form of cool “a little bit of this and a little bit of that” e-newsletter that covers private subjects from finance to vitamin and scholarship sources. I contribute often. Mark and his editors assess reader curiosity in numerous subjects, and one of many writers reaches out to speak with me. We discuss. I share ideas and knowledge. He drafts, I revise.

The premise is that microcaps are profoundly undervalued relative to a bunch of measures and have a tendency to carry out exceptionally nicely when rates of interest start to fall since that usually alerts a interval of financial acceleration. The MFO Premium screens recognized about ten choices, and Mark picked up on three.

With a bit more room, I’d have urged him – and also you – to analyze Pinnacle Worth (PVFIX), which is a five-star fund managed by John E. Deysher. The fund embodies a low turnover, absolute worth technique that permits the supervisor to carry substantial money when compelling alternatives are few.

With a bit more room, I’d have urged him – and also you – to analyze Pinnacle Worth (PVFIX), which is a five-star fund managed by John E. Deysher. The fund embodies a low turnover, absolute worth technique that permits the supervisor to carry substantial money when compelling alternatives are few.

Shallow observers will say, “he’s been within the backside 10% of his peer group 4 occasions within the final ten years.” Those that look nearer would possibly word that John’s market cap is one-twentieth of his peer group’s, and he’s posted double-digit absolute returns in three of these 4 years. 2017 is the one truly unhealthy 12 months. In each interval we observe – whether or not 3/5/10 12 months home windows or market cycles – Pinnacle’s Sharpe ratio ranges from “a lot greater” than its friends (50% greater since inception) to “ridiculously greater” (400% greater over the previous three years). The fund’s normal deviation is half of the group’s.

One measure of the success of an absolute worth technique is the fund’s huge outperformance, measured in APR or annualized share charges, throughout the latest bear markets.

| 2007-09 GFC | 2020 Covid bear | 2022 bear | Full cycle – 2022 bear + subsequent bull | |

| Pinnacle Worth | -24.8% | -23.3 | -7.7 | 12.5 |

| Small worth common | -53.6 | -38.0 | -18.0 | 4.7 |

John manages about $34 million in property, barely above the place he was in 2015 after we profiled the fund. Our conclusion, then and now, is similar:

Mr. Deysher would like to present his traders the chance to earn prudent returns, sleep nicely at evening, and, ultimately, revenue richly from the irrational habits of the mass of traders. Over the previous decade, he’s pulled that off higher than any of his friends (2015).

“Irrational habits of the mass of traders”? The place have I heard that earlier than? Hmmm…

John is a laconic soul, so studying his 2023 Annual Report takes modestly much less time than ending your morning cup of espresso.

Trump in your portfolio

Extra appropriately, Trump Media (DJT). Mr. Trump’s firm, previously Reality Social, is now publicly traded on the Nasdaq change. Over the week previous April 1, 2024, it had a share worth of between $43-73, giving it a considerably risky market cap. Its peak capitalization was $8 billion. It spent a lot of the final week of March at round $7 billion and started April at $5.5 billion. When it comes to market cap, that’s within the neighborhoods of Etsy, Hasbro, Voya, or Invesco. About 5,000,000 shares a day have been buying and selling fingers. In 2023, the corporate had gross sales of $4 million (giving it a worth/gross sales ratio of 1200) and misplaced $58 million (giving it a detrimental p/e ratio of minus 70). By comparability, the median annual gross sales of a McDonald’s location in 2020 was $2,908,000.

As a result of accounting is magical, the firm reported a $50.5 million revenue in 2022 on $1.5 million in income.

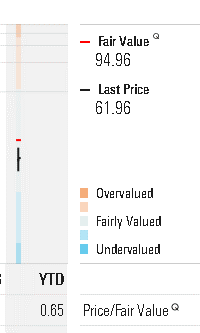

As a result of computer systems are magical, Morningstar’s algorithms have calculated a good market worth for DJT at $94.96 (as of April 1, 2024).

Not , you say?

You may not have a selection. The itemizing standards for shares within the Russell 3000 index are:

- Itemizing on a US inventory change

- A share worth above $1.00 on a rating day on the finish of Could

- A market cap above $30 million

- A free market float of greater than 5% (that’s, greater than 5% of the corporate’s whole shares have to be buying and selling on the open market)

We’ve got reached out to FTSE Russell, a part of the London Inventory Alternate Group, to grasp their inclusion course of however haven’t but acquired a response.

Skilled athletes and the economics of envy

There’s been a lamentable lot of commentary recently about Nationwide Soccer League gamers on $40 million/12 months contracts who deserve $60 million contracts. Their insistence on holding out for these previous few thousands and thousands displays the truth that “they gotta maintain their households.”

Actually?

The common American “takes care of their household” on $51,480 a 12 months. (The Census studies family moderately than particular person incomes; the median there’s $75,000 in 2022.) Loves them, hugs them, goes to their Little League video games and piano recitals, cleans up their messes, and binds their wounds, psychic and bodily. A 2014 examine by the Georgetown Heart on Training and the Workforce concluded, “Total, the median lifetime earnings for all employees are $1.7 million,” with considerably greater payouts for folk with a BA ($2.3M), MA ($2.7M), PhD ($3.2M, and actually I’ve obtained to search out somebody to sue over the hole between me and what I’m apparently owed) and MD/JD ($3.6M).

I’m, as a lot of , a child from Pittsburgh. In 1977, within the midst of a span wherein the Steelers received 4 Tremendous Bowls, future Corridor of Fame gamers Joe Greene and Lynn Swann made $60,000 / 12 months, roughly four-and-a-half occasions the common revenue for all Individuals that 12 months. After all, they performed for a man, Artwork Rooney Sr., who walked to work each morning. In 2024 phrases, a future Corridor of Fame participant making 4 and a half occasions the common revenue could be hauling in a cool $230,000 a 12 months!

In actuality, $40 million contracts replicate that you simply and I are rather more eager about watching sports activities occasions than in collaborating – a parent-coach, sponsor, ref, athlete – in a single. Our rapt consideration to their fantasy world underwrites huge contracts and, often, delusional habits. You may not be extra pleased getting out to the (native) ballfield, however on the finish of the day, you would possibly end up moderately extra glad. Which cues …

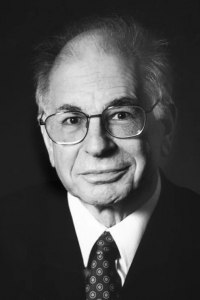

In memoriam … Daniel Kahneman (March 5, 1934 – March 27, 2024)

Dr. Kahneman handed away on the age of 90 after a life nicely and totally lived. He was acknowledged by The Economist because the world’s seventh most influential economist. That’s placing as a result of (a) our fetish for meaningless rankings makes me smile, and (b) he wasn’t an economist.

Dr. Kahneman handed away on the age of 90 after a life nicely and totally lived. He was acknowledged by The Economist because the world’s seventh most influential economist. That’s placing as a result of (a) our fetish for meaningless rankings makes me smile, and (b) he wasn’t an economist.

By “wasn’t an economist,” I imply “by no means even took a single Econ course in faculty.”

Kahneman was a professor of psychology whose work, together with Amos Tversky, laid the idea for the disciplines of behavioral economics and behavioral finance. His basic achievement was to categorize the constant patterns of cognitive weirdness; others then discovered methods to make uncounted billions by exploiting these patterns. His guide Pondering: Quick and Sluggish (2011) accommodates findings central to my instructing on propaganda and mass manipulation, nevertheless it’s additionally central to the curriculum of enterprise applications throughout the nation. Dr. Kahneman acquired the Nobel Prize in 2002, the Presidential Medal of Freedom in 2013, two dozen honorary doctorates, and numerous skilled awards, together with the Leontief Prize for contributions that “assist simply and sustainable societies.”

His less-known work on happiness and satisfaction aligns with my opening reflections on this letter. Kahneman and colleagues did moderately a whole lot of work on the topic, solely to find that most individuals don’t need to be pleased. They wish to be glad. Happiness, he concluded, was the fleeting sensation of pleasure in a specific second. It was evanescent. Satisfaction, he argued, “is a long-term feeling, constructed over time and based mostly on reaching targets and constructing the sort of life you admire.”

Charlie Munger would, I feel, perceive. Stepping via the doorway of your million-dollar house and basking within the awe of your folks would possibly make you content. Residing in an unassuming house and spending a part of every week constructing shelters for others – as Lynn Bolin does and Jimmy Carter did – could be a surer highway to satisfaction.

Thanks!

Due to Tom & Mes from TN, our outdated buddy Gary in PA (I’ll share a bit extra in Could, however I’m very assured this can be an amazing 12 months), and John of Honolulu.

To our devoted subscribers: Wilson, Gregory, William, William, Stephen, Brian, David, and Doug. The month-to-month reminders of your assist imply quite a bit.

Within the Could Observer, I sit up for the case for infrastructure funds, high quality investing, two fixed-income choices, and basic merriment. We hope to see you there!