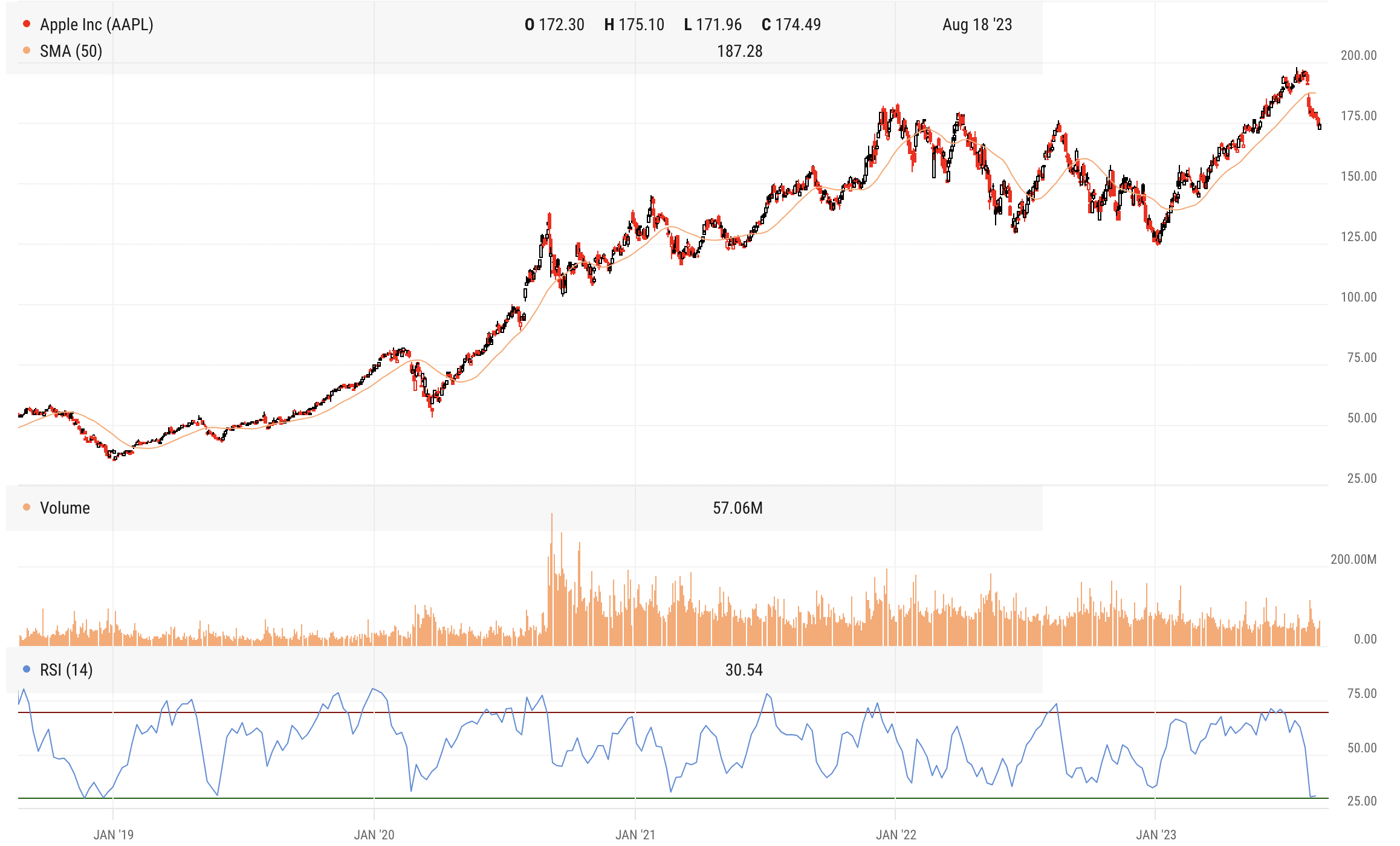

The Relative Energy Index or RSI is usually expressed as a 14-day studying to find out the diploma to which a inventory or an index is overbought or oversold, if in any respect. It was created in 1978 by J. Welles Wilder Jr. (right here’s the guide) who was a mechanical engineer by commerce earlier than turning his mathematical thoughts to inventory and commodity buying and selling, subsequently growing a few of the most generally traded instruments in technical evaluation right now.

An excellent rule of thumb is to consider shares with an RSI of 30 or beneath as being “oversold”, that means merchants have quickly been pushing down the worth quickly and meaningfully with their gross sales. On the upside, a inventory with an RSI of 70 or higher may be sometimes regarded as “overbought.” Shares can stay oversold or overbought for a very long time, so it’s not a magic method for buying and selling earnings.

Profitable merchants use RSI to provide context to a transfer a inventory is making or they’ll take a look at it in tandem with different indicators, for instance, the first pattern of the inventory’s worth, which issues extra. Some merchants are utilizing overbought or oversold indicators as triggers to fade the gang and go the opposite means. Snapbacks may be highly effective. Different merchants are utilizing RSI as a type of secondary affirmation with respect to the general pattern in worth. This latter group needs to see some form of divergence, for instance a inventory persevering with to fall in worth whereas RSI stops falling, which might be a prelude to a bounce.

Right this moment I need to take a look at the Relative Energy Index for Apple because the share worth has fallen fairly a bit not too long ago – perhaps too far, too quick.

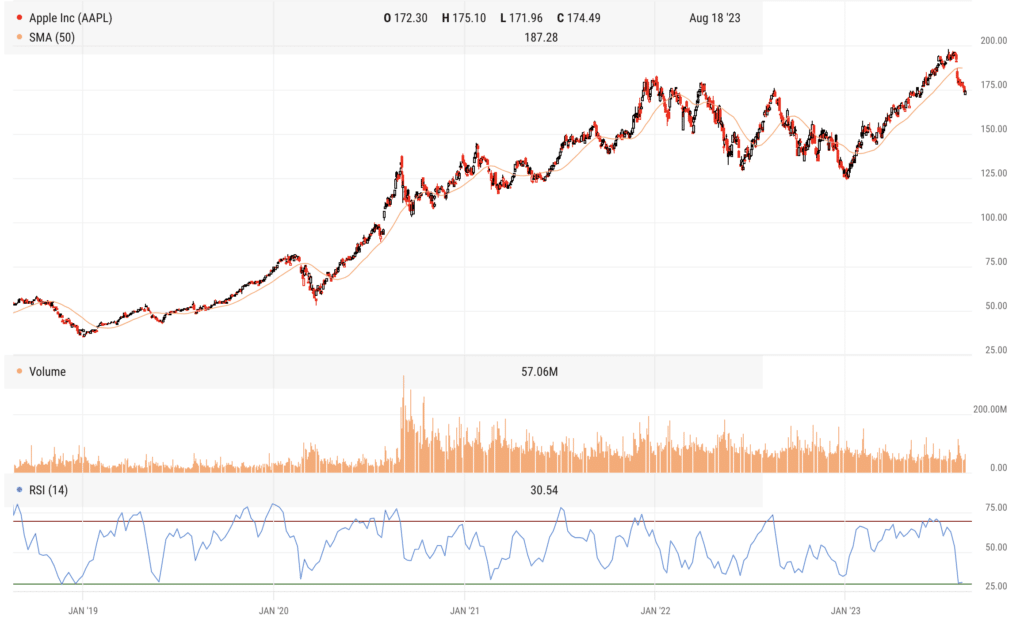

Apple is the largest inventory on the earth. It’s statistically oversold right here, having gapped beneath its 50-day transferring common after a superb not nice earnings report this summer season. Pay specific consideration to the underside pane, which is 14-day RSI. You’ll observe that patrons have been rewarded for stepping in every time the inventory has been oversold to this diploma over the past 5 years – oftentimes that reward has been rapid.

If you happen to’re trying on the inventory for a shopping for alternative, what you’ll need to look ahead to now could be a bullish swing rejection. Very merely – on Apple’s subsequent bounce, RSI ought to break again above 30 into “constructive territory. That’s the first step. Step two is to look at through the inventory’s subsequent pullback. If RSI can dip however stay above 30 (not get extra oversold), it tells you the sellers within the inventory have largely been cleaned up and bulls are again in management. Consider it like the next low, however within the RSI, not simply within the inventory worth.

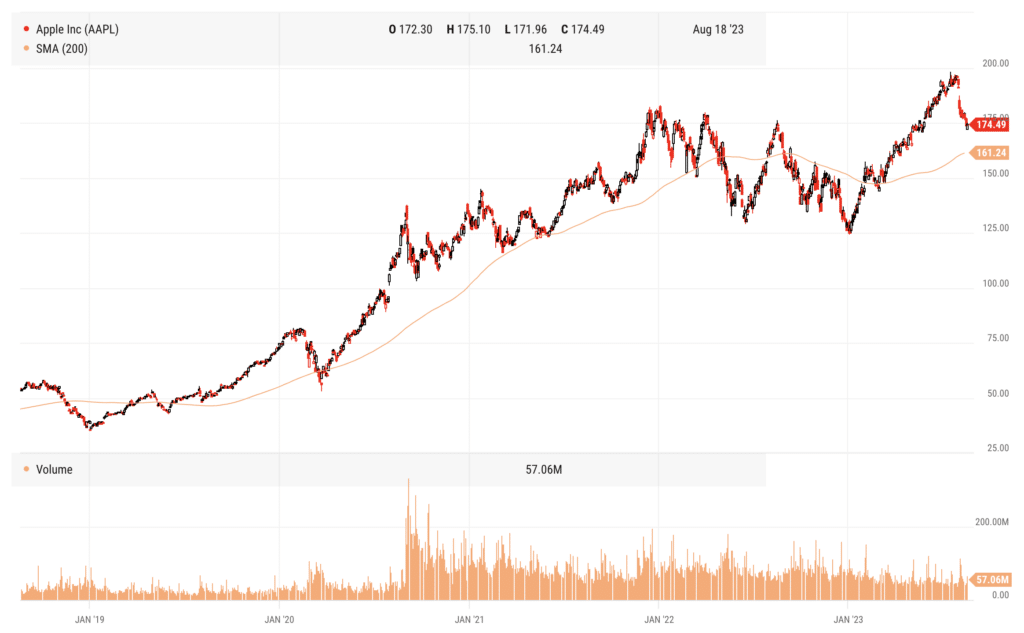

Apple continues to be in a extra intermediate-term uptrend no matter its worth motion this summer season. It’s effectively above the 200-day transferring common and that transferring common continues to be rising (beneath):

My private opinion is that Apple ought to have bounced forcefully off that 175 degree, which was the prior resistance courting again to January 2022. It didn’t (at the very least not but). This rising 200-day transferring common beneath could the subsequent large take a look at. I don’t love this set-up, regardless of how oversold it’s right here.

Trying forward, we’ve bought the discharge day occasion for the iPhone 15 on Tuesday, September twelfth after which nothing till Q3 earnings on October twenty seventh.

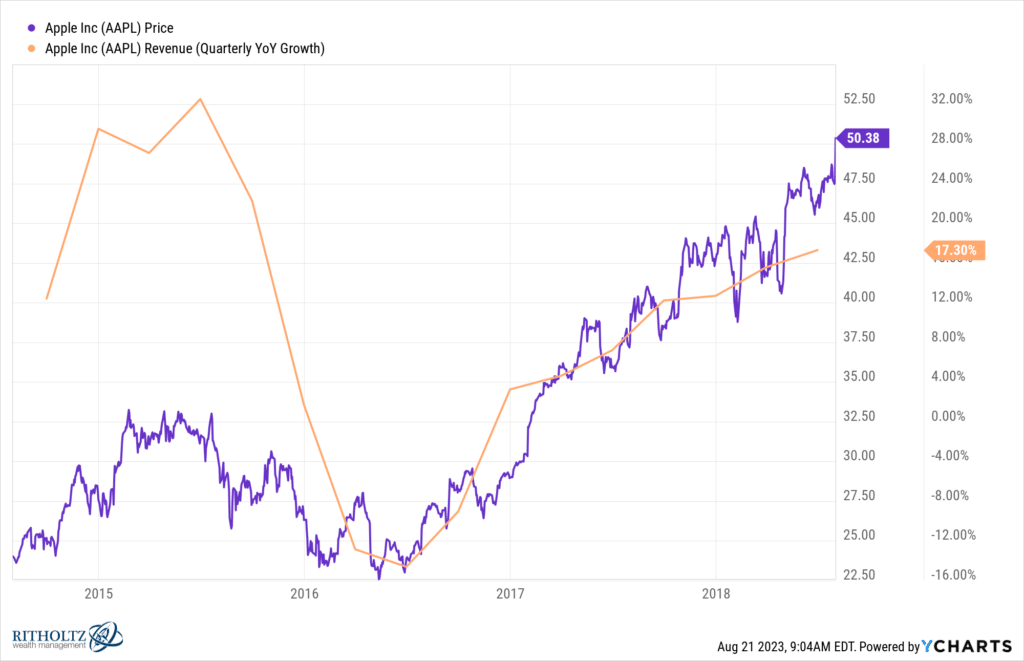

Apple will get some good thing about the brand new telephone through the present quarter, perhaps every week or two’s value of gross sales if it’s accessible mid-September. After three straight quarters of detrimental income progress, this can be important. They’re guiding to income progress for the quarter we’re in now, however we’re speaking about 1% yr over yr (with gross sales of $90.2 billion anticipated).

I really like the elemental set-up right here higher than the technical one.

The final time Apple reported three straight quarters of detrimental income progress after which snapped that slowdown with a gross sales enhance, it was 2015 into 2016. When gross sales troughed through the summer season of that yr, the inventory was as soon as once more off to the races.

It’s not solely the largest inventory on the earth, it’s additionally the perfect firm on the earth, perhaps of all time. You’ve bought a second right here the place gross sales progress is slipping and the inventory is as oversold as its been in years. One of the best case situation for patrons of the inventory right now is that gross sales reaccelerate and the brand new telephone is an on the spot, obvious hit. The technicals will let you know whether or not or not the remainder of your fellow market contributors are keen to make that guess. Watch worth, watch RSI, watch the take a look at of the 200-day transferring common to seek out out.