LIC has launched a brand new single premium conventional life insurance coverage plan. LIC Dhan Vriddhi (Plan no. 869).

Let’s discover out concerning the plan intimately.

LIC Dhan Vriddhi (Plan 869): Essential Options

- Single premium plan: You pay the premium simply as soon as.

- Non-linked, non-participating: This implies you realize upfront what is going to get and when. You may calculate the XIRR from the product upfront.

- Coverage Time period: 10, 15, and 18 years

- Minimal Entry Age: 8 years (10-year coverage time period), 3 years (15-year coverage time period), 90 days (18-year coverage time period)

- 2 choices (variants) based mostly on Sum Assured.

- Possibility 1: Life Cowl = 1.25 X Single Premium

- Possibility 2: Life Cowl = 10 X Single Premium

- Most Entry Age: Can vary from 32 to 60 years relying on coverage time period and variant (possibility 1 or 2) chosen.

- Mortgage Facility obtainable

Are you aware there’s a fast and easy approach to perceive what sort of insurance coverage product you might be shopping for? Collaborating, non-participating, or a ULIP. And the way these merchandise differ. Learn this put up to seek out out.

Single Premium plans have a singular drawback

The maturity proceeds from a life insurance coverage plan are exempt from earnings tax provided that the life cowl is a minimum of 10 occasions the annual premium or the only premium.

Honest sufficient. What’s the difficulty?

Let’s say you pay a single premium of Rs 5 lacs below LIC Dhan Vriddhi. I selected Rs 5 lacs as a result of, from this monetary 12 months, if the combination premium for conventional insurance policies purchased after March 31, 2023 exceeds Rs 5 lacs, the maturity proceeds received’t be exempt from tax. That is over and above 10X premium rule.

By the best way, all these restrictions are just for survival/maturity advantages. Demise profit is all the time exempt from earnings tax.

Coming again, you could have 2 choices.

- Possibility 1: Sum Assured of Rs 1.25 X Single Premium: Sum Assured of Rs 6.25 lacs. The maturity proceeds received’t be exempt from tax.

- Possibility 2: Sum Assured of Rs 10 X Single Premium: Sum Assured of Rs 50 lacs. The maturity proceeds could be exempt from tax (offered you don’t breach Rs 5 lacs in mixture rule).

Why would anybody select a decrease Sum Assured and let maturity proceeds turn into taxable?

Effectively, not so easy.

Whereas the upper life cowl (Possibility 2) ensures that the maturity profit is tax-free, it additionally takes a toll on the returns.

Why?

As a result of a larger portion of your premium/funding should go in direction of offering you life cowl. Conventional merchandise are opaque, and you may’t determine how your cash is getting used to supply you life cowl. Nonetheless, these mortality prices are inbuilt into your product returns. Within the case of LIC Dhan Vriddhi, that is effected by means of decrease assured Additions for Possibility 2. We’ll have a look at this side later within the put up.

All the pieces else being the identical,

Possibility 1 will supply higher pre-tax return, however the maturity proceeds might be taxable. Low Life cowl (Rs 6.25 lacs)

Possibility 2 will supply inferior pre-tax return, however the maturity proceeds might be exempt from tax. Excessive life cowl (Rs 50 lacs)

Now, for those who should spend money on LIC Dhan Vriddhi, you will need to take into account the above elements and determine accordingly.

As an example, for those who assume you may be in 0% or very low-income tax bracket while you obtain payout (and haven’t any want for a big life cowl), then chances are you’ll be OK with Possibility 1 (1.25 X Single Premium). Since you earn higher pre-tax returns (than Possibility 2), and also you received’t need to pay a lot tax in any case.

The nice half is that you’ll know upfront how a lot you’ll get and when. The one uncertainty is about your tax bracket while you obtain these funds. When you’ve got a agency thought, then you possibly can determine simply.

LIC Dhan Vriddhi (Plan 869): Demise Profit

Demise Profit = Sum Assured on Demise + Accrued Assured Additions

Sum Assured on Demise = 1.25 X Single Premium (Possibility 1) OR 10 X Single Premium (Possibility 2)

We will see how Assured Additions are calculated within the subsequent part.

LIC Dhan Vriddhi (Plan 869): Maturity Profit

Maturity profit is payable for those who survive the coverage time period.

Maturity profit = Primary Sum Assured + Accrued Assured Additions

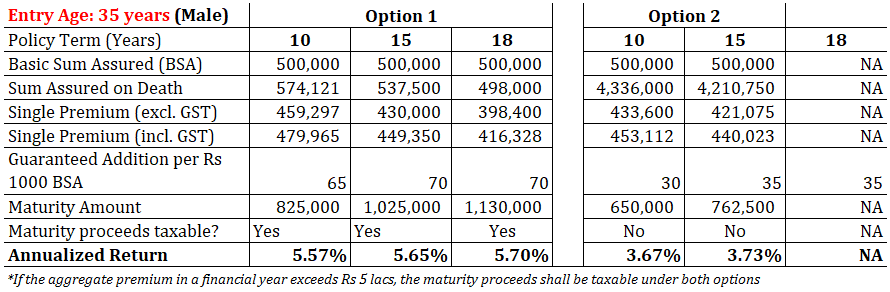

Copying the tabulation from LIC Dhan Vriddhi coverage wordings.

As you possibly can see, Assured Additions are decrease for Possibility 2. Alongside anticipated traces. That is to include the affect of Larger mortality price in case of Possibility 2.

LIC Dhan Vriddhi (Plan 869): What are the returns like?

Let’s perceive this with the assistance of an illustration.

I checked the premium calculator on LIC web site and selected the “On-line” Buy because the medium. You’re alleged to enter the “Primary Sum Assured” and never the Single Premium (that you simply need to make investments) as a part of the calculation circulate.

Be aware that “Primary Sum Assured” is totally different from Sum Assured on Demise.

I selected the Primary Sum Assured of Rs 5 lacs.

Entry age: 35 years (Male)

Possibility 1

Coverage Time period: 15 years (I selected the longer tenure)

The next numbers have been robotically calculated.

Single Premium = Rs 430,000 (excl. GST) (Don’t understand how this was calculated)

Sum Assured on Demise = Rs 5,37,500 (that is 1.25X Single Premium)

Single Premium = Rs 4,49,350 (incl. 4.5% GST)

What would be the maturity quantity?

Assured addition per 12 months = (Primary Sum Assured of Rs 5 lacs/1,000) X 70 = Rs 35,000

Assured additions accrued for 18 years of coverage time period = Rs 35,000 X 15 = Rs 5.25 lacs

Maturity Profit = Primary Sum Assured + Accrued Assured Additions

= Rs 5 lacs + Rs 5.25 lacs = Rs 10.25 lacs

You make investments Rs 4.49 lacs and get Rs 10.25 lacs after 15 years.

That’s an annual return of 5.65% p.a.

Be aware that is pre-tax return. These maturity proceeds might be taxable (after adjusting to your funding).

Possibility 2

Coverage Time period: 15 years

Primary Sum Assured = Rs. 5 lacs

Single Premium = Rs 4,21,075 (excl. GST) (Don’t understand how this was calculated)

Sum Assured on Demise = Rs 42.1 lacs (that is 10 X Single Premium)

Single Premium = Rs 4,40,023 (incl. 4.5% GST)

Assured addition per 12 months = (Primary Sum Assured of Rs 5 lacs/1,000) X 35 = Rs 17,500

Assured additions accrued for 18 years of coverage time period = Rs 17,500 X 15 = Rs 2.62 lacs

Maturity Profit = Primary Sum Assured + Accrued Assured Additions

= Rs 5 lacs + Rs 2.62 lacs = Rs 7.62 lacs

You make investments Rs 4.40 lacs and get Rs 7.62 lacs after 15 years.

That’s an annual return of 3.73% p.a.

Despite the fact that the returns are exempt from tax, 3.73% p.a. is a really low charge of return for a 15-year maturity product.

Be aware that the returns may even rely in your age. I calculate returns for two entry ages (25 and 35) for Primary Sum Assured of Rs. 5 lacs.

As you possibly can see, the returns are larger for decrease age.

What do you have to do?

I belief your judgement.

Totally different buyers have totally different expectations from an funding product. Some need security and return assure. Some need liquidity whereas others are eager on good returns.

With LIC, I wouldn’t fear about my cash not coming again. Furthermore, since LIC Dhan Vriddhi is a non-participating plan, you additionally know upfront what you might be shopping for. What you’ll get and when. You may calculate CAGR/IRR. Zero confusion.

On the identical time, you will need to take into account the speed of return and the taxation of maturity proceeds.

Are returns of three.5%-6% p.a. engaging sufficient for a product with an extended maturity of 10 to 18 years ? Not in my view.

As well as, there are standard flexibility problems with conventional plans. If you happen to should exit for some purpose earlier than coverage maturity, there’s a heavy exit price too.

Do you intend to spend money on LIC Dhan Vriddhi? Let me know within the feedback part.

Disclaimer: Registration granted by SEBI, membership of BASL, and certification from NISM by no means assure efficiency of the middleman or present any assurance of returns to buyers. Funding in securities market is topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing.

Be aware: This put up is for schooling goal alone and is NOT funding recommendation. This isn’t a advice to take a position or NOT spend money on any product. The merchandise quoted are for illustration solely and aren’t recommendatory. In a product assessment, my try is merely to elucidate the product construction and spotlight execs and cons. My views could also be biased, and I could select to not give attention to elements that you simply take into account vital. Therefore, you will need to not base your funding selections based mostly on my writings. There isn’t a one-size-fits-all answer in investments. What could also be a very good funding for sure buyers might NOT be good for others. And vice versa. Due to this fact, learn and perceive the product phrases and circumstances and take into account your danger profile, necessities, and suitability earlier than investing in any funding product.