A current examine from the American Enterprise Institute (AEI) discovered that many states misused federal help associated to the pandemic. As a substitute of utilizing funds for tasks associated to healthcare, training, and infrastructure, state politicians used the lion’s share of federal funding for the final fund and public pensions.

Apart from the blatant misuse of federal {dollars}, this examine highlights one other essential challenge: state and native authorities dependence on funding from the federal authorities. The extra states are depending on DC, the extra management DC has over state and native fiscal affairs. When DC inevitably cuts funding to the states, fiscal crises are certain to happen.

AEI’s examine discovered that state authorities revenues and spending “elevated by round 70 cents per incremental windfall greenback of dedicated federal funds by 2022.” States the place public staff had essentially the most affect over pension fund boards noticed the biggest will increase in pension contributions with these federal {dollars}.

Whereas this misuse of funds is no shock to lots of the critics of federal pandemic help, it needs to be stunning to the typical American. Regardless of the US Treasury explicitly banning using federal funds for pensions and tax cuts, it nonetheless occurred. Proof from the analysis exhibits “no noticed will increase in liquid money positions and primarily full spending of obtained help.”

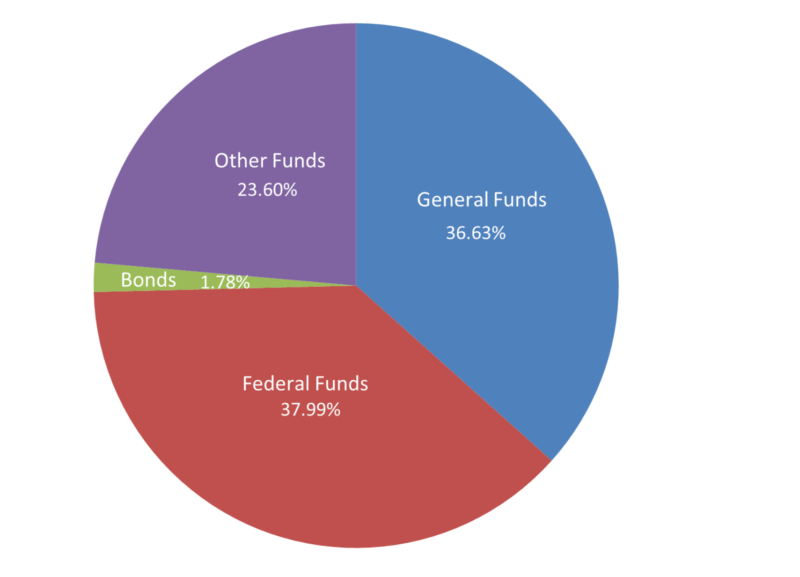

On this case, states should obligate federal cash from the American Rescue Plan (ARPA) by December 31, 2024. They then have till December 31, 2026, to spend it or give it again to the federal authorities. Incentives matter, and in a case of “use it or lose it,” states will discover methods for the cash to be spent. The newest knowledge present that the typical state will get 38 p.c ($21.6 billion) of its income from federal funds, the biggest single class. Expenditures funded by normal fund income make up the second largest class of expenditures ($20.9 billion). Different funds embrace income sources which can be restricted by regulation for particular capabilities or actions (fuel taxes for a transportation fund, tuition and charges for larger training, or supplier taxes for Medicaid) make up the third largest class ($13.5 billion). Bonds make up the smallest class of expenditures ($1 billion), though bond varieties included within the calculations differ by state.

State Finances Expenditures( Capital Inclusive) by Supply, 2022 (50 State Common)

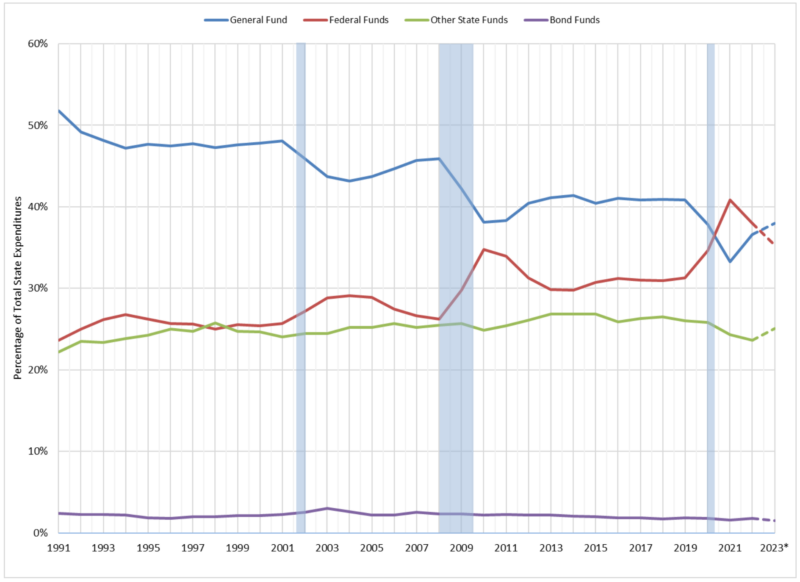

Sadly, this isn’t a brand new growth. Since 1991 (the earliest knowledge accessible), federal funds have steadily elevated as a share of complete expenditures on the state degree. The chart beneath exhibits that the biggest will increase in federal funds to the states occurred instantly following recessions. Out of worry of shedding income, state officers search help from the federal authorities, which is more than pleased to oblige. It’s a manifestation of the Public Alternative idea “the ratchet impact,” the place federal spending spikes instantly after a recession or emergency, then lowers when the disaster subsides, however by no means right down to pre-crisis ranges.

State Finances Expenditures( Capital Inclusive) by Supply as a Share of Whole Expenditures, 1991-2023

*2023 totals are projected

Notice: Shaded areas point out intervals of recession

Supply: Authors’ Calculations, Nationwide Affiliation of State Finances Officers State Expenditure Report 2023 and Historic Information

The Nationwide Affiliation of State Finances Officers (NASBO) additionally tasks that 2023 knowledge will present that normal fund expenditures will exceed federal fund expenditures for the primary time since 2020, but it’s not anticipated to return to 2019 ranges. With federal cash from ARPA nonetheless left to spend, federal funds will probably nonetheless make up not less than a 3rd of the typical state price range.

Like a lot else in authorities spending, the pattern is unsustainable. The newest Monetary Report of the US Authorities concludes by saying that “[t]he projections on this Monetary Report point out that if coverage stays unchanged, the debt-to-GDP ratio will steadily enhance all through the projection interval and past, which suggests present coverage beneath this report’s assumptions is not sustainable and should in the end change” (emphasis added).

That untenability, moreover, has not gone unnoticed. In August 2023 Fitch Scores downgraded the US credit standing from AAA to AA+, the second following the August 2011 decreasing by Normal and Poor. In November 2023, Moody’s Funding Service modified the US credit score outlook to destructive. Decrease credit score scores threaten larger curiosity prices on an already huge quantity of presidency debt. These rising prices and debt will power lawmakers in Washington to make some tough cuts to spending. When the time involves make painful cuts, politicians in DC will lower funding to the states, count on state leaders to cope with the funding points, and allow them to take the blame for the inevitable tax hikes and spending cuts.

Most US states ended FY 2021, 2022, and 2023 with price range surpluses. Many states took the chance to concentrate on tax reduction, switching from graduated revenue taxes to flat revenue taxes. Whereas the flat tax revolution helped many Individuals preserve extra of their hard-earned cash, the features will probably be for naught if states don’t correctly management spending.

One of the simplest ways for states to rein in spending is by enacting constitutional guidelines on the state degree such because the Taxpayer’s Invoice of Rights (TABOR) in Colorado. TABOR limits the expansion of presidency to the utmost development of inhabitants plus inflation, requires any taxes collected in extra of that restrict to be refunded to taxpayers with curiosity, and requires voter approval earlier than new taxes. This rule additionally applies to native governments, so the state can’t develop authorities by means of unfunded mandates on native governments. TABOR, nonetheless, doesn’t apply to federal funds given to Colorado.

One other instance is supplied by Utah, which established the Monetary Prepared Utah program within the wake of the Nice Recession. This package deal of payments requires state companies to have emergency plans in place for anyplace between a 5-percent to 25-percent discount in funding and requires state companies to hunt legislative approval earlier than making use of for federal funds.

State-level constitutional limits on taxes and spending present larger safety from reckless authorities spending than counting on the “proper” candidates to win elections or the “proper” bureaucrats to be appointed. When authorities actors are certain by robust institutional constraints concerning political instincts and incentives towards reckless spending, already-overtaxed residents needn’t depend on wishful considering.