David Snowball wrote The Rise of the Energetic ETFs within the July 2019 Mutual Fund Observer publication describing actively managed exchange-traded funds as:

“Energetic ETFs are a kind of hybrid between extra conventional ETFs and actively managed mutual funds. Like conventional ETFs, they commerce on the secondary market which implies that the advisor doesn’t must hold money readily available so as to meet day-to-day withdrawal wants. A number of the bills historically borne by the advisor both don’t exist (ETFs have fewer shareholder stories than, by regulation, mutual funds do) or are shifted to the brokerage agency. In addition they provide a structural tax benefit: shareholders aren’t answerable for the yearly tax penalties (and record-keeping) of the supervisor’s strikes; shareholders are taxed solely once they promote their shares.”

Actively managed exchange-traded funds have gotten much more standard. This text identifies practically 100 high-performing actively managed ETFs. This text is split into the next sections:

CONTAINING THE SCIENCE PROJECT

With out which means to show this into a big science venture, I extracted 471 actively managed ETFs that had at the least $10 million in property beneath administration, outperformed their class friends by at the least 1.5 share factors, and had expense ratios of 1 % or much less. There are actively managed, index, enhanced technique, managed volatility, and Sensible Beta classes with funds typically overlapping a number of classes. By a means of elimination, I narrowed the record all the way down to lower than 100 high-performing funds separated into 5 tables on this article.

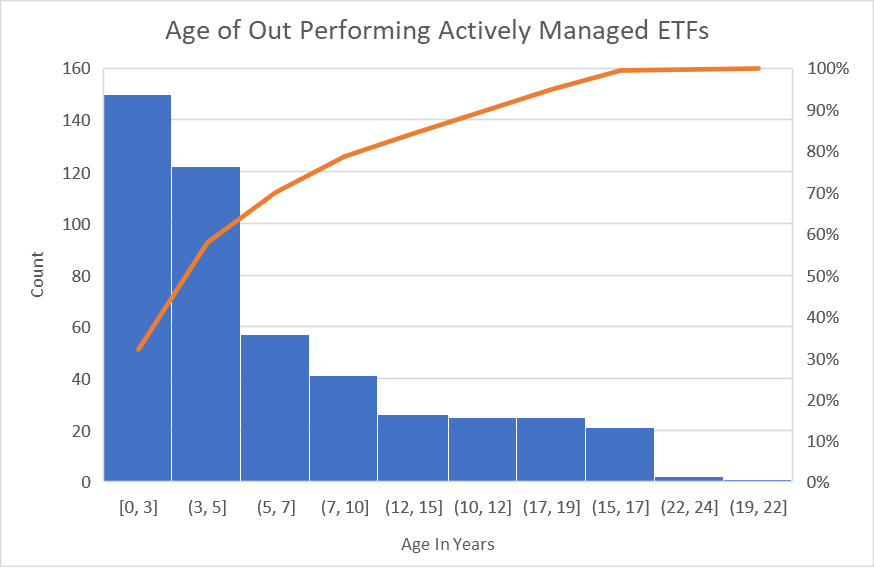

Determine #1 exhibits that roughly 65% of the outperforming funds are lower than seven years outdated.

Determine #1: Age of Outperforming Actively Managed ETFs

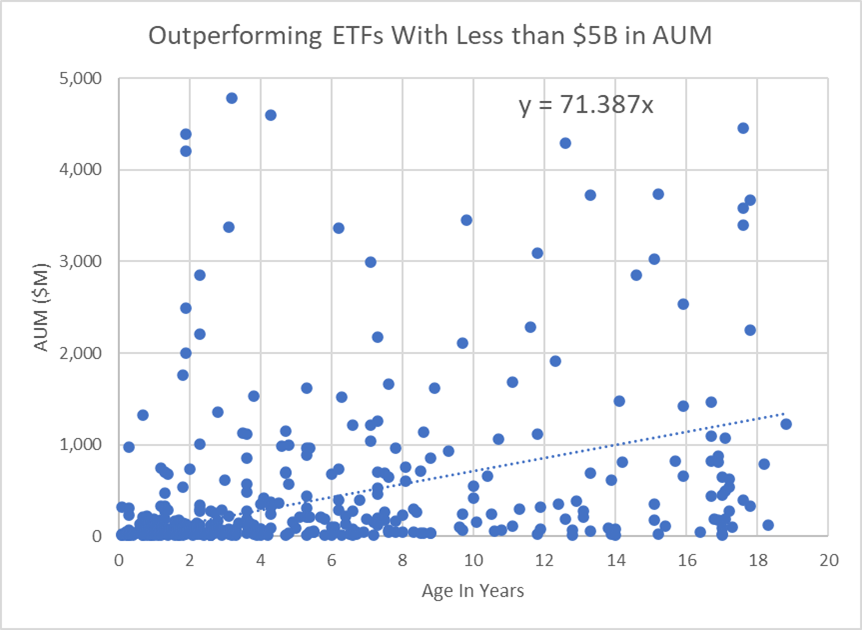

I’ll separate the “well-known outperforming actively managed ETFs” with over $5B and take a look at them individually. Determine #2 exhibits Belongings Beneath Administration versus Age of the remaining 362 outperforming actively managed ETFs with lower than $5B in AUM. The regression line identifies 129 “up and coming” future bond and fairness stars (above the blue line) which have AUM greater than 71 occasions multiplied by the age in years. There are twenty “unappreciated Nice Owl funds” amongst those who haven’t attracted buyers’ curiosity (beneath the dashed line).

Determine #2: Outperforming ETFs with Much less Than $5B in AUM

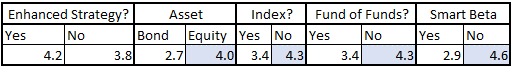

From Desk #1, we will see that funds which are “Sensible Beta” or “Fund of Funds” have decrease outperformance as measured by “APR vs Peer” than these which are. We are going to analyze “Fund of Funds” and “Sensible Beta” as a separate group.

Desk #1: Common APR vs Peer for Lifetime of Fund

EMERGING FROM THE FOREST INTO THE TREES

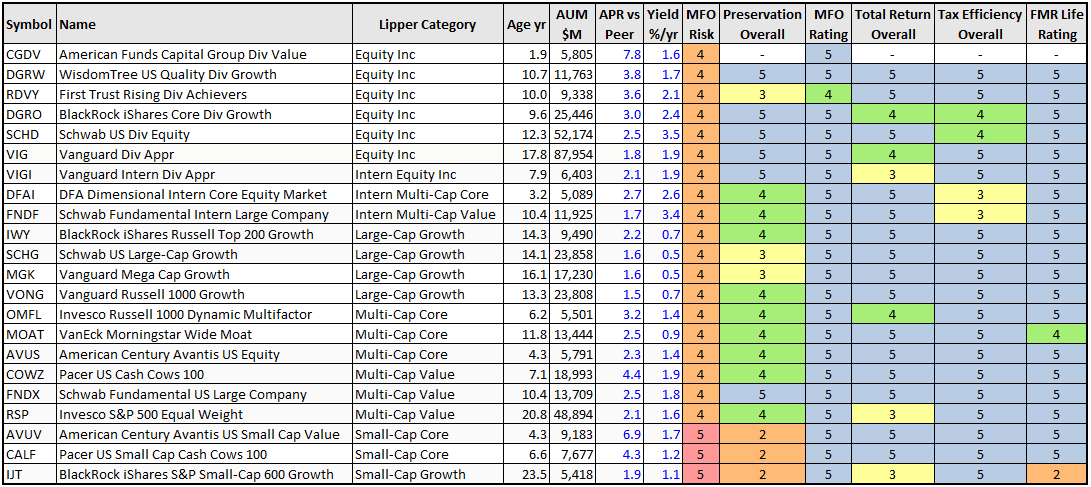

The unique 471 funds had been pared all the way down to 98 based mostly on “APR vs Peer” and risk-adjusted efficiency over a number of intervals. Desk #2 incorporates the fairness funds that buyers have acknowledged as outperformers as mirrored by having greater than $5B in property beneath administration.

Desk #2: Acknowledged Outperformers with Greater than $5B in AUM (Lifetime of Fund)

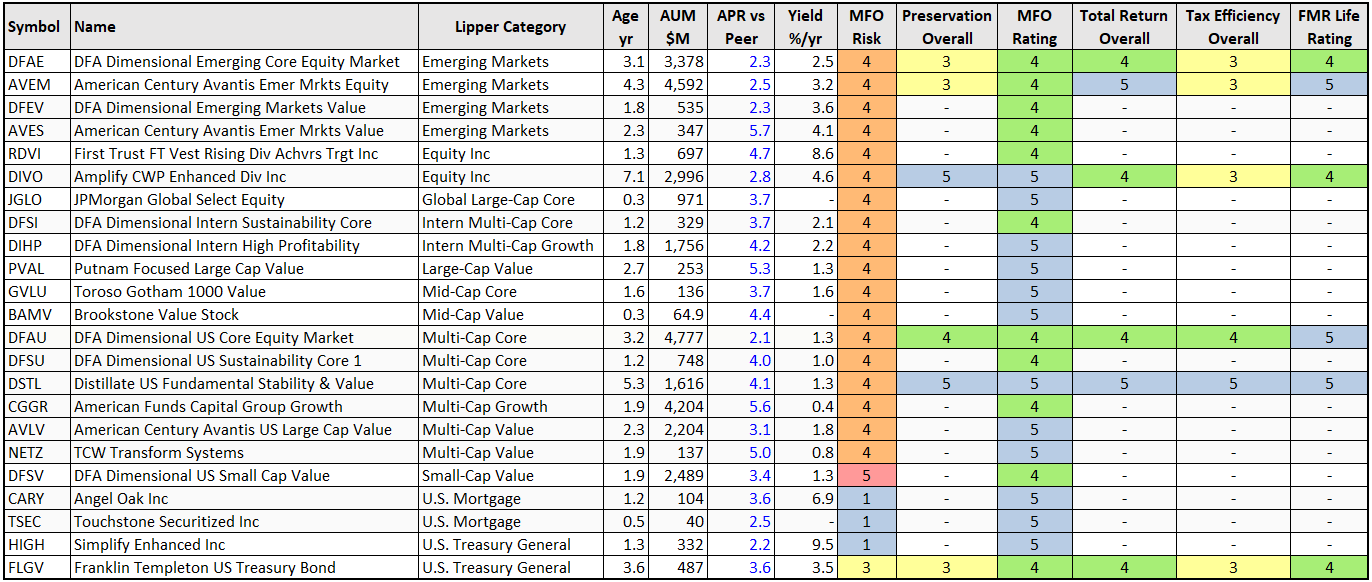

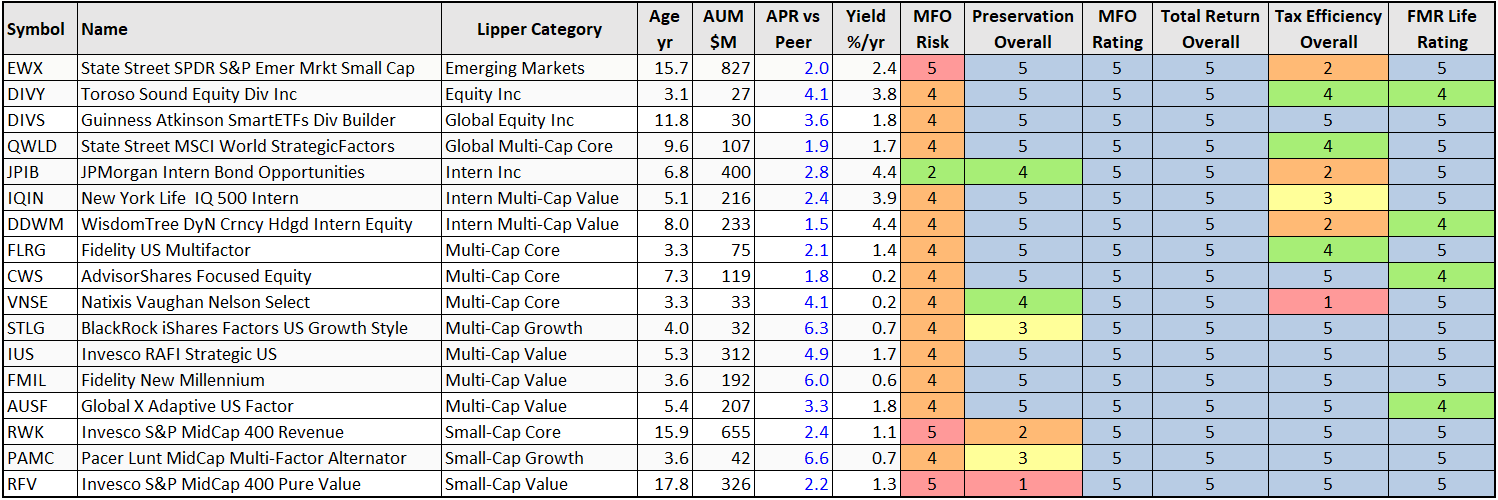

Desk #3 incorporates the outperforming funds that buyers are recognizing as “Up and Coming Future Stars” as measured by AUM relative to age. As could be seen, many of the funds haven’t been in existence for greater than three years.

Desk #3: Up and Coming Future Stars with Much less Than $5B in AUM

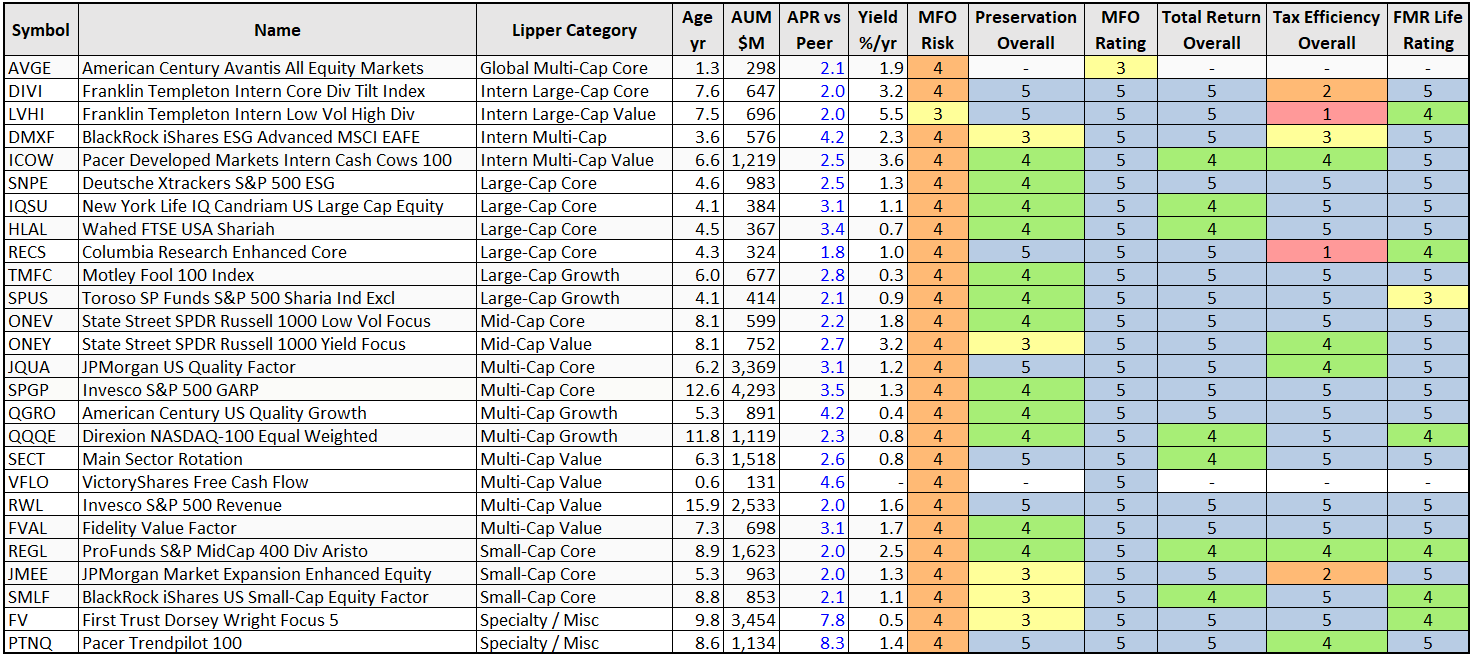

Desk #4 incorporates outperforming funds categorised as Nice Owls by Mutual Fund Observer that buyers haven’t dedicated to as measured by AUM relative to age.

Desk #4: Beneath-Appreciated Nice Owls (Lifetime of Fund)

Desk #5 incorporates solely Sensible Beta funds and Fund of Funds.

Desk #5: Outperforming Sensible Beta and Fund of Funds

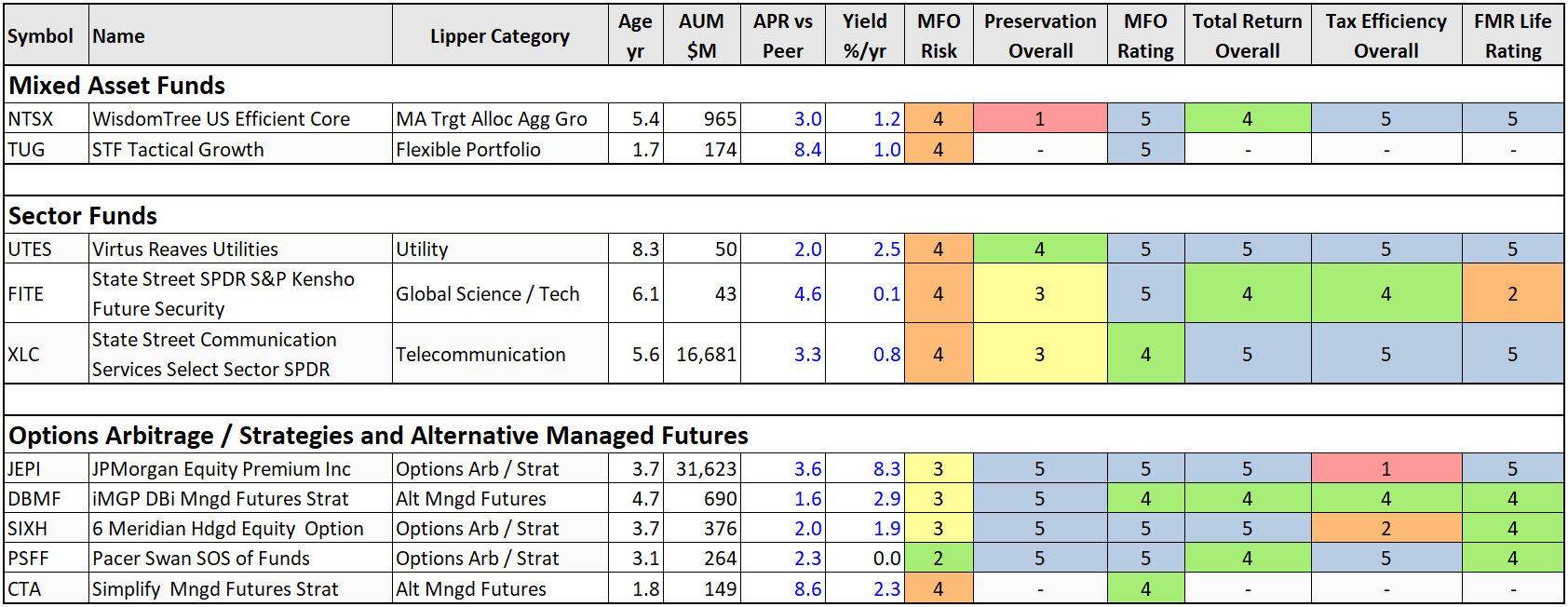

Desk #6 incorporates Blended Asset, Sector, and Choices Arbitrage/Methods and Managed Futures Funds.

Desk #6: Different Notable Outperformers

SHORT LIST OF GREAT OWL FUNDS

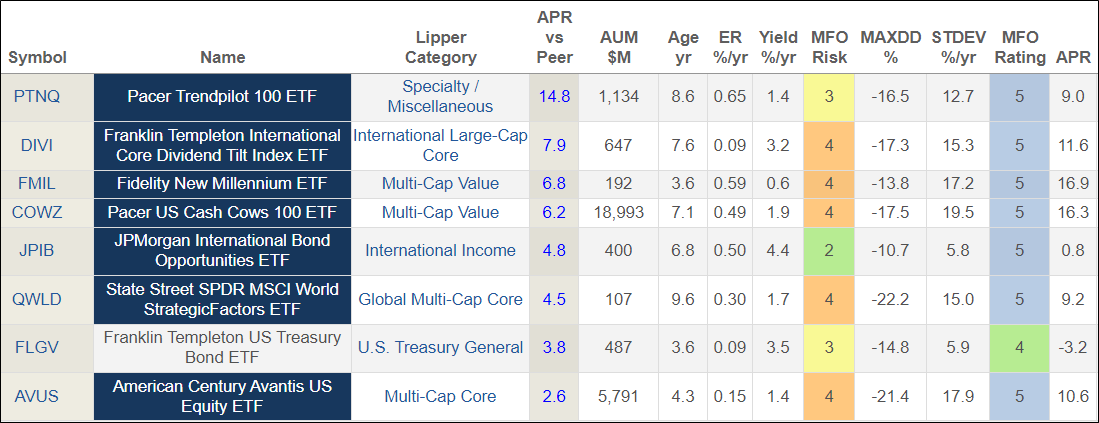

I then went via the 98 funds and chosen no a couple of fund per Lipper Class based mostly on relative efficiency over a number of time intervals except for the Mult-Cap Worth class which has two funds. Desk #7 incorporates my quick record of funds. Since I’ve already written about and just like the Constancy New Millenium Fund (FMIL), I chosen Franklin Worldwide Core Dividend Tilt Index ETF (DIVI) as a fund to profile within the subsequent part.

Desk #7: Brief Listing of Outperforming Funds (Metrics – Three Years)

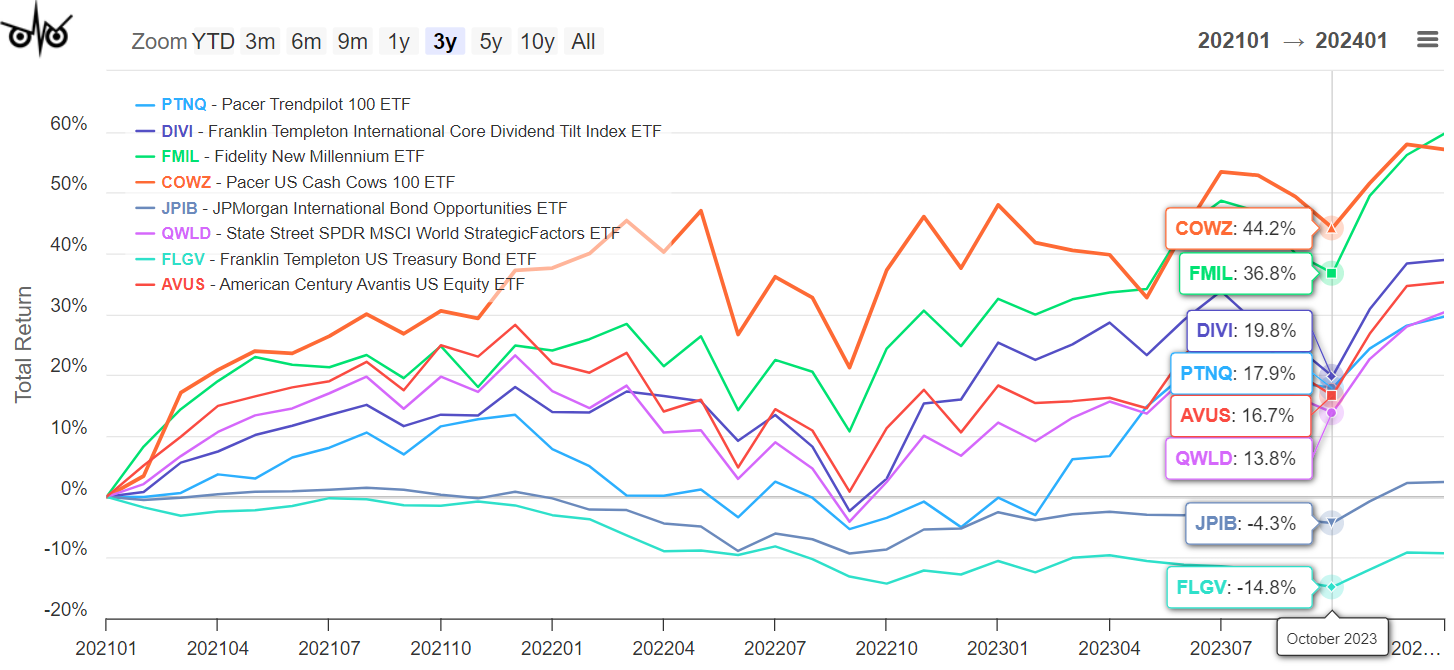

Outperformance is measured relative to friends in the identical Lipper Class and doesn’t indicate that the class carried out effectively, for instance, bonds in Determine #3.

Determine #3: Brief Listing of Outperforming Funds

FRANKLIN INTERNATIONAL CORE DIVIDEND TILT INDEX ETF (DIVI)

Franklin Worldwide Core Dividend Tilt Index ETF (DIVI) has $675 million in property beneath administration in 463 mid- and large-cap holdings with an expense ratio of 0.09%. The 30-Day SEC Yield is 3.9%. The trailing price-to-earnings ratio is 13.3. Fifty-seven % of its property are in Europe, with 28% in Asia, and 11 % in Australia and New Zealand. Almost 60% of the property are invested in Financials (23%), Well being Care (12%), Industrials (11%), and Client Discretionary (11%). The Fund was modified in August 2022 to trace Linked Morningstar Developed Markets ex-North America Dividend Enhanced Choose Index and modified its principal funding methods.

The hyperlink to the Prospectus is right here. The Principal Funding Methods are,

“Beneath regular market circumstances, the Fund invests at the least 80% of its property within the part securities of the Underlying Index and in depositary receipts representing such securities. The Underlying Index is a scientific, rules-based proprietary index that’s maintained and calculated by Morningstar, Inc. (Morningstar or Index Supplier). The Underlying Index relies on the Morningstar® Developed Markets ex-North America Goal Market Publicity Index (Dad or mum Index) and is constructed by making use of an optimization course of to the Dad or mum Index that goals to ship a better dividend yield than the Dad or mum Index, whereas limiting anticipated monitoring error to the Dad or mum Index (i.e., to offer a “dividend tilt” via the choice and weighting of securities from the Dad or mum Index)…”

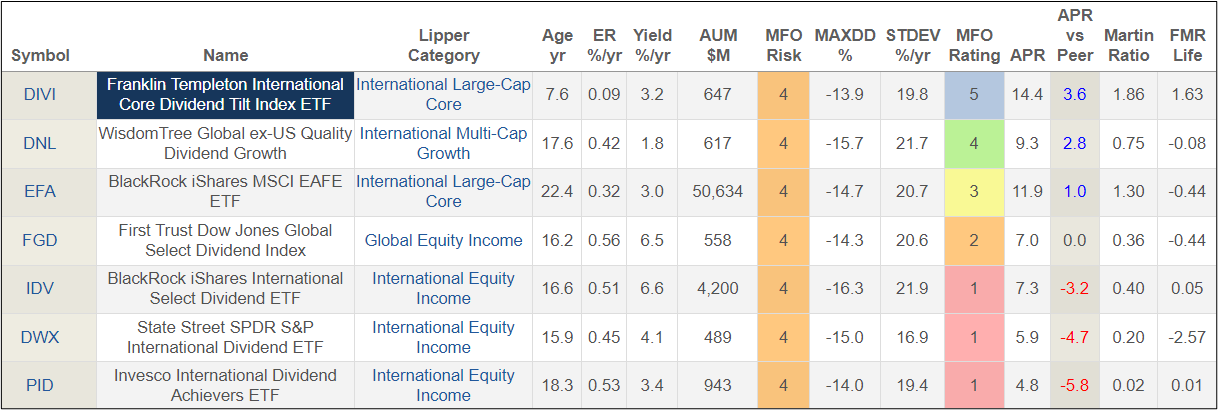

Fred Piard, a quantitative analyst with a Ph.D. in laptop science, wrote about Franklin Worldwide Core Dividend Tilt Index ETF (DIVI) in “A Main Worldwide Dividend Fund” on In search of Alpha. Mr. Piard lists a number of competitor funds which I embody in Desk #8 for the previous eighteen months since August 2022.

Desk #8: DIVI and Comparable Fund Efficiency (18 months)

PORTFOLIO OF OUTPERFORMING ACTIVELY MANAGED FUNDS

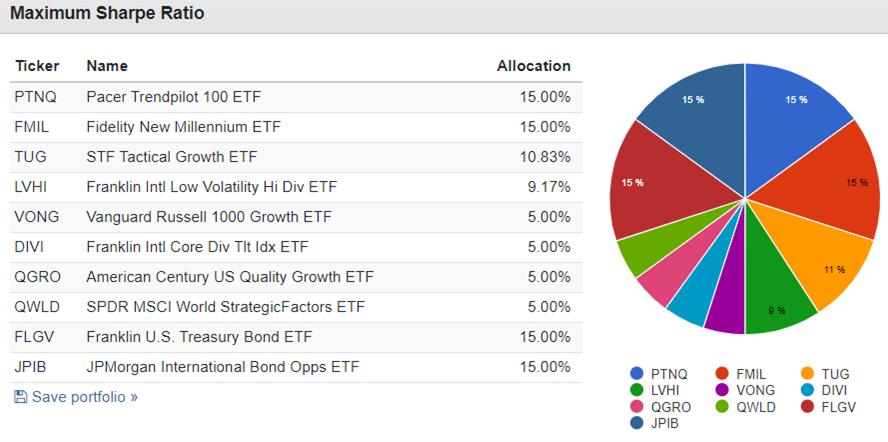

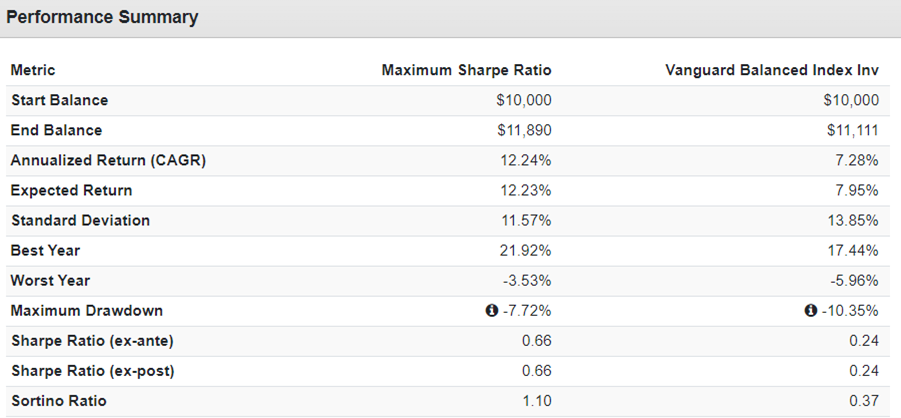

I take portfolio optimization with a grain of salt as a result of outcomes are based mostly on historic knowledge which can not characterize future efficiency; nonetheless, a lot perception could be gained. I loaded twenty-five funds into Portfolio Visualizer Portfolio Optimization and thru a means of elimination narrowed the record down to 10 to maximise the Sharpe Ratio. The hyperlink to Portfolio Visualizer Portfolio Optimization is right here. I take advantage of constraints on allocations to imitate a balanced portfolio.

Determine #4: Portfolio of Actively Managed Funds to Maximize the Sharpe Ratio

Desk #9 exhibits that the Portfolio of outperforming actively managed ETFs had a better return with decrease volatility and drawdown than the Vanguard Balanced Index Fund.

Desk #9: Efficiency of Most Sharpe Ratio Portfolio (18 Months)

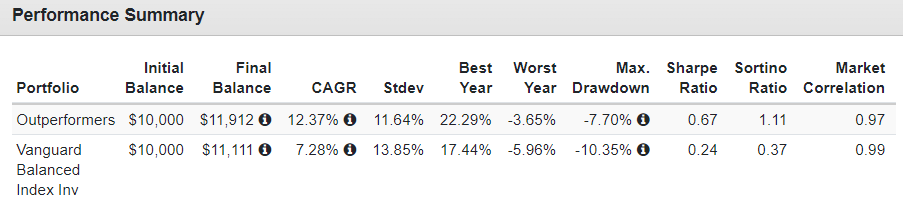

I used the Portfolio Visualizer Backtest Portfolio to get the stock-to-bond ratio. The hyperlink to the Portfolio Visualizer Backtest Portfolio is right here. The Outperformers portfolio is roughly 63% inventory.

Desk #10: Efficiency of Most Sharpe Ratio Portfolio (18 Months)

Determine #5 is a visible illustration of the efficiency.

Determine #5: Outperforming ETF Portfolio vs Vanguard Balanced Index Fund

Closing

Actively managed ETFs have some benefits over mutual funds. This text exhibits that many ETFs keep this benefit over the long run. I added the outperforming actively managed ETFs that I used to be not monitoring to my MFO Watchlists. These will turn out to be a bigger a part of my fund choice going ahead.

Finest Needs for Investing in 2024!