Touchdowns and Turnovers: MFO’s All-Star Picks for the Greatest US Fairness Funds of 2023

Who would be the NFL MVP? The cash is on Lamar Jackson of the Baltimore Ravens, declared “undeniably probably the most electrical gamers within the league.” The 27-year-old had a passer ranking of 102.7 with 3,678 yards, 24 touchdowns towards seven interceptions, and performed in all 16 video games. He was magical. (No less than till he confronted the Steelers towards whom he sports activities a 1-3 file or bought to the playoffs.) For his accomplishments, he earned a quarter-billion-dollar contract.

Who would be the NFL MVP? The cash is on Lamar Jackson of the Baltimore Ravens, declared “undeniably probably the most electrical gamers within the league.” The 27-year-old had a passer ranking of 102.7 with 3,678 yards, 24 touchdowns towards seven interceptions, and performed in all 16 video games. He was magical. (No less than till he confronted the Steelers towards whom he sports activities a 1-3 file or bought to the playoffs.) For his accomplishments, he earned a quarter-billion-dollar contract.

Sadly, Mr. Jackson isn’t making you any cash. Fortunately, one other MVP Jackson may: Jackson Sq. Giant-Cap Development, a fund whose TDs-to-turnovers ratio in 2023 was untouchable.

Likewise, C.J. Stroud was acknowledged because the league’s Rookie of the 12 months. However no rookie within the fund world put up extra compelling numbers than American Funds Capital Group US Worth ETF.

Within the spirit of Awards Season, MFO is proud to current its US Fairness Fund Awards for 2023. Numerous individuals provide fund awards, however they’re largely boring and primarily based on stuff you possibly can discern at a look: “highest one-year returns by an rising markets fairness fund, highest three-year returns by an rising markets fairness fund …” We’ll as an alternative observe the NFL’s lead and award:

- Defensive Participant of the 12 months

- Defensive Rookie of the 12 months

- Offensive Participant of the 12 months

- Offensive Rookie of the 12 months

- Most Invaluable Participant of the 12 months

Lastly, we are going to announce the rosters for the 2 Rookie All-Professional Groups.

Why provide awards?

These are not purchase suggestions. These are funds that, generally, you’ve by no means heard of (although we’ve got written about a number of). They characterize a chance to find out about new methods, uncover new managers, and maybe refresh your portfolio for 2024. Our choice standards, detailed earlier than every class, targeted solely on 2023 efficiency. That’s the “of the 12 months” half. Some have faltered previously, some may by no means see this stage of efficiency once more.

So two issues: (1) it’s enjoyable, individuals! Have some enjoyable! And (2) it’s an excuse to study one thing new. Embrace it!

Eligible funds included all US fairness funds together with OEF, ETF, and CEF funding funds; it excludes insurance coverage merchandise, funds with slim sector focuses or reliance on cryptocurrencies, and funds made for buying and selling or hypothesis. Lastly, the funds needed to be accessible to retail traders. That excluded funds with institutional minimums (GMO, as an example, has a number of promising new funds) or funds out there solely to a specific shopper group (for instance, funds solely out there to a agency’s fund-of-funds).

MFO Rookie funds are these in existence for a couple of 12 months however lower than two.

Defensive Participant of the 12 months

Standards: eligible funds positioned within the lowest tier for 2023 most drawdown whereas scoring whole returns of common to above. Amongst eligible funds, we appeared for the best return relative to friends.

Winner: Goodhaven Fund (GOODX)

GoodHaven Fund (GOODX) was launched in April 2011 by Larry Pitkowsky and Keith Trauner, two former associates of the iconoclastic Bruce Berkowitz, who manages Fairholme Fund. The fund had two good years, then an extended stretch of lean ones. In 2020, they took an extended exhausting look within the mirror and concluded that it wasn’t working. They concluded that they’d been undercutting their very own success, and their traders, with a collection of misjudgments and rolled out a collection of modifications in late 2020. Supervisor Pitkowsky focuses extra on high quality than statistical worth, on investing in “particular conditions” solely after they have been particular, and exercising larger endurance with good corporations.

GoodHaven Fund (GOODX) was launched in April 2011 by Larry Pitkowsky and Keith Trauner, two former associates of the iconoclastic Bruce Berkowitz, who manages Fairholme Fund. The fund had two good years, then an extended stretch of lean ones. In 2020, they took an extended exhausting look within the mirror and concluded that it wasn’t working. They concluded that they’d been undercutting their very own success, and their traders, with a collection of misjudgments and rolled out a collection of modifications in late 2020. Supervisor Pitkowsky focuses extra on high quality than statistical worth, on investing in “particular conditions” solely after they have been particular, and exercising larger endurance with good corporations.

By Morningstar’s evaluation, GoodHaven’s portfolio is characterised by dramatically increased high quality names with increased development prospects than its friends. That has corresponded with a interval of dramatic outperformance by way of whole returns, draw back administration, and risk-adjusted returns.

Comparability of 1-12 months Efficiency, 1/2023 – 12/2023

| Identify | 2023 Return | Most drawdown | Draw back deviation | Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

| GoodHaven | 34.1 | -6.7 | 5.8 | 2.3 | 1.92 | 5.00 | 12.6 |

| Multi-cap worth friends | 12.7 | -9.4 | 9.2 | 4.5 | 0.47 | 0.90 | 1.96 |

Defensive Rookie of the 12 months

Standards: eligible rookie funds positioned within the lowest tier for 2023 most drawdown whereas scoring whole returns of common to above. Amongst eligible funds, we appeared for the best return relative to friends.

Winner: Distillate Small/Mid Money Movement ETF (DSMC)

Distillate Small/Mid Money Movement ETF launched in October 2022. DSMC is an actively managed exchange-traded fund that invests in small- and mid-capitalization corporations. It’s designed to supply traders publicity to an attractively valued portfolio of roughly 150 U.S. small- and mid-cap shares that meet particular parameters involving reported and anticipated free money move and stability sheet high quality.

Distillate Small/Mid Money Movement ETF launched in October 2022. DSMC is an actively managed exchange-traded fund that invests in small- and mid-capitalization corporations. It’s designed to supply traders publicity to an attractively valued portfolio of roughly 150 U.S. small- and mid-cap shares that meet particular parameters involving reported and anticipated free money move and stability sheet high quality.

The objective, akin to Goodhaven’s, is to reside within the curiosity of high quality and worth. The managers argue that accounting guidelines haven’t saved up with the evolution of the worldwide financial system, “rendering many conventional measures of worth, high quality, and danger unhelpful.” In response they developed personalized measures of worth and high quality and, to an extent, reconsidered the character of “danger.”

Managers Jay Beidle and Matthew Swanson, founding companions of Distillate, beforehand labored for 10 and 18 years, respectively, as analysts and managers at Institutional Capital, LLC (ICAP), a Chicago-based worth funding boutique.

This small core fund returned 29.4%, besting its common peer by 13.5%. Extra importantly, its most 2023 drawdown was -10.8%, whereas its common peer dropped 14.3% in the identical interval. Distillate has gathered $48 million in property. The fund posted a smaller draw back (that’s, “dangerous”) deviation and had a decrease Ulcer Index than its friends, although its commonplace (that’s, day-to-day) deviation was about two factors increased. Its risk-adjusted metrics (Sharpe, Martin, and Sortino ratios) have been three to 4 occasions larger than its friends.

Comparability of 1-12 months Efficiency, 1/2023 – 12/2023

| Identify | 2023 Return | Most drawdown | Draw back deviation | Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

| Distillate Small/Mid | 29.4 | -10.8 | 9.9 | 5.2 | 1.02 | 2.46 | 4.69 |

| Small-cap core friends | 16.0 | -14.2 | 12.2 | 6.9 | 0.48 | 0.93 | 1.73 |

Offensive Participant of the 12 months

Standards: eligible funds positioned within the highest tier for 2023 whole returns whereas having a most drawdown no larger than common. Amongst eligible funds, we appeared for the best return relative to friends.

Winner: Worth Line Bigger Firms Targeted (VALLX)

Worth Line Bigger Firms Targeted launched in 1972. The supervisor invests in 25-50 large-cap ($10 billion and up) shares. The distinguishing attribute of the technique is its use of the venerable Worth Line Timeliness Rating System to help in choosing securities for buy. The supervisor is “helping by” however not “certain by” that system, so the highest-rated shares could be excluded for different causes.

Worth Line Bigger Firms Targeted launched in 1972. The supervisor invests in 25-50 large-cap ($10 billion and up) shares. The distinguishing attribute of the technique is its use of the venerable Worth Line Timeliness Rating System to help in choosing securities for buy. The supervisor is “helping by” however not “certain by” that system, so the highest-rated shares could be excluded for different causes.

Supervisor Cindy Starke has been with the agency since Could 2014 and is without doubt one of the longest-tenured managers within the fund’s historical past. Ms. Starke started her funding profession as a portfolio supervisor for U.S. Belief Firm. She moved on with that funding staff to develop into a founding portfolio supervisor at NewBridge Companions, which was acquired by Victory Capital Administration in 2003 the place she was a co-portfolio supervisor of the Victory Targeted Development Mutual Fund.

Worth Line’s 59% return, which positioned it within the prime 2% of its Morningstar friends, bested its friends by 2700 foundation factors with no larger volatility. The fund’s risk-adjusted return scores – Sharpe, Sortino, Martin – are a a number of of its friends.

Comparability of 1-12 months Efficiency, 1/2023 – 12/2023

| Identify | 2023 Return | Most drawdown | Draw back deviation | Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

| Worth Line Bigger Firms Targeted | 59.1 | -11.7 | 9.2 | 4.2 | 2.17 | 5.88 | 12.9 |

| Multi-cap development friends | 32.4 | -11.7 | 9.6 | 4.5 | 0.48 | 3.02 | 6.68 |

Offensive Rookie of the 12 months

Standards: eligible rookie funds positioned within the highest tier for 2023 whole returns whereas having a most drawdown no larger than common. Amongst eligible funds, we appeared for the best return relative to friends.

Winner: American Funds Capital Group US Worth ETF (CGDV)

American Funds Capital Group US Worth ETF is an actively managed ETF that invests in dividend-paying shares of bigger established U.S. corporations. One objective is to provide extra revenue than its large-cap benchmark index. The portfolio presently holds about 50% with about 15% of the portfolio in small- to mid-cap shares and 6% in worldwide shares.

American Funds Capital Group US Worth ETF is an actively managed ETF that invests in dividend-paying shares of bigger established U.S. corporations. One objective is to provide extra revenue than its large-cap benchmark index. The portfolio presently holds about 50% with about 15% of the portfolio in small- to mid-cap shares and 6% in worldwide shares.

The portfolio is targeted on dividend-paying shares however, particularly, on the inventory of American corporations “whose debt securities are rated no less than funding grade … or unrated however decided to be of equal high quality by the fund’s funding adviser.” That then serves as a marker of “established.”

The fund is managed, within the American Funds custom, by a risk-conscious staff of 5 who additionally share duty for a few of American’s largest fairness funds.

This fairness revenue fund returned 28.8%, besting its common peer by 1,760 foundation factors. Its most drawdown was -7.35%, 21o bps higher than its friends, and its Sharpe ratio was 4 occasions increased. The fund had decrease danger scores (commonplace deviation, draw back deviation, Ulcer Index and better risk-adjusted returns (Sharpe ratio, Sortino ratio, Martin ratio) than its friends. The fund has not gone unnoticed, drawing $5.9 billion in property since its February 2022 launch.

Comparability of 1-12 months Efficiency, 1/2023 – 12/2023

| Identify | 2023 Return | Most drawdown | Draw back deviation | Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

| American Funds Capital Group US Worth ETF | 28.8 | -7.4 | 6.0 | 2.8 | 1.70 | 3.94 | 8.44 |

| Fairness revenue friends | 11.2 | -9.5 | 9.1 | 4.6 | 0.40 | 0.78 | 1.81 |

Most Invaluable Fund

Standards: eligible funds are those who concurrently appeared within the prime tier for whole returns and the highest tier for the bottom most drawdown. Amongst eligible funds, we appeared for the best Sharpe ratio.

Winner: Jackson Sq. Giant-Cap Development (JSPJX)

Jackson Sq. Giant-Cap Development launched in 1993 as Delaware US Development. Jackson Sq. acquired the fund’s property in April 2021. The fund invests in corporations with an fairness capitalization of greater than $3 billion and describes itself as benchmark agnostic, holding a concentrated, conviction-weighted portfolio. That final half (“conviction weighted”) is critical in gentle of a current Morningstar examine that claims most lively managers fail, not as a result of they will’t choose good equities however as a result of they can not weigh within the portfolio in a method that enables the entire to make sense. They presently maintain 26 shares.

The Jackson Sq. staff aspires to “a concentrated portfolio of corporations which have superior enterprise fashions, robust money flows, and the chance to generate constant, long-term development of intrinsic enterprise worth.”

The fund is managed by William “Billy” Montana and Brian Tolles. Mr. Montana joined Jackson Sq. Companions as an analyst in September 2014. Mr. Tolles joined as an analyst in February 2016 and was promoted to portfolio supervisor in January 2019. The fund’s longer-term file is muddied by turnover in administration; Mr. Montana was one member of a five-person staff in 2020, 4 of whom have now left the fund. Mr. Tolles, contrarily, has been on board for half a 12 months.

Jackson Squares’ splendid 2023 efficiency is mirrored in 51.5% return, which exceeds its friends by 1000 foundation factors, however extra importantly by the refusal of the fund to say no in worth. Their most drawdown of two% is one-quarter of what their friends expertise and their Ulcer Index (a measure of how far a fund falls and the way lengthy it takes to get better) is on par with a short-term bond fund’s.

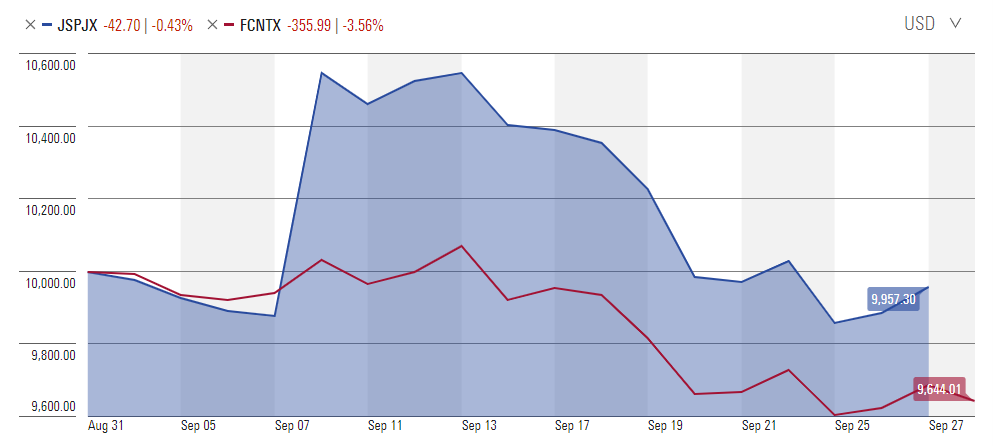

Right here’s the flag: This efficiency is out of line with the fund’s long-term file. That enchancment may need been attributable to Mr. Tolles’ arrival, which might make the advance sustainable. Alternately, the driving force of the fund’s win may need been “within the third quarter of 2023 the Jackson Sq. Giant Cap Development fund acquired proceeds from a class-action settlement from an organization that it now not owns. This settlement had a fabric impression on the fund’s funding efficiency. It is a one-time occasion that isn’t more likely to be repeated.” How considerably? On September 8, the fund’s NAV was $17.45. It opened on 9/11 at $18.62, a 6.7% achieve at a time when friends have been largely flat.

Right here’s what that appeared like, compared to Constancy Contrafund.

Comparability of 1-12 months Efficiency (Since 202301)

| Identify | 2023 Return | Most drawdown | Draw back deviation | Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

| Jackson Sq. Giant-Cap Development | 51.5 | -2.1 | 2.8 | 0.8 | 3.14 | 16.7 | 57.9 |

| Giant-cap development friends | 41.2 | -8.1 | 7.3 | 3.1 | 2.06 | 5.04 | 12.1 |

The fund edged out a cohort of stars for the award, it was adopted within the rankings by seven T. Rowe Value and Constancy funds together with TRP Blue Chip Development ETF and Constancy Contrafund. In the event you’re searching for an MVP with a greater likelihood of repeating the feat, you must examine runner-up T Rowe Value Blue Chip Development ETF (TCHP).

| Identify | 2023 Return | Most drawdown | Draw back deviation | Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

| Jackson Sq. Giant-Cap Development | 51.5 | -2.1 | 2.8 | 0.8 | 3.14 | 16.7 | 57.9 |

| T Rowe Value Blue Chip Development ETF | 50.1 | -6.3 | 6.4 | 2.5 | 2.62 | 6.98 | 17.8 |

| Giant-cap development friends | 41.2 | -8.1 | 7.3 | 3.1 | 2.06 | 5.04 | 12.1 |

TCHP is a non-transparent, lively ETF run by the identical supervisor, Paul Greene, liable for the Blue Chip Development Fund.

The Rookie All-Professional Staff: The Prime Rookie Fairness and Allocation Funds of 2023

Lastly, we searched MFO Premium for the whole roster of rookie stand-outs. Rookie funds are these with a couple of 12 months however lower than two years within the league. We screened for rookies who earned their spot on the roster by combining top-tier risk-adjusted returns in addition to peer-beating absolute returns. For the sake of simplicity, we separated fairness from revenue funds.

Lastly, we searched MFO Premium for the whole roster of rookie stand-outs. Rookie funds are these with a couple of 12 months however lower than two years within the league. We screened for rookies who earned their spot on the roster by combining top-tier risk-adjusted returns in addition to peer-beating absolute returns. For the sake of simplicity, we separated fairness from revenue funds.

Choice standards: Rookie All-Professional funds needed to end within the prime tier MFO Ranking (“MFO Ranking is the principal efficiency rating metric used within the MFO ranking system and located throughout a lot of the MFO Premium pages. It ranks a fund’s efficiency primarily based on risk-adjusted return, particularly Martin Ratio, relative to different funds in the identical funding class over the identical analysis interval”) and Sharpe Ratio Ranking. The All-Professional starters additionally needed to rating within the lowest tier of Ulcer Scores; that signaled that they have been greatest at (a) limiting draw back and (b) recovering rapidly from it.

ETFs have three- or four-character symbols, open-ended funds have 5 characters ending with “X”.

| Image | Identify | Lipper Class | 2023 return | APR vs Peer | Ulcer Ranking |

| WCFEX | WCM Targeted Rising Markets ex China | Rising Markets | 28.7 | 18.9 | 1 |

| WXCIX | William Blair Rising Markets ex China Development | Rising Markets | 23.7 | 13.9 | 1 |

| JHFEX | John Hancock Elementary Fairness Earnings | Fairness Earnings | 20.2 | 10.7 | 2 |

| STXD | Attempt 1000 Dividend Development | Fairness Earnings | 15 | 5.4 | 1 |

| PBDC | Putnam BDC Earnings | Monetary Companies | 30.1 | 19.8 | 1 |

| BKGI | BNY Mellon International Infrastructure Earnings | International Infrastructure | 9.8 | 6.1 | 2 |

| VMAT | V-Shares MSCI World ESG Materiality and Carbon Transition | International Multi-Cap Core | 28.8 | 12.6 | 2 |

| TRFK | Pacer Information and Digital Revolution | International Science / Expertise | 67 | 22.5 | 1 |

| MEDI | Harbor Well being Care | Well being / Biotechnology | 24.9 | 21.8 | 1 |

| HAPI | Harbor Human Capital Issue US Giant Cap | Giant-Cap Core | 30.3 | 7.3 | 2 |

| PJFG | Prudential PGIM Jennison Targeted Development | Giant-Cap Development | 54.1 | 14.1 | 1 |

| QGRW | WisdomTree US High quality Development | Giant-Cap Development | 56 | 16 | 4 |

| PFPGX | Parnassus Development Fairness | Giant-Cap Development | 42.6 | 2.5 | 1 |

| PJFV | Prudential PGIM Jennison Targeted Worth | Giant-Cap Worth | 18.5 | 5.8 | 1 |

| HSMNX | Horizon Multi-Issue Small/Mid Cap | Mid-Cap Core | 23.4 | 9.8 | 1 |

| FDLS | Encourage Fidelis Multi Issue | Mid-Cap Core | 21.4 | 7.8 | 2 |

| AMID | Argent Mid Cap | Mid-Cap Development | 31.1 | 11.2 | 1 |

| WGUSX | Wasatch US Choose | Mid-Cap Development | 30.9 | 10.9 | 2 |

| WCMAX | WCM Mid Cap High quality Worth | Mid-Cap Development | 28.7 | 8.7 | 1 |

| RVRB | Reverb | Multi-Cap Core | 26.8 | 7.3 | 2 |

| DSMC | Distillate Small/Mid Money Movement | Small-Cap Core | 29.5 | 14.8 | 1 |

| GSBGX | GMO Small Cap High quality | Small-Cap Core | 32.5 | 17.8 | 1 |

The Rookie All-Professional Staff: The Prime Rookie Earnings and Alternate options Funds of 2023

Our final roster is the Earnings and Alts Rookie squad. Rookie funds are these with a couple of 12 months however lower than two years within the league. We screened for rookies who earned their spot on the roster by combining top-tier risk-adjusted returns in addition to peer-beating absolute returns. For the sake of simplicity, we separated fairness from revenue funds

Our final roster is the Earnings and Alts Rookie squad. Rookie funds are these with a couple of 12 months however lower than two years within the league. We screened for rookies who earned their spot on the roster by combining top-tier risk-adjusted returns in addition to peer-beating absolute returns. For the sake of simplicity, we separated fairness from revenue funds

Choice standards: Rookie All-Professional funds needed to end within the prime tier MFO Ranking (“MFO Ranking is the principal efficiency rating metric used within the MFO ranking system and located throughout a lot of the MFO Premium pages. It ranks a fund’s efficiency primarily based on risk-adjusted return, particularly Martin Ratio, relative to different funds in the identical funding class over the identical analysis interval”) and Sharpe Ratio Ranking. The All-Professional starters additionally needed to rating within the lowest tier of Ulcer Scores; that signaled that they have been greatest at (a) limiting draw back and (b) recovering rapidly from it.

| Image | Identify | Lipper Class | 2023 return | APR vs Peer | Ulcer Ranking |

| SPCZ | RiverNorth Enhanced Pre-Merger SPAC | Various Occasion Pushed | 6.4 | 4.1 | 2 |

| COIDX | IDX Commodity Alternatives | Commodities | -4.5 | 3.4 | 1 |

| PIT | VanEck Commodity Technique | Commodities | -3.4 | 4.5 | 1 |

| AGRH | BlackRock iShares Curiosity Fee Hedged US Combination Bond | Core Bond | 6.5 | 1.6 | 1 |

| TTRBX | Ambrus Core Bond | Core Bond | 5.8 | 0.9 | 1 |

| ACSIX | Enviornment Strategic Earnings | Excessive Yield | 15.3 | 4.8 | 1 |

| PBKIX | Polen Financial institution Mortgage | Excessive Yield | 14.5 | 4.1 | 1 |

| HYGI | BlackRock iShares Inflation Hedged Excessive Yield Bond | Inflation Protected Bond | 11.8 | 9.3 | 2 |

| BRLN | BlackRock Floating Fee Mortgage | Mortgage Participation | 12.3 | 1.6 | 2 |

| LONZ | Allianz PIMCO Senior Mortgage Energetic | Mortgage Participation | 12.6 | 1.9 | 2 |

| CGMS | American Funds Capital Group U.S. Multi-Sector Earnings | Multi-Sector Earnings | 11.6 | 5.9 | 2 |

| CGMU | American Funds Capital Group Municipal Earnings | Municipal Normal & Insured Debt | 7 | 1.9 | 1 |

| BUFQ | First Belief FT CBOE Vest of Nasdaq-100 Buffer s | Choices Arbitrage / Methods | 35.4 | 18.3 | 1 |

| UYLD | Angel Oak UltraShort Earnings | Brief IG Grade Debt | 7 | 2.1 | 1 |

| CSHI | NEOS Enhanced Earnings Money Various | Specialty Mounted Earnings | 6.2 | -13 | 1 |

| CARY | Angel Oak Earnings | U.S. Mortgage | 8.9 | 4.4 | 1 |

| HIGH | Simplify Enhanced Earnings | U.S. Treasury Normal | 7.6 | 4.3 | 1 |

| BOXX | Alpha Architect 1-3 Month Field | U.S. Treasury Brief | 5.1 | 0.9 | 3 |

| TBIL | F/m US Treasury 3 Month Invoice | U.S. Treasury Brief | 5.1 | 0.9 | 3 |

| TUSI | Touchstone Extremely Brief Earnings | Extremely-Brief Obligations | 6.5 | 1.3 | 2 |

| YEAR | AllianceBernstein AB Extremely Brief Earnings | Extremely-Brief Obligations | 6 | 0.9 | 2 |